I’ve been spending an awful lot of time warning about market risk — for good reason.

Market Roundup

The junk bond market is reeling. The easy money that fueled massive stock buybacks and mega-deals is starting to dry up. Initial Public Offerings (IPOs) are struggling. And the economic problems that were previously hitting hard overseas are increasingly washing up on our shores.

But even in a lousy broad market … even in a challenged economy … there are actually a handful of stocks I DO like. They offer an all-important combination of characteristics that can help them survive and thrive even in a bear or “bear-like” market.

Characteristic #1: Low Volatility. In this environment, you don’t want to own stocks that swing violently all over the map. You don’t want the flashy names that might surge 5% one day, only to plunge 10% the next. You want to focus on stable, Steady Eddie names.

They may seem boring to hedge fund gunslingers or fast-money traders. But they’ll help patient, prudent investors like you sleep well at night.

|

|

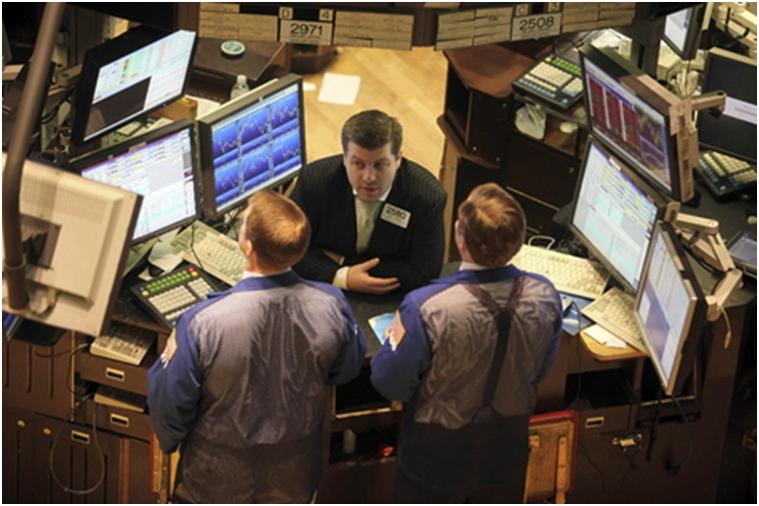

| Even in a challenged overall market, there are some stocks and sectors worthy of taking a chance on. |

Characteristic #2: High Ratings. Forget the “D” and “E” rated dreck. Stay focused on “A” and “B” rated names, as identified by our time-tested, quantifiably based Weiss Ratings. They have the potential to hold their value much better … and to generate gains … even in tough times.

Characteristic #3: Recession-Resistant Businesses. Deep industrials. Financials. Materials. They’re great stocks to own when the economy is booming, and sales and earnings are growing by leaps and bounds. But when conditions sour, history shows they can be pure poison for your portfolio.

I prefer safer sectors like consumer staples, utilities and the like. No matter how bad the economy gets, you still have to eat and you still have to turn the lights on.

Indeed, despite the fact financials, biotechs, small-capitalization stocks and more are badly lagging in this rebound … and despite all the challenges I’ve been chronicling … I still have one name that meets all these criteria in my Safe Money Report. It just hit an all-time high this week. A very small handful of other names I’ve identified held up well in the downturn, and are doing well in the bounce, too.

So if you’re going to own stocks, own the ones with characteristics like I just outlined. Then balance that out with hedges targeting vulnerable names and sectors, and a healthy cash position.

| “I prefer safer sectors like consumer staples, utilities and the like.” |

Does that sound like a solid strategy to you? Or are you taking a different approach? Are there any individual stocks or sectors you’re focusing on here? Or are you just plain too scared to own anything? Have other investment ideas that I didn’t touch on here? Then head over to the Money and Markets website and share them with your fellow investors.

|

What does the boom in junk-bond issuance mean for the markets? What about the increasing size of mega-deals? And how about the lack of a Social Security cost-of-living adjustment? These are the topics you’ve been discussing online.

Reader Chuck B. said: “It is one thing when a company finances a takeover or a stock buyback or dividend increase from its own resources. But when it borrows money for the purpose, stockholders should take a close look at what is going on in the company.

“Executives may be trying to artificially boost the stock price and make the company look better than it really is, to justify their own salary and bonuses. They should be called to task for that. They could eventually cause serious problems within the company, maybe even cause it to fail — possibly after they have left with their profits.”

Reader Robert P. added: “I may be wrong, but it seems to me that bonds, junk or otherwise, have had their heyday already — what with the Fed buying up everything they can get their hands on, at whatever the prevailing price happened to be, all in the name of ‘quantitative easing.'”

Reader Rob U. was even more emphatic about what may be coming next: “Low quality IPOs. Merger mania. Real estate mania in LA and NY. ‘Crane’ index at all time highs. China real estate bubble has burst. Near record consumer confidence. Very low unemployment and jobless claims. Record margin debt. A powerless Fed.

“If you are positive about stocks and the economy, you don’t understand financial history.”

As for Social Security, Reader Locutus said: “Am I the only one bothered by the approximately-$118,000 per year cutoff in Social Security withholdings? If I understand it correctly, that means Bill Gates and Katy Perry are each paying the same in annual Social Security costs as someone making $117,500 in annual salary.

“If Social Security truly is a Ponzi scheme, then let’s increase that ceiling tenfold, to $1,180,000 per year. Those making that kind of bank can well afford it. The assistance to the overall Social Security picture could be staggering in the long-term.”

Finally, Reader Jim said: “What do we not understand about the government owing us $100 trillion in unfunded liabilities? They don’t have it and they aren’t going to have it.

“Like every politician, they have made promises they can’t keep because they won’t be here to take the blame when it collapses. Most Americans still don’t understand they have all been sold down the river by the Federal Government.”

Thanks for weighing in. I too see a lot of reasons for concern — signs of financial excesses everywhere coupled with deterioration in several, “behind the scenes” indicators they don’t talk about every day on CNBC. That makes this a potentially very treacherous market, the early October snapback rally notwithstanding. So I’m not inclined to chase stocks here until we get more clarity.

Please do keep the discussion going, though, especially if your comments haven’t been addressed yet. This link will help you get started.

|

![]() Canada has a new prime minister and a new political party at the helm. Liberal Party candidate Justin Trudeau beat out Conservative Stephen Harper, helped by general unhappiness with the economy and the government’s policies for combating weakness north of the border.

Canada has a new prime minister and a new political party at the helm. Liberal Party candidate Justin Trudeau beat out Conservative Stephen Harper, helped by general unhappiness with the economy and the government’s policies for combating weakness north of the border.

![]() Disney (DIS) took advantage of the miracle of cross-platform marketing last night. It releases the latest trailer for its Lucasfilm division movie “Star Wars: The Force Awakens” on its ESPN network during the Monday Night Football broadcast. The seventh movie in the Star Wars saga hits U.S. theaters on Dec. 18.

Disney (DIS) took advantage of the miracle of cross-platform marketing last night. It releases the latest trailer for its Lucasfilm division movie “Star Wars: The Force Awakens” on its ESPN network during the Monday Night Football broadcast. The seventh movie in the Star Wars saga hits U.S. theaters on Dec. 18.

![]() Several companies reported earnings in the past 24 hours, and the results were a mixed bag. IBM (IBM) and Harley Davidson (HOG) disappointed, while Travelers (TRV) and Verizon Communications (VZ) fared better.

Several companies reported earnings in the past 24 hours, and the results were a mixed bag. IBM (IBM) and Harley Davidson (HOG) disappointed, while Travelers (TRV) and Verizon Communications (VZ) fared better.

![]() OPEC is holding a “technical meeting” tomorrow, one that will also include representatives for non-OPEC countries like Mexico and Russia. But no one is expecting a change in OPEC’s current Saudi-driven policy of flooding the market with oil to stick it to U.S. shale producers . So unless there are any surprises, it likely won’t impact the oil market too much.

OPEC is holding a “technical meeting” tomorrow, one that will also include representatives for non-OPEC countries like Mexico and Russia. But no one is expecting a change in OPEC’s current Saudi-driven policy of flooding the market with oil to stick it to U.S. shale producers . So unless there are any surprises, it likely won’t impact the oil market too much.

Any thoughts on all these earnings reports? The unwillingness of OPEC to cut production? Canada’s new political reality? Head over to the website and share your thoughts when you have a minute.

Until next time,

Mike Larson

{ 43 comments }

It is a shame we don’t have a parliamentary system similar to Canada’s, where a government that has failed the people. can fail a vote of confidence and be thrown out of office. Our Founding Fathers failed us in not seeing the need for such a device. It is the reason for Britain’s long survival as a nation.

That is addition to the periodic vote of the people, of course.

As a Canadian what I do not understand about American political system is that the majority of Americans have extremely low opinion on their representatives to the House and Senate yet 80 or 90% get re-elected to office. Democracy only works when the elected officials are held accountable by the voters who elected them.

Fortunately for Canada, Canadians have no qualms in voting out their elected officials when they believe the officials and the government they represent no longer serve the best interest of the people but only the best interest of their party and themselves.

Perhaps Canadian children are taught about citizenship from an early age. I doubt if American children are, any longer, judging by the goings-on in this country. I still recall a bit of my old “Civics” classes, which instilled a sense of responsibility for our national welfare, but that was back in the 1930s and ’40s. Do our schools still have anything like that, or is it now considered unnecessary, along with multiplication tables? Schools probably just teach about welfare benefits now.

That’s an easy one. Our system us based entirely on pork. It’s the other guys rep you disapprove of. If yours brings home the pork he gets reelected no matter how bad it is for the country. Jim

Excellent observation. I think our multi party system lends itself more to being open to changing people’s minds. The US seems to get more and more polarized all the time.

Our system has backed us into a corner, a replacement candidate is a clone of the one you are voting out. A real and desirable candidate does not have the finances or coalition to be on the ballot. If some miracle occurred and the candidate becomes elected that person would be blocked out of the process to protect the status-quo. Two of the things have always bothered me about our election system for President; popular vote should be but is not the way the position is filled, your vote is thrown into a by-state bucket to attain votes in the electoral college. Just because the state majority chooses candidate “b” it’s votes could end up for candidate “a” system to prevent the general population from making the wrong choice. We are in a corner in the US and I don’t think we will get out.

Well our system requires a change of power at least every 8 years (since term limits were added to the Constitution after FDR). The parliamentary system does not require a change of the head person (prime minister). Imagine the hand-wringing if Obama could stay in office indefinitely.

Amen to that. I would like to see term limits for the House (say 4-5) and the senate, say 2.

Amen to that!

And another Amen! Jim

Make it 4 years in the House and 6 in the Senate.

Canada today turned back to a Liberal Majority to bring the economy back to the average citizen with a strong voting presence of their youngest citizens….. I’m betting America will follow them down that road next year with a strong voting presence of our younger citizens also…..

I don’t follow them closely but I wasn’t aware things had been mismanaged in Canada. They missed 2008, their markets and real estate did fairly well, and their banks didn’t need a bailout. The collapse of commodity prices has hurt them badly. If the Liberals are willing to fix that I’m all for them. I also heard Obama sent one of his crack electoral teams to help them . The Democrats are indeed masters at winning elections. Jim

It’s a shame young people don’t actually have Liberals to vote for. The Democrats are just as hidebound in their practices as the Republicans. “Not a real choice.

Wait for markets to “stabilize”, for things to calm down, for “clarity”? None of these things ever happens! Markets are markets and that’s all.

Our neighbors to the north figured out that conservative policies don’t really work. Now if more people in the US could figure out that it was the economic policies espoused by Uncle Ronnie and the Bushies that got us to where we are now, maybe we can escape from the nihilistic, self centered “party of no”

The Democrats have gotten everything they wanted over the las seven years. Bush gave us one lousy temporary tax cut. I’m not so sure they the party of “no”as they are the party of ” the Media might call me racist if I oppose anything”. Jim

How come Mike’s site has REPLY but Larry’s site doesn’t ?

too many trolls.

I think Larry got tired of all the b**ching and whining, so he cut off the chatter line

there were some real jerks following him, second guessing every call he made. i’m sure they’re still around.

With all of the money and Fed hype going on, it is time to refresh the readers on who really owns the Fed! The well-being of the economy as a whole is secondary to the owner’s

well-being!

The banksters own the fed plus they own the poli-ticks so whadda ya expect.LOL

It’s really a crazy scheme when you simplify it. The Fed creates money out of thin air and loans it to us with interest. Why can’t the Treasury just print its own money and skip the middleman? Jim

Yeah, Jim. Then we could eliminate taxation entirely.

Here’s the deal; “Money equals power equals control, equals money equals power equals control, equals money equals power equals control,,, ad infinitum, ad nauseam.â€

I read that there are some $1.5 QUADRILLION of derivatives floating around in in the world banking and financial system. All essentially make believe money. I believe that figures out to about $187,500,000 for each of the roughly 8 billion people on Earth. When they start to go bad, it will make Dot Com look like prosperity. In the meantime, where is MY share?

We have reached a ugly end to a seven year borrowing binge.

Did you realize the US Dollar has been in a slow decline since May, and It just recently had a “Death Cross”, where the 50 day line crossed below the 200 day line? That won’t mean an immediate rise in Inflation, but that could be coming if the trend continues for long. Of course, other currencies could still be falling faster.

I’ve noticed there have been alot of “death crosses” in alot of different charts over the last couple of years…turned out to mean nothing….

May bear watching, but don’t get too excited before it’s time.

we’ve seen enough death crosses just in the last six years that have failed to play out to the downside that i think we can safely eliminate this formations as having any validity at all.

Been in decline since 1913 ! Thanks Federal Reserve central bankers , rich elite !

I have been receiving mailers lately telling me the world is going to end Dec. 16 when the Fed raises interest rates. From what I have been reading here many of you agree. I respectfully disagree. The Fed will not raise interest rates until there are clear indications of inflation which aren’t to be found anywhere at present. If they do it will be a one time deal to maintain credibility. If you look around the World it is very obvious our economy is the only one worth investing in now. If you fear the strong dollar then stay in domestic companies where it doesn’t matter. Price pressures on commodities are also good for many American companies. Color me optimistic. Jim

No interest rate increase this year. Possible next year, after the present regional Fed Presidents terms end on the FOMC, and a new and more hawkish group comes on. Even then it is unlikely, if the credit markets fall apart.

Mike: It seems “the market” has a fair likelihood of crashing in the near term. Is it an assumption that we remain invested and then which stocks to own?

I may have missed the point.

I’m doing my style of sector rotation, far from “the market” (as if it were the only market) and into more real assets. Thanks, Len

They call it “REAL ESTATE” for a reason. Property will always have value.

Canadian Election.

Mike like most Americans you know very little about Canada. I wonder what you learned in school? The economy in Canada is better than that of the USA and most Canadians have a higher net worth than the average American.

We voted out the Conservatives because they are and were a nasty bunch of crooks with strong ties the American Republican Party. We wanted better people in Govenment, decent people, not a bunch of slimeballs like the Conservatives

We also apparently have higher personal debt levels. Let’s hope that, as Justin spends all the money on infrastructure that he has promised, and puts the government further in debt, people take that windfall and pay down their personal debt. Justin’s father never worried about little details like fiscal responsibility so I don’t expect much of that from Justin either. I am reserving judgement until I see if any of his big promises are dropped. Dalton’s deception is still leaving a bad association in my mind with the word Liberal.

Agree with an earlier reply that the ceiling on which Social Security payments no longer are required should be raised. I would favor an arbitrary ceiling whereby anyone having wages of, say, $200,000 annually or less would continue to pay until their current limit is reached. Once the individual reaches the $200,000 threshold I would tax ALL wages (including bonuses and stock options) at the highest rate.

Enjoy your input

Crazy,6 am USA,CMG premarket down 8% along with a few more.Premarket up 77 points,is it just me or is something going astray,definately bad news is good news,glad Im in cash. A THE BEST.

The biggest rip off in health insurance for seniors are the “Part B supplemental plans” that are heavily promoted on TV by the insurance companies. Yet Larry Edelson says they are invaluable and a great buy. You folks could do Medicare beneficiaries a great service by finding someone who understands Medicare and explain why the Medicare Advantage plans are the best buy by far.