The second quarter was another painful one for the energy markets. Crude-oil futures fell almost 11%.

Gasoline and natural-gas futures didn’t fare much better. Both fell around 9% during Q2.

So, have we finally found a bottom in the energy markets … and oil in particular?

Not quite yet, but my signals tell me it’s coming soon …

I expect to see volatility continue throughout the energy complex. And we should see a little more downside in the near term for crude oil before we get a nice —tradable — rally later this month.

|

|

| Cheap gas: Independence Day saw gas prices fall to their 2017 low. AAA reports that the last time gas prices were this cheap on the holiday was July 4, 2015, when they were at a national average of $2.23 per gallon. |

Consider …

-

We have already seen a nice rally in crude oil. West Texas Intermediate traded higher for eight-straight sessions before falling 4.1% Wednesday after reports surfaced that Russia opposed deeper OPEC-led production cuts, a bearish indicator.

- The major oil-producing nations have extended their agreement to limit their output into early 2018. But … this has been more than offset by rising U.S. production. Weekly oil stockpile readings have stayed above the 500-million-barrel level for 21-straight weeks. And that adds up to more bearish pressure.

- And while compliance with the OPEC output-cut agreement remained above 95% last month for all members that signed on for the pact … increased production from Libya and Nigeria (which are exempt from the output-cut agreement) pushed the organization’s June production to the highest level for 2017.

All told, more bearish forces.

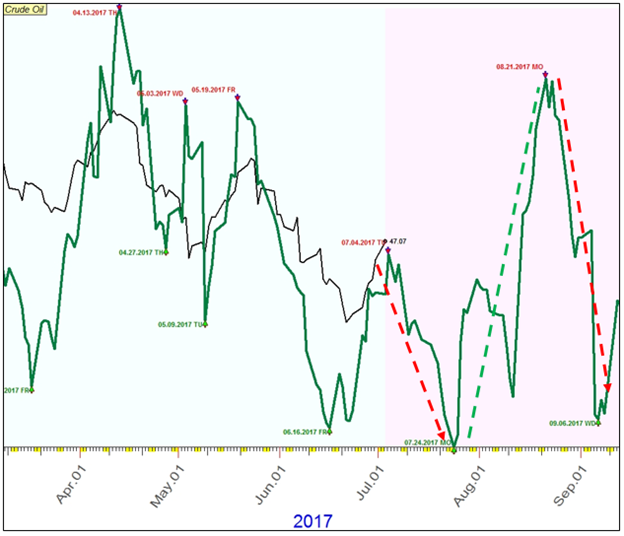

This aligns nicely with the Edelson Institute cycle forecast chart for crude oil. It indicates that Tuesday marked a temporary peak for oil prices. That means we should see crude oil prices heading lower over the next few weeks.

Take a look for yourself …

Based on the cycle forecast chart above, we should see a temporary peak in crude-oil prices this week. Then they then should head lower over the next two-plus weeks, before mounting a sizable rally heading into late August.

After the expected pullback, a potential catalyst for another sizable rally in crude oil could be that U.S. supply is growing slower than the market is pricing in.

In fact, Citigroup’s head of commodities research, Ed Morse, thinks inventories will decline by about 1 million barrels a day in the second half of the year.

Once the market starts to price in lower supply, we could see oil shoot up to the $55-a-barrel level.

I believe the rebalancing process in global oil markets is still making progress. So, I do expect more volatility in oil prices going forward. But it looks like we are closer to a bottom.

Here’s what I recommend …

Wait for this current pullback in crude oil prices to play itself out. Then be ready to pounce when prices bottom again, ideally around the $42.50-$43 price level.

The best way to play the next surge higher will be using ETFs, like the U.S. Oil Fund (USO). Or, if you want to add some extra juice to your trade, you can go with the ProShares Ultra Bloomberg Crude Oil ETF (UCO).

Best wishes,

David Dutkewych