|

A “stealth” market correction has been underway on Wall Street the past few months. If you blinked, you might have missed it.

Choppy market conditions since the beginning of March made some investors jittery about stock market valuations. But beneath the surface we’ve witnessed a rotational correction; many of the stocks and sectors that had been market leaders in 2013 needed to cool off and correct, while others rose to the top.

Small-cap stocks in general and especially biotech and Internet shares got clobbered last month. Meanwhile, the major indexes including the S&P 500 and Dow Industrials continue to sail on to all-time highs.

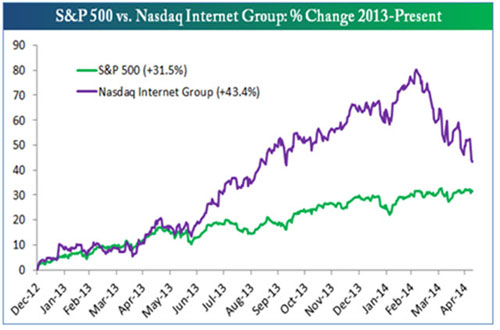

You can witness this performance divergence for yourself in the graph above. After outperforming the S&P by a very wide margin last year, Nasdaq-listed Internet stocks were overdue for a pullback and have indeed reverted sharply to the mean.

Like a rubber band stretched too far, the biggest winners were destined to snap back to earth at some point.

During March and April, the S&P 500 Index chopped up and down in volatile fashion without gaining much ground; up 1.2 percent to be exact. An investor returning on the first day of May after two months away from the markets could easily conclude not much had changed.

But if you were invested in biotech, Internet or small-cap shares over these two months, you were in for a shock.

The Dow Jones Internet Index ETF (FDN) dropped over 18 percent from peak to trough during the same period, and the SPDR S&P Biotech ETF (XBI) plunged 32.7 percent.

This type of market rotation can certainly be unsettling for investors to experience first-hand, but it’s only natural at this stage of the game, after a five-year bull market. The good news is: new leaders rotated to the top, preventing a significant correction for the overall stock market.

Market Rotation Is All About Value

Despite what you may hear from the talking heads on CNBC, this isn’t simply a rotation out of small- and into large-cap stocks. Amazon.com (AMZN) for example, is one of the largest-cap stocks in the S&P 500 … but its shares are down 22 percent this year. And it’s not about investors moving away from sexy Internet and biotech shares in favor of good old cyclical stocks either. Case in point: Facebook (FB) is up 16 percent year to date and didn’t lose much ground during March and April.

In a slow-growth economic environment, and with the world’s major central banks still manipulating financial markets, investors are seeking out undervalued assets with a margin of safety but that still offer solid upside potential.

This rotational correction has been all about a search for value, plain and simple.

Take the energy sector, for example. Energy stocks lagged the market badly last year, but the sector is among the leaders so far in 2014, up 6.7 percent and far ahead of the S&P 500 Index.

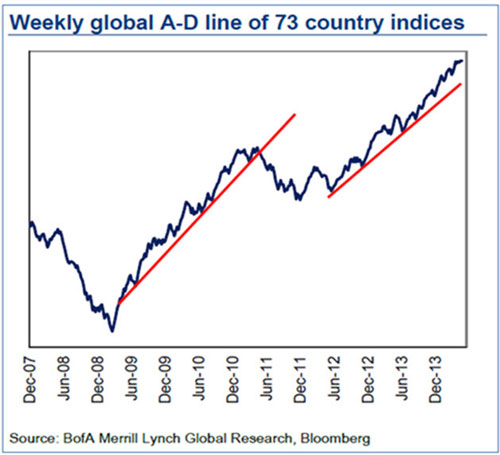

And take another look at emerging markets, which are also rotating back toward the top of the performance derby. While over-bought Internet and small-cap stocks struggled through a rotational correction, undervalued international stock markets were bouncing back to life.

The chart above plots the advance-decline ratio of 73 global stock markets. When the line is moving up from lower-left to upper-right, as it is right now, it means the majority of international stock markets are moving higher in tandem.

Since March 1, the Vanguard Emerging Markets ETF (VWO) is up 9.4 percent, while the S&P 500 Index has gained only 2.8 percent.

Select emerging markets remain very attractively valued compared to major developed markets. For example, the S&P 500 Index, at a fresh record high, is priced at more than17 times earnings. Meanwhile, the MSCI Emerging Market Index is available to investors at just 10.7 times profits, a significant 40 percent discount.

It’s easy to see why select emerging markets are benefiting from investors’ search for undervalued assets with a margin of safety.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.