|

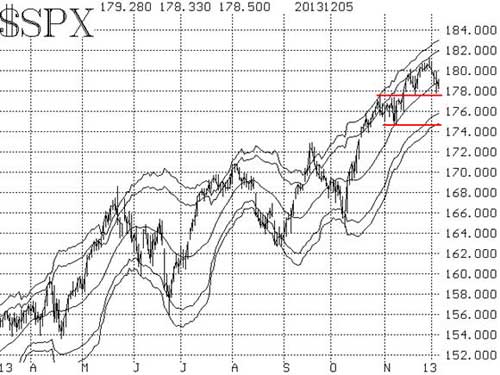

Even as stocks are rising today, the picture is actually fairly bearish except for one major thing: the price chart of the S&P 500 Index ($SPX) has not broken down.

A decline below 1,780 would also interrupt the recent bullish pattern of higher highs and higher lows on the $SPX chart.

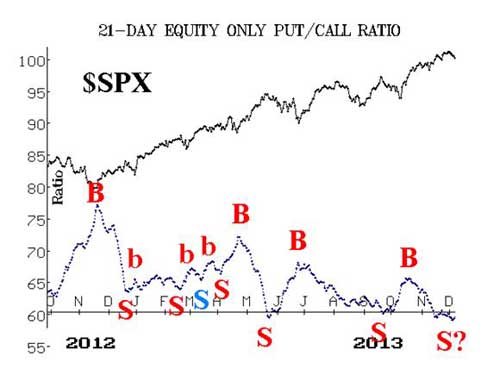

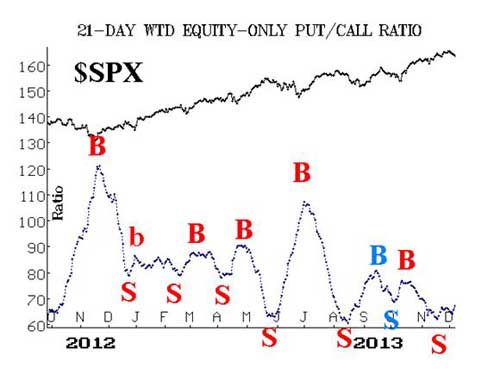

Equity-only put-call ratios are mixed. The weighted ratio, as you can see in chart 3 below, has started to move higher. That is bearish for stocks, and the sell signal is clear. The standard ratio, however, is not as clear.

Market breadth continues to be relatively weak. Both breadth indicators are on sell signals.

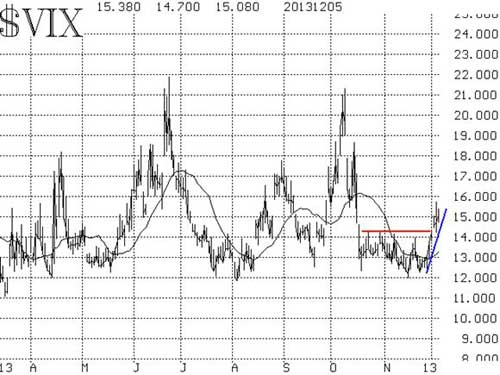

Volatility indices ($VIX and $VXO) have finally joined the bearish side of the ledger as well, since $VIX has broken out over 14.

In summary, despite a mounting array of sell signals, we would not sell this market unless $SPX can close below 1,780.

Weekly Charts

Below are the S&P 500 (SPX), CBOE Market Volatility Index (VIX), 21-Day Equity Only Put Call Ratio (PC21) and Weighted 21-Day Equity Only Put Call Ratio (PC21 w) charts, which are updated on Fridays.

Best wishes,

Larry McMillan