|

In recent Money and Markets columns, I have discussed how deflation is the primary economic force effecting both the real economy and the financial markets. And last week, we received further evidence from the World Bank that deflation continues to plague the global economy.

In fact, the World Bank, the arm of the United Nations that provides loans to the developing world, expects the world economy will expand at a rate of just 2.8 percent this year, compared with a January projection of 3.2 percent. The U.S. forecast was reduced to 2.1 percent from 2.8 percent while outlooks for Brazil, Russia, India and China were also lowered.

“The global economy got off to a bumpy start this year buffeted by poor weather in the United States, financial market turbulence and the conflict in Ukraine,” the World Bank said in its Global Economic Prospects report.

This is very concerning because as I have previously pointed out, a moderate level of growth is required for the stock market to maintain its current lofty levels, as the Janet Yellen-led Federal Reserve and Mario Draghi’s European Central Bank can only do so much with their experimental monetary policies to jump-start the world economy.

|

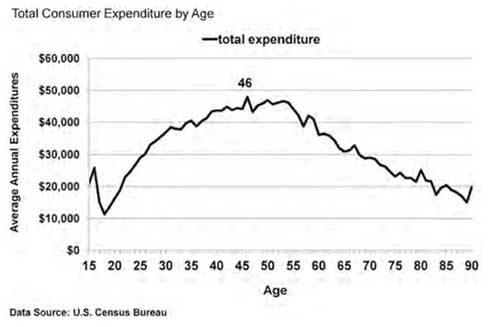

| What happens to consumer spending when more people retire than are entering the workforce? |

That’s because we live in a world where the “Killer Ds” — Demographics, Deficit, Debt, Deleveraging and Deflation — will determine the future for the world’s economies and financial markets. These powerful forces are at work across the globe: in the U.S., Japan, Europe and emerging markets.

And we had better get the world economy moving forward soon because demographics are going to be a very real issue in U.S. — the world’s largest economy — for the next decade or so.

It’s well known by economists that it was the dramatic increase in the U.S. population that occurred as a result of the Baby Boom generation that led to much of America’s economic prosperity from 1983 to 2007.

That’s because, according to data collected by the US Bureau of Labor from their Consumer Expenditure Survey (CE), a typical household spends the most money when the head of the household is age 46 as shown in this chart.

But most of the Baby Boomers have now moved past their prime spending years.

What’s next?

The Echo Boom generation (those born in the 1980s and 1990s) exceeds the Baby Boom generation in sheer numbers. In the U.S., Baby Boomers total 108.5 million adjusted for immigration, compared with 138.4 million Echo Boomers. That’s the good news.

The more important point — that a lot of investors are missing — is that the Echo Boomers won’t approach their peak spending years until about 2023. That means we are in the midst of a demographic consumption deficit in the U.S. that won’t resolve itself for another six to nine years!

What’s more, as I’ve said previously, the most important factor that drives the U.S. economy is consumer spending. Indeed consumption spending is about 70 percent of U.S. GDP, and businesses can only grow when consumer spending is expanding.

That’s why we need to consider hard questions such as what happens when the U.S. is facing a shrinking labor force? And what happens when more people retire than are entering the workforce? How does that affect economic growth and what’s the knock-on impact on commercial real estate? What happens when more homes go onto the market as people die than there are younger buyers to buy them?

These are powerful demographic issues and they are deflationary as well!

That’s why I recommend that carefully selected, high-quality global franchise companies that have the earning power to grow in even the most challenging economic environments form the core of your investment portfolio because growth — as the World Bank just confirmed and a careful study of the demographic data reveals — is going to be really hard to come by.

In the big picture, what makes this consumer spending cycle so powerful is the fact that people are born (and immigrate) in clear generational waves. These are the two ways that you become a worker and consumer in a country like the U.S. — workers represent “supply” of goods and the same people as consumers represent “demand.” Hence, new generations drive both as they age into their peak spending years — and that’s precisely what causes a broad boom in our economy.

Best wishes,

Bill Hall

P.S. What do the super-rich do right that the average investor does wrong … or doesn’t do at all? Click here for my FREE report, and I’ll show you the easy way to begin tapping into the savvy financial strategies that give the wealthy a big advantage over you.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 1 comment }

You still see people complaining about all the illegal immigration,from Mexico,Central and South America.Immigration,here in So California is highest from Asia,today and there are no signs it will slow down.I don’t see any reason to worry about the population declining or demand for housing going down.As far as less workers.That would be a positive,with companies finding they can use technology to replace workers.