|

If you’re a longtime reader, you know that I was raised on a vegetable farm in western Washington.

Life on the farm wasn’t easy. My father worked my siblings and me long and hard. One of the chores I hated the most was moving the cast-iron sprinkler pipes in the summer evenings. Those 20-foot pipes were heavy as heck! And since I was the oldest of three children, my father always recruited me to help him.

I knew better than to complain, but teenagers often open their mouths without thinking. Once, I suggested that maybe we were overwatering our crops and that we could skip a night.

Boy, did my father ever give me an earful after that! And he worked me twice as hard for trying to get out of work.

However, I will never forget what my father told me: “You think we’re in the vegetable business, Tony. But we are really in the water business.”

My father was right. Water is the foundation of the entire agriculture industry. Unfortunately, clean water is in short supply.

In fact, the lack of clean drinking water is the single-greatest killer in the world. Four children die each minute from illness/disease caused by a lack of drinking water.

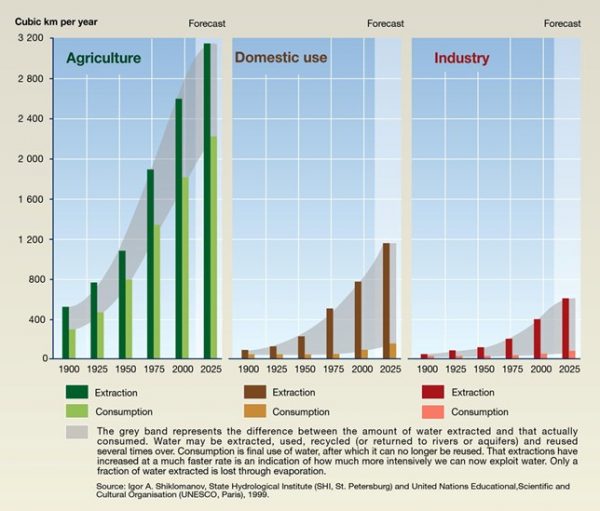

The problem is not that the world is running out of water. There is exactly the same amount of water today as there was a million years ago. Rather, a soaring global population and groundwater pollution is creating an acute shortage of clean water.

Only 2.5% of the world’s water is fit for human consumption. And two-thirds of that is locked away in icecaps and glaciers. This percentage has stayed steady since the last ice age.

Water is not like gold or oil, where a new discovery will suddenly increase the supply. And there is no substitute for water.

According to the International Water Management Institute, one-third of the world’s population is short of water. In fact, water is expected to become so scarce in the future that the vice president of the World Bank warned that …

“The wars of the next century will be about water.”

Yikes!

Clearly, there is some investment opportunity buried in that need for clean water. However, my suggestion will probably surprise you.

Every year, hundreds of do-gooders gather at the One Water Summit. This year, the U.S. Water Alliance is hosting the event in New Orleans on June 27-29.

There, they’ll discuss the most pressing issues about water: aging water infrastructure, demographic and economic shifts, political uncertainty, and climate change. Their goal is to find solutions to create a more-sustainable water future for the entire world.

The challenge is that any time a bunch of bureaucratic government workers get together, the result is a lot of talk and very little, if any, action.

In fact, you can count on government to screw things up more than make things better. And therein lies the investment opportunity …

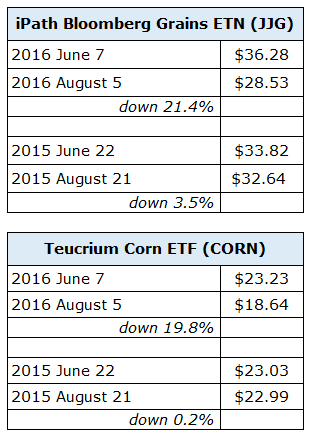

For the last two years, the price of the world’s two most-important food crops — wheat and corn — has substantially dropped in the two months after the One Water Summit.

As you can see, you could have made some fat profits by betting against those two ETFs. But if you’re uncomfortable or inexperienced with short-selling, there is an inverse ETF — DB Agriculture Short ETN (ADZ) — that would generate similar returns.

However, you could have super-sized those profits with options.

Indeed, if you had bet against JJG by purchasing put options before the One Water Summit held in June 2016, you could have earned gains of 800% in just two months! Meanwhile, put options on CORN could have handed you a cool 570% profit!

Of course, I’m talking about a short-term trading opportunity built around regularly recurring calendar events, like the One Water Summit.

Longer term, however, the outlook for agriculture — particularly water-focused stocks — is spectacular. There are four Exchange-Traded Funds that specialize in water-related stocks:

- First Trust ISE Water Index Fund (FIW)

- Claymore S&P Global Water Index ETF (CGW)

- PowerShares Water Resources Portfolio (PHO)

- PowerShares Global Water Portfolio (PIO)

So whether you’re a nimble, short-term opportunist or a sit-back-and-relax, longer-term investor, my father’s advice is just as wise today as it was back in the 1970s when I was a teenage son of a vegetable farmer.

Best wishes,

Tony Sagami

{ 2 comments }

Question: “Consumption is final use of water after which it can no longer be reused.” Example, please? Other than chemical decomposition, e.g., Electrolysis, [May be returned to water if burned (oxidize hydrogen) to release energy) how is water consumed and not ultimately reused? Any consumed by plants or animals, evaporated into steam, frozen to ice will ultimately be available again by natural processes. Even water in an embalmed or cremated body will ultimately be reclaimed – it may take millennia as there is probably still a little water in mummies.

CORRECTION:

Most of “Western Washington” ( West of the Cascades) gets plenty of rain each year ( in my experience), certainly more than enough for large trees to thrive. However, Eastern Washington is where most of the State’s agriculture is located, do to its warmer, drier climate and longer growing season annually.