|

As I pointed out in last week’s Money and Markets column, a state of stable economic disequilibrium is just what the market needs to maintain its lofty level and perhaps even move higher in these uncertain times.

And it’s the Fed’s easy money policies that are the key to maintaining current conditions, because without the central bank’s continued intervention, the current status quo where savers are unfairly punished while speculators are rewarded would almost certainly fail.

That’s why it’s imperative for investors to keep a watchful eye on the Fed so you can keep your portfolio out of harm’s way should the Fed’s policies change.

|

| The Fed’s easy money policies are the key to maintaining current conditions. |

Recall that since the onset of the financial crisis the Federal Reserve has repeatedly maintained the stance that it will keep interest rates low until unemployment falls to around 6.5 percent and inflation (as measured by PCE, or Personal Consumption Expenditures) starts to track around the 2 percent level.

But now that the unemployment rate is coming within the desired range, Fed officials are beginning to distance themselves from exact numerical targets.

How do we know?

A careful review of the minutes from the central bank’s meeting three weeks ago — which happened to be the final meeting for former Chairman Ben Bernanke — reveals that Fed officials agree that with the unemployment rate now nearing its target, “it would soon be appropriate for the committee to change its forward guidance in order to provide information about its decisions regarding the federal funds rate after that threshold is crossed.”

In January, the unemployment rate fell to 6.6 percent. While that is the lowest level in more than five years, it’s a well-known fact that the labor market is still far from vibrant. Indeed, much of the decline in unemployment has been the result of a large number of Americans dropping out of the labor force.

That’s why instead of pinning guidance on an exact level of unemployment, some Fed officials favor a new guidance strategy. The minutes show that several members emphasized that the Fed should support a “willingness to keep rates low” as long as inflation remains below its 2 percent target.

Newly appointed Chairman Janet Yellen provided even more relief for worried investors when she recently told House lawmakers in her prepared remarks to Congress that the Fed would pause its tapering of asset purchases if there was a “notable change” in the economic outlook, and increase asset purchases again if there were “a significant deterioration in the economic outlook — either for the job market or if inflation would not be moving back up over time.”

She then borrowed a phrase from her predecessor, Ben Bernanke, in his final speech as Fed chair by stating that “purchases are not on a preset course” and that “the committee’s decisions about their pace will remain contingent on its outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.”

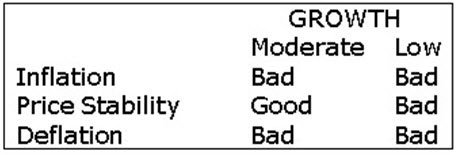

What all of this means is that we are likely to remain in the sweet spot for stock investors of tepid economic growth and low inflation that I described in a recent Money and Markets column. In that article, I presented the chart below that shows that an economic environment characterized by lukewarm economic growth and price stability is the only one that is good for stocks going forward.

The good news is that a close reading of the minutes from last month’s Federal Reserve meeting and Chairman Yellin’s follow — on remarks were consistent and confirm that the Fed understands the precarious position the economy and the financial markets are in.

Make no mistake, this period of stable economic disequilibrium can’t and won’t go on forever. But for now, I think that the Fed continues to thread the economic needle of price stability and tepid growth. And in the short run, that’s good for stock investors.

Best wishes,

Bill

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.