|

“Those of us who have looked to the self-interest of lending institutions

to protect shareholders’ equity — myself especially —

are in a state of shocked disbelief.”

Alan Greenspan

I was talking to a young-but-very-sharp money manager about Federal Reserve policy, and he raved about the genius of former Federal Reserve Chairman Alan Greenspan.

Genius? Funny, I consider Greenspan the financial version of Mr. Magoo.

He’s one of the main culprits behind both the dot-com bubble, by keeping interest rates too low for too long, and the real estate bubble, by pushing for mortgage deregulation.

One of the few brilliantly honest things that came out of his mouth was his 1996 warning about “irrational exuberance.”

I probably should be thanking Greenspan instead of criticizing him because I made a mountain of money in 2000 and 2001 by betting that stock prices would fall.

|

|

| Nearsighted old Mr. Magoo was always good for laughs in his cartoons. But Alan Greenspan’s economic nearsightedness cost our country dearly. |

In fact, it sounds like we’ve been given Version 2.0 of the “irrational exuberance” warning from the Federal Reserve Bank. Last week, the FOMC released the minutes from their last meeting, and it included an unambiguous warning about the stock market.

“Broad U.S. equity price indexes increased over the inter-meeting period, and some measures of valuations, such as price-to-earnings ratios, rose further above historical norms. … Some participants viewed equity prices as quite high relative to standard valuation measures.”

Quite high? Yikes!

“It was observed that prices of other risk assets, such as emerging market stocks, high-yield corporate bonds, and commercial real estate, had also risen significantly in recent months.”

Risen significantly? Oh, oh!

“A number of participants remarked that recent and prospective changes in financial conditions posed upside risks to their economic projections, to the extent that financial developments provided greater stimulus to spending than currently anticipated, as well as downside risks to their economic projections if, for example, financial markets were to experience a significant correction.”

Significant correction? Mercy!

Of course, talk is cheap, but Federal Reserve officials, in this case, are putting their money where their mouths are.

The assets of the Federal Reserve Bank’s own pension fund have reduced its allocation of stocks to the lowest point since the 2008-09 Financial Crisis. Check it out!

Meanwhile, responsible savers had to dump their comfortable CDs and money markets in a desperate search for yield in stocks because of ZIRP (zero interest rate policy). I find it disingenuous that the Fed has cut back their stock holdings in their pension plan while they have forced these savers into the stock market.

What a bunch of hypocrites! However, we’re talking about Washington bureaucrats so we shouldn’t be surprised.

The real question is whether or not you should do the same with your retirement dollars. Should you cut back on your allocation to stocks just like the Fed?

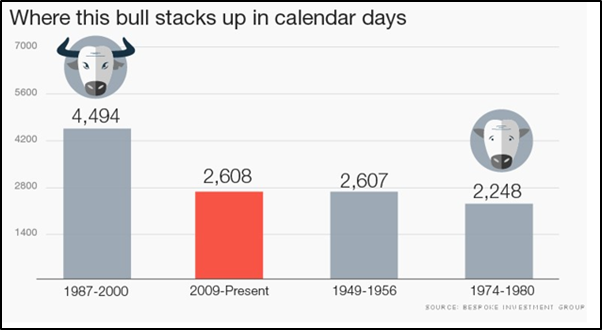

There’s no perfect answer, but we’re talking about the second-longest bull market in history. This bull market started in March 2009 and is now more than 2,600 days old. And the S&P 500 is up by more than 200% since March 2009.

That doesn’t mean the rally can’t continue. In fact, the bull market would need to last another 1,800 days or almost five years, to catch up to the 1987-2000 bull market.

That is why a 100% allocation in cash could be a costly mistake. Just like a 100% allocation in stocks could be, too.

I believe the right move is somewhere in the middle and here is how my retirement portfolio is allocated.

| Cash |

32% |

| Bonds |

23% |

| Gold |

9% |

| Stocks |

36% |

Let me point out three things:

- I am 60 years old so my investment goals are different from those of a 20-, 30- or 40-year-old.

- I have always been a conservative investor with a low tolerance for risk.

- I believe that stocks are currently very overvalued.

So, it looks like I share the same worries as the Federal Reserve Bank pension-fund manager.

That doesn’t make me right. And heck, I may end up being very wrong. But if stock prices do go down, I have enough buying power to go on a bargain-basement shopping spree.

And you?

Best wishes,

Tony Sagami

{ 5 comments }

A crystal ball would sure come in handy right about now, but if your allocation to stocks is on the low side and your cash balance is on the high side, adding at lower prices in the fall is the next best thing to a crystal ball.

I compare my invested portfolio to this breakdown or most of the allocations from any writer, I seldom see a real estate portion. I always hold some real estate, very little via REITS, mostly actual real estate – commercial, residential or farmland. Why do you Wall Street guys “never” hold real estate?

Greenspan. He should go to prison for treason against the United States. He is the mastermind behind the destruction of middle class America. The puppet master of Reagan. The inventor of boom bust economies. The thief of our social security dollars. Big advocate of free markets when him and his wealthy friends are getting rich but not when they need government bailouts. Free to pillage the middle class but not free to fail from their miserable greed. He acts naive but he’s nothing but a calculating criminal.

How do you categorize REITs and Stocks that might be considered bond proxies, such as Utilities, Telecom, etc.?

A Corporate tax cut could bring valuations back in line, if it ever happens!

Thanks!

Thanks Tony, after reading – and agreeing with – your views I was encouraged to see an asset allocation close to mine, especially since your “three things” also closely align with mine. There may be no perfect answer, but yours is as good as any I’ve run across.

Look forward to following your comments as we negotiate this challenging environment.