It has been 90 months and the S&P 500 Index has soared more than 200% since March 2009 in the aftermath of the global financial crisis when this bull market in stocks began.

Market Roundup

The hellish-low of S&P 666 reached at that time is most likely a generational low that will, hopefully never be reached again … at least not in my investment lifetime. That was a secular, or long-term, bottom created by the Great Recession.

Today, seven and a half years later, the secular bull market that began in 2009 is certainly long in the tooth.

But just because the bull market is aging, that doesn’t necessarily mean it’s about to expire.

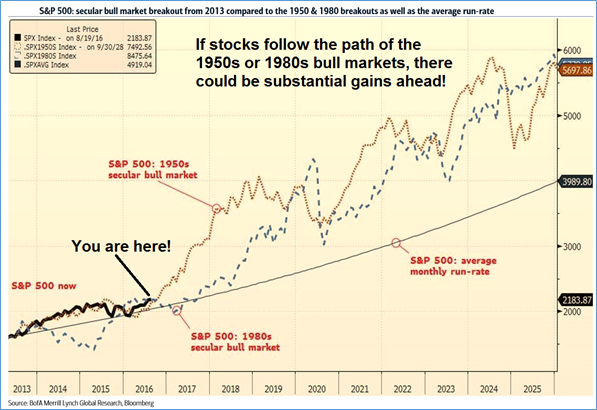

True, this secular bull market is the second-strongest in history in terms of length, second only to the bull market of the 1990s.

But there have been several bull markets that posted even bigger price gains than this one.

The 1980s’ bull run gained 229% in price. The post-World War II bull market in the early 1950s saw the S&P rise 267%, and the 90s’ bull racked up gains of 582%.

This compares to a gain of 221% for the S&P so far since the 2009 low. That’s measured by the standard definition of a bull market, which is a 20%-plus gain, without a decline of 20% or more.

But when it comes to financial markets, definitions can often be deceiving.

In 2011 for instance, the European debt crisis and the U.S. credit-rating downgrade triggered tightening financial conditions.

Stocks swooned that summer to within 9 S&P points (or just six-tenths of one percent) of a 20% correction … close enough to a bear market to be painfully uncomfortable.

Three years later, the Fed ended its easy-money quantitative-easing program in October 2014. Not coincidentally, stocks suffered an immediate “taper tantrum” selloff, and the S&P 500 has been on a roller-coaster ride, full of unexpected twists and turns, ever since.

Stocks essentially went nowhere for the next 18 months, until the S&P finally broke out to new highs in July.

Beneath the surface of the stock market, however, a lot more damage was done.

From early 2015 to July 2016, 269 stocks in the S&P 500 Index plunged at least 20% or more at some point, and never fully recovered those losses.

Even more small-cap stocks in the Russell 2000 suffered bear market-like declines of 20% or more during the period. Many have yet to recover.

Here’s the point: The 19.4% stock market decline in 2011, and the 20%-plus decline in so many individual stocks over the past 18-months, were both close enough to a bear market experience to count in my book, even if neither technically met the definition.

Enough damage was done to investor sentiment that it feels like a bear market just ended. In fact, retail investors have yanked almost $80 billion out of stock mutual funds so far this year. Meanwhile, they’re piling into fixed-income funds, at record-low yields.

That’s the kind of pessimistic behavior seen at market bottoms, not near tops.

Or as Sir John Templeton once said: “Bull markets are born on pessimism …”

Pessimism about stocks and the economy is pretty widespread right now and we’re certainly nowhere near the “irrational exuberance” climate of 1999 or 2007.

That means stocks may still be in the early innings of a longer bull run to the upside. Are there risks? You bet: Odds of a Fed rate hike are on the rise, we are entering a seasonally weak period of the year for stocks, and the November election looms.

But any stock market selloff in the months ahead should be a wonderful buying opportunity. Stay tuned!

|

![]() Rate hike ahead: Federal Reserve Chief Janet Yellen speaking this morning at the Woodstock of monetary policy, the annual Jackson Hole confab, said, “The case for an increase in the federal funds rate has strengthened in recent months…” This, plus recent comments from other Fed officials sends a strong signal that the Fed is prepared to hike interest rates sooner rather than later.

Rate hike ahead: Federal Reserve Chief Janet Yellen speaking this morning at the Woodstock of monetary policy, the annual Jackson Hole confab, said, “The case for an increase in the federal funds rate has strengthened in recent months…” This, plus recent comments from other Fed officials sends a strong signal that the Fed is prepared to hike interest rates sooner rather than later.

![]() Growth rebound: Yellen cited a more upbeat economic outlook as supportive of higher interest rates, but second-quarter U.S. GDP growth was revised downward this morning to a growth rate of just 1.1% for the three months ended June. Looking ahead, however, the Federal Reserve Bank of Atlanta’s GDPNow estimate pegs current-quarter economic growth at better than 3%. If that’s on target, it represents very strong acceleration in the U.S. economy over the summer.

Growth rebound: Yellen cited a more upbeat economic outlook as supportive of higher interest rates, but second-quarter U.S. GDP growth was revised downward this morning to a growth rate of just 1.1% for the three months ended June. Looking ahead, however, the Federal Reserve Bank of Atlanta’s GDPNow estimate pegs current-quarter economic growth at better than 3%. If that’s on target, it represents very strong acceleration in the U.S. economy over the summer.

![]() Good money after bad: The world’s largest pension fund just lost $52 billion last quarter. Ouch! Japan’s Government Pension Investment Fund lost 5.2 trillion yen ($52 billion) in the three months ended June, thanks to bad bets on stocks and a surge in the Japanese yen. Last quarter’s loss wiped out the past six months’ worth of gains in the fund.

Good money after bad: The world’s largest pension fund just lost $52 billion last quarter. Ouch! Japan’s Government Pension Investment Fund lost 5.2 trillion yen ($52 billion) in the three months ended June, thanks to bad bets on stocks and a surge in the Japanese yen. Last quarter’s loss wiped out the past six months’ worth of gains in the fund.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 19 comments }

Keep those stops in place. Remember the snake story – you knew it was a snake when you picked it up. I wonder what Harry Dent is thinking.

I cannot get on line to respond. Help

THANKS FOR THE SENSIBLE STRAIGHT TALK MIKE!

I’M GONN’S MISS U

It’s all because of going into 20 Trillion debt, and little growth to show for it. And extremely high cosumer debt , sub prime car loan debt, even sub prime and hardly any credit check mortgages are being written again, student loan debt, corporate debt.

It seems like nobody pays for anything anymore and everybody is expecting another bail-out.

The reality of things you see in productivity numbers and Manufacturing losses.

Everything else of the So called “growth” has to be paid back and is just smoke and mirrors. Interesting to see how much longer world bankers, includng Wall Street can count on Government Bail-outs. And it will get very ugly when that stops, and it will come to an end, otherwise there would never have been a great depression, credit is not endless.

Joe

Add to your post 5 Quarters of average Lower S & P earnings !! Maybe the Zimbabwe effect will keep these markets going ?????

Unless it looks like a sure Trump victory the Fed will do nothing. The Fed is politicized like everything else in this country.

Joe

Maybe the Fed needs to keep talking about higher rates to keep the P.M. ‘s from going Parabolic which would indicate the Jig is up ??????

Central bankers turning into day traders; what can possibly go wrong?

This is not your “father’s stock market”. We live in a different time. Everything is unprecendented.

1/2 say crash 1/2 say BULLS are marching! however the majority of those saying to stay in the market its going to go up are the investors who have a lot at steak when folks go to cash or pull out. All I can say from my opinion is that we are in for some big big downturns! there is no way with the majority of many business valuations over stated and profits up with volume either down or expected to be down going forward that thing are going to explode upward.

Workers again will feel the pain while shareholders and management will make off like the bandits they are. Does one ever wonder what happens to these people after the ax has fallen on them their wives, family mortgages hopes and dreams all sacrificed on the alter of greed.

Budweiser maker AB InBev will cut about 3% of the combined company’s workforce after the deal is finalized, according to transaction documents filed Friday with regulators.

How the Fed keeps the market topsy turvy.

Yellen speaks as follows

“Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.†unquote This was regarded as a benign signal from the Fed. Then her pit bull the Number 2 crook came out and said

Yet nearly as soon as Ms. Yellen made her remarks public, the No. 2 man at the central bank, Fed Vice Chairman Stanley Fischer, came out and said that the strength in the economy could justify a rate hike in September.

The Fed is really being disingenuous to the markets. Gold dropped suddenly by $10 an ounce and then climbed $19 an ounce and then fell back towards the end of the day. This is the kind of skulduggery one faces when trying to invest in gold. The Fed is deliberately orchestrating confusion in the markets to cover up the fact that they do not have a clue as what to do. I am on the side of the new Fed Up movement and this movement has sure grabbed the attention of Brainard a member of the Federal Reserve. He questioned their financial backing. Apparently their backers have deep pockets and this bothered Brainard. Its time a impartial committee was formed to investigate this abominable horror called the Fed that has feasted on us lo these many years.

Yes your ascertains are true

The 1980s’ bull run gained 229% in price. The post-World War II bull market in the early 1950s saw the S&P rise 267%, and the 90s’ bull racked up gains of 582%. but times are different now. Those market gains were “honestly” made by corporations expanding and hiring new workers and selling “stuff” Today is a whole different kettle of fish. Today the market is governed by borrowing huge sums of money at cheap rates you know our savings in the bank that return us nothing and buying back their own shares showering their CEO’S with obscene pay packets i.e. the salary of the CEO Mylan (who coincidentally is the daughter of a sitting US senator) who is crying crocodile tears on saying that the staggering increase of the epipen frustrates her to. Who is this bimbo kidding her pay packet went up from 2007 to 2016 from 2 million dollars to 18 million boo hoo hoo. They are fudging their books to make them look better than they are bordering on almost being illegal. Key word is almost. The government has given them way to much leeway in how they compile their quarterly and annual statements. Back this up with a whole army of lemming economists that lower the earnings/limbo stick on the ground and the corporations prance over them blowing their horns of prosperity. The above AB InBev merger is another example of the so called prosperity you mention. Its all a con game today and investors sadly are falling for it.

Gordon, my sentiments also

Mike

Maybe its time the rest of the world took the Japan Pension fund loss to heart. This is a real news item not all that other hot air flying around from the dime a dozen economists.

Gordon,

I am one of those Shareholders you refer to as “Bandits”. I guess you belive I do not deserve any return on my investment. I am sure if you have any investments in stocks you expect some return on your money.

CHART INTERPRETATIONS

It sure looks to me that your chart is suggesting a double digit increase in the S&P 500 in 2017 and no significant pull-back until early 2020. However, it shows a very choppy or volatile market developing a year from now through 2019. So, if the chart is close to reliable, it suggest “risk-on” for most of 2017 and then “risk-off” until late 2020. So, the real issue for investors is which sectors will have the momentum and when. Sorry, no way to forecast that. Its all real time and back dated ( past is prelude to future).

Larry Edelson has a different take. He sees a big correction in stocks and precious metals coming up this Fall, while nothing of the kind is suggested in your chart pictured here. So, each expert has their own somewhat different or opposing view of the intermediate term market trends. I suspect that if stocks take off later this year ( probably after the election) then gold will probable decline for the time being. I look forward to a big pull-back in gold mining stocks later on ( timing up in the air ).

Physical gold is far less volatile and appreciated much less than GDX in 2016- so unfortunately, I do not see $800/ounce gold. Gold could decline to $1100 in 2017, until later in the year when stock volatility picks-up ( VIX is bound to surprise to the upside eventually). When it comes to giving a forecast, we all are amateur weathermen.

The Fed is unlikely to raise in September, because it’s an election year. December is likely, but not certain.

What began in 2009 was a new bull cycle in the midst of secular bear market that began in 2000 and is still ongoing. Secular stock cycles end on valuation extremes, and we’re nowhere near a valuation bottom like 1982 or 1942. More to the point, we weren’t in 2009 either. The secular bear market will end with a collapse in valuations that will bring home the price we’ve paid for history’s most insane monetary policy.

The 1980s stock market is a long time ago now. As the Chinese say we live in interesting times.