Most of the investment news you’ve been reading no doubt has a bullish bias. And the reason is quite simple: Greed sells. Moreover, pessimists on Wall Street are harder to find than needles in a haystack.

However, I have zero interest in becoming part of the Wall Street crowd and I believe it is just as important — if not more so — to keep your eyes open for land mines as well as gold mines.

One of the biggest land mines I see today is one of Wall Street’s absolute favorite stocks: Tesla.

In fact, Tesla’s stock has dropped roughly $35 from its 52-week high. But I believe that is just the tip of a very large iceberg of pain. Here’s why:

There were two bad pieces of Tesla news recently: layoffs and recalls.

Bad News #1: If you listen to Elon Musk and Wall Street, business is about to take off at Tesla. However, Tesla announced that it will lay off hundreds of employees. This is an odd action for a company that is supposed to be growing like a weed.

And we’re not talking just about blue-collar factory workers, either. The layoffs include managers, administrative staff, salespeople and engineers.

And that’s especially alarming, because Musk recently announced that Tesla would ramp up production of its Model 3 car to 20,000 a month by December.

I say they’re full of baloney! Tesla missed its September production goal of 1,500 vehicles by a country mile by producing only 260 cars.

Look, if Tesla can’t meet its production targets with a larger number of employees, there isn’t a snowball’s chance in hell that it can do so with a smaller number of workers.

Yet, armed with this dismal data, the auto analyst at Morgan Stanley raised his price target from $317 to $379 at the same time. Brilliant!

Bad News #2: Nobody is perfect, and recalls are not unusual for the auto industry. However, they can be extremely expensive. Cue Tesla announcing the recall of 11,000 Model X SUVs, just two weeks ago.

The problem? The rear seats have failed to lock, and they fall forward in crashes. That’s a BIG problem!

Those are troublesome reports indeed. But Tesla’s biggest problem is the fact that what made it unique, will disappear in the very near future.

I’m talking about a tidal wave of competition from the established automakers. Most major manufacturers have plans to release at least one fully electric vehicle by 2020.Â

- The Chevrolet Bolt has a range of 200 miles and only costs around $30,000 (after tax incentives).

- Audi will begin selling a stunning all-eclectic SUV by 2018 that with carry a range of 300+ miles on a single charge and go from 0 to 60 in just 4.5 seconds.

- Porsche is known for its high performance and sexy appearance. And its all-electric Mission E can go from zero to 60 in just 3.5 seconds. Not only does it have a 300+ mile range, it is capable of charging to 80% of capacity in just 15 minutes.

That’s not all. Toyota, Mercedes, Nissan, Mitsubishi, Ford, Chrysler, Volvo, Kia, Hyundai and BMW will all soon sell electric cars. However, the biggest competitive threat of all will come from Volkswagen, which plans to offer as many as 30 different all-electric cars.

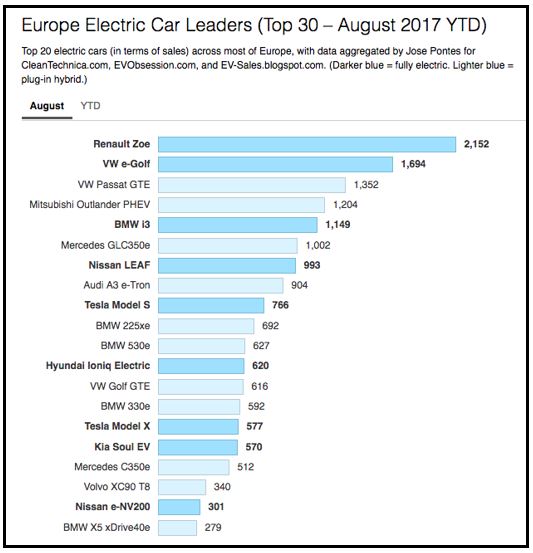

Take a look at the accompanying chart of European electric vehicle sales in the month of August. Tesla is in ninth place and getting clobbered by Volkswagen, which has the No. 2, No. 3 and No. 13 best-selling cars.

All the things that make Tesla cars unique — stunning body style, driving range, high performance and moderate price — will soon be ubiquitous. In fact, I think you can intelligently argue that Porsche, Audi, BMW and Mercedes are producing electric vehicles that are far superior to Tesla’s.

Tesla deserves kudos for its incredible foresight and engineering. But the established auto industry is set to collectively zoom right past it.

You can love Tesla cars, but I highly advise against loving its stock.

You could avoid the shares altogether, or you could buy put options. Buying puts gives you two great advantages – you can make money as a stock heads lower, and you can spend just pennies on the dollar to make that bet because you’re using options! That’s one of the tools in my Calendar Profits Trader arsenal. To see how we go for gains all year ’round, on both rising and falling stocks, click here.

Best wishes,

Tony Sagami

{ 11 comments }

I believe Tesla is moving to batteries and has a large plant out west to produce those batteries.He seems to be headed in that direction.I would like to know more info on this matter. thanks joe

Tesla has its battery plant in Reno, NV up and running. It is HUGE. (the size of 8 football fields.) A VERY competent person has been recently hired in the past couple of months as project director and I know who this person is and this person is highly competent and is a great asset to this innovative company.

That being said, Tesla has made those changes mentioned in the article and has addressed them. As for the recall, recalls happen in all manufacturers, not just Tesla.

How about the electric car manufacturers creating a fully automatic recharging vehicle by using the latest solar technology incorporated within each car’s roof ! That would be the winning manufacturer !

The sun does not put out nearly enough energy per square meter on the Earth’s surface to make this efficient. You have maybe 1 square meter of roof surface. ON a sunny day, you get about 1000 Watts/sqM of sunlight. Most actual installed PV solar cells are about 10% efficient in converting that light into electricity. So, your energy budget is 100 watt-hours of charge per hour in the sun–about 500-700 watt-hours total from sitting in the parking lot all day (it’s actually significantly less than that, because the roof of you car is not perpendicular to the sun’s rays). Now compare that to the battery capacity in a typical Tesla, which is about 80 KILOwatt hours. You do the math from here.

Blunt question follows

Are you shorting TSLA? Stock falls you take it to the bank

We are supposed to be moving towards electric cars. We will live in the days of automatic vehicle identification, electronic toll charging, single occupancy vehicles, dual occupancy vehicles. Even deliveroo and uber are next in these great technology revolution that we are living through.

Agree with everything in this article.You have to admire Tesla for getting pushing electrics,just like Toyota did for hybrids.But the future is going to be much more competitive.Tesla will survive but stock price is way too high.

Tesla has a lot more going for it than just being an electrically powered car. I am ordering my Model S before the end of the year. Can.Not.Wait.

Out of curiosity I wonder if you had a choice to pick the leader of American electric car manufacturers besides Tesla,who would you pick and why? I also wonder why cars don’t recharge while moving,,,or why can’t certain car parts double as batteries? Got 1,000 more,Thankyou for your time

Tesla probably will survive, since it has a valuable brand name in the EV market, but probably as a luxury division of another car company. Look for an acquisition at some point, but it won’t be anywhere near this price. Maybe after it falls back to $100 or (much) less. EV technology just isn’t that exotic. The materials science has advanced over the years, but that’s available to everyone. Tesla worth more than GM or Ford? If you think that, I have a bunch of other stuff I’d like to sell you.

One other thing: I’m not investing in puts yet. I know Tesla will fall dramatically. I just don’t know when. If you don’t have a good answer for both of those factors, don’t buy options. As someone once said, “markets can remain irrational longer than you can remain liquid.”