|

It’s time to get ready to rebel against Washington and against Wall Street investment bankers who play with your money. I’m dead serious about it.

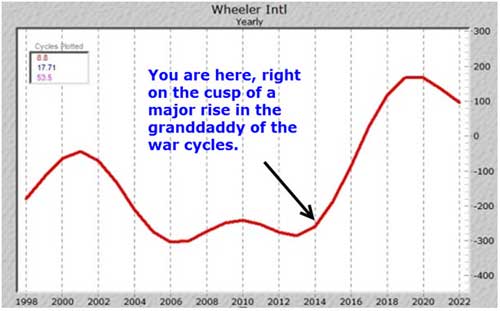

Why? Because the war cycles — as I’ve told you before — are ramping up in a way that has not happened in at least 100 years.

Mind you, the war cycles — a kind of volatility index that measures the cycles of mass human social unrest — are not something to take lightly.

Early this year, in January, I told you how they are ramping up and look what happened:

In April of this year, North Korea threatened to nuke the west coast.

Then in April and May, Egypt erupted in social unrest that led to the ousting of President Mohamed Morsi in July.

Then there was the April Boston Marathon bombing.

And just two weeks ago, on the Money and Markets cruise, I showed everyone who attended how the trajectory of the war cycles is pointing to an acceleration in social unrest starting immediately.

And what’s happened in the last two weeks alone?

|

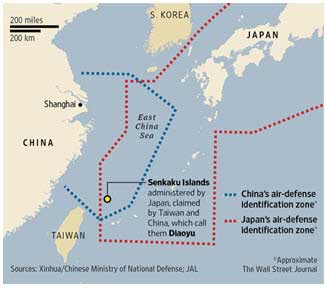

Â China has claimed the airspace over the Spratly and Senkaku Islands, setting off a potential major dispute. Washington sent in B-52 bombers and China countered by sending in an aircraft carrier and jet fighters.

China has claimed the airspace over the Spratly and Senkaku Islands, setting off a potential major dispute. Washington sent in B-52 bombers and China countered by sending in an aircraft carrier and jet fighters.

The clash isn’t over. China will own that airspace. And its next move — which could come at any time — will be to take sovereignty of the East and South China Sea, of its shipping lanes and the very big oil and gas deposits near the Spratly and Senkaku Islands.

Meanwhile …

Â The Ukraine is splitting in two. A civil war is right around the corner, where half the Ukraine sides with Russia and the other half with Europe.

The Ukraine is splitting in two. A civil war is right around the corner, where half the Ukraine sides with Russia and the other half with Europe.

This is a serious situation. And while it may seem like it’s all happening in distant lands and won’t affect you, believe me — it’s coming to the streets of America.

The reasons may be different, and I’ll get to them in a minute, but for the next six years — until the war cycles peak in 2020 — it will be time to batten down the hatches and protect and grow your money like never before.

It will also be time to get ready to join the rebellion against Washington, from the ground up, to get rid of the current form of government, which is as far from what our founding fathers envisioned as can be imagined.

So exactly how will the war cycles show their face

in the US of A?

First, the war cycles are international in scope. So while right now we are largely seeing domestic social unrest in many areas of the world, I can assure you that not only are you going to see more of that, but there is also going to be international unrest.

North Korea will act up again. More importantly, the China, Spratly, Senkaku Islands dipute WILL lead to military conflict between Japan, Korea, Indonesia, the Philippines, Vietnam and yes, the United States WILL get involved. I have no doubt about it.

It may not happen tomorrow, or next month. But I am 100 percent confident that in the months and years ahead that because the war cycles are now ramping up near vertically, they are going to lead to a major war.

Second, there’s a major economic war going on behind the scenes. And you need to know about it TODAY.

Washington is getting ready to confiscate large portions of your wealth. I never thought it would come to this, but it has.

I can see it clearly now. It started in September 2011. That’s when Ben Bernanke announced QEIII, but the money-printing failed to have the desired effect. Gold, instead of soaring, plunged. And it keeps on plunging.

Instead, what started to soar is collectibles and portable wealth such as gold coins … jewelry … diamonds … art work … rare books … rare watches … and more.

Savvy investors are now hoarding their wealth and getting it off the grid as much as possible.

WHY? Because all the money-printing in Europe and the United States is not working.

You see, the money-printing was designed not just to try and bolster the economies of Europe and the U.S. — it was also designed to inflate away Europe’s and Washington’s debt problems by devaluing currencies.

But here’s the catch: Right now, with the exception of the equity markets (for good reason which I’ll explain in a moment), disinflation still rules the day in the U.S. and in Europe, clear cut deflation has the upper hand.

In a nutshell, money-printing is not working to inflate away Washington’s or Brussels’ huge debts. So both governments are now turning AGAINST their citizens and are preparing to outright usurp their wealth to pay off gargantuan mountains of debt.

Just connect the dots:

Â Europe has now approved Cyprus-style confiscation of depositor funds should another bank in the euro zone go down the drain.

Europe has now approved Cyprus-style confiscation of depositor funds should another bank in the euro zone go down the drain.

In addition, from a rock-solid source I have that is behind the scenes in Washington …

— Leaders in Europe and Washington are seriously considering the 10 percent wealth tax that the International Monetary Fund recently proposed as a solution to pay off government debt!

And here’s the real kicker:

— Again, from my rock-solid source, Washington is also seriously considering nationalizing all U.S. retirement accounts and pensions — a confiscation in disguise.

Look, I’m not the paranoid type. I’m not an alarmist or one who sits around conjuring up conspiracies. Far from it.

But when I connect all the dots — from my studies on the war cycles to what’s happening around the world and behind closed doors … and then I factor in what the markets are telling me, what the NSA spying says, what Obamacare and its 16,000 new IRS agents being hired to enforce it means, I come to one and only one conclusion:

The massively indebted governments of Europe and the United States are now gearing up to pay off debts with your money.

That’s why the rich are now starting to hoard and hide their wealth. That’s why most commodities are still in a deflationary mode. After all, you can’t hoard copper, oil, or corn.

It’s why the NSA spying is continuing with no end in sight, and instead, according to recently released Snowden documents, and as reported by CBS News, the agency is collecting nearly five billion phone records each day, including information from cell phones belonging to Americans overseas.

Ironically, this is the reason the stock market is doing well. Equities are considered non-confiscatable. Equities are now becoming safer to own than cash in a bank. Just ask anyone in Europe. Equities also pay a better dividend as well, and carry none of the risks that government debt do.

Equities have done well in the past when the war cycles have turned up, and they are doing the same again today.

So get ready. As the war cycles heat up, the roots of rebellion will grow.

The good news: Ultimately, there will be a home-grown rebellion that throws the bums in Washington — all of them — out on their butts. A new day will come.

A new government more like our founding fathers envisioned will emerge: A better life, better freedom and equality and the pursuit of happiness for all.

But for the next six years it’s going to be hell.

As for gold and other precious metals, their time to shine again will soon be here.

Gold is moving toward a major January low. Silver to a major February low.

Once the lows are in, the precious metals will really shine, for in the end, they are not hedges against inflation, but hedges against governments run amok.

Stay safe and stay tuned,

Larry

{ 13 comments }

Please read as a warning to prepare and get saved by the LORD Jesus Christ.

Very Important to understand or may be crazy view !!!!!

Dear Sir,

What is a better buy for 2-3 years horizon? Gold or silver.

With Regards

Arvind

Great piece but what will confiscating senior's retirement funds look like in reality? And how can people on a pension protect themselves? Thanks and continue the great writing.

I think you meant Malaysia instead of Indonesia for your south china sea dispute. Indonesia is too far from Spratly. Please look at the map.

“It would be nationalized and become part of Social Security and Medicare. The best thing you can do is protect and grow your money now, before it happens. — Best Larryâ€

“Silver may offer more upside potential, but at a price, with extreme volatility. That’s why I prefer gold. — Larryâ€

The world is crazy today, Khaled, especially those who are in charge! — Larryâ€

Larry, How about the shift in cycles for the minors? When could we possibly expect another possible bottom since the last cycle low did not hold? Thanks for your great work!

Money And Markets Thankyou Sir.

“As I’ve been writing about all along, the next target is next month!†— Larry

Larry – A couple of comments: In the depression it was illegal to own more than a certain amount of gold – do you think that will happen again, and, if so, wouldn't silver would be a better investment. Also, it seems to me that eventually Congress will pass a law tracking all sales of gold and silver, since they are in competition to the currency (historically, when currencies inflate, governments have done this). If this happens, it will allow easier confiscation and/or tax on gains when the precious metals increase in value. What are your thoughts?

People may wonder WHY there are all these wars. For that answer, I'd like to direct them to http://www.jw.org, where they can download and read for free the book:

"What Does The Bible REALLY Teach". I found the answer in that book.

Now I really agree with Larry. The War cycle is heating up. And I'm sure that as Wars increase, we will reflect on Larry's forecast and nod our heads in amazement. Actually, Wars are a sign of the last days, but I'll let the book I mentioned above explain that one.

Let me just say that I've never seen a chart with a War cycle, but with mankind's history and the way things are so interconnected today, Larry's forecast seems spot on. Its scary. Very scary. But we know that one small thing can be the trigger to a big event. For example, there was a cartoon that mocked the Muslim's prophet Mohammed. People went crazy with protest and all sorts of hell broke loose.

Over a cartoon! So I look forward to more reports from Larry and thank him for his wonderful insight into world events. Thank you Larry!!!