|

||||||||||||||

The crazy volatility continued on Wall Street today, with a 620-point Dow rally coming just hours after an intraday high-to-low plunge of about 600 points yesterday. If you’re not seasick yet, you have a stronger stomach than me!

So what’s next? What might give us our next set of market clues?

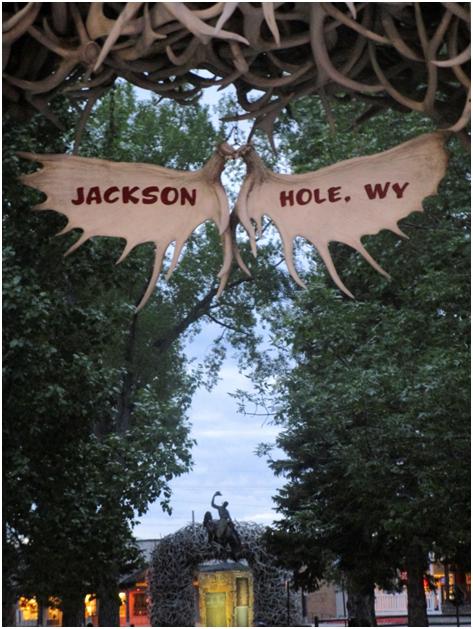

How about Jackson Hole, Wyoming? I remember passing through there on one of my family’s “Griswold-style” trips out West as a kid. Beautiful scenery … wonderful hiking … and I even managed to get the high score and leave my initials on a Ms. Pac-Man machine out there.

But starting tomorrow, there’s something much more important going on there than breathing fresh air or chasing Inky and Blinky around an arcade game screen. The Kansas City Fed will be hosting its 37th annual meeting, which draws Federal Reserve policymakers as well as foreign central bank and government officials. The keynote address will be delivered on Saturday by Fed Vice Chairman Stanley Fischer.

Market participants are behaving like monetary junkies ahead of the gathering, looking for any hint that the Fed might defer a rate hike beyond its Sept. 16-17 meeting. Some also appear to be hoping a foreign central banker or two might suggest doing more QE or otherwise trying to stem the bleeding in the market.

Me? I wouldn’t be surprised if someone, somewhere tries to throw stocks a bone. We’re deeply oversold, we’re seeing plenty of market turmoil here and overseas, and we’ve seen time and again that policymakers are beholden to Wall Street. A short-term rally may very well be in the cards, with Jackson Hole comments as a catalyst.

|

|

| Along with great scenery, Jackson Hole could provide the clues to the next move by the Fed. |

Where I differ … dramatically … from mainstream, conventional Wall Street thinking is on the longer-term impact of any new measures. Specifically, I don’t think QE by anyone, anywhere will have anything like the impact it had in the past on markets or the economy.

The list of reasons is long:

![]() The economic and market fundamentals are deteriorating rapidly around the world.

The economic and market fundamentals are deteriorating rapidly around the world.

![]() The bond, currency and foreign stock markets are all signaling that U.S. stocks are STILL the odd man out, and may need to play “catch down” to get to fair value.

The bond, currency and foreign stock markets are all signaling that U.S. stocks are STILL the odd man out, and may need to play “catch down” to get to fair value.

![]() Multiple rounds of easing around the world haven’t done anything to spur lasting rallies. Yesterday’s huge pre-market rally in stock futures, and early regular-session gains, went up in smoke by the close – despite an aggressive round of Chinese rate cuts.

Multiple rounds of easing around the world haven’t done anything to spur lasting rallies. Yesterday’s huge pre-market rally in stock futures, and early regular-session gains, went up in smoke by the close – despite an aggressive round of Chinese rate cuts.

Even the release of relatively dovish Fed meeting minutes a couple weeks ago only managed to goose stocks for a half hour … after which time they gave up all those gains.

![]() Speaking of the Fed, the St. Louis Fed itself just put out a paper saying that QE doesn’t work. I’ve been saying that for years, of course, but it’s nice to see the Fed finally agreeing with me.

Speaking of the Fed, the St. Louis Fed itself just put out a paper saying that QE doesn’t work. I’ve been saying that for years, of course, but it’s nice to see the Fed finally agreeing with me.

Or in other words, after 6-1/2 long years of bull market behavior built on bullish expectations about cheap money and central bank policy, the jig is up. The times they are a-changing.

Several of my most trusted fundamental and technical indicators are showing that policymakers are losing their potency, and that you need to be selling into the bounces they cause, not buying.

| “Several fundamental and technical indicators are showing that policymakers are losing their potency.” |

Or better yet, for funds you can afford to risk in search of greater profits, consider buying put options or inverse ETFs into big rallies. That’s what I’ve been doing in my Interest Rate Speculator.

So what do you think about the big Fed confab? Are you expecting big news out of it? Or do you think it’ll be a bust for Wall Street? What about the possibility of a September rate hike, more QE overseas, or other policy decisions that could be looming? Are you expecting them, why or why not, and what impact (if any) will they have? Let me hear your thoughts over at the Money and Markets website.

|

We’ve seen a massive amount of market turmoil in the past week, and many of you weighed in on what it all means in the last 24 hours. I appreciate that, because we need to keep the conversation going in these volatile times.

Reader Rick shared his opinion of all the central bank intervention going on, saying: “While the phrase ‘pushing on a string’ is usually just used for interest rate interventions by central banks, I believe the Plunge Protection Teams are doing the same thing all over the world. Or are they just using taxpayer money to prop up the markets so that the big investors can continue to have funds transferred to them, with the help of central bankers on the way down as they did on the way up?”

Reader Kraig also brought up market interventions, saying they serve no useful purpose. His take: “We remember how well the Fed did with its massive money printing. Keep the federal tinkerers out and let Mr. Market right itself. It will do better without the Federal Reserve’s interference.”

Reader Chuck B. picked up the conversation, noting that governments have lost the trust of the markets. He said: “One thing the current uncertainty in the markets shows, is that governments can do whatever they choose to try to control a free market. But the success of those actions depends on the degree to which members of the markets trust their governments. East or West, there doesn’t seem to be a lot of trust in governments these days.”

And Reader Steven offered his view of where the major averages might go in the coming days and weeks:

“I’m going to make an educated guess as to where the Dow will bottom out in the near term. I think that the Dow Index will go down to 12,500+/- before the stock pricing is cheap enough for the ‘flea-market’ buyers to move in and buy up the distressed shares.

“If the governments and the central banks haven’t made the necessary corrections by then, the Dow will slide to about 9,300 — at which time reform of the present banking system will be made mandatory.”

Thanks again for sharing your thoughts. Many of my longer-term indicators are pointing to the return of a bear market environment, even as many of my very short-term indicators are suggesting we’ll see a rally. That’s a big shift from the last several years, and it definitely requires a new way of thinking about investment risk and strategy.

I would note that some of you also reported trouble logging into your brokerage accounts earlier this week. One suggestion: Consider having a backup account at another firm, just in case we see another severe bout of turmoil. That should help ensure you can at least trade at one venue to protect yourself and profit.

If you have other comments on these very important topics, be sure you hit up the website when you get a chance.

|

![]() The European Central Bank could expand or extend QE over there if it needed to, in order to combat slower growth and falling commodity prices, according to ECB board member Peter Praet.

The European Central Bank could expand or extend QE over there if it needed to, in order to combat slower growth and falling commodity prices, according to ECB board member Peter Praet.

My response: Yawn! We’re long past the point where anyone has any illusions that QE works, with even the St. Louis Federal Reserve admitting it doesn’t a few days ago. Call it the law of diminishing returns — and the dwindling response from investors to this kind of verbal intervention further proves my thesis that we’ve entered a new market regime.

![]() We got our first deal in the energy patch in a while, with oil services firm Schlumberger (SLB) agreeing to buy Cameron International (CAM) for $12.7 billion.

We got our first deal in the energy patch in a while, with oil services firm Schlumberger (SLB) agreeing to buy Cameron International (CAM) for $12.7 billion.

The price of $66-and-change was a whopping 56% premium to where Cameron was trading before the news hit the tape. We’ll see if other buyers step up and announce their own deals, given the once-in-three-decades valuations prevalent throughout the industry.

![]() Republican candidate Donald Trump went toe-to-toe with Univision journalist and Mexican-American Jorge Ramos over immigration policy at an Iowa press conference. At one point, Ramos was kicked out of the conference. But then he was allowed back in and the two had a running debate – showing just how contentious the policy issue is.

Republican candidate Donald Trump went toe-to-toe with Univision journalist and Mexican-American Jorge Ramos over immigration policy at an Iowa press conference. At one point, Ramos was kicked out of the conference. But then he was allowed back in and the two had a running debate – showing just how contentious the policy issue is.

![]() Two soldiers from the NATO alliance were killed by assailants wearing Afghan security uniforms. The attackers were killed by return fire in the southern province of Helmand.

Two soldiers from the NATO alliance were killed by assailants wearing Afghan security uniforms. The attackers were killed by return fire in the southern province of Helmand.

So what do you think of the latest energy sector deal? The ECB’s QE rumblings? The ongoing campaign news involving Trump? Let me hear about these stories or others I didn’t cover at the website.

Until next time,

Mike Larson

{ 48 comments }

Mike: Like I said a few days ago… a tsunami… comes in waves, it ain’t done yet. I’m still in agreement with you and selling on the upswings, a cautiously making very small position accumulations on the downs of good companies I want to know for a long time in the good times or bad. I feel the negative impact on our home economies are still yet to come. What a roller coaster… get me a dramamine!

We were just in Jackson WY

I think i just saw Larry yelling from the rooftops!

I darn near reckon they got the “Hole” part right in the name of that there summit of theirs.

Mighty less certain about the first part though.

Elmer

So a couple of NATO soldiers were killed by the Taliban; what about the hundreds – maybe thousands – of Afghanis and others killed by Taliban car bombs. We read about a new blast nearly every day. It is about time we understand that the Taliban, along with al Qaida and ISIS, are basically extensions of the Wahabi sect that controls our “ally”, Saudi Arabia, and whose oil sheiks provide much of the backing for those organizations. Most of al Qaida’s members actually were Saudis, including bin Laden, They are also working to take over Pakistan, which has some 200 atomic weapons. And we worry about their opponent, Iran, which apparently has none, at this point, but may want some as a defensive deterrent in future years. Not to mention as an instrument of the Ayatollah’s ambitions.

All valid points! I just wish people would awaken. Too much FOX news (which according to numerology is “6-6-6 news,” though even MSNBC is “6” news.) The dark is coming… They “ended the awakening” (9-11), but caused so many more to awaken in response to their “end.” People can only be controlled to an extent.

I am told only ten per cent of Muslims are of the radical variety. Only seven per cent of Germans were Nazis! Jim

Germany had its Nazis, the U.S. its Ku Klux Klan, the Middle East the radical

fundamentalists.

Exactly! The Fundamentalists deserve the same fate as the other two. Jim

Fundamentalist of ALL persuasions deserve the Hell they create for others.

If you are going to pay attention to the stock market I would recommend seasickness pills, they got pills for everything. Or you can realize that the market isn’t part of the real world, I understand Peter Pan and Captain hook reside there. So now the rumor mill now has the explosions in China as terrorist acts or the other rumor is retaliation for computer hacking by our side. Then again it could be people incredibly stupid with hazardous materials. stay tuned.

Mike: the trump saga was awesome trump is what this country needs TAKE OUR COUNTRY AND OUR GOODS BACK AND FOR ALL THE COMPANYS that don’t boycott them after all these big companys like ford Nabisco even google apple etc.they are the ones that reverse engineered getting rid of UNION workers and replacing them with illegals just to break the unions and hired the poor refugees who would not say a word because they knew they could deport them with the slightest infraction ,and they could pay them the cheapest salary{minimum} wage and get away with it with politician donations and govt backing{walmart} even them workers get bad treatment from some of their CSM’S and supervisors and they are not illeagals they are u.s. citizens 3 generations,,and many of them did not know 4 days and weeks before this stock market crash all owners in cludeing the waltons, and ceo’s were selling off their share’s of walmart stock ,which was at approx.86$ a share,and today ?,but god forbid if one of the employees or so called associates sold their shares,the would indirectly start getting on their job performance ,that kind of trading should be halted.let them pay tax like every trader ,what happened to the days when you got rewarded and climbed up in a company,and the people just wanted a good job or even a part time job after your regular job just to put you ahead of the financial curve ,its plain greedy and not giving a dam about you or the country.

Trump’s candidacy is a joke. If he’s elected, I’m defecting to Russia. Did you hear what he said in the debates? He said he “paid for their campaigns so when he needed a political favor, they listened.” https://ricochet.com/donald-trump-the-honest-crony-capitalist/ The insanity is that people actually listen to him and want to vote for him when he is ultimately against their best interests and only looks for his own self-interest. He has no principles, nothing to stand for. He’s just an empty box, waiting to be filled further, and you can take some out of him as long as you put more back into him than you took. It is why people hate corporate America, not that most of us are smart enough to understand that, but that’s the way the cookie crumbles.

The Federal Reserve will raise the rate like I said before “Triple Eve of what people call Halloween” 28th October 2015 .. Only a 25 basis points. This is why this is called the “Whirlwind Year 2015” look at all the things going on… October is not far away . So far the earthquakes have not happened but they will show up too top the year off before the end of this Crazy Whirlwind Year of 2015 . Japan escape from the Northern Part . Indonesian the earth moves under your feet devastation . Nations need to repent ! Remember Righteousness exalts a Nation..Thank God for Grace!! Bonds in September see your later investors want a better yield..Prosper America.

Hi Barry,the FED is desperate,anything could happen from here,even QE,again,if its not possible,I would say anything goes.

Yes, the Fed may just raise interest rates in Sept. That would seem to fit with Larry’s predictions of downtrends through Oct.

Central bank money pumping does not put money in anyone’s pocket except the bankers unless you have willing borrowers. With the standard of living falling and the levels of debt in the economy, the Fed is now pushing on a string. I see a debt collapse coming – a very nasty one. Pay off your debts and keep cash on hand. A lot of folks are already doing just that because the velocity of money is slowing.

Can you imagine where our economy would be now if the several trillion dollars of stimulus had been given to we the people instead of the financial institutions and Obama’s crony capitalist pals. I’m amazed that China can watch what happened to us the last six years and still want to emulate us. Keynes has failed everywhere he has been tried but they still don’t get it. Most of China’s leaders must have degrees from Harvard and Yale as well. Jim

Follow the news. A public works program has been offered many times since 2009… The Republicans keep shutting it down…

The Republicans always felt like the most dangerous force in America.

Six years of public works improvements would have done wonders for the nation,

especially for our men.

Like modern unemployed Americans are going to get on the business end of picks and shovels! Somehow I doubt this. I have never denied Republicans suck. It’s arguable they are the single most ineffective political party the world has ever seen. I am just unable to see it your way about how wonderful the Social Democrats are. Jim

Mike,

Today was one of the best setups for shorting the market that you will ever see. The 620 pt up close was the third highest pt close in the Dow history. If you look at the top ten highest closing days you will see that the market was down 9 out of 10 of those times the very next day. It’s very counter-intuitive, and I think that’s what makes the trade work. I’ll take those odds every time, and I did today big time. It’s not a trade to get greedy with – take your profit the next day and get out.

So, the Fed has irretrievably degraded our future and our free market system and proven it is feckless as regards the economy. They shot all their arrows and missed, and now we have to pay for their retreat to Jackson Hole? If we were able to retrieve all the phony money they have created, we could send every man woman and child in the USA to a retreat in Jackson Hole. My message to the Fed, “You’re fired!”

Not so fast, D. The Fed kept our pensions arriving and our States semi-functioning.

Not so small an achievement. Pensions and other entitlements fund many of our local small businesses and landlords.

For the moment. They are bankrupt. Any one depending on money from the government is living on borrowed time. Jim

Goodness, Donald Trump is the worst candidate in the race. The fact that he even has credibility in this race is a sign of the times, and as one estimate predicted here: https://www.youtube.com/watch?t=387&v=1vP3Ju7J4gk , the times are very dark for the US. Most of those people voting in the polls might not even be voting age… I wonder how much of those polls are actually verified to be people who will vote?

The dead cat almost managed a meow today, but tomorrow, well if you believe in the tooth fairy… I don’t for a minute believe the durable goods orders report nor the consumer sentiment report. Time Will Tell.

I was away on a 2 week vacation, silly me on the timing, the last few “Safe Money” reports you warned that things weren’t looking as good as the numbers say(of course, I don’t get the last 3,000 Dow pts.) I sold 25% of my holdings in June & was ready to sell another 25% and buy “protection” (short QQQ, SMH or VIX options) Before I left (50/50) or as soon as you said times are close. Last couple issues I read you were “cautious” but saw no real problems until Fall and you had recommended quite a few purchases I did not make (Ewa @22.70 …low 18’s last checked) an OIl ETF and others. I have made No New purchases, (Except MBLY at 31.88 now 55.30 –60+ when I left) …especially because of my vacation. One of the last things I read was from a “associate” on market sentiment extremes : Jon Markman : Drach’s conclusion, based on the sentiment data: No matter how you look at it, the current level of caution out there should be seen as a positive for stocks. It’s a provocative perspective, but not unreasonable. I’ll keep an eye on this data for you as the summer and autumn progress. I just check today’s “Safe Money” 8/26 and you have more Long BUYS?? ….I just checked today’s 8/26 “Safe Money” and you suggest more Long Buys ?? In this Forum, you make some points, and sound like we’re going off a cliff, then ask what WE think. I would like to know what a person, in my place, Gone for 2 weeks and the markets are Down 9 or 10% Should be doing NOW?? …in July I was thinking of Cashing Out around 18,140 since Cash is a Position, as well, and I could Enjoy my vacation in 30 days. Now What…I think we may see a Bounce up to 16, 800 – 17,000 that won’t hold! ..Sell into it, Short it ? “Inquiring minds would like to know” hahaha …sorry, I needed a laugh! –I really Like your skepticism, I knew QE was a failure but , like you, don’t fight the trend—even if you disagree.

Michael, it is becoming clearer by the day that the next bear market has begun and actually most likely began months ago, with the brush fire starting in the commodities complex, and now thanks to many many other problems, is spreading to become a full blow fire very soon. ALL the signs are staring us in the face, if we have the wisdom and intelligence to identify and recognize them.

Mike could you please Delete my Comment I just SENT …It has a Redundant sentence in it …I can do it over

Mike; One reason our markets are running like a head-less chicken is we Americans spend more of our tax dollars on wars i.e. war making materials, airplanes like the F-35 which is presently 220% over the original estimates, and is now getting new engines because the ones originally ordered have caught on fire and are not “adequate.” We have spent over 2 trillion dollars on wars since 2002, and we will spend the next 3 or 4000 yrs fighting in the Middle East just as those who call that area ??home?? have been doing for the past 3 or 4000 yrs. If I were President, I would pull every American soldier, every American Ambassador and staff our of that complete area and let them beat the heck out of each other until they run out of oil money that blows up all the other’s infidels who ??live?? there. Ray Wallace

Ray, you’ve got to understand that we have to spend money on new defense technology otherwise we’ll lose it all. I’m not for wars, but if we don’t keep those in the defense industry funded it will die. These technologies are tough subject matters, and we have to keep people employed in those industries to keep the ball rolling. I’m a PhD scientist in chemistry, and I’m worried about keeping continuity in the hard sciences.

Best Regards,

Eric

You can’t pick up a rock in the Middle East without finding two people willing to fight over it. Eight hundred years of inbreeding has taken its toll. We don’t even need their oil anymore. Jim

From my way of thinking about what really going on is that Wall Street, Goldman along with Obama set in motion for this to wipe out the small players that can not be glue to watch the Dow during trading. The big traders or companies use option trade to cut their loses or even make gains mainly keeping most working class out of market

If everybody says something is going to happen that probably isn’t going to be what happens. Jim

I don’t see a rate hike in sept. or probably rest of the year. I see dove talk.–If the Fed raised rates ,now,even 1/4% it would rattle the markets,more and increase the deflationary scenario.It wouldn’t make sense to me,but then ,again,nothing much does,anymore…

It’s time for the uber-capitalists, and the less than uber-capitalists, to chip in to save

the Country and our Citizens. Every landlord in America, who is able, should be encouraged to return one month’s rent to each of their renters. It is really their turn to try to put a smile on everyone’s face, to share the struggle as community. Small plans can yield large rewards.

Comrade, they already take half what we make. Did you see where Living Wage Pizza Parlors are having to charge $32 for a pizza? You guys are so generous with other peoples money. Jim

Another bleeding heart liberal all you people do is take take take from the rest of us .you want everything for free why don’t you try working for it you know the hard way instead of gimme gimme do u know how much every house costs per yr just for property taxes and insurance . plus for the property itself plus fixing everything snow removal grass cutting that’s why I refuse to buy anything in the inner citys or even the best neighborhoods in the city. instead I buy premium propertys for a premium price I buy propertys with a open space on them florida and Arizona worked out real well and a few yrs back I purchased 12 acres in different lots that were in foreclosure I was made an offer recently I knew it was coming to build a gas station and strip mall I have another one with 8 1/2 acres I see the same thing coming in 3-4 yrs too bad u think everything is profit do u realize what it takes to get a home or building to code for 2015 I have to deal with costs for carpenters roofers plumbers electricians heating and cooling installers drywallers nothing is the same from state to state county to county and every building inspector can be a real pain in the butt depending on their mood that day

Jackson Hole, Jackson Hole, isn’t that where outlaws and crooks used to hide out in the old west?

Nice to see that nothing has changed.

You may be onto something. It was Rockefeller’s mountain hideout. Jim

Hi Mike. “[stocks] are deeply oversold”? How can anyone say that when we’ve hardly made a dent down in a multi-year stock boom market with hardly a significant dip along the way. A one or two day dip of half the percent drop expected for a typical market correction shouldn’t be considered “deeply oversold”. Double-or-nothing?

1n only should know how to spell properties if he/she buys so much

It seems that everyone and you have forgotten about “gold.” A small backing of the dollar with the gold in our mint (without withdrawing rights) could really stabilize the dollar. It would show that the Fed and the government is serious about controlling our debt and a possible inflationary “depression.” Have you gone to the grocery store lately? The commodity markets are at a bottom while prices are still going up on meat, etc. My theory is that the labor cost are driving this, or the middlemen are ripping us.

The market decline is not a surprise to me. For the last year the 8-10 indicators (I use – Monthly) have been saying “top,” especially the last several months. The last one finally turned over in June so I saw this coming. Mike is right. Inverse ETF’s are the way to go.

The West has been devastating Economies for a long time.

Wealth is created from the bottom up, not the top down, QE’s is believing that Wealth is created from the top down.

The West is receiving what it has sown. The East – meaning China has taken a page from the West (Believing that extra wealth is required, thus it is also reaping that which it has sown).

China may change its ways, but the West will not, until either a War will devastate all, or a long Depression forces a change in Policy.

I just read that Living wage Pizza Parlors have to Charge $32.00 for a Pizza. That’s a good idea. Think about it.

Actually, a local Pizza Parlor has gone to only one size pizza, to prosper in hard times.

Those who make big Money can afford it. Those who cannot, might think that working for food is not worth it, better to have someone at home to cook food without toxins being added.

Perhaps living up to the Jones is not worth it.

Perhaps returning to a Community atmosphere, where their is time for yourself and others.

Perhaps embracing responsible Capitalism could happen, instead of the unfettered Capitalism under which we live now.

That has raised the volume on questions about whether Yellen and the rest of the FOMC will hold off on raising interest rates at the FOMC meeting in September, as well as what ammunition the Fed might have left to jump-start growth in case of a slowdown. The rate hike is a topic Yellen and other Fed officials likely wanted to avoid discussing at Jackson Hole because it is close to the FOMC’s September meeting, experts said.