The junk bond market has been bleeding for more than a year, with prices falling and yields rising. And while the carnage started in the energy sector, it has gradually spread throughout the high-risk bond and leveraged-credit markets.

Market Roundup

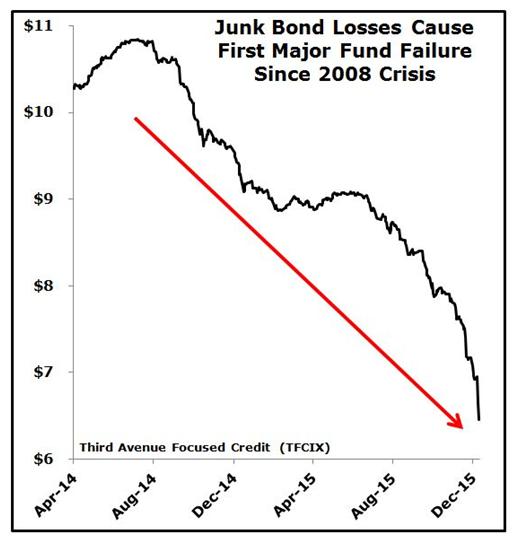

Now, the troubles have claimed a major mutual fund victim — the Third Avenue Focused Credit Fund (TFCIX). The fund was chock full of junk bonds, stocks, warrants, loans and preferred shares, and those securities have been plunging in value.

It had lost almost 27% of its value year-to-date, as you can see in this chart …

|

|

| Shocking losses … |

Selling its relatively illiquid holdings into a falling market could have caused the losses to get even worse. So Third Avenue Management decided to slam the gates shut on withdrawals from the $789 million fund.

This is shocking, folks. I say that because it’s an extremely rare move for an open-ended mutual fund. No mutual fund has ever halted redemptions without an order from the Securities and Exchange Commission authorizing it to do so.

In fact, we haven’t seen a fund failure even remotely like this since the credit crisis in 2008. That’s when a money market fund called the Primary Reserve Fund “broke the buck.”

There’s no telling how long it will take for fund investors to get all their money back. But one thing is clear: So much money flooded into junk bond funds in a desperate search for yield over the past few years … and losses are so widespread that every single one of the 30 largest high-yield bond funds is showing losses for 2015. That means even more investor withdrawals are likely in this asset class, hitting the junk bond market even harder.

|

|

| An extremely rare move for an open-ended mutual fund … |

So what are the consequences for you, and the markets in general?

First, if you own junk bond funds or ETFs, you’re probably losing money on them. There’s nothing you can do about the past. But you can insulate yourself against further losses by selling down your holdings now.

At some point, the risk-reward in owning junk bonds will make sense for fresh investments. Yields will rise high enough, and prices will drop low enough, to make riskier bonds too attractive to ignore. But I don’t think we’re there yet.

Second, what happens in the higher-risk corners of the debt market won’t stay contained there. It sure as heck didn’t in 2007-09, or in other major turns in the credit cycle. As debt market liquidity dries up and prices fall, it will put more pressure on companies that need cheap debt to survive and thrive. It will also cause banks to tighten lending standards on new loans, because they’ll have a tougher time unloading some of their risk on investors.

This is all bad news for publicly traded hedge fund, private equity and money management firms. It’s also bad news for foreign banks, many of which are already reeling from economic problems in South America, Asia, and Europe.

Finally, it’s a key reason why the broader financial sector has lagged the market rally … and why financial stocks in general look relatively vulnerable to me. If you own these kinds of names, sell.

Third, this makes it even more important for you to maintain a much higher level of cash reserves than you have for the past six-plus years. It also underscores why you should consider using downside hedges to protect against losses in vulnerable sectors like financials. In my Interest Rate Speculator service, I’m a bit more aggressive and looking to generate by targeting troubled shares.

Fourth, understand that many investors have been “hiding” in other sectors they believe aren’t as vulnerable to the credit problems. That includes sectors like technology, especially the infamous “FANG” stocks.

But if tighter lending standards, a flattening yield curve, and weak foreign growth weigh more heavily on the domestic economy, it’s going to pressure even those previously resilient kinds of names. So if you haven’t taken some profits on those stocks, or pared down your overall market exposure, this is a good time to do so.

Bottom line: You simply can’t ignore the credit markets if you want to be a successful investor. The first major gating of a mutual fund since the credit crisis in 2008 shows that the problems are getting worse out there, and further illustrates why taking protective action is warranted.

So what do you think about this latest mutual fund disaster? Are you holding junk bond mutual funds or ETFs, and if so, how are you reacting to the Third Avenue news? What does this say about the broader stock market? Do you believe the problems will stay bottled up in energy and commodity stocks, or is this a sign you need to dump other stocks as well? Let me know here at the website.

|

Market turmoil is definitely on the rise, driven by events in the credit markets. That inspired many of you to weigh in on what’s going on now, and what you expect to happen next.

Reader R.J. said: “There is no doubt capital has been chasing yield anywhere it can for six years now. The Fed’s statement is critical. If they don’t emphasize this is a ‘one and done’ rate hike, then all heck will break loose. If they use the right words, I think the bubble will continue to inflate for at least another year.”

Reader J.P.F. also shared some comments about the upcoming Federal Reserve meeting, saying: “Do we believe Janet Yellen will boost the Fed rates by 0.25% on December 16? Many do. I do not believe this, although I would like to see it.

“The economies of many countries just stink! Ours is even rotting from the bottom, while a rate increase could push some of these ‘walking zombies’ into default. It will not be the worst thing in the world to finally let the cleansing that would have happened after the 2008 bank mess, had the Fed not interfered to save the ‘too big to fail’ companies.”

Where will stocks head next as a result? Reader Jim said: “The trend of the last couple of years has been for the markets to rally to the end of the year, then to decline through January. Then in February, they would start advancing again. I think that this pattern will pretty much remain the same, except that after January, stocks will continue in a decline throughout 2016.”

But Reader $1,000 Gold was more optimistic, at least about select companies: “This is what consolidations are all about. I expect just a handful of large oil companies to survive. But in the mid-to-long-term, everyone will be better off. It’s why Warren Buffet likes large caps. So do I.”

Thanks for sharing everyone. Personally, I can’t help but be cautious, as I have been since the summer. That’s because the message from the credit markets is an unambiguous negative. Unless and until conditions change there, I believe sticking with a cautious investment strategy is a smart move.

Agree? Disagree? Then let me know about it here.

|

![]() DuPont (DD) and Dow Chemical (DOW) confirmed that they plan to merge in a transaction valued at roughly $130 billion. It will be structured as a merger of equals, rather than a takeover of one company by the other, and will be followed by a re-split of the firm into three new units.

DuPont (DD) and Dow Chemical (DOW) confirmed that they plan to merge in a transaction valued at roughly $130 billion. It will be structured as a merger of equals, rather than a takeover of one company by the other, and will be followed by a re-split of the firm into three new units.

But investors sold shares of both companies today. That could stem from worries about the health of the chemical and agricultural industries, the deal’s complexity, and/or regulatory opposition, among other factors.

![]() While worries about the future direction of the U.S. economy are percolating out there, the government reported relatively strong retail sales in November. Headline sales rose 0.2%, while sales excluding autos and gasoline gained 0.5%. That was the biggest rise since July.

While worries about the future direction of the U.S. economy are percolating out there, the government reported relatively strong retail sales in November. Headline sales rose 0.2%, while sales excluding autos and gasoline gained 0.5%. That was the biggest rise since July.

![]() The “Warren Buffett of China” has gone missing, and trading in shares of his investment vehicle Fosun International and related companies worth $34 billion have been suspended. Guo Guangchang has spent billions of dollars buying businesses as diverse as Club Med and Cirque du Soleil, plus banks and insurers at home and in the U.S. and Europe. It also owns real estate, including One Chase Manhattan Plaza in New York City.

The “Warren Buffett of China” has gone missing, and trading in shares of his investment vehicle Fosun International and related companies worth $34 billion have been suspended. Guo Guangchang has spent billions of dollars buying businesses as diverse as Club Med and Cirque du Soleil, plus banks and insurers at home and in the U.S. and Europe. It also owns real estate, including One Chase Manhattan Plaza in New York City.

But he disappeared several days ago, amid rumors of an anti-corruption investigation by Chinese officials. That caused prices of Fosun bonds to plunge, and helped fuel even more worries about the stability and safety of Chinese markets.

So what additional thoughts do you have about the Dow-DuPont tie-up, now that it’s official? Do you think the strong retail sales data puts to rest fears of a weak holiday shopping season? Or will sales deteriorate going forward? How about the latest news out of China? If you have any comments on these or other topics, be sure to share them below.

Until next time,

Mike Larson

P.S. Are you pondering what you should be doing now to preserve your wealth in a world gone mad?

A new report by Weiss Research Senior Analyst LARRY EDELSON has the answers you’re looking for.

Click this link to read your free copy now.

{ 81 comments }

Third Ave had a good reputation and this comes as a bit of a surprise but a good lesson for all. Some junk bond funds and ETFs will fall but will also recover as they don’t have quite this level of eclectic junk. The whole idea of a fund is to provide some sort of cushion against everything but total failure. The reckless use of leverage and exotics violates this principle. One would hope, but I doubt, that a painful lesson has been learned.

There are plenty of warnings by Third Avenue what investors are getting into, and the hight risks…investors went in with their gullible eyes wide open!!!

I pretty much said what I have to say about the Third Street Focused Credit Fund, yesterday. I agree with Mike that it is a shocking development, but it isn’t totally unexpected. If not that fund, another one. Others are likely to pop up. What worries me is the effect it could have on even higher grade bonds, and, after a bit, on the stock markets. So many companies – even quality companies – have gone into the debt market to finance expansion and capital expenditures, and these could be in danger of having their debt downgraded. Would investors want to own companies that have had debt downgraded? Even sound companies could see their stock move lower out of caution. I bought more of an inverse ETF today.

Your right again Chuck. There will be a slow but sure trickle down to effect to medium to low risk vehicles. The tsunami effect. Companies used to use profits to expand today they use cheap loans. Companies have become low interest rate loan junkies or to sum it up in a word GREED. I have learned at age 77 that things do come back to bite you in the posterior.

The wall street crooks need to stop tinkering with the markets they are the ones causing the doom and gloom along with the crooked FEDERAL GOVERNMENT.

Any Statist government is “crooked” by definition, isn’t it?

i doubt if any of these guys even know what a statist is.

Especially the gold market. Paper gold is useless but a good suppression tool. Look at the mints they cannot keep up with gold and silver coin sales. They are going through the roof. People can sometimes be dumb but these people know a bargain when they see one. Wall Street and the Federal government hate gold. They are trying to drown it in a sea of funny money.

thanks for a great article, mike. you’ve got my guard up. it’s going to be rough on bonds turning the corner on interest rates, especially high-yield. but the flip side of the coin is this is also the beginning of the “great rotation” from bonds to stocks that everyone has been waiting for.

That IS a possibility,$100, but it seems more likely to me that this “wall of worry” would be a very tough climb for the stock markets, and could result in a fall, instead. We should see very soon.

Whoops, $1000.

was that Freudian?

the fed is being as gentle as they can in popping the cherry, chuck. we’re at top dead center right now as we speak. i’m sure the fed will gently push us over the top as they proceed. the fed wants to push investors out of bonds and into stocks by raising rates ever so slowly causing a little turbulence as possible. let’s hope they don’t blow it. btw, $100 gold sounds good to me. i’ll sure back up the truck and buy.

On a completely different front, I see that Putin has praised U.S. attacks on ISIS oil infrastructure (oil sales through Turkey seem to be it’s main financial support). He says the Russian Air Force has begun supporting the resistance groups that we support against Assad’s forces. If true, this would be quite a turnabout, and would open a whole new can of worms in Syria.

Sixty five nations converging on the Middle East to make war looks very scary to me. Also, every major war has been preceded by nations imposing economic sanctions on each other. I see nothing good coming of this. Jim

What happens if ISIS manages to obtain chemical, biological, or even nuclear capabilities? Jim

ISIS is out to take over Pakistan, which would give them nukes.

Come to think of it, that could have something to do with Putin’s new opposition to ISIS.

How do you know who is friend or foe without a program? The who supports who is like trying to figure out who owns what in the different stocks.

Caveat Emptor–

Any thoughts on ETF SJB? I have small allocation and it’s been paying off

I have a small position in SJB myself. I bought it at a short term peck, but I think it is going to pay off anyway.

Whats happening the currency market/Euro up dollar down opposite to Weiss predictions >>Explain>>

J

keep it simple, john. what the ecb does to the euro affects our dollar, and what our fed does to the dollar affect the euro. you can complicate it if you want, but you circle right back to this.

I’m experiencing pain on some energy pipeline stocks. Just when I thought it was low it went lower! Seeing the divided go up made me feel better. As long as I have confidence the investment will survive the yield will cover the loses. In income investments I like to think long term. Am I crazy?

I have three myself. It’s been very painful. I ask myself if all of a sudden an important element of our infrastructure is trash. I don’t think so. I think it’s mostly related to credit market problems discussed here. KMI for instance is the prime dry gas mover, which has a bright future. Rich Kinder is one of the best at what he does. If and when we start exporting gas it should do a great business. A agree, a long term strategy is the right one. I’m sticking! Jim

You better take a snapshot of the dividend numbers they are falling like rain in April. Some are down to zero now. Do you honestly think that Kinder Morgan is going to keep paying a 10% plus dividend in this environment? If you do I have some swampland in Florida for sale.

You better take a snapshot of the dividend numbers they are falling like rain in April. Some are down to zero now. Do you honestly think that Kinder Morgan is going to keep paying a 10% plus dividend in this environment? If you do I have some swampland in Florida for sale.

Jack,yes

In light of that bond fund failure, will the Fed dare to raise rates next week? Will investors be reassured or frightened? The reaction will be telling, but we can never be sure. Psychology is never certain.

That is a great question. Monday should have some more early downside. If it is heavy downside…..who know what she will do. I hate having these federal gubmint planners manipulating markets.

I think the Fed’s credibility will rise or fall on this one. They are painted into a must do corner.

so if the fed is right, we’ll all have new respect for them.

The Fed has only destroyed 95 per cent of the purchasing power of the currency it was created to protect. With that track record I don’t expect much. Then again, even a broken clock us right twice a day. Jim

A broken digital clock is never right, and remember, there is a lot more digital money out there, than with numbers on the face.

Interesting you bring up the subject of digital money. I read an article contending that inflation was now highly unlikely because there is relatively little physical cash in circulation. Weimar and Zimbabwe featured wheelbarrows of bills that simply aren’t there now. What’s your take? Jim

What brings about inflation is not so much the amount of money in circulation, but it’s velocity. A lot of money, held out of circulation, does little to drive up prices. Even a little money, moving quickly from one use to another, produces the feeling of inflation. That can result in the reality of inflation. Even digital money can move relatively slowly. It has been for the last few years. A speedup in movement, which could result from an interest rate panic, could speed up that flow, and lead to the reality, as hidden funds are revealed. That is my impression, for what it is worth. We could even have inflation in the midst of a Depression, which would be a catastrophe.

‘Sorry, in that first sentence, I should have said, “the amount of money ‘available'”.

the fed has also more than tripled our assets in the last five years or so.

also that weaker dollar the fed created over my lifetime has made my mortgage payment go from my highest monthly expense to just a minor monthly expense.

It has also enabled the Feds to rob us blind. Inflation is a hidden tax. Think of the tens of millions of working people that have been inflated into the higher tax brackets. It was never intended that the average working person would pay income taxes. The rich were supposed to carry the load. As a practical matter this has forced Mom to go to work. Your mortgage burden may be decreased but look what you are paying for the simple necessities now. It’s outrageous. Jim

my wages and assets have grown with the rate of inflation with no effort on my part, yet my liabilities have remained constant. thus my standard of living has drastically improved over my lifetime as a result. this is the intent of the fed’s mandate of maintaining a 2% annual inflation rate. without this policy in place, my standard of living would stagnate.

Hopefully the worst happens…so Greenspan and Bernanke are exposed as both being responsible for making bad decisions over and over again. The financial blogs are overflowing with angry investors who fell into the KMI trap of outrageous returns that were created from cheap short term debt. I was smarter. I read his balance sheet and predicted the future. Opps that is right… blame Bush and the republicans, if that helps relieve the pain. Since the effective rate of interest is really below ZERO, now what?

I used to think Greenspan was better than sliced bread. Today I realize he was just another flunky putting in time to get a pension. The government told me all my working years to save my money for my retirement. Well I am there now I kept the faith. While I was busy saving they were busy screwing up the economy and the world. Now I am sitting in a screwed up world with money that does not work for me but costs me a parking fee with banks. Stock market at my age hardly especially a blatantly manipulated market by Goldman Sachs and a few other high rollers. So young people of the world spend it while it is worth something or buy a Weirmar wheelbarrow.

Michael, as I have consistently said in my replies to you. There are innumerable canaries in the financial coal mine and the High Yield, Junk Bond market is NO exception and ranks as one of the largest canaries in the worlds financial markets. Katy bar the door…the bear market is about to really roar!

I continue to be mystified by the “Chinese Miracle”. This latest episode only adds to the confusion. I have heard for years from many credible sources that China is the future economic powerhouse and a slam dunk investment. I have heard just as many experts contend it is just another centrally planned communist disaster. Nine per cent growth economy, or a sham based on a fraudulent, crony banking system and slave labor? I don’t get it. Jim

Just be patient young fellow you will get it. If you own Chinese shares you will really get it up the keester.

According to news from the Middle Kingdom, Gordon is correct. One of their best known billionaires has apparently absconded with whatever he could save, Larry could ultimately be right about China, but things seem to be going bad there faster than anyone could believe.

A collapse in credit markets HERE, could be far worse than the last one, and remember what happened then.

i have no doubt china will enter a secular bull at some point. but the bubble just popped, which usually leads to a recession, and recessions can last a year or two. i’m not good at timing these things, i can be patient and let the opportunity come to me.

Info not correct many funds have in the past stopped redemptions

Selling junk bonds? That depends on what your plan was when you bought. If you bought a bond under par, with a fixed coupon and with the goal to keep it to maturity, you are OK as long as the company doesn’t go belly up. However even if it does you are better off than if you own stock.

Yes, if the issuer has assets, you will eventually get SOMETHING – after the lawyers fight over the bones and grab what they can.

Do your subscribers a favor and recommend how to benefit from “junk bond” failures through such vehicles as Inverse ETF’s, etc.

any one can predict what will happen to gold and especialy Silver???

gold has been stuck in the same downward trend channel for the last couple years. expect more of the same until there’s a breakout to the high or low side of the channel. otherwise, gold is a sleeper.

Gold has had a 50% retracement of the 1700 point run-up. According to the technicians, it should now start moving MUCH higher. Take that with a bit of salt, but some sort of climb should be in the works. Watch for a break above the recent down channel.

that’s exactly what i’m watching for, a breakout high or low from the channel. frankly, i doubt we’re anywhere near that point. i expect to see more of the same for the next few years. but i’ll keep an open mind.

i imagine we’ll see volatility in gold once we reach the old s/r level below $1,000.

silver is just gold on steroids.

Mike,

I would like to point out to you that there has NEVER been a Stock Market Crash during a Progressive Liberal Administration in our history…. They have ALL occurred during Conservative Administrations..So for all of your walling and gnashing of teeth, I would ask you, why were you NOT making these dire claims as the Cheney/bush Administration was approached November 2007?

We don’t HAVE a Progressive Liberal Administration, Eagle. We have an almost Fascist Administration, installed in the Bush years, as his answer to 9/11, and continued by Obama – perhaps even added to, in some respects. The trend actually began with Nixon, and has usually been added to by most of his successors. Bill Clinton tried to reduce it, but I’m not so sure his wife would. The Republicans? LOL! A crash under Obama would NOT invalidate your thesis.

I find it hard to believe I’m safe from anything under the current administration. Chuck is right, we have been drifting into a Corporate-Fascist system for years with the aid and assistance of both parties. The War on Terror has accelerated it. Jim

Nixon sold us out to the Chinese at the behest of the One World Organization made up of the richest 3% in America… Reagan lower the taxes on the 3% and our deficit went parabolic, Clinton sold us out by signing the Republican initiatives to Remove Glass-Steagall and NAFTA….. Cheney/bush furthered the deficit by going to Iraq and Afghanistan without increasing taxes to pay for it….. Obama saved the Stock Market Crash and Great Depression, but failed to get another WPA/CCC program through as the GOP was against it… Personally, I’m backing Sanders over Trump or any other sell out member of the GOP, that panders to the 3% at great cost to the 97%… Want another Crash, vote in the Conservatives again… :(

You conveniently left out Jimmy Carter. I agree that for the moment Obama averted a real disaster, but the $10 trillion he borrowed from our children and grandchildren will have very negative long term consequences. The debt bomb created by the Keynesian Progressives here and abroad could mean a crash is imminent whoever is elected in 2016. Jim

Jim,

They said the same thing about FDR… Remember him, the most elected President in history until he passed legislation only allowing two periods in office…. Remember how our grandparents loved that President? Obama is NO different and Bernie will be even better with Elizabeth Warren as Vice President… Get used to it!… :)

According to Lipper, investors pulled $3.5 Billion out of bond funds last week, and they only had a day and a bit to do it after news of the fund failure broke. This coming week, more funds could shut their withdrawal doors, because of demand. If you are in one of these junk bond funds, take heed, and get out, NOW! The stock markets could also fall sharply in coming days. 50%?

I agree with you on the markets’ potential fall, Chuck.

Sorry, but I just have to post it again:

The action of the stock market now reminds me of what Hannibal Lector said when he had the guy tied up on a hand truck with a noose around his neck and was about to pitch him over the balcony

…â€Here we go…..!â€

Hannibal’s question is still at hand…….”…Will it be bowels in or bowels out…??”

I recently bought preferred stocks in major utilities that have fallen by 40 to 50% and are now yielding up to 11%. About 9 months ago they were trading at par. These companies have no risk of insolvency and they are obliged to pay on these preferreds. I don’t get it. Even if interest rates gradually climb over the next few years, they will not rival the yields I,m getting on these shares. I don’t think the economy can handle double digit interest rates any time soon. I also have some bonds from solid companies yielding double digits and I doubt very much they are gong belly up at this point – not unless we have a major collapse. Why would someone sell these and loose 50% of their money rather than hold on (based on their original due diligence that a certain percentage of their holdings may be lost – 10%…20% ? Stay the course … do you really believe that more than 50% of your investments will go bankrupt? To justify locking in a 50% loss today?

So I can only explain this as mass hysteria. People who are willing to sell and loose half their money are reacting out of fear just as people always do. Its OK, careful bottom picking will yield tasty fruit for those who understand a bargain when they see it and are not afraid or caught up in the stampede. Some things in this world never change throughout history – human behavior is one of them.

As you say, barring a mass collapse, you should stay the course. Mass psychology is likely to mean that many people will run with the flock, though, and like the lemmings, go over the cliff. Just use your head for something besides a hatrack. There will be opportunities to make a bundle.

The ONLY mass collapse that will occur is if a Republican is elected President and the GOP keeps the Congress…. Then it is guaranteed…. :( That said, I am optimistic and investing that way as history scientific evidence has taught me

The fact that the Third Ave. fund collapse happened on a Thursday could mean that people had the weekend to get used to the idea, after an initial bout of fear. This could reduce the immediate effect. What happens when another junk bond fund has to close it’s doors, though – and it will almost certainly happen. After a few such events, the Fed could order all such funds to halt activities. Or maybe not. The effect would be much the same either way: the credit markets would essentially collapse, and Trillions would disappear from the economy. Deflation, either way.

Chuck: “…Deflation, either way.” Agreed! Or put another way….complete collapse of confidence in any kind of growth….. Our FOMC, and with all the other central bankers around the world, have been fighting it for years now.

I don’t believe they’ve done anything but delay the inevitable….otherwise, all the trillions in monetary stimulus would have produced hyper-inflation by now.

And all it will take to trigger the avalanche is just one little disturbance in some area that only history will reveal….

The reason for the recent abolition of “stop-loss” and “good-til-cancelled” orders is to stop the electronic cascade once the slide (or really, plummet) begins…

Blame it on a political party, a particular president, a group of mutual funds, one or all of the FOMC chairs…….blame it on whomever you like, sadly, the outcome will be the same.

I think we may very well be witnessing a re-do of the 1929 crash and aftermath. It’s just taking longer to materialize because it’s much bigger this time around!!

Glass-Steagall was made law in 1933 after the Pecora Hearings made it clear what caused the Crash of 1929….. That worked well for 60 years until the genius Majority Republican Congress removed it in 1999 during the Clinton administration… Clinton did not veto it or sign it, but simple let it pass,a huge error in judgement … That allowed the same super dangerous trading practices and that brought the markets down 2007-2009 (60% loss).

Only one Presidential candidate is campaigning to reinstate Glass-Steagall and that is Bernie Sanders….. Our markets will NEVER be safe until this law is back on the books

I’m not a big fan of government solving any problems but in this case I think Eagle495 is correct that we need to reinstate Glass Steagull and stop banks from trading or competing against investors with concepts like computer trading which is designed primarily to take money from individual investors.

Why invest anything now? Banks are trading millions of shares per second to mislead traders, they have derivatives having the strongest weight of any financial vehicles, they take loan portfolios and mix them up to hide risk and sell them off to unsuspecting or believing investors who need return. We don’t have a stock market where investors invest we have rigged financial system designed to put money into banks and out of the pockets of savers.

History repeating itself? No one knows. Predicting what will happen next is never an exact science, otherwise we would be very rich. However, when you look at the interest rate chart you see it at zero and flat for the past 7 years. That’s pretty scary. Something is wrong here. I think the patient is dead. He has flatlined. What happens next is anyone’s guess.

Jim, I think the zirp is more like morphine to a terminally ill patient….takes away at least some of the pain, but doesn’t really do anything to help the state of health…….It’s a sad comparison for our national (and international) financial situation, but I’m afraid it’s more true than anyone would like to believe.

There’s a joke going around in Russia, that bears repeating:

A Putin aide asks him what it is like playing chess with Obama.

“Well, its like playing with a pigeon. First, he flaps around and knocks over all the pieces, then he s…s on the board, then he struts around like he’s won”.

Somehow, that sounds like something Putin might say. You can decide if Obama might act that way.

Good article Mike.

These junk bond funds will have greater failures because it’s now time to pay debts. Debt should realistically get much bigger overall. With the economy turning down significantly globally there should be a lot more debt begin to fail, especially because the world has gone on the biggest debt binge ever. Debt stimulation by governments isn’t working because the debt load is too high and the investments are made by ineffective entities i.e. governments who have no idea what the public wants. At the same time commodities are falling for the same reason i.e. too much debt is forcing borrowers to suck up too much of their income. I believe we are on the way down as everyone begins to realize how huge the debt is and how unrealistic it was to think we can always stimulate (borrow) more.