|

I’m penning this column from my cabin on the Crystal Symphony where I’ve met with subscribers who joined us on the first Money and Markets cruise.

I’ll tell you more about it in my next issue, including details of the presentation I gave on the war cycles and what they show for 2014.

But, today, I want to get to the most urgent matter at hand, none other than gold.

With gold now moving lower and breaking critical support at the $1,262 level, let me tell you exactly what’s happening:

First, the timeframe for a major low in gold runs until the end of January.

And now that it’s broken that $1,262 level, we are likely to see gold fall below the June low at $1,178, and then below $1,100. I suspect the final low will be somewhere between $990 and $1,035.

Second, the action we are seeing in gold of late is part and parcel of a major bottoming process. It’s swinging wildly. So are silver, platinum and palladium.

|

| Don’t let impatience or frustration cause you to take your eye off the prize. |

That volatility is important. Why? Because important bottoms in any market take time to develop. Unlike important tops, which occur suddenly, important bottoms are tricky.

Important bottoms are characterized by:

- Increasing volatility

- False breakouts

- Sharp moves lower

- Wild swings overall, causing traders and investors to become impatient, frustrated, even hopeless

The key during this very important time period: Don’t let impatience or frustration cause you to take your eye off the prize. That’s what the market wants you to do.

But if you fall prey to the market’s antics at this time, when a major bottom is being formed, you will not be one of those who rides the next bull leg higher to glory.

Keep in mind that at important tops, a market will always do its best to trap you near the highs and make it hard for you to get out …

While at important market bottoms, a market will do everything in its power to prevent you from getting on board.

So, though gold has broken the $1,262 level, sharp rallies are still possible within the confines of a trend that should find gold headed lower into January.

Third, the latest data from my cycle studies support the wild action we are seeing and the bottoming process.

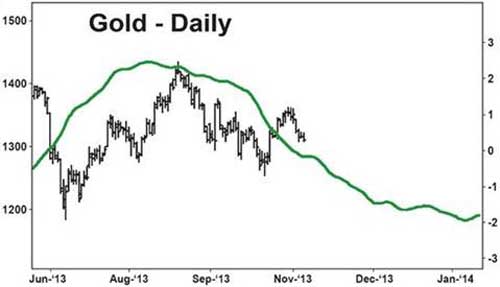

More specifically, as you can see from the chart below of the long-term daily cycles, gold should be heading lower into January.

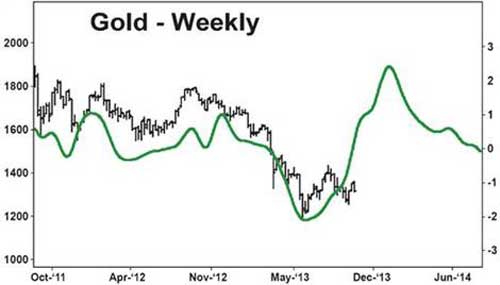

But look at the long-term weekly cycles for gold on this next chart.

This type of formation — where the daily cycles are bearish but the weekly cycles are bullish — is not unusual at important turning points.

It’s what causes wild swings, confusion in the market place — and yet, it’s part and parcel of the bottoming process.

It’s the market’s way of throwing as many curveballs at you as possible — to shake you out of the market — so only the savviest, most disciplined investors can profit from the next leg up.

One more thing about gold and the bottoming process. Here are my year-end momentum and trading ranges to monitor for gold …

Gold’s 2014 momentum range: $1,948.10 — $1,338.20

Gold’s 2014 trend range: $1,268.30 — $852.60

If you’ve been watching gold closely, you can see how accurate those ranges are. Gold rallied above the $1,338.20 level — the bottom of the 2014 momentum range — in late October, but then suddenly dropped right back below it.

This is critical. It is telling you that the momentum in gold remains negative, with a bearish bias heading into year-end.

And now, gold has fallen below the top of the 2014 trend range at $1,268.30. This tells you that the daily cycles are now overpowering the weekly cycles, setting up gold for a January 2014 low, at much lower prices.

All of this is also why I urge you to pay very close attention to the gold market now … to everything I write and send you … and be ready to act on a moment’s notice.

Gold is reaching its most important inflexion point since its major bottom back in 1999. And if you let the wild action throw you off course, you will miss the next big leg up that will take gold to well over $5,000 an ounce.

Be patient, disciplined and wait for my signals. If you can do that, you stand to make more money in gold over the next three years than you ever dreamed possible.

Best wishes,

Larry

{ 18 comments }

THANKS LARRY YOUR THE BEST !

What if it doesn't bottom in January?Then maybe,in May,or June or September?If you make enough predictions,eventually,you should be correct.

Very interesting and timely….first time I have read your research. Thanks…………

How about GDX?

Thanks Larry. Happy Cruisin!

HELP: Has anyone else had difficulty finding the correct ticker for Keynote Systems suppose to be KEYN

or

Gabelli GlblGld suppose to be GGN

thanks

How about buying put options on SA, KGC, ABX as hedges?

Thanks Larry…

Thank you, Julio! — Larry

GGN is correct. KEYN is not coming up on my screen. — Larry

A little insurance won’t hurt. — Larry

Money And Markets ,

thanks Larry, I am unable to access it as symbol GGN through TD Waterhouse or Stoackhouse? With Both Gabelli Glblgld and Keynote systems as part of your top 25 high potential, Id like to begin following them but cannot match up the Symbols KEYN or GGN.

Any ideas?

thanks Lulu

Jonathan Payne , i disagree. he has us stopped out on SA only……and just! Did Larry suggest options on slv, NO, he said sit tight and wait. If you aren't a member of RWR, perhaps becoming one will help you make better decisions.

How are you forward projecting the green-line on both the charts?

Hi, Joseph. The forward projected line is done by the computer; it is a cyclical projection based on prior data and Fourier Transform analysis. — Best, Larry

Yes patience.

“Beware of making predictions, particularly about the future.” – Leo Derocher

I agree 100%

Be interesting to watch your prediction.