In March, I alerted you to several dramatic reversals of fortune in global financial markets during the first quarter.

Market Roundup

Well, as first-quarter earnings reports conclude over the next few weeks, I’ve spotted another key reversal that you can profit from: This time it’s a reversal in popularity.

Pop-stocks lose favor

It hasn’t been easy to be invested in popular stocks lately as we’ve witnesses several high-profile earnings misses from some of America’s most widely held companies, including Microsoft (MSFT), Starbucks (SBUX), Goldman Sachs (GS) and Apple (AAPL).

The problem with popular stocks is they carry very high investor expectations for sales and profit growth.

And when they fall short of the mark, even if only by a little bit, these stocks are vulnerable to sharp selloffs.

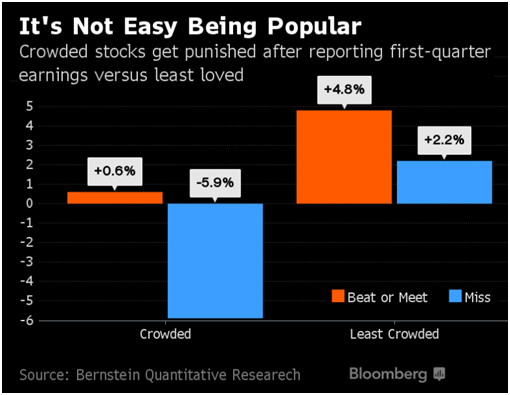

In fact, according to Bloomberg, stocks that failed to live up to high expectations this quarter have seen their share prices excessively punished as a result, based on analysis from Sanford C. Bernstein & Co. Interestingly, the opposite has also been true.

Ugly stocks reap rewards

Unpopular stocks with relatively low expectations have been disproportionately rewarded, even when they post mixed results. Better yet, many of these ugly-duckling stocks have been richly rewarded with sharp rallies after posting positive earnings surprises.

|

|

| Popular vs. unpopular: Who wins? |

The numbers according to Bernstein analyst Ann Larson: Popular stocks (those with high institutional ownership) gained just 0.6% on average after beating or matching earnings estimates.

Meanwhile, they lost nearly 6% on average when falling short of forecasts.

Unpopular stocks by contrast, soared 4.8% higher after matching forecasts or posting positive earnings surprises. And they rose an average of 2.2% even after missing estimates.

As Larson puts it: “Crowded trades (popular stocks) are typically already priced for perfection.” Meanwhile, excessive “pessimism” allows for “additional upside from positive news.” Well said!

If first-quarter results are a prologue, investors’ preference for unpopular stocks could prove to be a lasting trend to take advantage of. Where to look?

Opportunity in the market’s most hated sectors

Digging a bit deeper, the most crowded (popular) trades right now are in the real estate and consumer discretionary sectors. That’s according to a recent Merrill Lynch Fund Manager Survey. Meanwhile, the most unpopular sectors for institutional investors right now are emerging markets, and … you guessed it: energy!

| “You may want to look twice at any high-flying REITs or discretionary stocks in your portfolio.” |

Therefore, you may want to look twice at any high-flying REITs or discretionary stocks in your portfolio before they next report earnings. And if you decide to sell: Check out fresh buying opportunities in emerging market and energy stocks.

Not coincidentally, the stock market’s most hated sector: Energy also happens to be the best performing sector over the past month: Up 9.3% compared to a gain of just 1.9% for the S&P 500 Index!

Good investing,

Mike Burnick

|

![]() They’re back! Wal-Mart (WMT), the retail giant, said the greeter will return to the front door of its stores after an absence of several years. The retailer had moved greeters to other duties a few years ago. “We’ve been working to welcome customers to an improved Wal-Mart for some time now, and of the countless details we’ve taken a look at, a key piece has been better utilizing an important role – our greeters,” the company said.

They’re back! Wal-Mart (WMT), the retail giant, said the greeter will return to the front door of its stores after an absence of several years. The retailer had moved greeters to other duties a few years ago. “We’ve been working to welcome customers to an improved Wal-Mart for some time now, and of the countless details we’ve taken a look at, a key piece has been better utilizing an important role – our greeters,” the company said.

The tradition of having a greeter at the store entrance was started by late founder Sam Walton. The company said greeters will act as a “customer host,” who will greet customers but also check receipts to prevent theft. They will be trained to help deter potential shoplifters.

Will this make a difference to you, Wal-Mart shoppers? Comment below.

![]() Another move could make flying a (slightly) more enjoyable experience. British Airways (IAG) said passengers will be able to stream films on trans-Atlantic flights next year after the airline’s owners announced a deal to install what it claims will be the fastest Wi-Fi in the air.

Another move could make flying a (slightly) more enjoyable experience. British Airways (IAG) said passengers will be able to stream films on trans-Atlantic flights next year after the airline’s owners announced a deal to install what it claims will be the fastest Wi-Fi in the air.

Many airlines now offer in-flight Wi-Fi, but it has usually been much slower. It allowed emails and internet browsing but it wasn’t fast enough for streaming and other more intensive services. British Airways hinted its service would be for free for basic browsing, with charges for a faster service allowing downloads and video streaming. But it hasn’t made a final decision on pricing. The technology could also allow for Skype or FaceTime conversations, but those services could be blocked to avoid annoying other passengers.

The service will be provided by Gogo (GOGO), a Chicago communications firm, which has provided web access for U.S. flights largely through ground-to-air networks. Its new “2ku” technology uses satellites, lowering the operating costs for airlines.

Do you pay now for in-flight Wi-Fi? Would you pay more for high-speed service? Comment below.

![]() Drones could soon be used to transport urgently needed organs to medical patients. Ehang, a Chinese drone company, revealed the 184 AAV (autonomous aerial vehicle) at the 2016 Consumer Electronics Show. It is a huge drone that could also transport a human passenger as far as 10 miles.

Drones could soon be used to transport urgently needed organs to medical patients. Ehang, a Chinese drone company, revealed the 184 AAV (autonomous aerial vehicle) at the 2016 Consumer Electronics Show. It is a huge drone that could also transport a human passenger as far as 10 miles.

Reports state that Ehang is being commissioned by Lung Biotechnology, a subsidiary of United Therapeutics (UTHR), to build 1,000 drones based on the 184 design that’ll deliver organs to a network of hospitals. “We anticipate delivering hundreds of organs a day, which means that the … system will help save not only tens of thousands of lives but also many millions of gallons of aviation transport gasoline annually,” Lung Biotechnology Chairman and CEO Martine Rothblatt was quoted by Digital Trends as saying.

![]() Mow-to-own? St. Louis Mayor Francis Slay announced a new effort aimed to cut down on the city’s vacant lot problem. “The land we’re standing on is actually owned by the city’s land revitalization authority … It’s one of the nearly 4,000 small vacant lots in the city of St. Louis that sits next to somebody’s home,” Slay said, according to KSDK-TV. To combat this issue, aldermen have created the mow-to-own program for St. Louis residents.

Mow-to-own? St. Louis Mayor Francis Slay announced a new effort aimed to cut down on the city’s vacant lot problem. “The land we’re standing on is actually owned by the city’s land revitalization authority … It’s one of the nearly 4,000 small vacant lots in the city of St. Louis that sits next to somebody’s home,” Slay said, according to KSDK-TV. To combat this issue, aldermen have created the mow-to-own program for St. Louis residents.

Residents pay $125 for the vacant plot of land next to their home if they promise to maintain the property, including mowing and cleaning up the debris on the property. The land would be granted to the owner once they maintain it for at least two years. Land not claimed by residents will go to the city’s land revitalization authority.

The Money and Markets team

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 20 comments }

The Walmart greeters, instead of just standing there saying a half-hearted, muffled “Welcome to Walmart” as if there mouths are full of jelly beans or something, could make themselves a little more useful by cleaning the “trash” out of the buggies that are gathered at the front of the store!! …After all, we, the customers, are about to try to put our groceries in the nasty, wheel squealing or ca-thump, ca-thumping things they call grocery carts!!!

Regarding Walmart, the thing that’s wrong with their carts is the fact that the guys who go out to the parking lot to bring in the carts use the motorized “pusher” I’ll call it, for lack of knowing what the thing is actually called….then, once they accumulate a whole line of the carts, they have to pull the carts sideways across the pavement in order to steer them. There’s nothing wrong with that, except that it absolutely screws up the wheels on the carts, and from then on, they never work smoothly again!!!

Regarding “greeters,” a MUCH, MUCH better use of time and money would be to position “associates” (re-programed greeters?) around the store to help customers find where the store has hid needed items now! It seems they’re ALWAYS moving things around….I guess, trying to get people to pick up more “impulse” items. And if you need more than two items, I will guarantee you’ll wind up walking across the entire ponderosa at least once!!

Is that designed by Walmart to give all us fat rednecks our exercise??? Who needs to join a gym??!! Just go to Walmart!!

What this is really about is checking any bag we are carrying in, like we are there to steal. I hated Walmart when they used to do that. What other store insults their clients this way? I do not feel greeted.

I agree with the point the other person made about using these employees out in the store where we can find someone to tell us where stuff is. Finding and buying stuff generates money for the store. Insulting us by saying we are being greeted, not searched, but not the same level yet as airport security, makes one go to the Dollar Tree or Dollar store first. There are more good American people shopping out there.

That’s assuming they know where things are any better than the customers do. Around here, about half the time they don’t know any better.

II have been reading Mr. M. Larson information he has been forwarding to my address e-mail. This time I had the means to get a better understanding of the condition he so skilfully alerts. At the moment, I have all my inverting assets tied up with a Bank inversion system here and I cannot get myself into another venture because I haven’t got the means. With respect to the actual anticipation for a crash, I get information from other websites like you that mention it as a matter of fact, without much ado, others are more of a fighter in this regard.

I am located in Canada and at the moment I am trying to untie the knot I have with the bank. Whatever I do with respect to inversion has to be with great caution despite the alerts. The unseen hand must be very clever to be doing their craft for so long and today nobody mentions that they know who they are and what business they manage. While they are at large there won’t be a real control for investing.

i was hearing 2-3 years ago , that walmart had inventory sitting in the back and not being stocked do to not enough employees !

I hope they get it out before xmass this year

oh wait , i do not shop @ this chineese merchandice seller that sent jobs away from USA

I applaud you for that but really…..what retailer does not sell the Chinese junk? Even the grocery stores are selling it now. Read the labels on fish and other products verrrry carefully before you buy. Even many of the Chinese try to buy baby formula, cosmetics and other foods NOT made in China. Some things in life that are dangerous……you can control.

We seem to be in a follow the leader environment/mentality with regard to stock markets. The Dow goes up Asia and Europe follow. Markets seem to have lost any attachment to what is happening in their own backyard and tying their can to American markets. The Dow goes up because the oil market goes up and I fail to see the reasoning in this its almost like the Dow investors are clutching at straws or throwing darts at a WSJ financial page. Fridays US markets are puzzling the jobs report came in terrible and yet the market went up considerably. There is no rhyme or reasoning to the market anymore.

The Dow is still holding up, I believe, because of the ZIRP. With low CD and bond yields there isn’t an alternative. Jim

The DOW is up because the FED is quietly purchasing thousands of bonds.

i agree with randy. look at the m2 money supply increasing – a behind the scenes stimulus.

Acting as a “customer host” and checking receipts for theft. How debasing.

Wal Mart needs to have more cashiers available for customers. It takes about 20

minutes to get through the line – on a good day.

The return of the greeters at Wal-Mart is a good thing. Instead of criticizing the “greeter”, get to know him or her. These are hard-working, usually disabled in some way, folks who are there to earn a paycheck or get out of the house for a few non-boring hours. Try sitting at home 24 hours when you’re retired. They are helpful when they can be and will tell you things about the store that you’ll never hear elsewhere, the good and the bad. Checking receipts, well, certain stores do and most don’t. Why, because when they took away the greeters, guess what, a Million dollars of merchandise started walking out the door! Yes, people still do steal, and a lot. This was something the greeters told us confidentially. They see it all, whole TV’s walking, kids stealing, old people pulling cons. and they can’t stop the thieves for fear of a lawsuit. If you resent WM, go to Target, pay more and be prepared to be “watched” by TOS while you’re in the restroom. Enjoy!

As far as security against theft at Walmart is concerned, whatever happened to the sensors at the doors that detected when an item passed through that had not been checked? The mechanisms are still there, but it’s been years since I’ve heard one go off!!

I was at Sam’s Club a little while back, where they ALWAYS have someone checking your receipt, and was out the door and into the parking lot when I realized that a bundle of water underneath the basket of my buggy had NOT been checked….even with ALL their “efforts”…..I went back and ended up at the customer service desk to pay for my item. I wasn’t trying to steal anything…Imagine what I could’ve gotten out of there with if I had tried………..Due to people only halfheartedly doing the job they’re being paid for.

Chuck: Walmart’s hiring “hard-working, usually disabled in some way, folks” AIN’T gonna solve the shoplifting problems they’re trying to fix!!

AND, evidently, they need to look at changing the TOP tier first….Walmart can’t seem to get out of it’s own way when it comes to their price-per-share in the stock market! They never have seemed to learn the principle of under-promising and over-delivering when it comes to reporting earnings!

The bathroom thing is another matter…..it won’t be long before they’ll have the transgender bathrooms too! But that’s alright…if one of those transzies starts anything with me, I could take down a bear with this bundle of keys I carry!! Bring it on!!!

They cannot electronically tag everything. It would cost a fortune. But Chuck is right….there are professionals out there that do nothing but shoplift all day long. And they actually “stock” some of the off-beat 99 cent stores with stolen cosmetics, canned food, razors, etc. Some brazenly even sell on Craigslist out of their house (they usually don’t last that long). It all adds up big time…..and we, John and Jane Q. Citizen…..pay for it in the manner of higher costs on everything. Contrary to what Bernie tells the lame college students…..there is NO free lunch. SOMEONE pays. And it is usually the middle class.

If there are professional shop lifters out there, why doesn’t the Security Team have their profile and recognize them on security cameras when they come into the store? I believe this tale of roaming bandits all around us is over kill. I see police every once in a blue moon arresting a shop lifter and taking them to the police car, but not in large droves like some people claim. I should not be debased by Walmart ho ho greeters. Walmart surely can fix this problem instead of fixing me. Taser everyone as they enter the door and Taser them again as they leave! Police stationed outside the doors with ARs would keep us in place.

I do not like the attitude toward shoppers at either store, Target or Walmart. Security cameras are suppose to see the ones stealing stuff from them and not the ha ha greeters looking in our plastic return bag. Same deal at SAM’s Club. The security cameras they have in place must really be crap. Maybe their cameras are from China. Also, they can place electronic tags on the merchandise that sets off an alarm when take out the door. You innocent shoppers are giving up your freedom of privacy like you are Walmart sheep. Protest this bondage. Trump needs to make Walmart great again.

More checkers please! PLEASE!!!!