|

||||||||||||||

That was some rally yesterday and today, huh? And if you listen to the average pundit on CNBC, you’d think it stemmed from a bunch of prescient, wise, old fund managers putting all their spare cash to work. You know: The cash they claim they raised months ago, just so they could put it to work if we got a significant “correction.”

There’s just one problem: The data suggests these guys don’t have any cash! They basically spent it all … and then some.

First, the amount of spare cash on the books at U.S. mutual funds just sank to 3.2% in early August. That’s the lowest in history.

As a percentage of stock market capitalization, fund cash levels are also hovering right around the record low set in 2000. You probably don’t need me to remind you that’s when the Nasdaq topped out and subsequently crashed by around 80%.

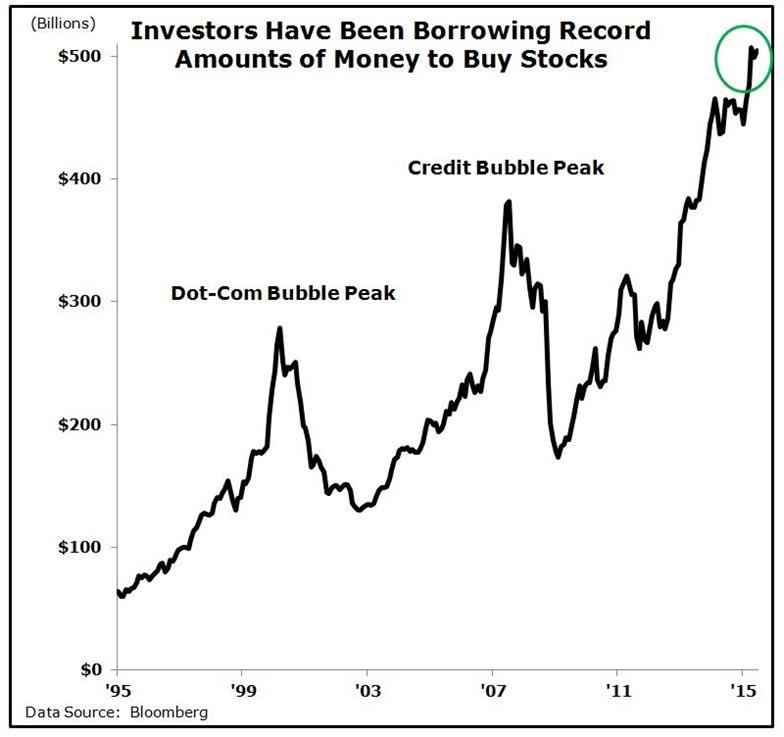

Second, big money investors haven’t just been burning through all their spare cash to buy stocks. They’ve been borrowing gobs of money to buy even more.

As of April – roughly where the broad markets peaked – investors had racked up a whopping $507.2 billion in margin debt on the New York Stock Exchange alone. That was the highest in U.S. history, and more than two-and-a-half-times the $182 billion outstanding when the current bull market began in March 2009.

Take a look for yourself. We’re practically off the charts compared with the previous peaks from the dot-com and credit market bubbles:

|

|

| On the margins … |

Not familiar with margin borrowing? Then here’s a quick primer: It’s when you borrow against your stock and bond portfolio to buy even more stocks, bonds, or other assets. The amount you’re allowed to borrow depends on what kind of assets you own, and which broker you use.

The net effect is to boost your leverage. The more the market goes up, the more money you make – much more than if you just bought with spare cash.

But when markets tank, so does the value of the collateral backing your margin loans. Brokers have built-in risk thresholds that require them to issue margin calls if the value of your collateral goes down. When you get one, you either have to put up more cash, or your broker will start selling your assets.

See the problem here? Falling markets force margin calls, which result in brokers selling customer assets. That puts more selling pressure on the markets, triggering even more margin calls … and even more selling. It’s a self-fulfilling process that helps exacerbate ugly days in the market like we’ve just had.

How big of a problem is this? Well, as I just highlighted, margin loans overall hit a record high this spring. And the Wall Street Journal just reported today that big-name banks and brokers have made tens of billions of dollars more in margin loans over the last couple of years.

Per the Journal, Morgan Stanley (MS) alone had more than $25 billion in securities loans outstanding as of June 30. That was a whopping 37% rise in the past year. Bank of America (BAC) extended almost $39 billion of such loans (it owns Merrill Lynch), up 14%.

Bottom line: These indicators aren’t great timing tools. They won’t tell you what’s going to happen in the next hour or day or even week. But they do confirm that …

|

|

| Dangerous signals for the markets? |

A) There’s a ton of margin debt outstanding, debt supported solely by rising asset prices, and …

B) There isn’t a lot of cash out there, cash that could give us a cushion during severe downturns.

So I ask you, do you want to trust that fund manager who just went on TV saying what great buying opportunities these declines are? Or do you think maybe, just maybe, he’s secretly panicking because he has no cash left in his fund? Or maybe he needs stocks to bounce to avoid getting more margin calls in his own personal portfolio?

Am I being too much of a skeptic here? Too much of a worrywart? Or does the surge in margin borrowing and decline in cash levels concern you too? What do you think will happen here in the markets next? A rip-roaring rally back to new highs? A failed test of the recent lows? Something else? Hop on over to the Money and Markets website and weigh in when you can.

|

Chaos and turmoil are the name of the game in today’s markets, with swings of hundreds of Dow points up and down becoming the norm. I’m doing my best to help you sort through what it all means, and what’s coming next. And many of you also shared your opinions over at the website overnight.

Reader Carla said: “Like I said a few days ago … a tsunami. It comes in waves, and it ain’t done yet. I’m still in agreement with you and selling on the upswings, cautiously making very small position accumulations on the downswings in good companies I want to know for a long time — in good times or bad.”

Reader Charles said: “Central bank money pumping does not put money in anyone’s pocket, except the bankers, unless you have willing borrowers. With the standard of living falling and the levels of debt in the economy, the Fed is now pushing on a string.

“I see a debt collapse coming – a very nasty one. Pay off your debts and keep cash on hand. A lot of folks are already doing just that because the velocity of money is slowing.”

Reader Jim added: “Can you imagine where our economy would be now if the several trillion dollars of stimulus had been given to ‘We the People’ instead of the financial institutions and Obama’s crony capitalist pals?

“I’m amazed that China can watch what happened to us the last six years and still want to emulate us. Keynes has failed everywhere he has been tried, but they still don’t get it.”

Reader Daniel jumped in with these comments: “So, the Fed has irretrievably degraded our future, and our free market system, and proven it is feckless as it regards the economy. They shot all their arrows and missed, and now we have to pay for their retreat to Jackson Hole?

“If we were able to retrieve all the phony money they have created, we could send every man, woman, and child in the USA to a retreat in Jackson Hole. My message to the Fed: ‘You’re fired!'”

Lastly, Reader Billy said: “It’s becoming clearer by the day that the next bear market has begun and actually most likely began months ago. The brush fire started in the commodities complex, and now thanks to many, many other problems, is spreading to become a full blown fire very soon. ALL the signs are staring us in the face, if we have the wisdom and intelligence to identify and recognize them.”

Thank you for all the cogent comments. It’s hard to look at market dislocations like we had in the past week and conclude it’s just “business as usual.” The signs coming from commodities, credit markets, and currencies have been problematic for a while now, and stocks are finally sitting up and paying attention.

I got more cautious than I’ve been in several years — vocally — before the collapse. And these wild swings don’t make me feel any better about where markets are headed in the months ahead. So you can bet I’ll have updated investment strategies and recommendations designed to help you protect yourself and profit from this new market regime.

Anything else you want to add? Don’t keep it bottled up. Share your thoughts over at the website.

|

![]() After plunging virtually nonstop for weeks, China’s Shanghai Composite Index jumped more than 5% in the overnight session.

After plunging virtually nonstop for weeks, China’s Shanghai Composite Index jumped more than 5% in the overnight session.

But it’s pretty clear the rally was “bought and paid for” in Beijing, given that stocks were down slightly on the day until a miraculous, mysterious rally in the last 45 minutes of trading. Bloomberg reported that China wanted stocks to look better because China is conducting a military parade on September 3. No, I’m not joking.

![]() The 1% has enjoyed most of the fruits of the current economic expansion, even as the 99% has continued to suffer from lackluster wage and economic growth. But maybe that’s starting to change, judging from the latest earnings report out of Tiffany & Co. (TIF).

The 1% has enjoyed most of the fruits of the current economic expansion, even as the 99% has continued to suffer from lackluster wage and economic growth. But maybe that’s starting to change, judging from the latest earnings report out of Tiffany & Co. (TIF).

The upscale jeweler reported 86 cents per share in adjusted earnings, missing analyst forecasts by five cents. Its shares fell to a two-year low after the news.

![]() How much money did investors lose from the market decline earlier this week? The industry may not even know, according to the Financial Times.

How much money did investors lose from the market decline earlier this week? The industry may not even know, according to the Financial Times.

Many mutual funds and ETFs use a computer system from Bank of New York Mellon (BK) to provide accurate pricing data. But software glitches are resulting in inaccurate Net Asset Value calculations and other problems. Regulators and industry representatives are desperately trying to sort the glitches out amid some of the worst volatility we’ve seen in years.

![]() All eyes (at least here) are on Tropical Storm Erika as she continues to churn through the Leeward Islands and Northeastern Caribbean on its way generally toward the U.S. Southeast. It’s too early to say exactly where or whether the storm will hit Florida and the Bahamas, though the official National Hurricane Center forecast puts her not far off the coast as a Category 1 hurricane by Sunday.

All eyes (at least here) are on Tropical Storm Erika as she continues to churn through the Leeward Islands and Northeastern Caribbean on its way generally toward the U.S. Southeast. It’s too early to say exactly where or whether the storm will hit Florida and the Bahamas, though the official National Hurricane Center forecast puts her not far off the coast as a Category 1 hurricane by Sunday.

What do you think about China rigging its markets just so people watching a military parade don’t spend all the time secretly checking their stock portfolios on their smartphones? Or the news that major fund custodians are having big data problems? And how about Tiffany? Is this a sign of other earnings warnings to come? Let me hear your thoughts over at the website.

Until next time,

Mike LarsonÂ

{ 89 comments }

Mike,

Thank You for pointing out how high the Margin levels are in our banks as they are also trading with our savings deposits….. Back before 1999 when the geniuses remove Glass-Steagall our savings were safe as there were two kinds of banks, Saving Banks and Investment or Commercial Banks….. Now the run away bankers are making bets not only with their funds, but with ours….. This will not end well, unless both the Democratic voters and the Republican voters start calling their Congressmen and women and demand the reinstatement of Glass-Steagall. Until that happens a repeat of 1929 and 2007 is right around the corner, in my opinion.

Mike, perhaps you could share your thoughts on this dark cloud hanging over the markets since 1999?

When we have a 1929 or 2007 the losses don’t go to money heaven. Somebody makes vast fortunes on the deal. Perhaps they are the ones who engineered the removal of G-S and are now standing in the way of its reinstatement. Congress couldn’t fix a broken water pipe. Jim

Jim,

We are about the same age. Do you remember the controversy when it was discovered that Goldman was taking bets out the back door against the financial securities that it was selling to it’s Retail customers out the front door….

Yes, they should be in prison! Thieving b——s. Jim

Agreed, but that happened under Cheney/bush, not Obama…

I sometimes wonder if Goldman Sachs runs the world. If you observe the revolving door between top executives at GS and top government positions it would be an easy conclusion to reach. I know you are hard Left and I am obviously hard Right. I have no problem liking people I disagree with. It’s intellectual dishonesty that disgusts me. If nothing else you are consistent. Diverse opinion improves our chances of reaching the correct result. I bet you and I could sit down at the table and fix this mess in no time. Jim

Cheney and Bush were bought and owned by Wall Street. However, I think

Obama is also. Jim

Jim, just an aside on the right/left political paradigm – back during the campaign for the U.S. Presidency in 2008, Ron Paul hosted what I thought was a stellar political symposium with a noteworthy message (and I write this from what I hope is a reasoned left-leaning bias).

Dr. Paul assembled a panel including all of the leading 3rd-party candidates, and himself. Each person – representing the rightward Constitutionalist and Libertarian parties, the left-friendly Green party, independent Ralph Nader, and Dr. Paul himself – acknowledged that by his/her presence, s/he agreed to a common set of five principles shared by all of the others, despite their individual policy differences. Among those principles I remember a call to either audit or abolish the Fed, scale back U.S. military interventionism, and reduce the influence of big money in politics.

It’s amazing how aligned both ends of the political spectrum are when it comes to at least some critical issues.

You are probably right. I grew up dirt poor, volunteered for the Army (Special Forces) during the Vietnam era (we had a draft then). Used the GI Bill (Thanks FDR) to graduate from College (International Economics). Worked a lot of good Union jobs during College as I had to help support my family. Dad was damaged goods (101st Airborne WW-ll).

I’m now wealthy and have been retired since I was 51 (now 70)… Tried to never forget where I came from and how I got to where I am now… Basically, I think we are both two old working stiffs who’ve worked hard to get where we are now. We just have different Political beliefs….

Me thinks Jim is beginning to realize the capital letters after a politician’s name, or the left and right names that divide us have nothing to do with control or even policies.

The two political parties simply switch-out operatives and modify their mode of operation every few years to keep the masses fighting amongst themselves while the criminal politicians, like a magician uses slight-of-hand pretenses to distract the gullible working stiffs.

There’s already to many “tables” in the District of Criminals and 99% of them need to be burned and put the people who sat at them to work doing productive manufacturing.

As loyal Americans I think we have much more in common than we realize. The Left has a long hallowed history of progressive reform. Being a Southern Democrat makes me a really odd duck because I am conservative in my social and fiscal views but thoroughly dislike the Republican Establishment. I am at odds with the Democrat Party because I feel it has been hijacked by extremists that don’t give a damn about anything but their own power. I went to school with these people, they are reckless and dangerous ideologues. They use this stupid two,party system to divide and conquer us. I will always be for meeting people halfway and getting the job done. Jim

Mike, I don’t think FDR helped you do anything. I think you did it yourself and would have made it without help from anybody. Liberty and the free market made you a success, not big government. Jim

FDR’s programs kept a lot of farms, ranches and homes from being foreclosed and the inhabitants from starving….. My Dad and his eight brothers all went off to the CCC camps and sent their paychecks home….. Then from the CCC’s to the War… Luckily for us, they all came home, some with “zippers” and some with combat psychological injuries which bought on their early deaths…. To all of them, FDR was a “GOD”…

Jim,

Thanks for the compliment. Truth is, it is hard to explain what poverty really is like until you have lived it…… I basically got enough from the GI Bill to pay for tuition and books and nothing else….. When I left for the service, I swore I would never live in poverty again. Well, that was short lived. I found a rat hole near campus and lived on one meal a day (if I was lucky) as it took the rest of what I made in that “Good Union Job” to keep a roof over the heads of my brothers and sisters and food on the table… This wasn’t the 1930’s, this was the 1960’s….. Many a night I wondered what the heck I was doing, spinning my wheels in pursuit of that college diploma dream.. One day it happened, and I graduated (almost couldn’t afford to rent my graduation robe!…) and everything changed dramatically….. This isn’t a “poor me story”… I’m only sharing to try to explain the reality of school for me and many like me, back then, ok?

Agreed…. I’m reminded of College days in the late 1960’s and early 1970’s… It was a really tough time to be a Veteran on campus…. We had guys like Karl Rove and Mitt Romney advocating for the Vietnam War (but not serving) and we had Jane Fonda and many long hairs advocating against the war,,,,, Thank God, I found a bunch of other Veterans on my first day on campus, in the Library in the only “quiet area” (enforced by those Veterans)….. Walked up and asked if I could join them…. “Why’s your hair so short”? “Just came off of Active Duty”… “Sit down soldier”!.. :) Those guys saved my bacon as I had a lot of anger of what I was hearing and seeing… Small Island of sanity in a world driven crazy by the uninformed and the hypocritical….

You hit on the head “a long hallowed history of Progressive reform” Always for the Average American, the ones that do the “death and dying”….. Spent a lot of time in the South (Ft. Benning and Ft. Bragg)… Good people, good soldiers… Could have my “six” any day….. That said, I’m a Western Mountain Boy….. Imagine John Denver as a soldier and you are pretty close… :)

Thank you for your service Mike… I wish we had more Americans like you…!

There were millions like me and we all came from poor working class Democratic families… We had no choice as there was no way we could afford college… Those that survived and used those GI Benefits for College have drug their families our of poverty….. There were virtually no rich Republican kids in the service then as they were all on college campuses having the life of Riley…… George was in College as was Mitts, as was Karl as was Limphog and so many more of the right wing GOP….. Now those guys are talking about Patriotism….. Sounds a little hollow doesn’t it? Incidentally, most of the guys I served with and went to college with have not forgotten where they came from and how they got where they are today….. And they still vote Democratic!… :)

I empathize with your comments about the current Democratic and Republican parties. I am a Hoosier with ancestral connections to Virginia and Kentucky in particular. It would be great if the Democratic Party could be reclaimed by working and middle class principles instead of the Marxist leaders now in power. I also think it is quite ironic that the Republican Party dominates the South currently, yet secretly would love to see its cherished traditions erased, i.e. Nikki Haley’s recent actions in SC. And to think southern states seceded because good ole Abe was elected. He must be laughing where ever he is these days. Most people are unaware that he corresponded with Karl Marx during his lifetime.

Keynes did not fail…politicians failed…applied correctly Keynes works…as a previously submitter said…where would we be if the stimulus had been given to the populace…student debt should have been paid off in full so household formation could continue and all mortgages should have been reset to 3.5% 30 yr fixed and anyone who didnot want it could go down as he would have anyway…those two moves would have reset the US for growth and allowed the free market to take care of the rest…but so many right wingers hate Obama that no logical approach like that would have made it…so we end up where the bigots and haters took us

These are exactly the moves I was referring to but I still don’t think a nation can borrow its way to prosperity. But, if you are going to borrow it should go to the people. I don’t hate anybody, I just want to get it right. Jim

Ever since 2009 the GOP has kept the public works programs that would benefit the average American from being passed…

Over the last fifteen years The Left has gotten virtually everything they wanted. The Right has gotten absolutely nothing but one lousy temporary tax cut. The Right has stopped nothing and they have enacted nothing, thus Congress’s 12 per cent approval rating. Jim

Jim,

If I remember, you grew up in the oil patch and are still an oil producer….. Did you not profit handsomely from the secret agreements that Cheney pushed through that took oil over a $100 at the beginning of Cheney/bush? Interesting how simple economics are now ravaging the oil patch as production has greatly increased to take advantage of those fraudulent increases in the price of oil, aye? Think the price is low now, just wait until the Iranian oil comes on line!… :) Gee, the average lefty, finally gets a break..

We have had $100 oil under Obama for years, to help make his Green Agenda viable. Jim

A while back I heard OBAMA the great whiner saying we needed higher oil and gas prices to support his green energy programs he wants gasoline in the $9.50 – $12.00 per gallon range or his programs wont work. And recently he is pushing the epa to force the shutdown of all coal fired coal plants in this country by tightening the emission standards to an impossible level

You are right, it is my turn in the barrel! Jim

Jim,

Let’s see if I remember right on oil… Wasn’t Brent around $18 when Cheney held his secret meetings? Didn’t it then go up to about $140, just before the Cheney/bush Stock Market Crash in November 2008? If I remember right, it had dropped to about $41 as Obama began the PIP program and the Fed began QE in March 2009? Then didn’t it go back to about $114 as the economy recovered? Of course with that improvement in the economy, producers began pumping like mad and nowhere we are heading back around $30? I’m figuring with the world slowing down and Iran coming on we ought to see $18 again pretty soon… So you guys in the oil patch really ought to thank Obama for saving the economy, right?

2007

Mike, I’m sorry but there is absolutely nothing I like about that arrogant SOB and his entourage of intellectual lightweights I can like. Unlike you and I they don’t have an ounce of real world experience between them, and it shows everyday. We need real leaders who care about us and not their own political fortunes. I’m so weary of everything in my life being politicized I could puke. There must be a Third Way. Jim

If oil goes to $18 a barrel the whole world will explode. I’d rather go broke than see that happen. Jim

If you watch cnbc, every fund mgr and their mother can’t stop saying “invest for the long term” probably so that the market doesn’t bust their leveraged trades.

Good point. I get so sick of their canned answers. My sister is 65 and her broker had her 70% in stocks. How much ‘long term’ might she have if we get another huge crash?

Mike , Thank you for your continuing information . As a small business owner I decided to close March 2014. Financing was not an option and I wanted to cut my exposure and prepare for what is happening today. It is unfortunate that many still do not see the collapse coming . As for me , I am hunkered down ( not on easy street ) , but not exposed as I was in February 2014 . Thank you again for your guidance . Good luck to all !!

Good day, Mike! China having a military parade? Nothing to do with the fact USA sent 3 squadrons of F22 Fighter Jets to the Baltic Countries, perhaps? You don’t for a minute think China is concerned about jets that have 360 degrees of view, carry 4 warheads, can out maneuver and kill 5 F16, F15 or equivalent aircraft? Perhaps? A military parade put on by China is really a spectacular showing, I must admit. Yet; perhaps? There is money to be made out there. Sniffing out the gems, taking action, is key to current market stats. Getting out entirely is too pacifist and opens no doors. Besides, this drop down, to wherever, is creating the next leg up, perhaps? Stay with it, roll with the punches, grab an opportunity or three and prosper. Perhaps?

The rebound of yesterday and today is just a temporary reprieve. Tomorrow or certainly within the next few days this market will be going back down in a very vicious manner. This Bear Market is ready to rock and roll. And unlike 2008 when the federal government was in fair shape and able to help……..this time it is going to be horrible. Obama has put us into so much debt that there will be NO help for those on the margins. His 7 years of wild spending has purchased nothing for America………….and now we will all pay for his foolhardiness…..in spades.

You know Fred, the right wing said much the same thing about FDR in the 1930’s and they were wrong then also….. Am I correct that you were one of those that listened to the right wingers saying that the world was going to end when Obama was elected in 2008, near the bottom of the market? You sure have missed a lot of gains listening to those “Wrong Way Willie’s” who have been proven to be wrong once again….. Perhaps you ought to stop listening to those guys. How many times do they have to be wrong until you flush them, aye?

The markets are definitely in a corrective wave. Most likely retest the 2100 one last time. Last chance for alcohol before the drunks are let loose in the streets. Wake up tomorrow wondering who picked their pockets.

Because so much happens in the market based on Janet Yellen and the other Feds, it would be nice to know their stock holdings and what restrictions they have on their market investments.

This is just the beginning of a long, downward spiral, not only for our economy but for the rest of the world as well. Raising interest rates in September will exacerbate the problem somewhat but is only a small part of the bigger picture. We are in for a huge decline, much worse than 29, I think. However, there are two good sides to this story. First, we will clean out all of the bad debt and bad government still hanging around from 2008, thanks to QE 1-3, the banks and the feds. We are going to see financial institutions and companies dropping like flies on a bug zapper. Civil insurrection is a vey distinct possibility. Second, for those who position themselves correctly, it will be a fantastic opportunity, especially for boomers like me, to set themselves up with great retirement money so get ready and protect yourself in any way possible. My heart goes out to those less fortunate than myself. When it is over, it is my hope that we will never bring this on ourselves again.

Bill,

We are the consumptive engine of the world…. Currently, more and more manufacturers are returning to America as they are finding more and more Americans unwilling to buy products produced in China… As conditions get worse the Chinese will suffer more and we will gain more of our manufacturing back… In my opinion, that is why the dollar is being pushed ever higher… I think we are reaching a point where more and more Americans are connecting the dots and more and more are realizing that we need to look after the average American first and everyone else a distant second… America will win and China will lose… Read Tom Clancy’s book “The Bear And The Dragon. Clancy wrote it over ten years ago as “fiction”. He also has incredible access to our intelligence circles… The move back to the left has begun, just as it did in the 1930’s…

August 27, 2015

Mr. Larson,

Let’s face it, the people running this country have no clue what the hell there doing nor do they care who gets caught in the cross fire and I’m ticked. They just don’t know when to stop the damn spending and I’m sure it’s because they feel they have the American people to bail them out. It isn’t going to happen this time. I am very new to receiving all this information from you and the other experts and I have to say, I am scared to death. I don’t have the kind of money you and your other followers have to invest or put away for a rainy day or should we say a major financial collapse. I basically live from pay check to pay check with a little left over. I’m one of those middle class people that the politicians talk about who are hurting financially but no one seems to really care. It’s not there cross to carry ! I wish you could give me some idea as to how I could get myself in a secure position financially for this up coming financial collapse. I have several silver bars along with bags of silver coins, as well as a few thousands dollars invested in loose gemstones (all of which does not reside in my home) but nothing monetarily put aside. I do have retirement funds but not sure what’s left of one of them after the first financial melt down. Trying desperately to find out. I am open for suggestions , as well as guidance in regards to being prepared for the upcoming collapse, as well as possible investing.

Thanks !

Char, The collapse has already happened. It began in 2007 unde Cheney/bush and ended under Obama in 2009… When you have a minute, go to the library and pick up a book on Hoover’s Crash of 1929 and his Great Depression. Also pick up a book on FDR and the financial recovery, under his leadership, after he was elected in 1932….. When you read about the late 1920’s and the early 1030’s they will probably sound very similar to 2007-2009…. Same Political parties, same outcomes…

Char, the people running this country (into the ground) know precisely what they are doing, so do not be deceived by their rhetoric and promises.

The people you and I have elected, thinking they’re the least of the two evils are really one and the same two evils, only with different capital letter after their names.

Theirs’ is a wholehearted effort to transfer your wealth to themselves, their crony fellow politicians and their crony bankers and brokers.

Americans need to wake up and smell the stench they’ve elected and somehow get citizen businessmen and women into the offices of government.

Offices of government should not be political… They should work for the good of all Americans not the dogma of a few political elites who make promises that are never kept.

America needs to abolish the two-party system and the electoral college and go back to a popular vote from a field of non-politicians.

Income Inequity, for the past 100 years has gone up when the Republicans were in charge and down under the Democrats……As Income Inequity has gone down under the Democrats, the stock market and the economy have gone up. As Income Inequity has gone up under the Republicans the Stock market and the Economy have gone down…. Simple Economic facts…. And yet you are telling us that they are the same? Geeezzz!…. :(

Numerous of Americans have their

retirements In annuities, with heavy amounts of money in market funds.

What is there answer to a currency collapse?

You and others tell us just how bad it could be. Nobody addresses a problem for so many.

How about it.

History is such a great tool to learn from,is it me or most people(politicions) have short term memory loss.If only they would learn.

If only they would stop taking political payoffs….. Citizens United made an unfair system even more corrupt..Reasonable people are looking to overturn Citizens United which was supported by ALL of the justices appointed by Republican Presidents… :(

those who do not learn history , are doomed to repeat it !

those who do learn history , are doomed to watch it repeat !

Agreed, but those that learn history will have the knowledge to step out of the way of that developing storm before it comes ashore….. Knowing the history of Glass-Steagall and why it came about, allowed a lot of knowledgeable people to get out before the Crash came and back in when Obama repeated FDR’s stimulus programs…. Sadly, if the Crash had been greater, more of the Republicans would have been thrown out of office and a Public Works program like the WPA and CCC’s would have been passed and the plight of the average American improved… Can’t think of a better indicator that the Republicans are in bed with the Big Banks, than their letting the Banks get relief, but not the average American…..

Tiffany’s is certainly a bell-weather for the uneasy decline of the 1% of Chinese in the “wealthy club” and effects of dropping stock market prices. Suddenly the chill winds of the “reverse wealth effect” have hit the 1% basking on sunny Chinese and North American beaches! Also look at Sothebys (BID) stock price recently, falling 25%, like a slaughtered bull; from $47 to $35 in 60 days. Now targeted below $32, maybe $30 by December = Chinese easy money sloshing out the door at Sothebys! Yet another sign the bloom is off the wealth rose. Chinese money flows into US equities and real estate are drying up too!

I must say that I really enjoy reading your comments. I receive several financial newsletters from various sites and they all want to build up the market. On a day that the market does well they say all is well with the market. On a day that it is bad they sound shocked and surprised but Money and Markets does not do that. You people tell it like it is and are not afraid to say so. Keep up the good work!!

99.9 percent of the time I agree with your comments.

When I called my investment adviser on Monday and sold holdings to catch some long term gains in the accounts that belong to multiple family members, I heard things like “you do know you are selling into a falling market, don’t you?” and “so, you think you can time the market?” I ignored the chatter and placed the orders. The next day, I picked some great bargains but didn’t get greedy. I’m not a day trader. I sold virtually all holdings twice before in the early 2000’s. My timing was off getting back in but there was no great statistical variation caused by the moves long term. The last time I wanted to sell off a lot of holdings, tax consequences be damned, he begged me to listen to him and stay in the markets. I did so and even talked my father into diversifying his portfolio into “average” risk. That was May of 2008. Taking his advice and going against my better judgement reduced our family’s net worth by about 40% in the wink of an eye. I regret taking his advice to this day. But, I got back in 2009, a bit early, and without his sage counsel and I recovered all the losses in the stock market within a year or so by conducting my own research. Today, the world is a wasteland of tumult. There are great opportunities in cutting edge industrial and electronic technologies, biotech etc. But blithely accepting any government statistics or the alleged wisdom of some hedge fund manager blathering about on CNBC, Bloomberg or Fox Business is a fool’s game (ex. the US unemployment rate, or “well, that’s out of our system so let the Bull Market continue”). Decisions by recent Presidents, Presidential candidates, present and former Cabinet members and the lap dogs in Congress and down to the State level, especially in California, should be grounds for capital punishment. For their “meager” compensation, they all seem to retire in extraordinary wealth or the benefit gravy train of academia. That said, historically, October is the worst month of the year for securities. Our economy may be the cleanest shirt in the dirty laundry basket, but when the market spooks and the algorithms take over, regardless the reason, you have a seat on an ‘E’ ticket ride. The best decision you could make right now is to know your tolerances to risk and stress, and if your adviser tries to keep you 100% in the market over the next 2 to 3 months, please, get another adviser. Amass dry powder, have a plan in place and fasten your seat belt. It’s going to be a bumpy ride to the end of 2015. But whatever you do, don’t call yourself a victim. Victimhood is for losers.

Well said…. Rule #1: ALWAYS do your own homework….. Rule #2: Never forget Rule #1… Most stockbrokers are neither analyists nor very savvy, in my opinion…. Personally, I’m reminded of aluminum siding salesmen or used car salesman… Do your own study and educate yourself and you greatly increase the chances f your winning!… :( Lots of Bernie Maydoffs out there….

Hi Mike — Pretty scary stuff about the amount of margin debt out there. Not to be forgotten is the excessive amount of student debt, the huge auto loan debt bubble, stupendous credit card debt and the indebtedness list goes on and on. Oh, and lest we forget the elephant in the room……the government’s US$18.5 trillion debt, and of course those hundreds of trillions of unfunded liabilities (social security, etc.). Yes, we’re addicted to “free” money. It’s no wonder why Yellen is looking for every excuse not to raise rates.

Dr. Smith has warned us about the Normalcy Bias. All this debt is anything but normal. I’m sure we will look back someday and ask how in the heck we ever convinced ourselves that debt doesn’t matter. Jim

Yellen is only looking for an excuse to roll the presses…

What I find interesting and confusing at the same time is that you are indicating, with very good supporting information, is that the stock market seems poised for a free fall since there is no cash to actually buy. Yesterday, Larry Edelson, in an article saying “I told you so,” that the market is headed to 31,000 in two years. Would you please clarify? Is it going to “crash” and then head to 31,000 or are you guys on different wavelengths?

Crash, burn, and then explode…!

Looks like you uncovered a lack of liquidity. Seems to me this would be graver if interest rates were to rise. In a combination of changing winds, China appears to be dumping steel here and their devaluation may squeeze many Asian growth markets. The hope perhaps is that the U.S. will once more be the locomotive for the world.

China is cratering on exports because both the US and Europe are in hidden recessions (ie: economic circumstances the govt is covering up with their own brand of stats.) Its not a China problem, same with the oil collapse, once demand fell off mainly due to the China building bubble and bust. We’re in a global supply glut due to decreased demand because all the liquidity created by the Fed Reserve has gone to Wall Street. And the corporations, rather than using this cash to build up their companies are buying back their own stock to make earnings look better than they would otherwise look. How do you have 5.5 percent unemployment when half the workforce isn’t even working?

Where I live people are mostly employed. Obamacare has made it possible for more voluntary parental leave and voluntary part-time employment as workers are no longer chained to their jobs for health care.

But yes, buybacks are no way to create a growing business.

China contributes to the oil glut, but so does Saudi Arabia and the United States, the world’s largest oil producer.

I own several businesses, farming, stocks, trucking co, rentals and a finance company. My contention was to be diversified, I am. But I have always said in any business do not quite your day job and as you can pay cash and pay down debt. As one entity was doing well I paid down debt in other areas. As a result I have lots of cash in stocks waiting to pounce on the opportunities that lie ahead. The house rentals break even but help for write off on tax returns which is important, paying to much tax is foolish and adds fuel to an inexhaustible government fire.The trucking company is buried down in California Regulations so we are moving to Arizona. The financing company without defaults creates a great write off because of depreciation. Farming is the last frontier, income is split between years so you manage money that can be deferred on brought in or move profits to the stock market.

Hi Mike,

Isn’t margin debt as a percentage of stock market capitalization much more important than the total of margin debt? As the market grows so does the total of margin debt but the percent has barely changed in 30 years.

Read more: http://www.businessinsider.com/only-nyse-margin-debt-chart-that-matters-2013-10#ixzz3k4KYkifp

Can you point to an academic study showing a strong correlation between margin debt and stock market crashes?

The chart in this report shows a perfect correlation of margin tops to market falls. 2000, 2008 and this fall may be a top in margin too as it is currently higher than in 2000 and 2008.

It would have been a more informative article If you had mentioned the $ Margin $ during the other bubbles >>

And i have been telling people QE was wrong and should have been given to legal americans and not illegals or foreign students ! To pay off their debts first ! Thia would have refinanced the banks and helped americans !

kudos to

Reader Jim added: “Can you imagine where our economy would be now if the several trillion dollars of stimulus had been given to ‘We the People’ instead of the financial institutions and Obama’s crony capitalist pals?

But Keynes has never been done as he said “put $$$ aside for the bad years is the part they all do not do !”

the politicians failed everywhere he has been tried ,by spending all surpluses !.â€

The more I think about it the madder I get. Wasn’t all this money actually ours in the first place, you know, us the taxpayers? So they give our money to the crooked bankers for free so they can get fat lending it to us at four per cent. They send all of us deeper into the hole and then look us straight in the eye and telling us what a favor they have done us. Student loans, car loans, house loans, etc. Debt slaves all. We are the biggest bunch of suckers the world has ever seen. Jim

Hey Jim, I’m with you. My dad always said, “you can’t send a dollar to Washington, get a nickel back and think that you came out ahead”!!!

This takes the “stupidest comment yet” prize:

“Reader Jim added: “Can you imagine where our economy would be now if the several trillion dollars of stimulus had been given to ‘We the People’ instead of the financial institutions and Obama’s crony capitalist pals?”

The stimulus was around $900B. Go check on GAO.gov to see how it was spent. “We the People” got lump sums and various credits. The freefall of lost jobs was reversed through various projects based on your district. In short, it was too small, but what got spent did help.

I think Reader Jim has forgotten when the crash happened and who Paulsen worked for.

Later on, Obama did show poor judgment in trusting Summers and Geithner, but Democrats pushed for a larger stimulus ($3 trillion was a number mentioned) only to be stridently opposed by Republicans. Remember, the GOP leadership met on the day of Obama’s inauguration to plan how bad they could make the economy so that they could make Obama a “one term president.” It didn’t work, but they still made Americans suffer.

Well said Samantha,

You have kept your eyes wide open and know the REAL story…. If the GOP had let that Public Works bill through, our economy would be much stronger now…. All it appears the GOP wanted were their bosses banks saved and to drive “that Kenyan”: from office… Luckily the voters could see the peeling paint on Mitt’s candidacy and rejected him… Luckily for the average American!…

Let’s see Samantha, the government borrowed (stimulus) money (and printed money it couldn’t borrow) it didn’t have, so the Democrat and Republican criminals could send it to various hand-picked predominantly Democrat rabbit holes (otherwise known as projects), and of course, those dollars must pass through crony banks in order to get to the rabbit holes which resulted in never reaching the workers who actually spend the dollars. Today those dollars are still languishing in the bankers pockets and their investments in junk derivatives (if they haven’t crashed by now).

Democrats and Republicans can’t seem to get it through their brainwashed skulls that there’s an enormous immoral and unlawful Ponzi scheme designed to take dollars from workers and put it into the hands of the already wealthy.

Simply put, the upside dollars invested by the Joe Blows with the hopes some breakage firm will somehow out of thin air multiply their meager dollars put away for retirement someday, will always go to the wealthy when the inevitable and likely pre-programed downside pours all those retirement dollars into the pockets of the already wealthy.

A fool and his money will always become strangers to one another whether it’s in the stock market or the dice table.

Well, I’m now led to believe that your “Dr” is not in Historical Economics…. :( Are you a millionaire M.D.?

I’ve been on the sidelines waiting for a huge correction for months. PreMarket Monday, watching the DOW futures at -600 and the VIX peak, I bought a variety of long puts at the low Monday morning when the Dow was down 900 or so and option premiums up. With the rallying since, I’m down 30% with long puts that expire Oct – Jan. Should I ride it out for a lower low than Monday, cut my losses, or any option spread ideas? Do not want to get assigned stock so weary of selling, but would appreciate any input.

Dear Karen , i was shorting the market and having puts long term before the 1000 points down and predicted the fall but i didnt sell greed kicked in , i am still carriying mine and i still think the market will go down in a couple of months to be exact the month of october, so i think you should hold on and we are still on a crash mode .

It is absolute LUNACY to allow margin borrowing to buy stocks that is not backed up with real hard cash. NEVER should margin buying be allowed using stock ownership, it is a perfect recipe for financial disaster. It is solely based upon GREED.

What you said about borrowing and margin calls is 100% true plus much more . My main concern is china their market crashed from 5000 to 3000 WITH FULL SUPPORT and manuplation of the chineese government , without it probably it will go to 2000 maybe less. All the measure are taken there will not work at least in the short term so we still have big problems there . All Feds all over the world are on high alert and in panic mode themselves , they can not make any bad decessions because this time if we had a melt down God help us , so they will do what ever it takes to stimulate markets and by all means , but they cant do it for ever , i think in the month of october we are going down again.

Insanity: doing the same thing over and over again and expecting different results.

-Albert Einstein-

One more thing which is very important the market been going up since 2008 , so almost 8 years with all out QE, so this is an end to an economical cycle with more troubles and uncertainties , so now what ???? Its so scarey the smart thing to do is to sit back and watch , the market is not going to run away , you can go back anytime and if it rallies up( which i dont think so) its ok I will miss the first 30% up and i will get in at the right time when things are clear , China, Greece, interest rates , world markets, oil prices and commodities and so on , then you make a move on safe grounds

1920-1929 and 2000-2007….. Republicans and run away banking speculation…. 1932 and 2009: Democrats recover the economy and return economic stability by stimulus and regulation of the speculation…. Re-regulation has not happen YET, thanks to there being too many Republicans in Congress who will not let it pass… It was called Glass-Steagall (1933-1999)… Watch Senator Elizabeth Warren (Professor of Economics and Law at Harvard)…. See wants to return G.S. and the Republicans are opposing it…. Markets still at risk until regulations returned…

Government, in general, is a scheme of politicians to take from the populace for the benefit of politicians and their friends. We need a framework of some sort to set standards and even things out, but our politicians – of all sorts – have corrupted our system to the point of no return. Our nation is on its last legs, unless the people rise up and demand a vast cleansing, but that will likely not happen in time to save us. Damn few people give a hoot, so long as they can be distracted from the truth by popular culture, entertainment, advertising, etc. One day, the truth is going to rise up and smack us all in the face. It won’t be pretty.

With millions of baby boomers in or near retirement, and an a lot of them taking blood baths with the Dotcom bubble burst and the 2008 drop. How many of them have money in this market ? How many of them have much money left ? Now with all these people in or near retirement drawing their pensions or IRAs or 401 Ks. Who’s is buying the positions they’re liquidating ? Now to rub salt in the wound, since we are at a virtual economic war with China, they won’t buy our bonds anymore. That is why the Fed has been printing money as fast as they can called quantitative easing. I don’t know where we are with that I think we’re on the third or fourth try. It’s not some secret investor from Switzerland buying all our debt. And if you don’t know where we are at that’s OK because neither does the Fed. So the rise in the market for the last 4 years is primarily made up with phony baloney money. Anyone who is buying into this market is fooling themselves a true correction is like a 50 60% drop. Another point is Greece is in serious trouble and no where near coming out of it, but Italy, Spain, and Ireland aren’t far behind.

I’m with Mcmillan who called for the mkt to begin it’s march downward on Thursday last ( gutsy as hell to specify the day ). He was dead on and added that the ugliness would last until early 2016, though he failed to predict any bottom level, letting the mkt decide ( maybe for a change ! ) In the meantime I have been gradually adding to my UVXY which has been quite good for awhile and I suspect will be until early 2016.

Hi Mike, nice piece very interesting. just curious, how you get that chart or info from Bloomberg of the amount of money borrowed to buy stocks?

There is a big difference between a sovereign-debt crisis and and inflationary spiral. The Fed normally uses higher interest rates to slow down inflation, but higher interest rates are certain death for a sovereign-debt crisis.

If the Fed prints more money to reduce interest rates, they will increase the sovereign-debt and cause more inflation!

If the Few uses higher interest rates to slow down inflation, they will increase the sovereign-debt and cause more inflation!

Monetary policy cannot do any more and was impotent for several years. We need fiscal stimulation in the form of infrastructure repair to deal with the lack of demand in this economy. The consumer cannot get a loan and cannot buy. We need infrastructure spending paid for by the rich and high earners through taxes or altruistic contributions. The latter won’t happen and Congress won’t do the former. With this Congress, we are in deep doo-doo.

People invest money to make a profit , which means at some point you have to sell and take that profit . If the margins are as high as they have ever been the only way prices are going to rise is if more margin comes into the game or more money from somewhere else comes in . Once all the money is in , it’s time to sell and take your profit . Problem is , once the profit takers start selling , look out below . It might have been a slow climb to the top . The trip down can be a free fall . Just don’t be too greedy . If you are in the money start taking some of that money out of the game and stick it in your pocket , or in your mattress if your pocket is not big enough .

Cheers

I don’t think you need a study , it’s obvious . Where is the money going to come from to drive prices higher . People use margin because they have none of their own cash left . If margin is high it means there are a lot of stupid people out there that do not understand the situation they are getting into . I know many a person who got burned using margin . It’s the same as any other bubble , destined to pop .

I thought buying stocks on margin in a slightly different form was one of the causes of the market going down in flames in late 1929? Of course it was different then than now because the buyer put up as little as ten per cent, the bank put up the rest. The buyer made regular payments and the bank and the buyer and bank shared dividend in portion to the share of the stocks. When the price fell below the bank’s share the buyer had to make up the shortfall or the bank sold the shares. As prices fell more and more stocks entered the market furthering the free fall. So they found a new way to build an old cliff.

To Reader Jim, who said that Keynes has failed everywhere he has been tried.

My daddy studied with Keynes at Stanford and sends this correction, “What Keynes said is that in bad times the Government can stimulate the economy by going to savings and spending it to stimulate the Economy.” The obvious problem is that the Government does not have any savings like they did in 1929. Keynesian stimulous has never been tried. Stimulous does not work with borrowed money. RWM