|

Hello, everyone. This is Bill Hall and I am pleased to bring you this Money and Markets market update.

Recently all eyes have been on the U.S. labor market, and last week we received some great news. That is because the initial jobless claims number released by the Department of Labor showed that we had improved dramatically in that regard. In fact, initial jobless claims fell to the lowest level in eight and a half years. Yes, that is right, the lowest level since February of 2006.

That provides evidence that the U.S. economy and the U.S. labor force may be turning the corner and growing again. And that’s important because 70 percent of the U.S. GDP is a function of consumer spending. So that’s why jobs are so important — without jobs, consumers cannot spend.

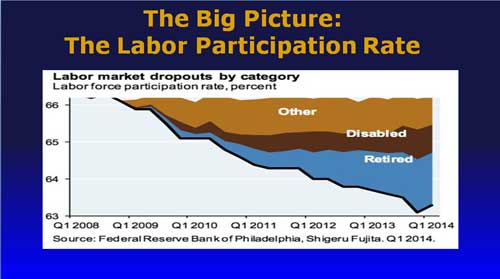

But as encouraging as the jobless claim number was, let’s take a look at something that may be even more important: The labor force participation rate, which measures the percentage of the population that is employed. And what is troubling here is that we are hovering around 36-year lows. Yes, a labor force participation rate of around 63 percent pushes us back to about March of 1978.

The slide below shows the job losses or the declines in the participation rate that have occurred since the financial crisis of 2009. What we see is the job loss or the people who are not in the labor force broken into three categories: other, disabled, and retired. And while the number of retired and disabled workers has increased substantially over this period of time, we are seeing improvement in the other category. Those are people who are looking for jobs and now may be able to find them.

So it is information like that which was released last week by the Department of Labor that helps us decide whether the participation rate is actually getting better.

Are we doing better? Are we putting Americans back to work? Remember, we need to put Americans back to work so we can get the economy moving again so they can spend again.

Now we will look at our next slide which shows the level or the yield on the 10-year Treasury. The 10-year Treasury bears watching because it is the ultimate measure of inflation, or if we are getting improvement in the economy. Because if the market believes there is real improvement in the economy, the yield on the 10-year Treasury will rise.

But instead of rising like many predicted it would do based on the information released last week about jobless claims — remember, that says the economy is probably getting better – what we saw was the 10-year Treasury drifted lower. That tells us that the market as a whole really does not believe that this economy is getting better, or that the labor market is getting better.

So what we have is a mixed bag. The big question is what should investors do based on this information? How do you make money in this environment?

My recommendation is that you stick to high-quality, dividend-paying securities. Recently in my Money and Markets columns, I’ve recommended three high quality stocks: Oracle, Medtronic, and Becton Dickinson. Take a look at those and I think they will serve you well.

That wraps up today’s comments, and I look forward to speaking with you again soon.

Best wishes,

Bill Hall

P.S. Wealthy investors are surprisingly picky about the companies they invest in — demanding the very best in order to preserve their capital and make it grow. And it’s the same criteria I use to pick investments for members of the Park Avenue Society.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 1 comment }

Hi Bill

There is another aspect of this that we need to consider and that is full time verses part time jobs. I have heard that we lost about 500,000 full time jobs and gained over 700,000 part time jobs. That is jobs that don’t pay enough for middle America to get by on. Could the new medical coverage issues have something to do with that? Could you give us your thoughts on this please?