Martin here with a surprise announcement:

Martin here with a surprise announcement:

An investment timing genius with an amazing stock track record is returning to the Weiss Research team of experts!

His name is Tony Sagami, and with the market still climbing a wall of worry, the timing couldn’t be better.

I first met Tony in the 1990s, and we’ve been very good friends ever since. Here’s a transcript of our latest conversation …

Martin Weiss: Welcome back, Tony! I suspect many of the people reading this already know who you are; we started working together so many years ago …

Tony Sagami: More than 20, actually! When we both had black hair and black beards.

Martin: Haha. That’s what you remember. What I remember best is the day the Nasdaq Composite Index was trading below 1,000, you told me it could double or triple from there, and I said you were nuts.

Tony: I was nuts, I agree. But the Nasdaq was nuttier. It didn’t double. It didn’t triple. It surged by over five times — to 5,132. And by that time, I was turning so bearish I couldn’t see straight.

Martin: You told our subscribers to dump all their tech stocks. Every single one. That was gutsy. But then you took it one step further. You told them to buy put options on the Nasdaq index to directly profit from the decline. So while nearly all other investors were losing their shirts in the biggest tech stock disaster of all time, our subscribers were making some of the biggest profits of all time. It was one of the boldest and most accurate market calls I’ve seen in my life.

Of course, it’s easy today to look back and say the signs of the dot-com bubble were obvious. But for the thousands of so-called “pros” caught up in the frenzy, it wasn’t so obvious, was it?

Tony: No. But it was crystal clear to us in early 2000. The Wall Street crowd, the mainstream media, individual investors. They all had collectively lost their minds. They had driven stock prices — including pieces of pie-in-the-sky companies with scant sales and no profits — to ridiculously high prices. The risk hugely outweighed the reward. It wasn’t a sandbox I was willing to play in anymore.

Martin: You nailed it that time. Then you did it again. After riding the market up from 2003, you took your profits and ran, avoiding the excruciating pain of the worst Debt Crisis of modern times.

Tony: Thanks, but investors don’t need a history lesson right now. What they need now is solid, reasoned, no-nonsense direction for the future, which is what I’m here for.

Martin: A perfect segue to my main question: Is the stock market now poised for another tumble?

Tony: A tumble? Yes. A crash like the dot-com bust or the Debt Crisis? No. Sure, this current bull market is getting old in the tooth. Through last Thursday, the S&P 500 went 102 straight days without a 1% downward move. Just since Trump’s election, the S&P 500 has added $3 trillion of market value.

And sure, that type of enthusiasm is unsustainable. But unlike in 2000, the stock market is NOT grossly overvalued. It’s at 18.4 times forward earnings. That’s not cheap by any means, but we’re not talking about nosebleed territory either.

Here’s the key. This is a very timely conversation because I’m starting to see some cracks in the stock market’s armor.

Martin: What cracks?

Tony: Here are three that worry me.

Crack number one is the default rate on sub-prime auto loans. It hit 9.1% in January (the most recent data available). That was the highest level since the Debt Crisis, a first warning sign of consumer distress.

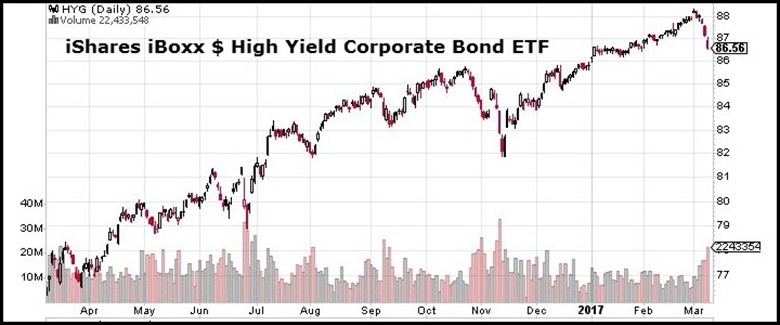

Crack number two is in the junk bond market. Last week’s decline alone was enough to wipe out all the interest investors could have made in the last year. The junk bond market has historically been a reliable risk-on/risk-off indicator. I watch it like a hawk.

Bull markets never die or correct for one reason alone. But one of the most common bear market triggers is an overzealous Federal Reserve. That could be crack number three in the market’s armor.

The Fed is slated to announce three rate hikes in 2017, a scenario that the Wall Street crowd seems oblivious to. Never forget: The Fed can kill a party faster than the police at a high school kegger.

Martin: Are you saying it’s time to run for the hills?

Tony: Not at all, Martin. What I am saying is that you need a plan — a defensive strategy to protect yourself for the day when the rally runs out of steam. It was your father who told me “buy, hold, and pray is not a strategy.”

Martin: What strategy do you recommend, then?

Tony: One of the easiest is to monitor the major stock market indices for a drop below a long-term moving average. On the Dow, for example, as long as the index is above its 200-day moving average, hold. As soon as it falls below, start selling.

Martin: Some people might think that’s cliché. But I’ve seen it work. Back in 1987, for example, my father and I saw the Dow fall below its 200-day moving average. It was Thursday, October 15, and that evening, we recorded a hotline alerting our subscribers to an imminent crash. Sure enough, October 19 was Black Monday, the worst single-day crash in Dow history.

Tony: I knew your father well and learned a lot from him. But the key is not to over-anticipate a crash, not to run for the hills too soon, which leads me to another defensive strategy.

This strategy recognizes that bull markets can greatly exceed valuations, that the Trump rally could last even longer, and it still has the potential to make investors richer than they’re inclined to think.

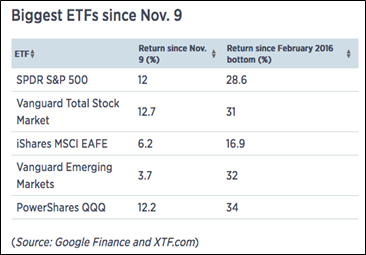

You have the best example right here and now: Anybody sitting on the sidelines since the election missed out on a mountain of profits.

This strategy also recognizes the explosion in Exchange Traded Funds (ETFs). There are hundreds of low-cost, effective ways to profit from falling stock and bond prices.

Martin:And you’ve been very successful at making money from ETFs, on the upside and the downside. Why?

Tony: Because after predicting markets for as long as I have, I find that the strong bullish and bearish trends are easier to identify than ever.

Martin: How so?

Tony: When you and I first entered the investment business, the focus was on corporate profits. All the big Wall Street firms had dozens of accountants and finance majors squirreled away in back rooms, poring over balance sheets, financial statements, annual reports. Good old fundamental analysis. But it was hard to make money with it because nearly all the news, whether good or bad, was almost invariably old news.

Martin: Are you saying corporate profits don’t matter anymore?

Tony: No. They still matter, but the focus has shifted to economic and political news as the main drivers of asset prices.

Let me give you two current examples:

Whenever the Federal Reserve releases a policy statement or Janet Yellen gives a speech, the numbskulls on Wall Street pore over every word, every syllable that comes out of her mouth. Heck, a degree in linguistics may be more valuable than a degree in finance these days.

Whenever the Federal Reserve releases a policy statement or Janet Yellen gives a speech, the numbskulls on Wall Street pore over every word, every syllable that comes out of her mouth. Heck, a degree in linguistics may be more valuable than a degree in finance these days.

Meanwhile, the real action is what I call “Revenge of the Nerds II.”

I’m talking about high-frequency trading based on computerized models. They’re dominating the stock markets. They’re used by large investment banks, hedge funds, and institutional investors. They’re using computers to transact a massive number of orders at extremely high speeds. And all this is totally unrelated to the fundamentals of a company.

Martin: So what else is new?

Tony: What’s new is that now more than 70% of equity trading is done by high-frequency traders. And as I said, what’s even newer is that the factors driving some of the biggest momentum in the market (which their computers pick up on) are often major geo-political events. Like Brexit. Like the Trump election. And most important, like the Great Money Tsunami that Larry talked about.

Martin: I’m glad you brought up the Revenge of the Nerds. Because I remember that you were one of the first “nerds” to apply computerized trading to mutual fund and ETF investing.

Tony: I did. Back in the 1990s, I pioneered the use of complex computerized algorithms to analyze markets. I created software that helped thousands of sophisticated individuals and investment advisers.

Martin: You called it “computerized investing,” and you were one of the early pioneers. But the big question now is, how do you combine everything into a single, integrated investment strategy that’s exactly right for this time frame?

Tony: First, I determine what news events — both political and economic — really drive the markets. For example, Federal Reserve releases have more impact than Durable Goods orders. So I have figured out the 10 key economic/political events that affect stock market prices the most.

Second, I have created a rating system that quantifies the strength of any current trend. I call that the “Trend Persistency” rating.

Third, I buy into trends with the highest bullish trend persistency rating, and I sell into trends with the highest bearish persistency rating. Or, when there’s no strong signal either way, I sit on the sidelines. That way I take full advantage of the high-frequency trading crowd.

The profit opportunities are as regular as clockwork because the scheduled release dates of the 10 key economic/political events that drive the markets are known months in advance. You know exactly when they’re going to come out.

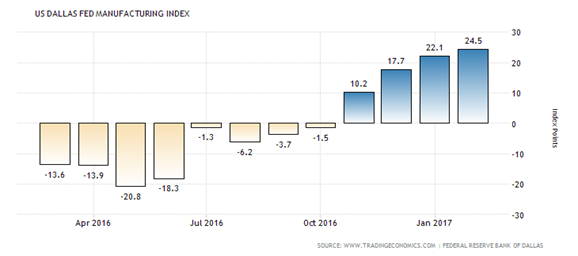

For example, I know that the next Dallas Federal Reserve Manufacturing Index numbers will be released on March 27, 2017. I know that the index has shown a consistent renewed strength over the last four months. (See chart above.) I know it’s one of the top ten events that will drive markets. And I know how it ranks in pure firepower compared to the other nine.

It’s a market-moving event with a strong trend persistency… and a strong opportunity to make money.

We call this kind of trading calendar profits, and it works. Of course, nothing is guaranteed in this crazy world. But never underestimate the power of the calendar to time the market, especially when you use the trading tools I just told you about.

Martin: Thanks, Tony. We look forward to hearing a lot more about this.