For years now, global economies and financial markets have been caught in the vice-grip of deflation.

For years, global central banks have pushed back with extraordinary easy-money policies, delivering ultra-low and even negative interest rates worldwide.

And for years, financial commentators … including my colleagues Larry Edelson, Mike Larson and myself … have been predicting this will end very badly one day – when the spell of omnipotent central banks is forever broken and investors reject government debt of any kind.

Well, 2016 may go down in the financial history books

as a real game-changing year:

The end of the great bull-market bubble in bonds.

It was fun while it lasted. After all, the great bull market in bonds persisted for 35 years!

From a peak above 15% in 1981, yields on the 30-Year U.S. Treasury Bond steadily declined to a low of just 2.1% earlier this year.

And since bond prices move in the opposite direction of yields, this meant windfall profits for bond investors for several decades.

But now the game has changed, and it means a major shift is already underway across financial markets.

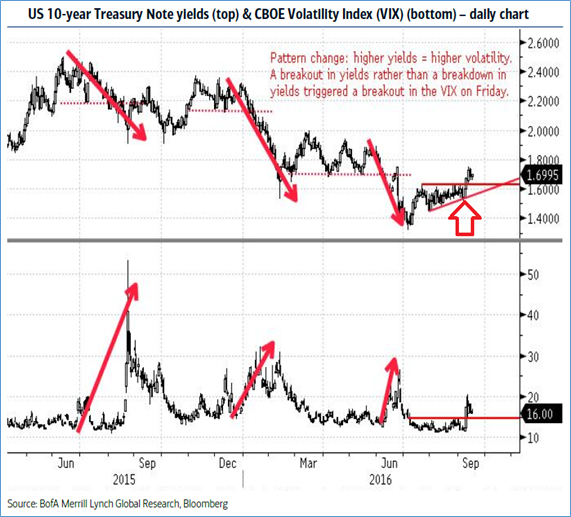

As you can see in the chart above, yields on the benchmark 10-Year Treasury note were at a low of 1.3% as recently as July, but spiked higher to nearly 2% this week.

What’s different this time is that previously, bond yields consistently declined whenever uncertainty and stock-market volatility were on the rise, but NOT this time.

This time yields are rising as investors unload bonds and prices tumble.

Now, a move in bond yields from 1.3% to almost 2% may not sound like such a big deal, but consider this: A paltry 1 percentage point rise in yields translates into a roughly 7% loss in the principle value of global government and corporate bonds.

That’s equivalent to a $3.4 trillion hit to the global bond market, a loss large enough to erase several years’ worth of interest payments!

And why are bond yields suddenly selling off worldwide?

The short-sighted seers on CNBC will tell you it’s due to fears about an impending interest-rate hike from the Federal Reserve. But I don’t believe that for a minute.

Look, the Fed’s desire to “normalize” monetary policy and to begin raising rates has been the worst-kept secret on Wall Street.

After all, the Fed ended its quantitative-easing program, when it bought government bonds to suppress interest rates, two years ago, in November 2014.

Then this past December, the Fed made its first move in over a decade to raise short-term interest rates.

Yet 10-Year Treasury prices were higher back then than they are right now. So, you can’t pin the blame for recent bond market losses on fears of rising rates alone.

What’s really happening?

Rising fears of inflation, that’s the real game-changer.

Here’s a fact that wasn’t widely reported on CNBC or in the Wall Street Journal this week: On Halloween, the Fed’s preferred measure of inflation, something called the PCE deflator, was reported to have risen 1.2% in September from a year ago.

But this time last year, PCE inflation was up only 0.2% in the year ending September 2015. In other words, inflation is accelerating.

In fact, prices are rising at a 2.1% annual clip over the past six months alone … a rate that surpasses the Fed’s publicly stated 2% inflation target.

No surprise when you consider: American wages are finally on the rise; commodities, including oil, are rebounding; oh and healthcare and tuition costs continue to soar at double-digit rates.

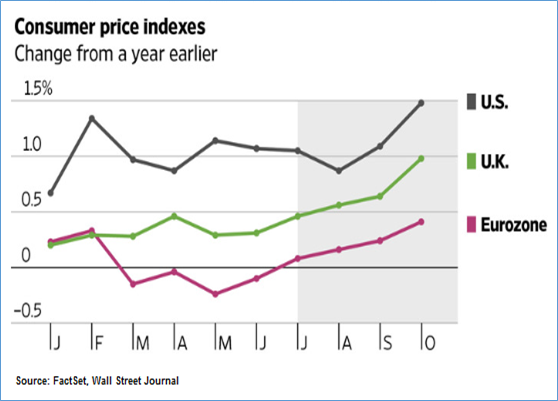

And it’s not just here at home either. Measures of inflation are also on the rise in Europe and the United Kingdom, too, as you can plainly see in the chart above.

Bonds are selling off due to fears that the Fed, and many other central banks are already behind the curve on inflation, which I define as the real cost-of-living, not the contrived government data.

Mind you, I’m not saying we’re in store for the 1970s-style inflation with soaring prices for everything from food to fuel. But investors have gotten so accustomed to years of low inflation, and have grown so complacent it will continue, that even a mild acceleration in prices – with interest rates at record lows – can be a major game-changer for financial markets.

How will this impact your investments?

We’re seeing the trends already.

Stocks that benefit from rising prices, including energy and financials have been outperforming the stock market.

Financials are up 6.6% since the end of June, the second-best performing sector behind technology, which is another sector that typically performs well amid rising inflation. And energy stocks are up 14% year-to-date.

Meanwhile, the most interest-rate sensitive stocks, including utility and telecom shares, are getting thrashed – both sectors have declined 6% since July 1.

Bottom line: I’m seeing growing evidence that interest rates are likely headed even higher so long as inflation remains on the rise. This means the long-anticipated bond market bust may finally be unfolding now, right before our eyes.

Stocks and ETFs with bond-like qualities are vulnerable to get dragged down along with bond prices. Be sure to adjust your own portfolio holdings accordingly.

Good investing,

Mike Burnick

P.S. A worldwide bust in government bonds is just one of the many market shocks my colleague Larry Edelson is forecasting. Read his latest report on how to profit from it here.

Â

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 12 comments }

Great Summary Mike

Excellent Work

Best Regards

Black Tulip 88

Go to the grocery store. The Sr. Bush lost an election because Carvel knew that it was the economy. He didn’t know the price of any food. The people realized he was out of

touch.

The solution is very simple: BUY PM STOCKS (esp. low-priced ones with a very positive balance sheet)!!!

remember 1971 thru 1976. interest rates rose higher than those of the 1960’s or 1950’s. under Carter they went down until 1979-1981 when they went to record levels. Bonds were bought and sold at record low levels presumably because people needed money to pay bills(housing costs were soaring). remember M-1,M-2 and M-3. they were going up. they are not quoted today. but they must have contracted over the past 10 years. Does not the Federal Reserve lower interest rates by buying treasury bills(now all paper) and raise rates by selling?

t.parker

I am predicting a bull market in stocks. I always knew that yields move in the opposite direction to bonds. Hows this all gonna effect the sub prime mortgage crisis. Surely the US Economy is improving as the election nears. Hows this all effecting the GDP Deflator and has their being increases in productivity and how does this all effect the Cobb Douglas production function the production function exhibiting a unitary elasticity of substitution between labor and capital. Throw into the mix all the technological progress that’s being made in society as the Chinese say we live in interesting times. Who’s gonna lead the house of representatives, is it gonna be Trump or Clinton. These things work out the opposite to what you think. Trump is the outsider so he will probably get in. He’s certainly been campaigning long enough. What Mike doesn’t seem to comprehend is that all businesses need a regular flow of credit, countries would not exist without, its how a country passes from one generation to the next? Its impossible to not use credit and for a business to not have a good working capital flow management cycle using debt. Debt is required by businesses and countries to educate its workforce and improve the health, labour and capital of its human being workers. Human Beings havnt been replaced by automated robots in the workplace yet. Maybe if we want governments without debt, what we really want is centrally planned economies, economies in which factors of production are owned by the government and prices are determined by government directives. Or maybe we should have a closed economy which is what the USA economy is in that it engages in autarky and does not engage in international transactions.We live in interesting times as the Chinese say.

I miss reading Mike Larson’s articles too…where is he?

There is Mike Larson? I’d like to here more from him.

Bonds? Sounds like a pyramid scheme to me. Looks like there are a lot of contenders for the Global Golden Greed award.

Wells Fargo is back in the crosshairs of the SEC and lawsuits by individuals watch out Mr. Stumpf they may come for some of your wealth to.

France wants to charge HSBC for fraud

The EU wants to charge Google for anti trust violations it seemed that Google did not want to play nice with the competition and of course it goes on and on and on.

These stocks are on my recommendation list.

We have gotten ourselves between a rock and a hard place. Interest rate increases would be great for savers, BUT, should rates return to the historical norm with the debt that has been added to our balance sheet over the last ten years it would wipe out the federal budget leaving a choice between huge tax increases, tremendous cuts in entitlement, and other spending, and inflation out the wazoo. Possibly even hyper-inflation.

“Is the Mother-of-all-Bubbles (Finally) Bursting?”

Yes, Just look at the twenty year extended maturities on the $17.5B Saudi bond sales. The capital will not be repaid in 20 years and the pension funds will lose their capital. The bond money is going to be used to cover Saudis current budgetary spending shortfalls.

Mike,

Look, the problem longer term WILL be DEFLATION and NOT INFLATION!!!! As Larry states, we have over $400 TRILLION, THAT’s TRILLION Dollar so WORLDWIDE DEBT!!!! THERE IS ABSOLUTELY NO WAY THE WORLDS CENTRAL BANKS CAN DELEVERAGE THIS DEBT GRACEFULLY. NOW WITH A WORLDWIDE ECONOMIC SLUMP, WITH COMMODITIES CRASHING/DEFLATING, CHINA REAL ESTATE CRASHING, AND DEMOGRAPHICS CRASHING WORLDWIDE, $15 TO $20 TRILLION OF WORLDWIDE QE IS A DROP IN THE BUCKET. THIS NEXT CAPITAL MARKETS CRASH WILL MAKE THE SUBPRIME/ALT A/CDS DERIVATIVES CRASH LOOK LIKE CHILD’S PLAY!!!!!

Agree.

When the bubble bursts, everything will go down. Your home, stocks,gold, etc. etc.

Sell it all now. Cash is worth more after the bubble bursts.