“  |

This week, I was absolutely delighted to hear that we had over 100,000 views of my fireside chat videos.

The last one, in particular, with the specific steps I recommend, has generated unprecedented interest from readers. So I hope you didn’t miss it. (If you did, just go here and it will play on your screen right away.)

Today, I answer some of your questions. Plus, there are many more that I hope to get to soon …

Tech Stocks

Q. You mention Jon Markman and the doubles or triples he’s seen with his tech stock picks. I am intrigued but also concerned. Where can I get more information? How can I get my questions answered?

A. I’m asking Jon Markman probing questions from readers in a series of short podcasts. Didn’t you get them? If not, click here for the latest. And then watch your email for more next week.

Treasuries and Money Market Funds

Q. In your last fireside chat video, you recommended Capital Preservation Fund with American Century. But the yield is zero! Why on earth would any sane investor place their money into that fund?

A: This fund, which invests only in short-term Treasuries, is not for yield. It’s exclusively for maximum safety and liquidity. For yield, we invest in a series of other investments, such as the one that gives us 8% with low risk, which I mentioned in the fireside chats.

Q:Â Most of us are aware and concerned that the United States is on the brink of losing her creditworthiness. Her banker has virtually destroyed her currency; and her government, corporate, and personal indebtedness has been estimated as high as $200 trillion. I would like to understand, sincerely and respectfully, how U.S. Treasuries are a “bedrock of safety.”

A: I figured you might ask that question — because it’s a darn good one. My answer: Short-term U.S. Treasury bills are still the most liquid investments in the world. And with a Treasury-only money market fund, anytime we want our money, we can have it wired overnight. I fully agree that the long-term future is dark for the U.S. government’s finances and the U.S. dollar. But it’s going to take a long time for those trends to unfold. They’re not going to collapse overnight.

Q. I thought I heard you say you would recommend some other fund family’s versions of the Capital Preservation Fund (short-term Treasury funds), besides the American Century.

A. You’re right! I did. Here they are:

American Century Capital Preservation Fund

American Funds Money Market Fund

Cavanal Hill US Treasury Fund

Dreyfus 100% US Treasury Money Market Fund

Fidelity Treasury Only Money Market Fund

First American US Treasury Money Market Fund

Gabelli US Treasury Money Market Fund

Huntington US Treasury Money Market Fund Trust

JPMorgan 100% US Treas. Sec. Money Market Fund

Schwab US Treasury Money Fund

Sterling Capital US Treasury

T. Rowe Price US Treasury Money Fund

US Global Investors Funds US Treasury

Vanguard Admiral Treasury Money Market Fund

Western Asset US Treasury Reserves

Real Estate

Q. I have just listened to your fireside chats. You mentioned that you expect asset inflation and a declining dollar from the unprecedented money printing. Wouldn’t we get substantial price appreciation in real estate because of asset inflation?

A. We’ve already seen substantial asset inflation in stocks and certain collectibles like art and antiques. And yes, residential real estate is also bound to follow. The only glitch there will be the impact of higher mortgage rates. So it’s OK to buy moderately — especially properties you use — but it may be too soon to jump in with both feet.

Q. Do you or your family have property abroad? Do you or your family/trust have a second residence outside of the USA? I ask this as I am looking to purchase farm property outside of the USA.

|

A: Yes! We do have property abroad. But it’s not exactly property we purchased recently.

It’s our farm in Brazil that’s been in the family since 1889, when Elisabeth’s great-grandfather first bought it. In fact, its oldest structure (as shown in the photo) was built in 1723.

We’ve also been thinking seriously of buying a vacation property in Brazil. But we keep putting it off — partially because we’re concerned about a decline in the Brazilian real, but also because we never seem to find the time to make the rounds.

Looking ahead, our decision on what to buy is going to be based on lot more than economic analysis. We want places that …

(a) are safe

(b) relatively accessible, and

(c) culturally compatible, plus …

(d) have stable currencies and

(e) good value.

For us, that rules out …

* A beautiful, extremely inexpensive beach condo on the Mediterranean Coast — but in a particularly turbulent North African country.

* A home on the southern coast of an extremely friendly and yet well-developed tropical island — but it’s over 200 miles south of Japan’s KyÅ«shÅ« island. We’d need at least three flights and 30 hours to get there.

* Or a luxurious grand villa overlooking gorgeous Lake Cuomo in Italy — far too expensive and overpriced!

Instead, my personal preference would be something like a small finca in the mountains near San José Costa Rica, a flat in the Algarve of southern Portugal or maybe even something in Greece.

These are safe, do not involve over-the-top political turmoil, and are not extremely hard to reach. I can’t say for sure their currencies are going to rise against the dollar. They may actually fall for now. But when they do, that could be the best buying opportunities.

Whole Life Policies

Q: I want to invest some of my money in whole life insurance, but my concern is with the dollar. What happens to my money if and when the dollar falls? — James

A: It’s hard enough to pick the right whole life policy based strictly on the merits of the carrier and the policy. When you throw in questions about the currency, it muddies the waters. So I suggest you follow these steps:

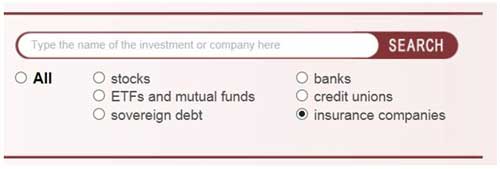

Step 1. Check the company’s Weiss rating on our website, www.weisswatchdog.com. Here’s how …

- To search for your insurer, click on “insurance companies” at the top of the screen and enter the insurance company’s name. (See below.)

I apologize, but our search engine is not yet smart enough to recognize different spelling and abbreviations for the company name. So just type in the first word or two and then select your company from the search results.

- Add the company to your Watchlist. That not only gives you the current rating but also entitles you to email alerts whenever the rating changes.

Step 2. Seek to do business with insurers meriting a Weiss Financial Safety Rating of B+ or better.

Step 3. Work with an independent agent to buy the best value that meets your needs.

Step 4. I would not hedge against the dollar risk yet. But if the dollar turns sharply lower, you can consider some “dollar-crash insurance.” For example, you could use ETFs that are designed to rise when the dollar falls. Example: PowerShares DB US Dollar Bearish Fund (UDN).

The same goes for other dollar-denominated assets you’d like to protect from a dollar decline in the future.

Physical Gold and Preparedness

Q. Do you think it’s important to have some physical gold along with the more secure stocks and funds? Also should we do a bit of prepping — food storage, etc.? I’m not inclined to go whole hog with the prepping group but unfortunately it does make sense. — Florence L.

A: Yes, physical gold has been recommended in our Safe Money Report since 1999, and that position is now up 367%. As to prepping, I think the single best preparation is education — not just for our children and grandchildren, but for ourselves as well. Reason: It’s far too soon to know what the specific threats will be. But knowledge and skills give us better ability and flexibility to adapt.

Conflicting Advice

Q. Your writers are very good and I try to read all of the commentary. But therein lies the problem. I seem to be getting confusing signals. Is there a way for your company to come up with a mechanism to break down trading styles? Perhaps you could include a mechanism that instructs followers on short-term, intermediate and long-term investments? I am looking for simplification. — Patrick H.

A. Excellent insights, Patrick! In fact, that’s one of the main reasons I decided to hold my fireside chats — to help clear up confusion and do a better job of providing direction.

Remember: I don’t tell our editors what to say. Each is a creative, independent thinker. So some disagreement is natural and even welcome. But here are some big-picture guidelines:

First, short-term timing can be tricky. Unless you happen to like rapid-fire, in-and-out trading, don’t base most of your investment decisions on that aspect.

Second, the primary dangers we’re most concerned about — including rapid price inflation and a dollar decline — are a long-term process. It’s important to keep them in mind and take precautions ahead of time. But you should not let them stop you from making money and growing your wealth now.

I hope this helps focus your attention on the time horizon that’s the most important and the easiest to plan for — the medium term, such as the next 12 months.

With that in mind, here’s what I recommend (expanded from my video to reflect a lot of your questions.)

1. Keep a good portion of your money completely safe in a Treasury-only money market fund. And, for now at least, don’t expect any income whatsoever from those funds.

2. Maintain some core, long-term holdings in gold or gold bullion. (Regardless of the next up-or-down move in the market.)

3. With the rest of your money, expand your horizons to a series of investments that can benefit from asset inflation AND that have strong merits on their own right. Here are just a few examples:

* 8% yield with relative safety, using energy royalty trusts, such as the one Mike Larson recommends in Safe Money.

* Steady dividend-paying stocks that earn a Weiss Investment Rating of B or higher.

* New tech superstars, such as those to be announced by our tech stock specialist, Jon Markman, this coming April 8th. (To register for that gala event, click here.)

* Choice real estate that meets most of my parameters above — and some of yours as well.

* A nice, diversified portfolio of other recommendations from our team that you’re comfortable with.

Good luck and God bless!

Martin

|

EDITOR’S PICKS

Looking Beyond the Tapering and Interest Rate Debate by Bill Hall To taper or not to taper? That is the big question facing the Federal Reserve. And as I have pointed out in Money and Markets’ columns, it’s the Fed’s actions that investors should be watching closely, because the U.S. central bank’s easy money policies have become the most powerful force affecting stock prices. Follow the Money Flows to Emerging Asia by Mike Burnick Emerging markets have been one of the worst places to invest your money so far in 2014. While stocks worldwide have struggled with increased volatility, the MSCI Emerging Market Index is down 5.8 percent, even as the S&P 500 Index clings to a 1.4 percent gain. Consolidation and Frustration Ahead? Try a Long-Term View by Douglas Davenport No surprise: The Federal Reserve, under its new leader, Janet Yellen, announced that it will reduce its monetary stimulus by another $10 billion a month in April. The move was widely anticipated. |

THIS WEEK’S TOP STORIES

Consumer Stocks Lagging Earnings Potential May Offer Good Buying Opportunities by Don Lucek No news is good news, as the saying goes, and that’s certainly true of the Weiss Ratings Model. There hasn’t been much over the past couple of weeks to change its recent bullish leanings. Who Will Sink and Who Will Swim as Interest Rates Undergo Seismic Shifts by Mike Larson Many investors assume interest rates can do only one of two things. Go up. Or go down. And many others assume that the results are binary. Higher interest rates are always bad for borrowers, the economy, and the stock market, while lower interest rates are always good. Tech Stocks: The Poor Man’s Way to Riches by Jon Markman Of all the excuses I hear from investors who are missing out on today’s boom in tech stocks, the one that puzzles me the most is this one: “I simply don’t have enough money to take advantage of rising tech stocks.” To that, I can only respond, “Really? Do you have $32?” |