|

All over the world, energy investors are waiting, watching, wondering.

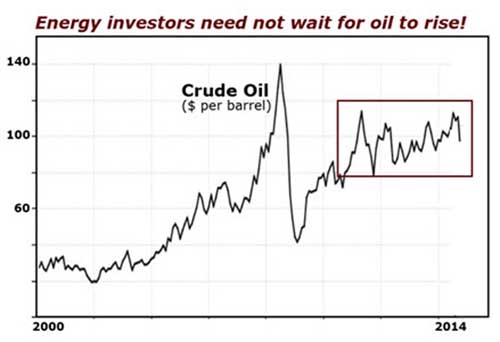

They’re waiting for crude oil prices to surge, to head again toward $120 or even $150 per barrel.

They’re watching the spreading conflict in the Middle East, expecting that its impact on oil production facilities in the region will create a supply crunch.

And they’re wondering why, after so many months, oil prices continue flop around near the $100 range (see red box in chart below).

If you’ve been among them, the wait is over.

Don’t get me wrong. It’s not because now, at long last, oil will necessarily begin to surge.

|

In fact, one person who’s been helping investors make substantial profits in the energy markets says that the success of oil investors today has a lot less to do with prices than ever before.

I’m talking about our own Mike Larson.

And to get his views on precisely what IS driving the success of his investment recommendations, I interviewed him at length yesterday afternoon.

Here’s an approximate transcript …

Martin Weiss: Mike, most people, especially reporters and editors at major media outlets go to you for your expertise on real estate, interest rates, bonds. Where does energy fit into your world?

|

Mike Larson:Â Energy has always been a big part of what I do because it’s always been a big factor behind inflation and interest rates. But more importantly, many energy INVESTMENTS have long been on my radar screen because they fit so nicely into my perpetual search for the reliable yield — and steady, sustainable growth — that’s at the heart of my Safe Money Report.

Martin:Â For example?

Mike:Â Take Sunoco Logistics Partners (SXL), for example, which helps support new oil fields in the United States. I was originally attracted to the stock because it yields 3.3 percent. But the price appreciation has been a big extra bonus — up over 27 percent since we first recommended it eight months ago. And that gain pales in comparison to the surge we’ve enjoyed in a major supplier that supports oil transportation by rail, up 109 percent so far.

Plus …

Martin:Â I know you have other examples. But let’s get to the fundamental question you’ve been harping on. You’ve been saying that the price of energy is no longer the key factor you’re concerned about, that waiting around for oil prices to rise is a waste of time and totally unnecessary. Why is that?

Mike:Â It’s really very simple: There are two fundamental ways any merchant can grow revenues. He can sell his goods and services for a higher price. Or he can sell them in higher volume.

Same for energy companies.

This is critical. So let me say it again, but this time from the perspective of the energy stock investor:

You can invest in energy companies that tend to profit from rising oil prices. Or you can invest in those that profit from a greater volume of business overall, regardless of oil-price ups and downs.

Martin:Â Two entirely different approaches.

Mike:Â Yes, and with entirely different kinds of results. But unfortunately, too many investors have been hung up on the former, on the companies that profit (or lose) due to oil price movements.

Big mistake! While they’re watching and waiting for the price of oil to make a move, an entirely separate set of investors has been making money hand over fist with the companies that profit from the growing volume of business.

Martin:Â Tell our readers why. Explain what has changed.

Mike:Â The great new U.S. energy bonanza. The boom taking place right here in the United States. And it’s all about volume!

The volume of known U.S. domestic oil reserves has mushroomed.

The volume of U.S. domestic oil production has mushroomed.

The volume of business for refining, storage services, transportation, logistics — even things like housing for workers — has gone through the roof.

Martin:Â This is very surprising to a lot of people.

Mike:Â It shouldn’t be. The problem is, for many years, most people have had their minds focused on OPEC; their heads buried in the sands of the Saudi peninsula, thinking that’s where the big game is. But it isn’t — and hasn’t been — for quite a while.

|

People like T. Boone Pickens have been talking about this for a long time. Other experts have also told us, over and over again, that this day was coming someday.

The difference now is that the “someday” is today. It’s happening. It’s happening right now. And it’s huge.

Martin:Â You’re talking about shale.

Mike:Â Absolutely!

Shale oil and gas reserves in North America are massive, far bigger than traditional oil reserves anywhere else in the world.

The new technologies for extracting them efficiently are no longer experimental. They are here. They are working. They are expanding rapidly.

Bottom line: The U.S. is moving rapidly and steadily toward becoming the single country with the world’s largest oil reserves, the biggest domestic production and, ultimately, the most exports.

Martin:Â Hard to believe. Especially for those of us who lived through the Arab Oil Embargo, the gas lines, the decades of worry about what new tricks OPEC or other big oil countries might pull next.

Mike:Â Hard to believe, but true. I don’t want to steal the thunder in this interview, but …

Martin:Â Steal the thunder from what?

Mike:Â This month, I’m going to host an online conference with T. Boone Pickens, and you’re going to be fascinated by what he’s saying now.

A few days later, I’m going to be releasing a special report on this topic — the working title is “Saudi America” — and you’re going to be shocked to see the massive numbers behind this new phenomenon.

Suffice it to say that, as a big factor in the oil world, OPEC is fading into the background. Same for the Persian Gulf, Venezuela, Russia, the North Sea.

Today, the big story has returned full circle to North America, especially the United States. Today, the big story is U.S. shale reserves, U.S. shale technology. Plus major new advances in that technology.

Martin:Â Can you give us a sneak preview of your conference with Pickens and your special report?

Mike:Â I already have. It’s in the Money and Markets column I put out just yesterday.

Martin:Â I saw that. In fact, it was so intriguing — that’s why I called you today for this interview. But right now, please share with our readers a quick run-down of the types of companies that you think will be making the most money in this energy bonanza.

Mike:Â Sure, but first let me distinguish between the old and new way of investing in the energy sector. In recent months, we’ve had crude prices somewhat above or below the $100-per-barrel level. We’ve had natural gas ranging between about $3.50 or $4. And those prices are largely unchanged for the last couple of years. And yet, the stocks of companies that have been involved in this business — storage, transportation and especially export — have been doubling and tripling.

In the old days, investors sought to catch an up-wave in crude. They bought companies like Exxon Mobil. And they rode it out as far as they could. That was pretty much the only big game in town.

Martin:Â Most of the other plays were peripheral or speculative.

Mike:Â Right. Then if the commodity went down, everyone lost money. The whole point of my Friday column this week is what we’ve been talking about in this conversation — that the entire dynamic of the industry has changed.

The key change is this:

America is now capturing more and more market share in the global energy industry! The production is coming home! So the infrastructure and servicing now has to be built out again here in the United States!

That’s why your goal can no longer be to play the Exxons of the world. It’s to find the companies that are making a killing right now.

Look at Cimarex Energy. This company is an oil and gas producer. But because they’ve been getting so much more oil and gas out of the ground, that stock has tripled over the past two years. And that’s just one more example.

Martin:Â This is a big complex industry for most investors. Can you help investors narrow down their focus?

Mike:Â For starters, focus mostly on domestic instead of international. In the past, the stocks that outperformed were the big multinationals, drilling in places like the coast of Brazil, doing all the deep-water exploration — the Halliburtons of the world.

The price of oil was so high, the push was “find the damn oil wherever you damn can.” That was the price play.

Martin:Â So the first filter should be domestic over international.

Mike:Â Right. The next thing you should do is focus on companies that are producing, using or benefiting from these new shale technologies and other newer drilling techniques. I’m talking mostly about companies operating in the Mid-Continent region, the Permian Basin, Marcellus Shale, the Bakken Formation in North Dakota. Plus, there’s another important region in Louisiana where some junior producers are jumping in.

Martin:Â Major regions where they’re now finding so much shale oil and gas.

Mike:Â Yes. Plus, several spin-off regions that border these.

Martin:Â I’ve always associated shale with a high cost of extraction. If the price of oil falls, will most of that still be viable?

Mike:Â Yes. The high extraction costs are primarily a problem associated with the oil sands — not the oil and gas shale reserves. But let me get back to the logical steps you asked for.

Martin:Â Go ahead.

Mike:Â As a third step, I would focus on service providers. And when I say service providers, I’m not talking just about the traditional ones, but also several others.

Martin:Â Like …

Mike:Â Likecompanies building the “man camps” in North Dakota. Companies feeding and clothing the workers. And also, of course, companies providing the equipment.

Martin:Â And the fourth step?

Mike:Â Transportation and storage! You’re finding a lot of oil and gas in locations that aren’t served by existing pipelines, and this is where companies like Sunoco Logistics, which I mentioned earlier, come into play. They’re building massive amounts of new pipelines for both oil and natural gas liquids. Plus, meanwhile, there are companies building tank farms to store all this stuff.

Martin:Â What about the Keystone Pipeline mess?

Mike: Sure, that’s been a big political boondoggle, but these companies are simply working around it. Different routes. Smaller pipelines.

They’re smart. When they can’t prosper thanks to the government, they figure out ways to prosper despite the government.

Fifth, don’t forget railroads. Pipelines aren’t the only answer. Oil by rail is also growing exponentially.

Look at this stat: In 2008, before the current boom got underway, U.S. railroads were transporting about 9,500 carloads of crude oil by rail. Now they’re moving more than 407,000! That’s a 43-fold increase. And it gives you just one measure of how big this domestic oil boom is becoming.

Martin:Â Does this help explain why the Dow Transports are doing so well?

Mike:Â Yes! It’s outperformed the Dow Industrials by nine to one in the last nine months. And a good part of that is thanks to this domestic energy boom.

Finally, look beyond just the railroads. Also look at companies that make and lease the rail cars, that are major service providers to the railroads — companies that have multi-year order backlogs.

Martin:Â Excellent insights and guidance, Mike. Thank you! We are looking forward to hearing a lot more from you on this — in your upcoming conference with T. Boone Pickens, in your special report on “Saudi America”, and more.

Mike:Â Thank you, Martin, for the opportunity to talk about this. I have a great passion for this subject, and I’m delighted to share it with our readers.

|

EDITOR’S PICKS

Is This Twitter’s Facebook Moment? by Mandeep Rai Is Twitter (TWTR, Weiss Ratings: D) having a Facebook (FB, Weiss Ratings: B-) moment? Twitter’s shares soared today as it reported a doubling of revenue and said user numbers grew 24 percent year-over-year, an addition of 16 million active users to the current 271 million. Market Doesn’t Believe Economy Is Getting Better by Bill Hall Recently all eyes have been on the U.S. labor market, and last week we received some great news. That is because the initial jobless claims number released by the Department of Labor showed that we had improved dramatically in that regard. An Insider from Russia Gives His Take on Investing There by Mark Najarian After the fall of the Soviet Union, Western companies and individuals made billions by investing in Russia. The abundance of commodities — oil, gas, metals, forestry — and a Wild West atmosphere made it, some said, impossible not to make money there in the 1990s and early 2000s. |

THIS WEEK’S TOP STORIES

Shifting Sands of Time, Countries and Markets. What to Do … by Larry Edelson The sands of time are shifting, and so are vast swaths of geopolitical fault lines … entire countries … economic systems and yes, the financial markets. What Amazon and Putin Have in Common by Jon Markman I don’t know who has been more brazen over the past week — Russian strongman Vladimir Putin or Amazon.com czar Jeff Bezos. by Charles Goyette I want to share with you the most discouraging words I have read lately. A matter-of-fact statement that demands consideration. Just an anonymous observation that I had to conclude was depressingly likely |