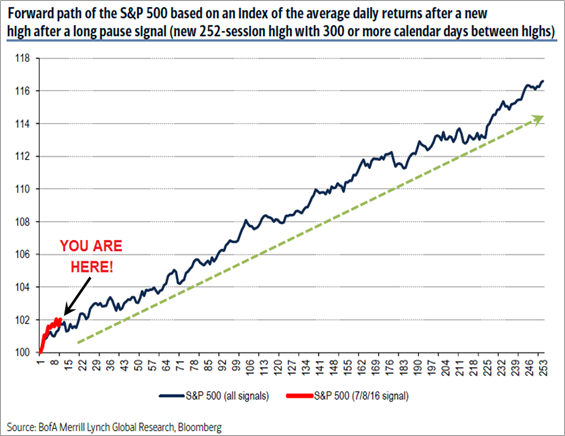

Three-and-a-half percent! That’s how much the S&P 500 Index has gained since it notched a fresh, 52-week high last month, on July 8, after a long pause of 414 days since the last 52-week high for the blue-chip index.

Market Roundup

A 3% gain in just 20 trading days is nothing to sneeze at, and it may be just the beginning of more upside gains to come in the year ahead.

Last month in Money and Markets, I alerted you to a rare and powerful buy signal for stocks. I explained exactly why new highs after a long pause have historically been very bullish for the stock market over the next year.

But as a quick refresher, here are the details…

History shows that whenever stocks take a “a long pause” between 52-week highs and then finally break out, stocks go on to post even bigger gains, according to Merrill Lynch research.

![]() One year later, the S&P 500 is up 91% of the time, posting average gains of nearly 16% …

One year later, the S&P 500 is up 91% of the time, posting average gains of nearly 16% …

![]() That’s more than TWICE the average gain of just 7.5% for any random one-year period going back to 1929 …

That’s more than TWICE the average gain of just 7.5% for any random one-year period going back to 1929 …

![]() It’s a rare ultra-buy signal for stocks, which has only happened 23 other times back to 1929, and it’s been consistent, producing big gains for stocks 9-out-of-10 times in the past!

It’s a rare ultra-buy signal for stocks, which has only happened 23 other times back to 1929, and it’s been consistent, producing big gains for stocks 9-out-of-10 times in the past!

Hat tip to Merrill for the updated chart below, which shows the path stocks are likely to take based on previous ultra-buy signals in the past.

Note the tiny red line at bottom left. That’s the current trajectory stocks are on now, in 2016. As you can see, this rally has only just begun, if history is any guide.

Still, just about every investor I talk with these days is spooked about the NEXT stock market correction, which many fear is lurking just around the corner.

Or worse, they’re worried that after a seven-year bull run since 2009, that this bull market is almost over with another bear market looming.

The stock market has already overcome a number of risk factors on the way to its 5.9% gain year-to-date, including: Brexit, slowing GDP growth and persistent signs of deflation, as reflected by deepening negative interest rates worldwide.

Still, stocks have managed to overcome all this. But next up on the laundry list of things that could “go wrong” is of course the November election.

For my money, I’ll let the market’s price action be my ultimate guide, and right now trends look bullish. For instance, take a look at the sector rotation that’s now underway shown in the table below.

Nearly all of the sectors that have led the stock market’s rally, post-Brexit, are cyclical stocks.

Technology has led the way with a 13.4% gain after some excellent earnings results from bellwether stocks like Facebook (FB) and Amazon (AMZN).

Health care is #2, up 9.7% post-Brexit after underperforming the market during the first half of 2016, mainly due to election year uncertainty.

But the next five leading sectors are all cyclical, with financials and materials up over 9% and industrial stocks up 8.6%.

This isn’t the kind of leadership you’d expect if we were heading for a recession and bear market, when defensive stocks typically lead. That was the story during the first half of this year, when telecom and utility shares led the way … nowhere for the overall market, but that’s all changed now.

| Â “This shift in leadership is a bullish sign for the market.” |

And this shift in leadership is a bullish sign for the market, especially when beaten-down financial, industrial and material stocks are able to rebound strongly just as the stock market notches new highs.

That’s not to say a stock market correction is off the table by any means.

After all, we are moving into the seasonally weakest period of the year for stocks, from August – October, which is the only three-month period of the year when stocks have declined on average. And September is the cruelest month historically, posting an average decline of 1.1% since 1928!

So a 5-10% correction is certainly possible in the months ahead, in fact it’s overdue, but that could give you a great chance to buy. As long as the market trends I’m watching stay bullish, any correction should be greeted as a buying opportunity for more gains ahead!

Good investing,

Mike Burnick

|

![]() According to Former Federal Reserve Chairman Alan Greenspan, oil prices have probably bottomed out at around $40 per barrel after dropping more than 20 percent in the past two months. He went on to say oil could trade in a range of about $40 to $50 a barrel over the next couple of years.

According to Former Federal Reserve Chairman Alan Greenspan, oil prices have probably bottomed out at around $40 per barrel after dropping more than 20 percent in the past two months. He went on to say oil could trade in a range of about $40 to $50 a barrel over the next couple of years.

![]() The U.S. withheld $300 million of military aid to Pakistan due to the fact that Defense Secretary Ash Carter couldn’t confirm enough action had been taken against the Haqqani Network insurgent group.

The U.S. withheld $300 million of military aid to Pakistan due to the fact that Defense Secretary Ash Carter couldn’t confirm enough action had been taken against the Haqqani Network insurgent group.

This is the latest strain on the relationship between the two nations following America’s first drone strike in the southern Pakistani province of Balochistan, which killed Afghan Taliban leader Mullah Akhtar Mansour in May.

![]() Forbes has released its newest list of the longest-lasting cars. These are cars you can confidently buy for the long haul – about 250,000 miles, say the editors. The Forbes picks reportedly don’t just survive, they carry on with comfort and style.

Forbes has released its newest list of the longest-lasting cars. These are cars you can confidently buy for the long haul – about 250,000 miles, say the editors. The Forbes picks reportedly don’t just survive, they carry on with comfort and style.

The list includes, from tough to toughest: No. 10, Toyota Sienna; No. 9, Lexus RX 350/450h; No. 8, Mazda Mazda6; No. 7, Volkswagen Passat; No. 6, Audi Allroad; No. 5, Subaru Forester; No. 4, Toyota Prius/Plug-In Prius; No. 3, Lexus ES 350/450h; No. 2, Toyota Camry/Camry Hybrid; No. 1, Scion xB.

![]() Nike has given up golf – equipment that is, reports Reuters. The company, which dominates the sportswear world, will stop selling swoosh-branded clubs, balls and bags. Instead, Nike plans to focus on creating state-of-the-art footwear and other apparel for golfers. It also plans to build on its sponsorship of Tiger Woods by recruiting more professional golfers to wear its gear.

Nike has given up golf – equipment that is, reports Reuters. The company, which dominates the sportswear world, will stop selling swoosh-branded clubs, balls and bags. Instead, Nike plans to focus on creating state-of-the-art footwear and other apparel for golfers. It also plans to build on its sponsorship of Tiger Woods by recruiting more professional golfers to wear its gear.

The Money and Markets team

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 18 comments }

The fact that many are expecting a “correction” in the market is, indeed, a bullish sign….. from a contrarian point of view.

However, my own analysis has produced this: 1) the “January affect” has already pointed to the conclusion that the market will swoon at some point during 2016, 2) according to the “dow theory,” the transports have been on a downward trajectory, again indicating a coming overall market correction, and 3) the bollinger bands on the VIX chart have just really compressed….almost a carbon copy of last year’s action, just prior to the 1,000 point selloff in one day, and subsequent selling during the latter part of August, 2015.

Right now, all eyes are on the “jobs number” coming up in the morning. Regardless of how that pans out, I’m long UVXY, and may soon buy more!!

Thoughts, anyone? I’m open to ideas. I’m here to learn (hopefully, not the hard way.)

Yes. Improbable that this logic applies with valuations and momentum so stretched.

D,

Excellent comment! The average S & P 500 PE over the past 5-years has been 15.8 X, and the 10-yr. average is 15.9X. We are currently at 19.4X, and the question becomes, how much higher can it go? Certainly low interest rates must remain so, or PE’s start to decay.

Read where the US stock market capitalization compared to US GDP is now 119%. That is the 2nd highest ratio in the last 50 years. Only time it was higher – late 1999 / early 2000! Must have much higher corporate earnings to justify Mike’s argument.

if you keep trying to raise stock prices by reducing the number of employees and moving jobs and capital to other countries, your customer base–the american middle class worker–won’t be able to afford you products and foreing markets are saturated with goods and services provider cheaper than even the usa can via china. so until and unless wall street acts as if it gets it that “we are all in this together” and starts acting in the interet of the public weal, i suggest and believe the equities market will collapse altogether and be replaced by under-the-radar workers- collectives and underground economies. small and decentralized and not beholden to short-term profit goal-seekers.

the fruit is rotting offa the trees from the inside out.

ever see a tree die of dutch-elm disease? hrmm. apples from those pesky flies? hrmm.

By the way, your list of toughest vehicles does NOT seem to include any American made ones……!!?? So much for our stuff, huh?? …..

AND……I can’t help but note that American dealerships have not discounted their prices any to make up the difference for their vehicles not lasting as long……….

TO WHOM IT MAY CONCERN .

I WAS TOLD FROM THAT BEFOR A BULL MARKET WE NEED A GREAT CORRECTION AND SO FARE WE DID NOT GOT A VERY DEEP CORRECTION TO PREDICT A FULL MARKET NOW CAN SHOW OTHER WISE TO BE BULLISH IN THIS MARKET

SINCERELY

MRS TASKER

When working for my MBA, I took a course on investing. The first thing that I was taught was never base predications of the future on what has happened in the past. Instead I was taught to analyze all the facts and try to assign probabilities to possible outcomes. I was taught to use charts in my analyst but never base a decision on a chart or past history. Always base a decision on the probabilities. If basing a decision solely on charts, we would all be rich, wouldn’t we. Right now, the charts do not reflect the enormous underlying currents that could cause a catastrophic collapse of equity prices. It is just a matter of when investors realize the Fed is not their friend.

To: this world is…

Companies reduce American workers and make their products abroad so that Americans can afford them when they get sold here. Displaced workers must retrain for the types of jobs we still have and will have. Example: my son wanted a made in America suit; he found a nice one that costs $2500, but couldn’t afford it. So he then found a nearly identical suit made abroad (Bangladesh or somewhere like that). Price: $250. So do you want to spend a month’s take home pay on a suit, or 10% of said take home pay? I thought so.

People criticize Trump for advocating tariffs as being a protectionist. Protectionist only became a dirty word after national corporations wanted to hire cheap overseas labor. Our founding fathers realized that this country had to impose tariffs to protect our economy. Yeah, those geniuses were protectionists. Think about it, what is wrong with one trying to protect themselves, their families and their country. Protectionism has been promoted as a dirty word by the MSM because a few wealthy people want a global economy so that they can have global power. Wasn’t that what the American revolution was all about, breaking the shackles of a global power and global economy. Trump has it right. We need jobs brought back from outsourcing. Only jobs will cure this nation. Lowering taxes will not. Globalization has done more damage than Trump is addressing. The MSM tell us that people who are not working are lazy and just want to suck on government benefits. Not so. I live amongst these people. They want to work, but don’t have the power to fight globalization. When companies transfer local jobs overseas, displaced workers must depend on government benefit programs in order to survive. Our workforce participation has dropped to very low levels; dependence on government benefit programs, such as food stamps, is at an all time high. Society and the economy are intertwined, they cannot be separated. Attempts to do so will result in chaos. The government must provide some support for those displaced by globalization and free trade. The proponents of free trade will tell you that globalization has provided you cheap products which improves your standard of living. This is a bold faced lie! Globalization has only lined the pockets of the elite. Those cheap products have two costs: the direct cost at the cash register and the indirect cost of higher taxes to fund the government benefit programs for the displaced workers. The products are probably much more expensive than they would have been if they had they been manufactured locally. A second effect of globalization creating large numbers of government dependent displaced workers is a huge reduction in our tax base and our potential market for goods. The reduction in the tax base means that those working must pay their taxes along with those taxes that cannot be paid by the displaced workers. However, the bill is too large for the working population, so the government must compensate by printing and borrowing more money. Bingo! 19 trillion dollars debt. It also dooms the life of the dollar. NOTHING IN LIFE IS FREE! Globalization is destroying our country for the benefit of a few. Even those few will suffer because the earnings in the price/earnings ratio come 100% either directly or indirectly from society and society is fast losing its ability to support those earnings! Borrowing to drive the economy, as proposed by the Federal Reserve, not only kicks the can down the street, but also enhances the “bursting of bubbles”. Borrowing to drive the economy puts the economy on borrowed time. Payback is coming with a vengeance.

Ken Banks

There is a very real danger that if we continue to rally, it’ll morph into an endgame blowout rally for a formation that spans 10x longer than what led to the 1929 and 1987 crashes; the backside of which will have unimaginable/uncontrollable wealth destruction that absolutely nobody is prepared to deal with.

ELECTION YEAR “UNCERTAINTY”

“Health care is #2, up 9.7% post-Brexit after underperforming the market during the first half of 2016, mainly due to election year uncertainty”.

What might all that prior “uncertainty” be ? Hillary Clinton was trash-talking Health Care, most especially Big Pharma. The institutional investors that invest the big bucks and move markets also determine which sectors are in and which are out. Its their money that makes markets go up or down. Back in Oct., Hillary was looking like the presumptive winner and Donald Trump was looking like a loser who was unlikely to make the cut.

Now, Donald Trump has the upper hand the institutional money may have reevaluated Hillary’s chances of winning downward. That would explain the revival of the Health Care Sector of late. If Donald Trump wins, the market could explode upward. Even lowly oil and gas companies might get a break. Its still too close to call and very fluid.

It might pay to take a pass on the new Bull until after it is confirmed with a Republican Victory in Nov. If Hillary wins, gold will still be the sector to be in next year, as it was this year. Gold is a vote of no-confidence on Hillary and Janet Yellen at the FED. Remember, gold is overdue for a steep correction, so don’t pile in right now if you are not there already. Incidentally, The FED has been the source of most of the volatility in stock markets today. So, any change there ( replace Janet Yellen) might help unleash the Bull next year.

Wait to fight another day. Cover your bets across the board for now and concentrate later after the election uncertainty is over. Economic policies will differ quite a bit depending on who the winner turns out to be. Hillary will go after Big Pharma, Oil and Gas, Coal, but will be a closet warmonger. Defense is a probable winner no matter who wins because we all live in an increasingly dangerous world. We need the “Big Guns” more than ever.

Yes your right Mike there could be a move upward thanks to all time high share buy backs by corporations. I think this is phony stock market fuel. Its funny how prior to 1982 stock buy backs were considered manipulation. The then head of the SEC because of a drop in the market waved his magic wand and boom what was illegal now became legal and the Dow jumped 25%. Really. And we think China manipulates their markets. Pikers.

Mike its amazing after the two serious drops in the market in the last two years wiping out trillions they miraculously made a comeback in short order. Look at the Brexit drop the hurt lasted 2 weeks and then we came back to all time highs again. Is this not rather strange well thanks to companies rushing in and buying back their own shares the market was propped up. The little guys are feeling the fear factor and are slowly pulling out of the market so what keeps it afloat besides hot air and manipulations. The market is like a dike with leaks springing up all over the place and not enough fingers to plug them. Is this market going to go to 31,000 as Larry predicts with stock buy backs and financial engineering? That and foreign money flooding in are the only options to reach this level it sure is not real earnings and expansion. How long can this Disneyworld style market exist? Sooner or later common sense must set in and the people that have made tons of money on this phony market will start heading for the doors but the doorway will not be wide enough and most will get trampled. All Ponzi schemes collapse sooner or later. It will be ugly.

Adaptive Expectations are commonly used in Economics. For example if It rained yesterday it’s more than likely that it will rain tomorrow. This is generally how future booms and recessions are predicted. I thought Audi or a Lexus were the ultimate high performance car.

I think current rally are cause by foreign fund which got no better place to put their dollar. I see the current data are all quite weak, don’t deserve such a performance. Please have a trailing stop to take your profit. Good Luck,

Mike Burnick is bullish.

Mike Larson is bearish.

So you guys ever talk?

They did not list Porsche,they have more cars (that they have made) on the road then any car!

Mike Larson,

Isn’t it a trifle early to take a bearish position? Are you long S&P puts today? What expiration? Please be specific