There’s no question the bull market in stocks that began in 2009 is long in the tooth by nearly any measure. As a result, plenty of investors are edging toward the exits already, with steady outflows from mutual funds, as I reported last week.

But history says this early exit could be a big mistake, leaving just before the biggest potential gains may be earned.

The current bull market is now the 2nd-longest in history at 91 months in length and a gain of 223% for the S&P 500!

It’s also the 3rd-best bull in terms of price performance, and it’s only a few percentage points away from beating out the 1980s’ bull-market gain of 228.8%.

But stocks would have to more than double from here to match the granddaddy of all bull-market gains: 582% in the 1990s!

| Â “History suggests that very big gains are most likely in store for stocks.” |

I know what you’re thinking: Fat chance of the S&P 500 doubling yet again with current valuations already stretched. But history suggests that very big gains are most likely in store for stocks.

Analysts at Bank of America studied every bull-market peak since 1937, and their research shows that missing out on the last leg of a bull market is a costly mistake. Their findings:

If you skip the final year of a bull-market advance you’re likely to miss out on 21% gains – that accounts for nearly one-fifth of the entire bull-market profit on average.

Jump ship two years before the top and you’re likely to miss out on a median gain of more than 40%! That’s a lot of money left on the table.

Consider this: Investors who left the stock market party one year prior to the 1987 peak, would have missed a 40% gain over the next 12 months.

You would have STILL come out ahead, even after the October 1987 crash!

And if you think valuations are expensive today, how about the dot.com era of the late-1990s when internet stocks were valued based on clicks?

Even so, if you bailed out of stocks in mid-1997, you would have missed a 70% gain in the S&P 500 over the next three years!

Bottom line: It’s human nature to be skeptical, and after a bull-market run that’s lasted nearly eight years already, it’s perfectly normal to wonder if the music is about to stop.

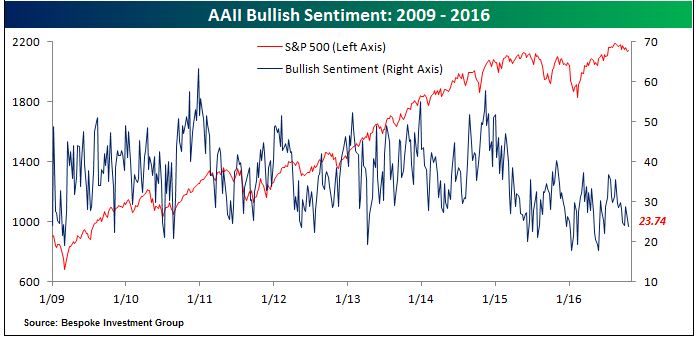

But pessimism seems rampant right now. Money managers are holding the highest cash levels in nearly 15 years, and retail investor sentiment is close to the lowest levels at any time since this bull market began in 2009 (see chart above).

This is NOT the stuff bull-market tops are typically made of.

History clearly shows that the last leg up in most bull markets can be explosive with spectacular gains for investors who sit tight!

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 28 comments }

Last leg has little to run as short term rates are slowly going up

Like letting air out of a tire

Well great. Now Weiss contributors have covered both sides of the market. Us folks sitting out here – relying on people that are in the business full-time to help us to create an outlook – never really get what we are looking for. Like going to a doctor who will give you best case and worst case so to cover your hopefulness and their legal liability at the same time.

A bird in the hand is worth two in the bush

It’s a breath of fresh air to read your positive comments regarding the market, believe with all the new investments forthcoming from around the world the market is in for a huge increase as The U.S.A. is still the best place to invest. Know that scary predictions sells newsletters. Need to stay positive and invested.

I appreciated it a lot. Is is much better than my own analysis I am sure. Thanks.

you are right. It is far better being in the market and ride out the crash rather than sit with cash to avoid crash. In the long run, market will go back up again. I have never made any money playing with time.

Tell that to the Japanese investor who stayed invested in 1990 and 24 years later is still down over 50%!

If I hold a $1000 in my matress for the next 2 weeks at the end I still have a $1000,Look at the DOW right now,something big is brewing,hope we are all on the same page

http://www.huffingtonpost.com/rep-alan-grayson/dumb-rich-people_b_1546303.htmlIf Brought forward to the current, the performance difference is many times greater….. The study period is almost 100 years and noted for the same number of each type of administration…..

If the Orange bombastic is elected, we will have a Worldwide Financial Crash….. If it goes the other way, we will have a rally into year end beginning November 9th and 2017 will be a great year for gains…

Do they ring a bell at the market top, now? Cash out a year early and leave 21% on the table. Cash out a day late, and how much do you leave on the table? Not making 21% sounds less distressing than losing 50% or more.

Bulls make money, bears make money, but pigs get slaughtered. Get out before the top.

Is your option news letter for sale ?

Mike, Thanks for your report, but everyone in Investing is riveted on the K-Wave which takes a dive every 50 years. With that History you can see why we are now going through Winter until 2020 and beginning Spring then. Brexit was a player recently. One of many to come, with currencies in flux, yuan coming on board at UN, distrust of current governments, histrionic elections, and morality trending to violent problem solutions, it makes one pause. Take care. — Gloria

Why are Mikes newsletters 16 paragraphs long while Jeff’s are 50 paragraphs long? Does Bad News and Crime really sell newspapers? I am predicting a bull market in precious metals, and a bear market in the stocks and commodities markets. I am also predicting the dollar to appreciate in value relative to other currencies.

Hi Mike

Several things to consider. 1. It started as a bull market partly due to a previous collapse in confidence. So it depends where on the graph we want to look and our entry level. Are we long or short? 2. Dollar values are only a perception because the fed has been printing the stuff. How much is our currency really worth other than as a means of exchange. 3. You can’t make money in these unusual times out of interest rates. 4. Is it time in the market or timing the market? 5. Our funds are spread and partly invested in at a low cost, with a relatively high yield returns and wondering which black swan is going to strike first. 6. There are weak and safe currency positions to consider as well.

It’s very interesting how several of you that are employed by Weiss reseach totally CONTRADICT one another. Larry says the market is headed lower and you say don’t miss out on the next 40% Larry even has trades recommended to profit on the upcoming DOWN moves in the market.

Yes it is a little confusing …. get ready to buy into gold, the dollar is going to get stronger, the market will head down…… now we hear don’t get left out of the next explosive burst in stocks…. I’m leaning towards Larry…..

Agree 100%. I’ve been investing in the stock market for close to 40 years. Good recommendation.

I have no stock knowledge but I am computer literate and like to know how can I turn my small IRA investment of ($29,000) into more money and I am 52 years of age?

If you are computer literate check out free stock screeners. Under fundamentals set your parameters to high ROIC, high ROE, low debt, long history if dividends, P/E never above 35. From the list start researching online and thru your online broker if you have one. Thru market analysis and opinion you can widdle down to a select few. Buy on the dips and hold on. Google “Coffee Can” approach, only invest in a dozen or less you really like after researching. Buy silver and gold after crashes. Good luck

Past is not an indicator of the future. One should not try to predict future based on some past event, that too which occurred only once before. It is better not to lose money than miss the gains. Better safe than sorry.

Study 1925-1935 and you should find lots of reasons to study the past……

It all depends if we continue to believe all these so called quarterly profit numbers that have been goosed upwards shamelessly by so called economists, the business friendly Fed abomination and the cheap fast depreciating fiat currency that governments are using to plug the many many leaks in the financial dikes. Yes this so called stock market rally will keep clunking and clanking along. If the government, the Fed, bullion banks paper gold (the list is to long to mention) keep up their war against gold (so they can buy it on the cheap) yes the market can continue on its merry way up. Investors have now been brain washed to the point where they no longer believe that companies must expand to succeed they only must buy up their competition and lay of 75% of the workers and keep borrowing cheap money to buy back stock and of course fudging their earnings. They are becoming experts at this with the blessing of the government and the SEC. Its a crazy world we live in Master Jack and it will all end badly. Sadly the government with all their shenanigans has time on their side but as we all realize as we age time does run out.

This bull market is as the word state a lot of bull.

WOW! there’s actually a bull forecaster at weiss. way to go, mike. i agree, one more up wave to go before a recession.

have you not about the derivatives melt down likely to happen prior to the election? causing a banking & housing collapse!

I have read all these comments and each has something to offer. I am 80 and have been investing since I was 18 in 1954. At that time I quizzed my Grandfather and Father about what was it like from 1890 through to the Eisenhower boom, starting that year. Both of them said about the same: always buy a quality business, watch it every day like you owned it, get to know as much as you can about its management, its “corporate culture” , its products/services and competitive position, patents and advantages over competitors; its history. Key questions: Have they paid dividends each year,with many years of no cuts and raised them regularly? Do they keep debt levels low and can they pay-off debt with ease, on time, at levels well below free cash flow after dividends? Is their share count stable, with few increases, except for stock splits? Do they have ROE% and ROA % well above cost of capital? Finally, is their industry in the growth phase, mature or in decline? The New York Central RR and Pennsylvania RR may have good qualities, but what is their future in 1954? What is the expected productive life of that copper, gold or silver mine and can they produce metal at a cost well below cyclically low market prices? Is there a Kodak blue chip you hold today, sitting pretty, while a technology transformation, that can destroy their business model, is brewing quietly, unperceived? Last point was/is the most difficult. Final word “It is really hard, serious work; don’t let anyone kid you, my boy, keep a cool head and be prepared for surprises every day, then act promptly.” “Don’t be greedy and never panic”. Some successes since 1954, following those guidelines: AT&T, Silver miners like Lucky Friday (Hecla) and more recently, since 2009, Silver Wheaton (SLW). Union Carbide (sold/transformed into Dow Chemical and Praxair); Colgate, 3M. Recessions and depressions must come. Be cool when the dark clouds are gathering and take appropriate steps to evade getting hit by lightening, which usually follows first signs of the gathering storm. Solid, dividend paying companies do much better, over decades, than glamourous, high flying, popular speculations. Get the idea?

You were taught well… However, in addition, I would add a Political angle to be considered:http://www.huffingtonpost.com/rep-alan-grayson/dumb-rich-people_b_1546303.html

A company needs debt leverage in order to pay its bills and compete with other companies in the same field. It also needs liquidity in a credit crunch. Businesses are naturally risk averse. But risk has two components. Systematic Risk and UnSystematic risk. The best companies adapt to change quickly when faced with adverse market conditions. The sub prime mortgage crisis wasn’t caused by collateralised debt obligations but rather by unsystematic risk factors. Simply laissez faire as neo classical economists would describe. We are not in a pareto efficient situation but the kuznets curve says the waves of human economic activity are oscillating at the moment.