|

Do you think that the new ugly war exploding in Iraq is about religion … that the violence tearing apart Ukraine is about autonomy … or that the scary conflicts in East Asia are driven by territorial disputes?

If so, you’re not wrong. But what you may be missing is the overriding, ever-present elephant in the room:

Oil Wars!

Larry Edelson, who repeatedly forewarned us of today’s rapid escalation in global conflict, puts it this way:

“Global conflict is now ramping up even more quickly than even I had anticipated — not just economic wars, currency wars and trade wars, but also civil wars, regional wars, cold wars, revolutions and social chaos.

“They will turn out to be some of most important events of your lifetime — events that will shape your financial future and the financial future of all those you love for the next 50 years.

“Unfortunately, however, most people still don’t understand them. They don’t know what’s happening — let alone what to expect. They haven’t connected the dots to gold. And they don’t realize how deeply the conflicts tie back to oil and energy.”

This was the whole point of Larry’s landmark speech on our Weiss- Money Show Cruise last year. It’s been his mantra in Money and Markets emails, on Money and Markets TV, in his Real Wealth Report and in his online webinars.

In fact, he said it so often, some folks asked:

“Doesn’t Larry ever get tired of talking about this stuff?

Why is he pounding away at it over and over again?”

Well, now we know the answer, don’t we?

Not only do we have new, dangerous wars exploding — or about to explode — in Ukraine, the Middle East and East Asia …

Not only are those wars threatening to spread globally …

But we are also beginning to see their impact on global markets.

Just connect the dots:

- Wars drive oil and gas prices skyward …

- Surging energy costs drive up inflation, threatening to gut the purchasing power of paper currencies …

- Scared money flees the regions threatened by wars and revolutions, and …

- Hundreds of billions of dollars rush into gold.

It’s classic. It’s a proven pattern we’ve seen for centuries. And it’s happening NOW!

Just consider the two wars now in the news …

Iraq: Earlier this past week, millions of frightened Iraqis breathed a temporary sigh of relief when they learned that ISIS, now the most powerful terrorist group in the world, was pausing in its drive to take over Iraq and attack Baghdad.

But the relief quickly turned to grief — and intense fear — when folks realized that the so-called “pause” was the terrorists’ deliberate strategy:

They wanted to first capture Iraq’s biggest oil fields and refineries near the town of Beiji … cut off the country’s source of energy and income … and then take Baghdad.

Why? Because Beiji is the largest oil operation in Iraq, and because Iraq is the second largest producer in the region!

Ukraine: This conflict has been all about gas and energy from the get-go — not only because of the immediate threat to cut natural gas flows to Ukraine and Western Europe, but also because …

Huge Natural Gas Reserves off the

Coast of Crimea in the Black Sea

As the New York Times recently explained,

“When Russia seized Crimea in March, it acquired not just the Crimean landmass but also a maritime zone more than three times its size with the rights to underwater resources potentially worth trillions of dollars.

“Russia portrayed the takeover as reclamation of its rightful territory, drawing no attention to the oil and gas rush that had recently been heating up in the Black Sea. But the move also extended Russia’s maritime boundaries, quietly giving Russia dominion over vast oil and gas reserves while dealing a crippling blow to Ukraine’s hopes for energy independence.”

How big are these reserves? The Times reports that Exxon Mobile, Royal Dutch Shell and other majors have already explored the Black Sea, and some experts are now saying that Russia’s new energy windfall there may be as big as the North Sea, where Britain and Norway have enjoyed windfall profits for four decades.

Is Everything as Dark as It Seems?

Yes!

But there’s also a light at the end of the tunnel:

|

| Click for larger version |

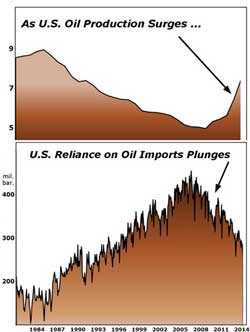

First, U.S. production of petroleum and related products, which had been declining for nearly two decades, has recovered — and done so very quickly.

That’s a dramatic turn of events with lasting consequences for investors who target the right sub-sector of the energy world.

Second, thanks to the rising production, U.S. reliance on imported oil has plunged.

Does this mean that the United States is invulnerable to the oil and gas wars now exploding abroad?

I wish! Unfortunately, the oil wars are breaking out suddenly and right now!

In contrast, America’s trend toward energy independence is a slow process that will take many more years.

That means surging energy prices and a massive flight into gold.

What to Do

First and foremost, make sure you have a stake in both energy and gold.

Second, stay alert for specific recommendations in Larry Edelson’s publications. His picks are soaring; and he’s getting ready to recommend more.

Third, stick with them. The wars are just beginning to escalate and spread. Their impact on precious metals and energy are just beginning to appear. And the profit opportunities you’ve seen so far could be just a small sneak preview to what’s possible in the months ahead.

Good luck and God bless!

Martin

|

EDITOR’S PICKS

The Questions That Weren’t Answered by Charles Goyette For those who remember the “stagflation decade” of the 1970s, there is something eerily familiar about the news of slipping U.S. economic growth and the Consumer Price Index climbing 0.4 percent in May, hard on the heels of a 0.3 percent increase in April. Strength in Weakness? May Be Time for Sector Bottom Fishing by Don Lucek Is it really so odd that the U.S. stock markets are running up so much this year on so little volume? How to Invest as Boomers’ Peak Spending Years Fade by Bill Hall In recent Money and Markets columns, I have discussed how deflation is the primary economic force effecting both the real economy and the financial markets. And last week, we received further evidence from the World Bank that deflation continues to plague the global economy. |

THIS WEEK’S TOP STORIES

Inflation Returns! Fed’s Fantasy-Land Forecasts Failing! by Mike Larson The Fed keeps saying there’s no inflation … The Fed keeps telling us prices will stay subdued for several quarters … The Fed keeps promising to keep interest rates pegged to the ground for years … Can Iraq Turmoil Lead to ‘Stagflation’? by Jon Markman The new unrest in Iraq has put into play the one thing that central bankers — who’ve been busily juicing the economy with cheap money stimulus — fear most: An energy-price-fueled spike in inflation. Dow to Double to More Than 31,000. Mining shares to QUINTUPLE! by Larry Edelson The pullback I’ve been warning you about in the U.S. equity markets is finally at hand. But once this pullback in the broad stock indices is over — the Dow Jones Industrials will lead the way higher yet again, and catapult to 31,000 over the next three years. |

{ 1 comment }

I see red whenever I read “Russia seized Crimea” . I wish you all would start reading the international press – try Robert Parry and Pepe Escobar from Asia Times. Russia did not “seize” Crimea – and the propaganda coming out of cnn and the NY Times just makes me ill. The US has no business on Russia’s borders, fomenting coups, supporting murderous thugs and destroying life in what was once a beautiful and peaceful country, whatever its economic problems. If you cannot see that the wars and conflicts rising up around the world are directly attributable to the IMF and US meddling, then I don’t know where you are looking.