My family and I sure are looking forward to the holidays this season. At my house, we’re in full-on Christmas mode now.

It’s the first holiday season in three years we’ve spent at home, instead of visiting family or soaking up the sun at our beach house in Cape Town.

To celebrate, my wife has decided to go full “Clark Griswold.” Fortunately, my electrical skills are much better than his. Georgia Power is in no danger from the Bauman household.

We’re just one of millions of households across the world anticipating the Christmas season.

With the tax cuts on the way, however, some American households are celebrating a bit more than others. That probably includes National Retail Federation President and CEO Matthew Shay.

After all, his organization represents the interests of a sector that will reap massive benefits from corporate tax cuts. As Shay put it:

“President Trump wants to sign tax reform into law by Christmas, and we think that would be the perfect present for the American people and the U.S. economy.”Â

If you play your cards right in 2018, you could enjoy that “perfect present,” too. Here’s how …

Thanks for the Tax Cuts, Santa!

Retailers pay a higher effective tax rate than any other sector. That’s because they aren’t eligible for the tailored tax breaks that tech, manufacturing, financial and energy companies get.

And unlike multinational companies, most U.S. retailers earn almost all of their revenue from domestic operations — so they can’t play the international tax shell game.

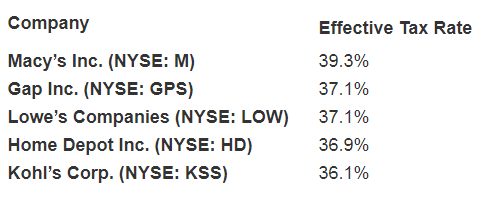

Consequently, even though the corporate U.S. tax rate is currently 35%, many U.S. retailers pay an even higher effective tax rate once you add in state and local taxes. Here are a few examples:

By comparison, the average U.S. corporation pays an effective marginal tax rate of just 18.6%.

Of course, U.S. brick-and-mortar retailers are wilting under the blitzkrieg assault of online retailer Amazon. 2017 has been a bad year.

But many of these retailers have decent business plans. The best of these rely on a combination of an increased online footprint and reinforcing the customer value that can only be created by an in-store shopping trip

The problem has been that companies hemorrhaging cash are hardly able to implement such plans. Banks aren’t interested in lending to them.

A corporate tax cut would give such companies the wherewithal to make these investments. Let’s look at the math.

For a company with a 35% tax rate, reducing it to 20% would lift profits by 23%. That’s a nice chunk of change. But for some, the numbers are even better …

Mall stalwart Nordstrom (NYSE: JWN), for example, paid 48.2% tax on $684 million revenue in 2016, leaving just $354 million in net income. Under the GOP plan, it would have had $103 million more, a gain of 29%.

Iconic store Macy’s (NYSE: M) — which has been on a death watch for much of 2017 — would get an extra $143 million.

That kind of cash can buy a lot of innovation … IF you know how to do it.

The Restart-Ups

Macy’s is up 46% over the past month. American Eagle Outfitters (NYSE: AEO) is up more than 30%. So is Gap Inc. (NYSE: GPS).

The SPDR S&P Retail ETF (NYSE: XRT) is up more than 13% over the same period. That’s XRT’s biggest monthly gain since October 2011. The S&P 500 was only up 1.5%.

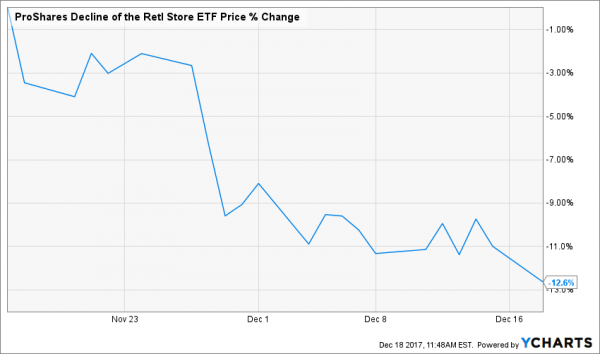

By contrast, the new ProShares Decline of the Retail Store Inverse ETF (NYSE: EMTY), which shorts retail stocks, lost 2.9% in its first week. It’s down 12.6% overall since it launched in mid-November.

EMTY — as in, empty stores and malls — has been devoid of profits since its November launch.

That suggests Mr. Market has already started to price in the effect of tax cuts on the retail sector.

So how can one make money there?

For U.S. retailers, drastic corporate tax cuts are a new lease on life. It offers them a one-time windfall that they can use the way a start-up uses venture capital … to innovate a new business model that can survive on its own over the long term.

So, treat these lucky retailers like start-ups:

-

Seek good insight: In-depth analysis of specific firms is going to be more valuable than ever. Pay careful attention to unfolding operational plans, not just earnings calls and other financial news. Find someone who specializes in the nitty-gritty of the retail sector, and follow him or her.

-

Treat large-cap companies like small-caps: Some retailers, especially in the home improvement subsector, are big firms. Lowe’s (NYSE: LOW) is a $71 billion company. Home Depot (NYSE: HD) is worth $212.5 billion. Larger caps don’t usually see big swings in share prices. But as 2018 unfolds, look for a lot of price volatility in retailers, as the market reacts to their plans to deploy their windfalls from the tax cuts.

- Beware of dividends: I’d be wary of retail firms that pass along their tax savings to shareholders. Windfalls like tax cuts should be invested in the future. Paying it out is basically raising the white flag.

Most years, you never know what Santa’s going to have in his big bag. U.S. retailers already do.

What matters now is what they do with it.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

{ 3 comments }

Pessimistic me – invest in the future?? I’m expecting to see most of these benefits going to increased executive compensation and share repurchase programs

All well and good for corporations and the 1%. Recent report shows that after the individual tax cut sunsets occur, corporations and the 1% will receive 107% of the tax cut. Will the res of us still be able to buy products beyond necessities.

Since on line buying is the future, it would seem the empty malls in our cities could be used for the benefit of providing affordable housing and support for our retiring baby boomers. A quasi private government program to accommodate this population could be a great use for this real estate and properly financed, could make for an interesting investment.