With the Federal Reserve policy meeting now out of the way, investors can turn their full attention to the next potentially market-moving event: The November election, just over one month away.

This one is particularly interesting since the two presidential candidates are polar opposites. It’s the career political insider with the baggage that comes from decades in D.C., vs the controversial career businessman who’s a political unknown.

Financial markets are politically agnostic for the most part, but what markets hate most of all is uncertainty … which is what we have in spades this election year.

In one corner is Hillary Clinton, the consummate Washington insider. For some voters, she’s seen as the more capable candidate. After all she had eight years of on-the-job training when her husband occupied the White House … talk about baggage! But for others, she’s seen as a symbol of all that’s wrong with D.C. political dysfunction.

Donald Trump by contrast is the brash outsider who some voters believe can shake up Washington politics and get things done. But for others, he’s a dangerous political unknown who could bring about the end of western civilization as we know it.

Clinton was judged to have won the first debate on Monday, and she got a small bump in the polls. But the race is still too-close-to-call with two more debates and just five weeks of campaigning remaining.

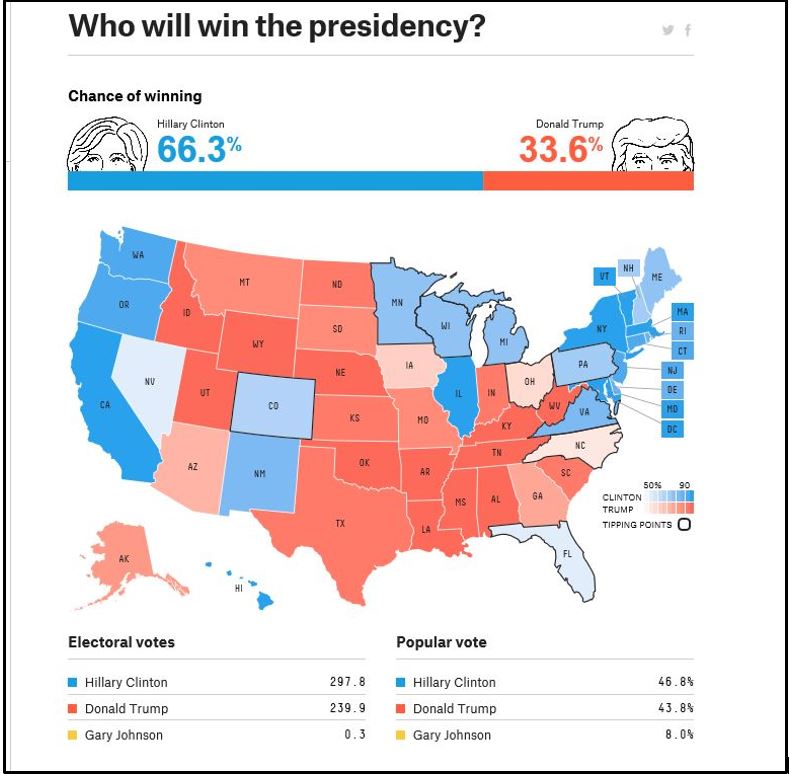

According to the 2016 Election Forecast by FiveThirtyEight (see the chart above), Clinton is in the lead, but by a slim margin. The chart is updated daily. As of this morning, she is projected to win 46.8% of the popular vote vs. Trump’s 43.8% (with about 8% going to the Libertarian Party’s Gary Johnson).

That means the election could literally come down to the wire, which also means plenty of uncertainty – and market volatility – between now and then.

And we’ve already seen volatility pick up. After Monday’s debate, Dow futures jumped nearly 200 points overnight, only to give it all back by the time markets opened Tuesday. Expect more to come.

Volatility is highly correlated with political uncertainty, which we certainly have this year, and the market’s favorite fear-gauge, the CBOE Volatility Index (VIX) typically rises by 40% on average in the two months leading up to Election Day.

What’s more, when elections are a close call (think Bush v Gore in 2000) and uncertainty is high, stocks have sold off about 5-to-6% on average between September and November.

Bottom line: Keep a watchful eye on shifting election odds, and buckle your seatbelt for more volatility ahead.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 18 comments }

Can you honestly think Clinton will change things around or carry on the same route.We cannot keep going the same road,Kay sera sera or something like that.

Seems like the DOJ has been given the green light to go after crooked banks. Its about time. Must tied into the fact that this is an election year and politico’s up for re-election are feeling the heat. Yes these dinosaurs must be kicked and prodded to do their job. Mores the shame.

I have a different view. Clintons have been schumzing Wallstreet a very long time as well as Janet Yellen and Obama. Of course Wallstreet is fearful if they lose power. Isn’t it time the average citizen is paid interest on their money in the bank? Trump is unlikely to play the game.

Democratic Insider vs. Republican Outsider. Neither one is exactly a Leader type of personality, With Clinton, we know what we will get: more of the same, which has just about destroyed American influence in the world, except for our military power. That has been greatly misused. With Trump, we don’t know just what we will get, except a lot of big talk, and misuse of the presidential power. China should love it, either way. Exit time for the U.S.

I detect the tone in your comment that Hillary’s baggage is inevitable because she has been a Washington insider. Her baggage is much worse than that. It is beyond the pale! However, the economy, because of the Fed and the unwillingness for people to live within their means, will continue with low growth, huge debts, and low interest rates (or worse), causing hardship way into the future no matter which candidate wins.

Why is it that ppl concentrate on the countrywide poll percentages instead of electoral college math.? Perhaps a conversation with Al Gore would behoove them.

Double bottom line: Realize that a Trump win, if you haven’t liquidated your security positions beforehand, will bring disaster to your holdings (both securities and bonds). Guessing the results of the election correctly becomes critical to the health of your portfolio (and the nation).

Cut the “and the nation” at the end. The rest should stand as written.

Don’t take any polls or pollsters too seriously. Polls which sample likely voters ignore the nearly 40% who will vote this election for the first time in years. Polls which assume high Dem turnout and low Repub and independent turnout make an implausible assumption.

In the last two elections, the Dems ran a candidate who energized their base, and got unusually high turnout from their black voting bloc. In the last two elections, the Repub candidates were hard to tell from the Dem candidate and they made it clear that they despised their support base. In the last two elections, Republican and independent turnout was low. Why go vote for Romney-care, when we already had 0bammy-care?

In this election we have a Republican candidate who is strongly anti-abortion and an American nationalist, running against a Democrat candidate who is strongly pro-abortion and an anti-American globalist. The Republican candidate is energizing his base (not just the traditional Republican base, but also his own) and will bring to the polls a big chunk of the 40% of Americans who could vote, but normally don’t. The Democrat candidate has no energy, and no ability to energize any of the Dem voting blocs.

Turnout assumptions which are driving the pollsters’ modeling are likely to be very wrong indeed. In short, this is not your father’s election, and your father’s statistical models don’t work.

Hi Mike

Let me add something. With Mr. Trump you have a no nonsense candidate who doesn’t need the job but can see what many others can see and that is without change our country will lose its middle class completely and go broke. We need to wind back bureaucracy and simplify taxation. The democrats don’t understand that business success is a function of many parts, including attracting working capital to make a profit. What gives me some comfort is Mr Pence and the other supporters and enablers who will help get the job done. What shocks me most is to hear Janet Yellen say that the Fed could enter the stocks and bond markets to completely destroy the belief in free markets. I have recently listened to a 13 minute video filled with Mrs Clinton making positive statements only to then change her position. She represents everything that is wrong with Washington. Either way we are in for a difficult time, whoever wins. I represent a considerable slice of investment assets and without policy change capital flows into worthwhile projects will not change without change itself.

Interesting and sad that you don’t mention the only candidate who represents the 99%. Your Wall St. spin and ignoring Jill Stein are the reasons that we’ll probably have a war and economic meltdown. Your Wall Street friends won’t be able to enjoy their riches when a nuclear bomb hits or all the speculative banks collapse. Sharing and Caring are principles that ultimately benefit both Wall Street and Main Street.

Wonderful. Both the records and the analysis given.

Really appreciate it.

Moreover, i think American people must have revisited their Campaigning Policies and Preferences. I mean American nation and institutions must have made this election as a worldwide process in order to make America really Great Again through adopting some worldwide problems and conflicts of bigger human concern as The Campaign Points. Points like,Individual Rights, Violation of Human Rights, JammuKashmir Dispute, World Water Distribution and the Rights of the Natives, World Resources Distribution and World Heritage Claiming Strategy Corrections etc.

I think American nation must have had acted on these lines apart from all other nations otherwise there is no difference…..

I don’t think the economy will necessarily continue with low growth. It could crash if any of US and world bubbles (eg. bankrupt governments, fiat currencies, stock markets, etc) gets burst after the election

Message to Libertarians. With our republic being converted to a dictatorship by the Democrats, this is not the time for “Protest Votes”. Grow up and accept Trump as the only feasible chance of USA freedoms surviving.

Australian press are not too happy with Trump, the fear of change, we have more welfare than we have taxpayers, this really needs to change for all of us!!!!

Re: Nels Comment … This analysis seems logical. Let’s hope it happens that way.

I agreed with a posted comment. What is more moderate than that?

CNN and other socialist Media are now zeroing in on Trump having paid no taxes, while Hillary paid $ 2 Mill. and channeled another Mill. into the Clinton Foundation. Since the majority of her income is derived from speeches, I would assume that not only foreign individuals have paid for these speeches but also American companies, the latter of which will have deducted the relevant fees from their income. So how much has really ended up in the Fed’s coffers?

Trump changes his mind numerous times in a short paragraph. He is totally clueless, rude and crude. He says he is the smartest, greatest, knows more about anything than anyone else, and that he is the only one that can ‘fix’ anything. No, he is not the one to run America!