|

The Weiss Million-Dollar Ratings Portfolio (WRP) service is intended to provide long-term investment ideas rather than give short-term trading recommendations. However, in using the Weiss Ratings we can frequently identify strong stocks that overreact to negative news, providing not only a long-term investment opportunity, but one that can appeal to the short-term trader as well.

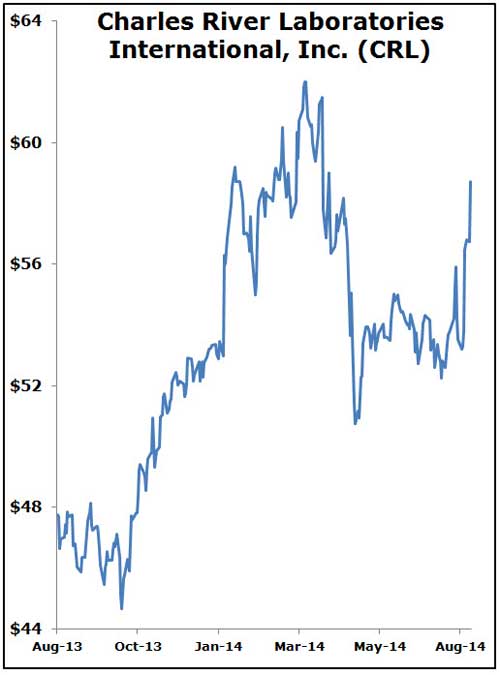

Charles River Labs (CRL, Rated B) is one of the holdings in the WRP that fits this bill. The stock got hammered after its first-quarter results — not so much for its expectations-beating performance but more for the intensifying competitive environment. Two competitors had combined. And firms like CRL, which design and conduct clinical trials for pharmaceutical and biotech firms, were seen as potential losers in the drive to generate revenue from a well-defined market.

The Weiss Rating on CRL back in June, after it had completed its sentiment-driven nosedive and first attempt at recovery, looked intriguing to me. Not only had the stock survived any significant deterioration in terms of its Weiss Rating, but its fundamentals suggested that expectations may have been too low versus the stock’s valuation. And despite its stock-price pullback, CRL remained a solid B+ in the Weiss Ratings set in late June, indicating that its financial solidity and earnings-growth track record afforded it some consideration as a trade but also as a longer-term investment idea.

It hasn’t been a smooth ride since we first engaged in the stock, but it has been quite a profitable one.

After the company wowed the investment community with better-than-expected second-quarter results last week, large-investor interest seems to have returned to the stock. After jumping 5 percent post-results, the stock once again staged a solid gain in a down market after large investors had a chance to consider the firm’s results.

Not only did they beat expectations, but because the company is flat-out on a capacity basis, strong results should be expected for the time being. More than a few Big Pharma and biotech firms are assuming the risk of discovering new disease-fighting compounds, and CRL will continue to help them research and trial those compounds.

Opportunities like this — stocks that have seemingly pulled back for reasons unrelated to their own fundamental underpinnings, but which retain a Buy-level Weiss Rating (B- up to A+) — should be considered for both short- and long-term investment.

Best,

Don Lucek

P.S. Be sure to watch your inbox later today for Mike Larson’s afternoon edition, with closing numbers, a timely feature story and readers’ comments.