Two of the biggest stories over the first four months of 2016 are very closely related:

Market Roundup

#1: The Fed’s dovish reluctance to raise interest rates, which has crushed the U.S. dollar and …

#2: The astonishing rally in commodity markets that has been fueled in large part by the weak buck.

First, the Fed’s quarter-point hike in the fed funds rate last December is beginning to look more and more like a “one-and-done” move. Since then, the Fed has blinked every time when it comes to normalizing interest rate policy. Markets don’t believe another rate hike is coming anytime soon.

Second, as a result, the once-strong U.S. dollar has reversed course to the downside, with the Dollar Index falling to a 16-month low yesterday.

This has helped propel commodity markets and resource stocks through the roof this year.

|

|

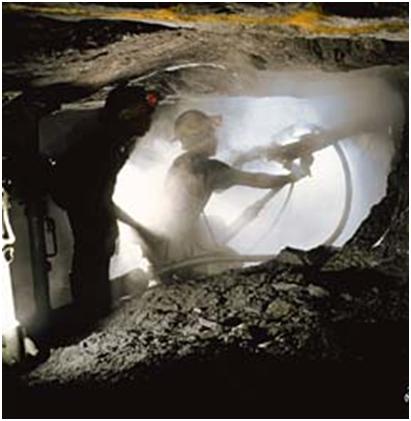

| Is the rally in mining stocks coming to an end? |

In fact, the S&P Metals & Mining Index has gained a stunning 51% year to date, and the S&P Oil & Gas Index isn’t far behind, up nearly 40% from its January low. So it’s clear that the magnitude of the surprising stock market rally since February is due in no small part to the stunning performance posted by commodity stocks.

But is this rally sustainable? The Reserve Bank of Australia doesn’t think so.

This week, the RBA cut interest rates by 25 basis points, taking the benchmark yield below the psychologically key 2% mark and sending the Aussie dollar tumbling below the 75-cent level.

The RBA cited the strong appreciation in the Australian dollar and low level of inflation as key drivers for its decision and the move was clearly an attempt to stem the carry-trade flows that have poured into the Aussie in the wake of the Fed’s persistent dovishness.

The Fed’s reluctance to normalize policy and signs of global economic slowdown have clearly changed the calculus for the RBA, which as recently as last month appeared to be content to keep rates stationary for the foreseeable future.

The RBA noted that recent actions by Chinese policymakers were supportive of the near-term growth outlook but, privately, Australian policymakers must be worried that the latest rally in commodities is unsustainable.

Chinese demand remains soft with the Caixin Manufacturing Purchasing Managers’ Index coming in at 49.4 vs. 49.8 eyed as it stays in contraction territory.

The move today, therefore, was both a response to the weak U.S. dollar and an anticipatory attempt to ease credit ahead of a potential slowdown in growth in the second half of the year.

| “The RBA is the most market-sensitive central bank when it comes to commodities.” |

The RBA is the most market-sensitive central bank when it comes to commodities. Therefore, its actions speak louder than words.

Many market commentators have made the argument that the recent rally in commodities has been nothing more than a short-covering “paper” rally. That actual demand for goods has slowed rather than increased over the past three months. The RBA rate cut last night may have just confirmed that analysis.

If the rally in commodities is over, it’s likely to drag stocks down as well, as global economic slowdown concerns begin to seep into equity investors’ consciousness. Therefore, in 2016 “sell in May and go away” could very well be the strategy. Certainly the RBA thinks that it is a risk.

Happy trading,

Boris Schlossberg

|

![]() The showdown is set: Donald Trump is the presumptive Republican presidential nominee after a big victory in the Indiana primary and the decision by rival Ted Cruz to drop out of the race. Trump has not formally captured the 1,237 delegates needed to win the nomination. He probably won’t do that until June, but the path is clear now. After Cruz pulled out, Republican National Committee Chairman Reince Priebus tweeted that Trump is now the presumptive nominee and encouraged the party to “unite and focus on defeating” Hillary Clinton.

The showdown is set: Donald Trump is the presumptive Republican presidential nominee after a big victory in the Indiana primary and the decision by rival Ted Cruz to drop out of the race. Trump has not formally captured the 1,237 delegates needed to win the nomination. He probably won’t do that until June, but the path is clear now. After Cruz pulled out, Republican National Committee Chairman Reince Priebus tweeted that Trump is now the presumptive nominee and encouraged the party to “unite and focus on defeating” Hillary Clinton.

Bernie Sanders won the Indiana Democratic primary in basically a moral boost for his campaign but is unlikely to derail Clinton’s progress to the nomination, given her lead in the delegate count, although Sanders vowed to carry on despite the “narrow” path to victory.

![]() Navy SEAL Charles Keating IV, who is the grandson of savings-and-loan financier Charles Keating Jr., died in combat against ISIS in northern Iraq, his family said, according to a report by CNN. “He is our family hero in every sense of the word,” cousin Elizabeth Ann Keating told CNN. Keating was 31 and was an adviser to Kurdish Peshmerga forces fighting ISIS. He died in a “coordinated and complex attack” by 100 ISIS fighters about 18 miles north of Mosul, Pentagon officials said.

Navy SEAL Charles Keating IV, who is the grandson of savings-and-loan financier Charles Keating Jr., died in combat against ISIS in northern Iraq, his family said, according to a report by CNN. “He is our family hero in every sense of the word,” cousin Elizabeth Ann Keating told CNN. Keating was 31 and was an adviser to Kurdish Peshmerga forces fighting ISIS. He died in a “coordinated and complex attack” by 100 ISIS fighters about 18 miles north of Mosul, Pentagon officials said.

![]() One sector of the economy, at least, seems to be thriving. Backed by a solid month for trucks and SUVs, the auto industry posted its best April ever, with most automakers reporting strong increases. U.S. consumers bought more than 1.5 million vehicles in April, just above the old record set in April 2005. Consumer demand is driving sales. In 2005, carmakers were offering big discounts and lease deals to boost sales, and some vehicles were actually sold at a loss at that time. This time, cars and trucks are selling at solid prices, helping to keep the industry healthy.

One sector of the economy, at least, seems to be thriving. Backed by a solid month for trucks and SUVs, the auto industry posted its best April ever, with most automakers reporting strong increases. U.S. consumers bought more than 1.5 million vehicles in April, just above the old record set in April 2005. Consumer demand is driving sales. In 2005, carmakers were offering big discounts and lease deals to boost sales, and some vehicles were actually sold at a loss at that time. This time, cars and trucks are selling at solid prices, helping to keep the industry healthy.

![]() The U.S. trade deficit shrank more than forecast in March, with imports falling in percentage terms by the most in seven years. The trade gap narrowed 13.9% to $40.4 billion, the smallest since February 2015, the Commerce Department reported Wednesday. The median forecast in a Bloomberg survey set a $41.2 billion deficit. Imported merchandise declined Shipments overseas fell for the fifth time in six months amid soft global sales.

The U.S. trade deficit shrank more than forecast in March, with imports falling in percentage terms by the most in seven years. The trade gap narrowed 13.9% to $40.4 billion, the smallest since February 2015, the Commerce Department reported Wednesday. The median forecast in a Bloomberg survey set a $41.2 billion deficit. Imported merchandise declined Shipments overseas fell for the fifth time in six months amid soft global sales.

The Money and Markets team

P.S. Two short days from now, you will no longer have access to a free copy of The Mystery of the Golden Ratio. Mike Larson wrote this report to help you preserve your wealth – and also to grow richer as this impending crash unfolds.

But time is running out. Please – for your own sake – do NOT allow this deadline to pass until you have all the facts: Click this link to read The Mystery of the Golden Ratio and get on-board before it’s too late!Â

{ 23 comments }

Imports shrank over 5 times as much as exports, but they both shrank, which is not good news on either side of the border. Import shrinkage implies smaller demand, therefore lower economic activity in this country. Export shrinkage could be because American prices are too high for foreigners’ tastes, or because of smaller demand in other countries, etc. Not good either way.

Thanks Boris. In my opinion the recent “commodity rally” was brought on at least to some extent by the Shanghai Agreement; wherein Japan and Europe agreed to strengthen their currencies, whilst China and the US hold status quo to allow the yuan to be devalued against the euro and yen but not the dollar. This was aimed to enhance China trade with Japan and Europe through devaluation that would not show up against the USD. The last time China devalued against the USD money fled China but US stocks still tanked last August. At this time with the Shanghai scheme in place money stayed in China to play the commodities casino; after all there was no devaluation of the yuan to the USD as the flight scenario had been avoided.

To me our illustrious world leaders are very present day orientated; but who cares so long as the can gets kicked down the road past the Brexit vote and the US elections.

By the way, it looks more and more likely to me that Trump will be trumped when VP Biden receives the DNC party nomination.

Will

How do you think the DNC supporters would feel about Sanders or Clintons dumping?

Hi Howard. I would say that RNC supporters would probably feel worse after being dumped by Trump.

It’s like this Howard. Bernie gets dumped by Hillary; and Hillary gets dumped by Hillary. If HillBilly supporters don’t vote for Biden, then Biden can not pardon her in consideration of her contributions. So they better vote for Biden.

Biden had family issues at a critical time that kept him out of the limelight during the primaries, so once Hillary reaches sufficient delegates it could then be FBI to the rescue. Later it would be Biden’s turn to rescue HillBilly. Now who could be pulling such puppet strings?

I have my own scenario. There is every reason for both corrupt parties to self destruct. It couldn’t happen to more deserving folks. The scary part would be what comes next. Jim

Yup, that’s right.

It would be encouraging if the peoples will had their way

Howard,

All the polls show that if people had their way, it would be Bernie, by a HUGE margin……

Joe Biden is all you have to offer as an alternative? Watch the documentary “Confirmation” and see what a true smuck this guy was and is. He is another classic example of politicians being returned again and again to Washington because of people for a name not a asset to the country. Politicians riding the gravy train to the last station a fat pension and all the benefits that go with it.

Joe ( they want to put y’all back in chains) Biden wisely skipped the primaries because he would have made a complete fool of himself like he always does when given the opportunity. Jim

As far as commodities are concerned it depends on whether you know when to take a profit or cut a loss.

My concern Howard is that it would be like hoping to hear clinkity clank after jerking the one armed bandit in Vegas. Literally, it was like a casino in China regarding commodities from what I have read.

I’ve got a conspiracy theory for you. Stocks have shot higher led by commodities, right. The only problem is the fundamentals for both are lousy especially oil and iron ore which have led the way. This reeks of Central Bank manipulation. Jim

I will always take a profit, Because if you buy at it’s lowest point sooner or later it will have to go up. Just price average into the 52 week lows and be patience and hold.

Commodities will always go up and down.

I’ll cut you some-slack on this call re:RBA rate cut, because you’re so far away from Australia, but it’s important to correct you..It wasn’t because commodities are dying..quite the opposite in fact..The reason was Australia has now joined the Currency Wars started by USA, followed by China, Japan and more recently Europe. It’s a race to the bottom. The Aussie $ had gotten too strong against the manipulated Greenback. plain & simple. Aussie house prices are sky-high and we didn’t need more fuel on that fire..but the RBA wanted a weaker Au$ anyway..so they did it..Just before election was called for 2nd July

A weaker Au$ means higher prices and fewer jobs there just as the weaker Buck has produced in the U.S. Folks Down Under should remember that during their election. They are the ones who will pay the bill.

Somewhere in the past two months I read about China hosting international events and planning to cease industrial production during these times to avoid air pollution. In the interim they were intensifying production and creating a temporary commodity boom.

There is the the USD and there is everything else. When one goes up, the other goes down, like a see-saw.

oil rules! the price of oil follows a simple supply & demand model, so the value of the dollar must follow oil. now turn the telescope around and look through the wrong end. what you see is when the dollar gets weaker and oil goes up. the dollar doesn’t change the price of oil, the price of oil changes the value of the dollar. you’re a currency guy, boris. your colleagues all look through the wrong end of the telescope. is that what you’re going to do to?

Here’s a chuckle for you … imagine Hillary and the Donald running together on the same ticket. They could enjoy a 96% disapproval rating.