|

Many readers are asking: “Is the Trump Rally going to turn into a Trump Crash? If so, what should I do?”

My two most-recent columns give you most of the answers.

In fact, the first one, “7 Horsemen of the 21st Century Apocalypse” elicited such passionate comments from readers, I decided to respond with an equally passionate gala issue, “Shocking Forecasts for 2017-2022.”

In it, I told you about major cycles set to converge this coming October. I showed you why everything in your life is about to change. And I laid out four critical phases in a massive debt crisis ahead, generating an opportunity to build not just one, but FOUR entirely separate fortunes.

Meanwhile, readers also have a batch of related questions. Here are some of the most-interesting (or-explosive) ones, followed by my responses …

N. Mast writes: “What news! Everyone better ask this question: So, What Do I Do Now?”

My response: My father, one of the very few who forewarned investors about the Great Depression, explained it this way:

“There are two big mistakes you can make. The first is complacency. If the danger is small, you don’t worry about it. If it could be catastrophic, you don’t believe it.

“The second mistake is panic. You over-prepare or you do it too soon. You disrupt your life unnecessarily. When nothing happens, you’re the boy who cried wolf.”

|

| Martin’s father, Irving Weiss, circa 1990. |

The danger he was talking about was a future stock market crash. And his solution to the dilemma was to stay flexible with liquid investments, always staying on the lookout for advance warning signs.

That advice is still valid for the stock market today. And it’s also valid for a future social crisis or war. So in the very near future, I’ll comment on possible warning signs for both.

N. Mast has a follow-up to his what-do-I-do-now question: “What say you besides the purchase of stocks?”

My answer: I’m like you. When I lie awake at night thinking about the news swirling around us, stock investing is not the first thing that comes to mind. What I worry about first is the safety of my family: My son who lives in Tokyo. Our adopted grandchildren who live near us. The 260 children who attend our school.

But then I realize that nearly everything I might need to help protect them from looming dangers will cost money, sometimes quite a bit of money. So that steers my thought process back to two things: How to build wealth with relative speed; and how to put that wealth away in a safe place. I’ll send you more specs on this topic tomorrow morning. Look for an email from me between 10 AM and 11 AM.

(I know you crave more-specific instructions, but please be patient with me. Coming soon.)

Bonnie’s comments are along the same lines as N. Mast’s. “It’s too huge. We can only save what we have in our power.” Bonnie then writes about voting power and what to do with it.

My response: I think you should also vote with your dollars. You can invest in companies that can defend, protect and strengthen us … and, by so doing, also give you the best profit opportunities. (I also cover this aspect in my email tomorrow. The sender name will be Martin D. Weiss, Ph.D.)

Larry adds this analysis: “There has been low spending on defense by the U.S. over the last bunch of years, relative to GDP. There is bipartisan consensus to boost that spending. The large defense contractors seem to be a reasonable place to overweight investments today. Further, they are not overvalued, particularly with Huntington Ingalls Industries and Rockwell Collins having PEGs in the 1s. If hostilities do break out, G-d forbid, these stocks could be a reasonable secure harbor for protection of assets.”

My comment: Well said! We also like Raytheon, Lockheed Martin and Northrop Grumman. But as always, wait for weakness before buying.

Rob M. adds: “Impossible to know how far the seven corrective pendulums must swing before we begin to regain stability. But hopefully when we do, those of us who survive will experience the beginning of the greatest boom of all time.”

My comment: What you call the “seven corrective pendulums” I call the “Seven Horsemen.” I take it, though, that you don’t mean just a correction in the ordinary stock market parlance. Like me, I think you recognize that what we face is the rising risk of something broader and deeper. But like you, I believe there’s a light at the end of nearly every tunnel.

Longshot12, who is pro-Trump, moves the conversation to politics: “Congress, Republicans and Liberals both act like they won the last presidential election and boycott all ideas that helped Republicans and Trump win, ignoring blatantly the people’s will – for Healthcare; better relations with Russia; and building the Mexican wall, not to keep out legal immigrants, but the criminals and gangs that are crossing daily.

“Congress would rather fight WW III, than admit why Trump won the election, and why Republicans had no chance of winning otherwise. Now we have the mess, Congress against the American Majority, a disgrace for this country.”

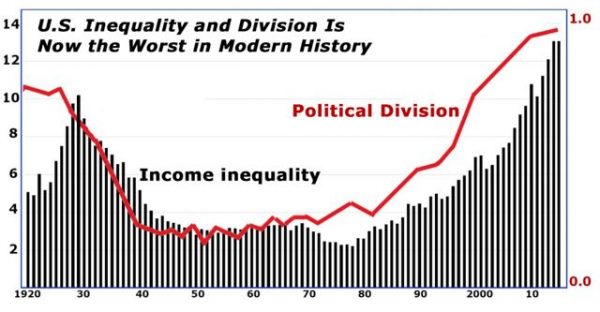

My reply: I think my chart says it all. And it’s so important, I’m going to show it again:

Political divisiveness in this country didn’t suddenly make its appearance on the presidential campaign last year or in Charlottesville’s Emancipation Park last week. It’s a schism in our society that’s been growing steadily since the 1970s (see red line in chart).

Nor is this happening by itself. As I explained two weeks ago, this is all part of a bundle of megatrends — not only political extremism but also extreme income inequality (black bars), the vast accumulation of debts, Fed money-printing and more.

Whenever you talk politics, always remember this phenomenon. Try to rise above the scene and look down on events from a higher plane. If you can do that, you will recognize that the bigger, systemic reason people are angry at each other may be very different from what they say or think. In that sense, we are not just victims of our emotions. But our emotions themselves are victims of social forces that we’re often unaware of.

The first step to escaping that mental trap — and to regain better control over our destiny — is to become more aware of it. So study the chart. And if you have specific questions about it, please let me know in the comment section below this column.

|

The 24-karat blunder: The costly mistake every gold investor needs to avoid like the plague … |

Geo is anti-Trump and responds to Longshot12 this way: “The Trump cultists just can’t accept their messiah is a lunatic. Politics is about compromise and cooperation; the current despot is about chaos, division, narcissism, bluster, personal attacks, demonization and cashing in on his position. What a disgrace to the office of the president.”

Tony replies to Geo with this: “What is the compromise position with someone who wants to destroy you? We tried 25 years of ‘compromise’ with North Korea. Can you be a bit more specific as to the position we should now take? Do you recommend we cooperate with them so that they can achieve their goal of our destruction?”

Grist2 also responds to Geo: “Now that is funny. Politics is compromise and cooperation? Where the heck were you during the 8 years of Obama? Guess he was feeding you what you ordered while the rest of us starved to death. Guess what, Geo! Hillary would have put Trump to shame in your terms of Chaos, Division, Narcissism, Bluster, Personal attacks, Demonization (or rather demoralization) and cashing in on her position. Think you should consider standup comedy. Now, can we get back to talking about making money in the stock market?”

My response: Sure, but first I need to say what I’m thinking. When I do, don’t turn your wrath on me. Instead, please take it within the same vein of objectivity (and some fun) that I do. 😊

Many years ago, I asked Dr. Marvin Harris, my professor of anthropology, about the causes of conflicts and wars. He was just finishing the final draft of a brilliant book that became quite famous, “Cows, Pigs, Wars, and Witches,” and here’s what he said:

“That’s a very interesting question, isn’t it? The fact is, the combatants themselves rarely understand the true, underlying causes of their fighting. Instead, they explain it in terms of their own personal emotions or conditions. Headhunters like the JÃvaro in Ecuador say their goal is to capture the soul of the enemy. Crow warriors say they want to touch the dead body of the enemy to prove how fearless they are. Other warriors are consumed with yearning for vengeance. Still others say they hunger for human flesh. But are these emotional and cultural expressions the true causes of war? No! The true causes of war are systemic. In other words, they lie deeply imbedded in the technological, economic, social, political cycle of the day.”

|

| Larry Edelson, Circa 2003 |

Our colleague Larry Edelson, who passed away in March, also had a degree in anthropology. And he saw the world through a similar prism: “You have two choices,” he told me on his deathbed. “You can be an unknowing victim of the cycle. Or you can rise above it, understand it, and use it to your great advantage.”

Good luck and God bless!

Martin

{ 15 comments }

Your chart on Us Inequality visually explains the seeds of dissension, but can you explain the vertical scale?

thanks

Gary Vinson

For heaven sakes! Look to history. What do 1929 and 2007 have in common? BOTH had Republican Presidents and Republican Majority Congresses. How did it happen? Just follow the money…. The Republicans are funded by the richest people in America and the legislation they pass favors their Ultra Wealthy donors at gread disadvantage to the 97%. That is why Income Inequity goes up under the Republicans and when that purchasing power is taken from the 97%, the markets fall… It is Econ. 101… Always been that way and always will!… :(

That is why returns have been over 4,000 TIMES better when invested with only Democratic Presidents as oppossed to Republican Presidents since 1929!… :( Wake Up!… :(

Sorry to disagree with you, but the boom / bust cycles have taken place since the beginning of times. Those standing next to the “feeder” had always profited, regardless of political affiliations. The Roman Empire. The French Empire. The British Empire. Now, the American Empire. Just look at the Congresswoman Feinstein – her connections, contacts, the power and, the business empire built by her husband!

Pls, do wake up.

Basically what they had in common was falling income for the middle class. Farm income declined pretty much throughout the 1920’s. During the Kaiser War the American farmers were expected to feed war torn Europe so they took on huge debt to buy tractors and related equipment. This was expected to continue for some years after the war but 1919 saw bumper crops in Europe. Many farmers also owned an interest in farm equipment or worked for those companies. There also was a recession at the end of the war, the Southern Pacific’s order for fifty heavy freight locomotives caused quite a stir especially when twenty were shipped from Eddystone Pa. to Los Angeles and on to Oakland Ca. in the ‘Prosperity Special’. In 2007 wages stagnated ad inflation didn’t, less consumer activity. J P Morgan understood that good wages wee needed to sustain a consumer based economy.

I seam to recall that all the wall Street campaign money went to Hillary and none to Trump. Obama the only president ever to have 8 years of GDP below 3%. You wonder why anyone would follow a Democratic president especially one that took our deficit to the stratosphere. I don’t think Trump can fix it especially when the leadership in both parties are fighting him. I expect a crash.

it took 8 years to supply/”refresh” ( QE ad nauseum…) all the corporate and banking interests money supply that was gambled (essentially lost…. and still missing, by the way….) on derivatives and foolish lending practices……what party led the huge bailout (and when, chronologically…research those dates, friend….) when the 2007-8 crisis hit?

2007-08 crisis hit a s a result of about 8-10 years of permissive, risky, speculative behavior by (admittedly..) all of us….which occurred during the great Bush double term. Link up cause and (eventual…) effect correctly to the respective parties/timelines…..

Yes. As “Eagle495″ says, look at history. 1917 and 2017 both had Democrat national administrations in the US Federal systems. Does that imply the tendency of Democrat administrations to go to war? And to use up the surpluses which previous Replub have generated? Probably does as war typically spends funds because of the enormity of the danger to”our way of life”. And spending typically generates prosperity.

Thats because democrats have increased the debt in huge amounts. which will be our ultimate demise. Obama raised the debt double what all the presidents before him combined. I see no hope with people who cannot understand economics or that simple finance rules are the same for governments as regular people. The only exception to that is lowering taxes so business can boom which will temporarily raise debt but later IF used to pay down debt ,like Reagan did which caused debt then boom which caused Clinton era prosperity and paying off huge amounts of debt. Since most have not a clue begin preparations for disaster and wait for things to get worse then eventually better after much misery.

JoAnne says the opposite of what I have read. Perhaps she is correct, but I would appreciate citations for her statistics. Thank you.

we chose-as a national “security” issue/label…..to “back” refund, cover all those bad bets/loans that happened the decade before…..both parties aged to massive bailouts of their supportive corporate players, vs. the painful, but perhaps instructive “reset’ that we eventually will have to experience. Well, maybe our kids and grandkids….yeah, they can deal with it……

The graff above is 100 years and everyone is focused on short-term. The change happened in the 30s , regulations is what made the changes, banking, transportation, media, insurance antitrust,etc. Greed brought upon regulations. Further personal tax rates were changed with these regulations to end the severe inequality, personal to 90%+ or – . The tapering off of That heavy personal tax rate also aligns with the turn up in the cycle along with deregulation and then more deregulation, greed, and offshoring , globalization mergers and acquisitions, technology, accounting changes and so many other changes

i think we are still too ‘wound around the axel’ … too polarized in our ‘looking’. demo/repub … lefty/righty … investor or holder … trump is a meat puppet like clinton, like ‘w’, like all those in ‘power’ in DC. they have their meal ticket punched and are given their marching orders. those who buck the ‘deep’, die, disappear or get silenced by scandal … never elected again.

when you have that as both the background and the foreground, you start looking at more and more possibilities … short term(define that!!)? id say ‘the market’ will increase as my mentor larry sed. gold will increase in ‘dollars’, but i still ask … ‘dollars?’ like those reichmarks in the 20’s and 30’s?? … the picture of the man with the wheelbarrow full of notes on the way to go buy a loaf of bread(or try to)!

then there is the digital currency craze … i have friends … they have made a lot of ‘money’ with bit coin etc etc … nice! and? what can you do with it? i mean ultimately is it an investment, a way around the ‘gubment’, at the prices it is going for now … is it really something truly ‘useful’ to everyone/anyone? and we all must be aware that the gubment isn’t going to let ‘opportunity’ pass them by, the have their own block chain in the works … then what?

again I’m a larry guy, been following him for years and years … made a lot of ‘money’ in the market with his gold( … and silver) calls. his loss was both as ‘the best friend i never met’ and as the word i trusted in the domain of gold and silver. he was the voice of sanity when others were running around like chickens with their heads cut off … blah blah blah …

me personally i wouldn’t and haven’t put a dime in the stock market in 10 yrs … getting out last time before the ’07 ‘crash’.

the markets are a rigged game … from my perspective … and the ‘plug’ can be pulled at any time by the ‘deep’/powers that be. I’ve stuck a few screwdrivers in electric sockets in my life … I’m just not going to do that any more. to the rest of you … have at it!

BudWood – Yes, spending does create prosperity, but only if created from income earned by productive activity that was conducted previously to produce more needed tangible goods and beneficial services. If financed by newly created from nothing debt alone, it may temporarily create demand for the production of needed future goods or services that ALSO HAVE TO REPAY THE DEBT incurred to finance their customers purchase. It also might result in the non-productive repricing of existing assets like real estate that do not increase overall wealth and only increase (inflate) the rents needed for their repriced debt servicing. “Marking to market” does nothing to increase the supply of already existing assets, but it does increase the rents required for their higher debt servicing costs. With debt servicing costs increasing faster than real puchasing power incomes resulting from the production of tangible goods and needed services, discretionary disposable incomes from labor continually decline as the dry good industries now encountering reductions in sales of non-essential goods are experiencing. (Poorer people make lousy customers)! Estimates of the USA’s money supply worldwide now approximate 35 years of current GDP output, so there are 35 years of claims yet to be honored by our economy. Venezuela’s ongoing predicament should serve as a warning!

Everyone has their rally quips. Simply stated, less gov’t is better & more closely resembles our founders who no doubt would be aghast at what has transpired since. Like him or not, Trump has reduced regulations, steered toward protecting America & it’s citizens, shown backbone to other nations & put forward Honorable people for positions. Media & opponents on both sides have vilified him at every turn. Can we really know what’s real? Yes. Thank you Larry Edelson! We love & miss you!

Economic Cycles have been here since the beginning of modern civilisation.

It is one thing to say you could have made x % on an investment after the event has occurred.It is a completely different skill to predict and profit from an event before it happens.My impression from your various articles is that , Larry Edelson believed the supercycles converged in October 2015, you appear to be arguing that they will converge in

October 2017.Larry predicted 2020/2021 as the peak of the cycles, you appear to be pushing it out further.Whatever the future holds anyone who had invested in a simple dow tracker fund would be hugely in profit now.