|

Years of cheap credit have not only helped the U.S. economy recover, but the world’s economy. There’s no doubt about it.

But at what cost? Financial stability, at least according to the International Monetary Fund’s (IMF) latest assessment. They’re warning that ballooning U.S. corporate debts are getting way, way out of control.

In fact, U.S. companies have added a whopping $7.8 trillion of debt and other liabilities since 2010.

You read that right: $7.8 trillion with a “T.”

And in just seven years!

Debt is piling up so fast that it’s nearing the bloated debt levels not seen since the 2008 financial crisis.

High corporate debt levels are not inherently a problem. But when that kind of cash is added at super-low interest rates – unsustainable super-low interest rates – then things get nasty rather quickly for corporate balance sheets when interest rates tick higher.

That’s why I’m not one bit surprised that since the Federal Reserve began normalizing rates, corporate credit fundamentals have weakened big time. And that’s created the conditions that historically precede a credit-cycle downturn, according to the IMF’s report.

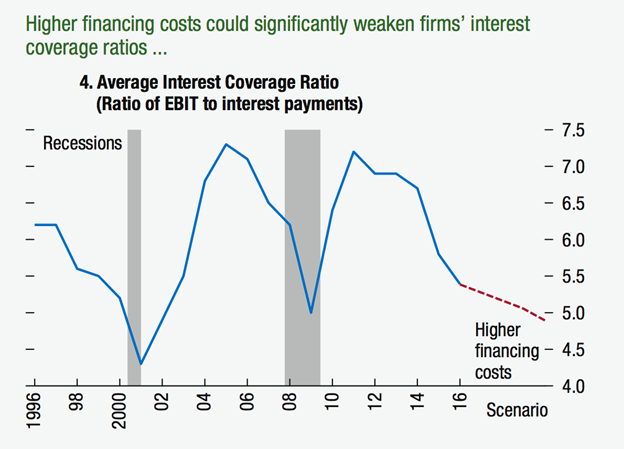

Take the average interest-coverage ratio for example. It measures a company’s ability to meet its interest payments. When times are good – and credit is cheap – you’d expect that ratio to improve.

The scary thing is the opposite is happening …

As you can see in the IMF chart above, the average interest-coverage ratio has fallen sharply over the past two years: Earnings are now covering less than six-times the cost of interest. That’s way off its highs and closer to the weakest multiple since the onset of the financial crisis. Yikes!

But it gets worse.

I don’t have to tell you that firms have chosen to buy their own stock rather than issuing/floating fresh shares. And they’re going on these buying sprees by going deeper in debt to buy back the stock. Stock that is, given the run-up in the markets, already at nosebleed levels.

In addition, corporate credit quality has been hammered by weakening debt covenants and by a rise in rating downgrades.

So, it’s no wonder that corporate leverage ratios – read: debt loads – have been on the rise since 2010 and have now come close to historical peaks. Take a look at this IMF chart …

Bottom Line: U.S. companies are piling on the debt, and their leverage metrics are the worst I’ve seen in years. The IMF says the spending sprees are grinding away at financial stability. We know there is a mountain of debt out there and that U.S. corporate debt is creeping toward levels last seen in 2007.

We also know that there are sectors vulnerable to higher interest rates and to rising borrowing costs. So, don’t just sit back and relax! Beware of sectors that are bloated with debt, including energy, utility, and real estate.

Best wishes,

David Dutkewych

{ 5 comments }

Will the 20% tax cut by Trump help these corporate?

This article seems to assume that interest rates are going up and will continue to go up. This is an unfounded assumption. Rates are NOT going up and will not go up to any significant degree in the near to medium time frame.

And there lies the problem Tom. The fed / government / Wall Street, only answer to correcting the economy is keeping the interest rates “ARTIFICALLY” low. A lot of economist will tell you the interest rate shell game is only supposed to be used for a quick fix. That so called quick fix has been munipulated for over 10 yrs now. This country is in grave danger. I beleive the interest rates should be at 9% right now. If your boy Greenspan would have jacked the rates pre – 2008 he could have stopped all the scammers and headed off the collapse.

Hi David,

A 20% tax cut will encourage more foolish management to forget that they must make Long Term plans and not just take their profits and run. Paying down their debt would be a wise move if interest rates continue to climb.

It is the Consumers who will drive the real growth with the extra spending power that they are given with tax cuts…

Lets hope that Americans also have more kids, so that the need to continue the

influx of Immigrants will be curtailed. Why would a Country bring in the Poor who will

likely remain a burden on the taxpayers for decades to come?

Maybe the last 40 years of abortions can explain the need for Immigration..

Did the US problems begin when the 40 year Ban on Immigration was lifted in 1964.

It did not take more than five years after WW1 for the government to instate

the Immigration ban around 1923.. Funny how history repeats itself.

The last 7 years of corporate growth .. (since the so-called Recovery) was driven by

CEOs who decided that buying back their own stocks with cheap borrowed money was a

great way to personally profit from their own Stock Options.

This was not True Growth, but promoting the appearance of a booming economy..

(for some).

Yes, we have been watching a shell game, where decreased participation in the Stock Markets was hidden by taking on new debt.

This is likely the reason why some investors have been buying Index Funds for diversification, rather than risking their future by betting on a single or a few companies.

No Alternative Energy Company ever escaped unscathed… and it will get worse as

interest rates rise and Stock Players think twice about buying when others are selling..

Look at Tesla… which appears to be doing great, but they have still never turned a profit on what they are selling.. (Last I heard was that they are still indebted to the Federal Government for $2 Billion..)

Buying Solar City might have been the wisest thing that Elon Musk has done to diversify. (I guess he was not flush with cash when Solyndra went on the chopping block.) He now has all those customers with solar panels on houses and a customer base where he can sell his battery Packs.

If the Market does have a big correction soon, it will be due to not having it earlier..

A government which encourages lying to the people will pay dearly, but

those in that government may have profited greatly while they were pulling the strings of winners and losers.

Why was Goldman Sachs loaned money to balance their books after the crash of 2008?

Not difficult… That is where the Federal Government employees Pensions are invested.

I may have some of my dates a bit wrong, but I am only a dumb Canadian Eh?

I also wrote this from memory…. so you can ignore me, or check out what I have been saying for yourself.

Have you reduced cash accumulations (outside US) of corporations from debt before coming to any conclusion? At any rate, sensible investors need to encourage reduction of debt and not buy back of shares and increase of debt.