I’m showing my age, but one of my favorite TV shows during my youth was Lost in Space. I was particularly fond of the robot, which would regularly shout out warning phrases such as this favorite, “Danger, Will Robinson!”

I’ll admit I also had a huge crush on Judy Robinson, played by Norway-born Marta Kristen. But that’s beside the point.

My point is that robots may have been futuristic science fiction in the 1960s, but they are rapidly becoming a crucial member in global commerce and manufacturing.

In fact, robots are about to take an even more prominent role in our everyday lives. How so?

“With government driving up the cost of labor, it’s driving down the number of jobs. You’re going to see automation not just in airports and grocery stores, but in restaurants.”

-Greg Creed, CEO of Yum Brands

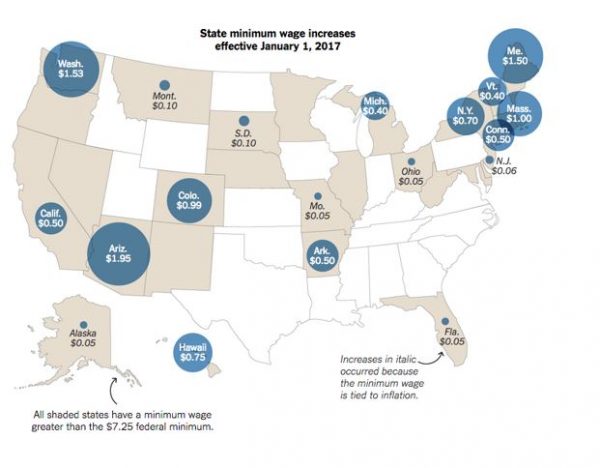

Nineteen states — including California, New York, Washington, Massachusetts and Arizona — have recently raised their minimum wage to as high as $11.50 per hour.

As a result, businesses are replacing human labor with machines to reduce labor costs.

As a result, businesses are replacing human labor with machines to reduce labor costs.

- Wendy’s says it will install self-serve ordering kiosks in 1,000 of its restaurants by the end of this year.

- About 50% of Panera Bread’s company-owned stores are already equipped with automated ordering kiosks. And the remaining locations expect to have kiosks in place by the end of the year. McDonald’s is rolling out an army of “Create Your Taste” touchscreen kiosks.

Andy Puzder, CEO of Hardee’s and Carl’s Jr., said that robots are “always polite, they always upsell, they never take a vacation, they never show up late, there’s never a slip-and-fall, or an age, sex, or race discrimination case.”

Indeed, automation — including robots — is going to affect a lot more than just your hamburgers and French fries.

Last week, BlackRock, the largest global investment management firm in the world, announced it will increase its reliance on computers to pick stocks. The firm will combine its traditional analysis with computerized stock selection.

As a result, BlackRock will lay off 40 employees, including some portfolio managers!

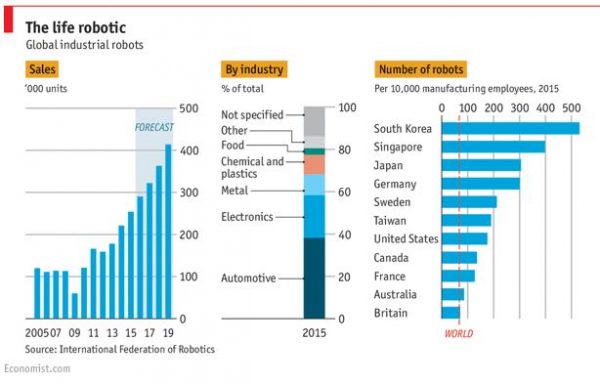

The biggest market for robotics is manufacturing. According to the International Federation of Robotics, unit sales of industrial robots grew 15% in 2015, while revenues increased 9% to $11 billion. In just North America alone, robotic sales increased by 14% to $1.8 billion.

But that’s just the tip of the iceberg. Barclays Bank predicts that robotic sales will increase by more than 1,000% between now and 2020 and that the value of that market will hit $82 billion!

So if you’re really serious about keeping up with the robotic industry, you should regularly visit the International Federation of Robotics (IFR); especially during the last month of each quarter (March, June, September, and December) when the IFR releases its President’s Report. Go to https://ifr.org/ifr-press-releases/

How can you invest in robotics? The biggest players include ABB Ltd. (ABB), Fanuc Corp. (FANUY), iRobot Corp. (IRBT), Kawasaki Heavy Industries Ltd. (KWHIY), Rockwell Automation Inc. (ROK), and KUKA AG (KU2.DE).

Fanuc, for example, is the world’s largest maker of industrial robots. And chances are you own a product built by one of its machines. Fanuc robots build cars for Ford and Tesla and even parts of Apple iPhones.

Bottom line: Robotics may be one of the most profitable places to invest your money. And any investor who overlooks this dynamic industry will be sorry.

However, that doesn’t mean you should rush out and invest in them tomorrow morning. As always, timing is everything.

Best wishes,

Tony Sagami

Â

Â

{ 6 comments }

You’re absolutely right, Tony, but I still will stick with my gold and silver junior mining stocks (GPL and MUX) during the third and final phase of the PM bull market that really should get started in earnest during this number 1 world year of new beginnings (think Trump and this continuing and exacerbating WWIII that George Bush/America began with the idiotic invasion of Iraq that destabilized the Middle East. The law of cause-and-effect indicates that America will pay dearly for the unjust action. Of course, America loves war!

Funny that a living wage was not mentioned in the reasons given for replacing worker with a robot.

If you want to promote robotics in industry you have to get it into the technical schools and colleges in the USA. I taught robotics and automated manufacturing at a university in early 1970’s with a full sized Unimate Puma robot and five instructional size robots. We then add a full size, 100 ft conveyor track with a series of work stations to manufacture different parts. We had nation recognition for a “lights-out mfg system”. I was fired and got my tech a job in industry. “All good deeds will receive their just punishment!”

You are citing Andy Puzder, another Trump debacle appointment, to validate the robotic takeover? He’s a robot-puppet capitalist, just like you. What you want is a generation of peons to do your will and bloat your profits while you treat them like expendable crap. Stop bitching about “government driving up the cost of labor, it’s driving down the number of jobs”. Human labor is expensive, deal with it.

What happens when robots repair and make themselves? There will be no jobs – perhaps just a few artistic “jobs”. What will people live on and what will they do? Idle hands are the devil’s workplace (they will get bored and get into trouble).

How many of Puzder’s polite robots will be buying his hamburgers? How many robots will be buying anything from any business? In a healthy economy money “circulates.” How much money will robots and unemployed people be circulating? Puzder wants money coming in but none going out. If every business operated this way the economy would grind to a halt. Puzder is an economic parasite.