My daughter and I were going through an old family photo album recently, and we came across some of my high school photos. “You were a babe in high school, Dad,” said my 24-year-old daughter, Keiko.

I think my daughter was just being nice. But I was certainly better-looking, as well as a lot thinner, back in my high school days.

Heck, one socially clumsy woman I dated (once) told me that I’d be handsome if I lost 50 pounds. Unfortunately, I can’t wave a magic wand and make those extra 50 pounds disappear.

Corporate America, however, has such a magic wand. And it wields it to make its blemishes disappear with a flick of an accounting wrist.

|

|

| Tony as an Eagle Scout |

I’m talking about the use of non-GAAP, or pro forma, accounting methods to calculate profits.

GAAP — or Generally Accepted Accounting Principles — used to be the only way that corporate America reported its profits to Wall Street.

Not anymore. Most companies use non-GAAP to report profits. (Think “adjusted” earnings.)

Let me assure you: Corporate America isn’t using non-GAAP accounting to make themselves look worse. They’re of course doing so to make themselves look better.

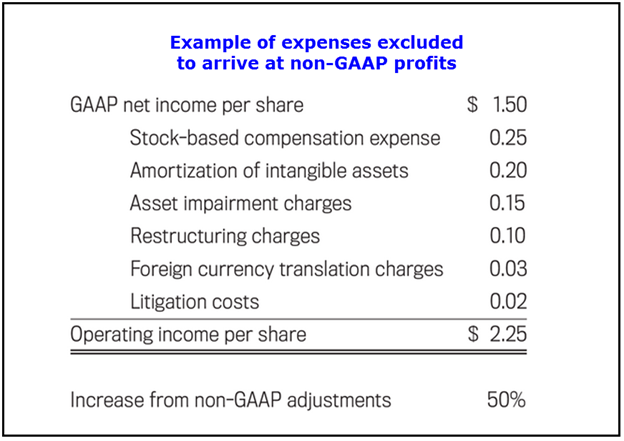

That’s because non-GAAP accounting ignores irregular, non-cash expenses. Or one-time charges such as restructuring, stock-based compensation, goodwill amortization, or large nonrecurring expenses.

And this can result in two different pictures when it comes to stock valuations and earnings-per-share. Sometimes those differences are pretty stark.

Here are some recent examples:

- PayPal (PYPL) released its Q2 results last week and reported $659 million of profits on a non-GAAP basis. However, using Generally Accepted Accounting Principles, profits were only $430 million. That is 53% more profit, just by using accounting hocus-pocus!

- BroadSoft (BSFT) reported 40 cents per share of non-GAAP profits. But it actually lost 10 cents per share on a GAAP basis. Clever accounting turned a money-loser into a moneymaker.

- Valeant Pharmaceuticals reported $1.05 of non-GAAP quarterly profits but an 11-cents-per-share loss under GAAP rules.

I could go on and on. But I hope you get my point that corporate America uses creative accounting to turn lemons into lemonade.

And there is a lot of lemonade (Kool-Aid is more appropriate) being drunk on Wall Street …

Complicating the issue is that there is no accepted standard for what types of expenses can be excluded from non-GAAP calculations.

Meaning there’s no apples-to-apples comparison between different companies. (Or between sectors and industries, for that matter.)

But Wall Street doesn’t seem to mind …

We’re not quite through the second-quarter earnings season. But the majority of companies have already reported their quarterly results. And an impressive 70% of them have exceeded Wall Street’s non-GAAP earnings expectations.

Corporate America is embracing non-GAAP accounting in a big way, simply because it makes them look more-profitable than they really are.

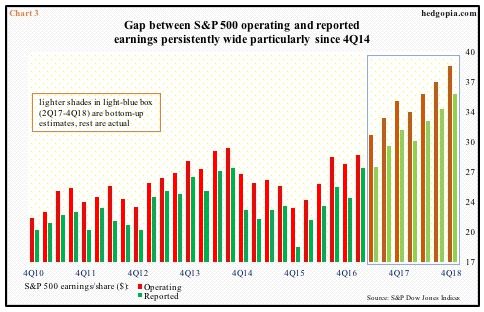

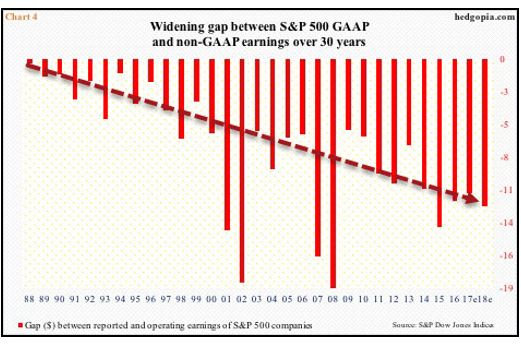

Moreover, the difference between GAAP profits and non-GAAP profits is growing like mad.

I think the root of the non-GAAP mania is pure and simple greed.

The calculation method to determine performance bonuses for many chief executives is based on non-GAAP profits. So, the higher those profits, the fatter the bonuses … which sometimes run into the hundreds of millions of dollars.

How does corporate America get away with this? Well, it couldn’t. Not unless Wall Street and investors are willing to swallow those shenanigans numbers.

The good news is that corporate America is required to report GAAP earnings in addition to non-GAAP earnings. But you have to dig below the headline numbers to find it.

In general, I avoid companies that have more than a 10% to 20% difference between GAAP and non-GAAP earnings.

I know that’s a very cautious and old-fashioned strategy. But if I can’t wave away my extra 50 pounds of weight, then corporate America shouldn’t be able to wave away hundreds of millions of expenses through the creative use of non-GAAP accounting!

Even better is to pay extra attention to companies that use good, old-fashioned GAAP accounting to calculate profits. Four such tech giants that do so are Apple, Alphabet (Google), Facebook and Microsoft.

Speaking of solid companies, I’m on my way to do some in-person research on several others right now …

On the Road Again

About the same time that you are reading this, I will be arriving at Amsterdam’s Schiphol airport. No, not for summer vacation, but to visit a handful of Netherlands-based companies.

This may surprise you, but the Netherlands is a hotbed of cutting-edge technology companies that are traded on the NYSE or Nasdaq. Some examples are ASML Holding N.V. (ASML), Mobileye (MBLY), NXP Semiconductors (NXPI) as well as corporate giants Royal Dutch Shell (RDS), Unilever (UL), Schlumberger (SLB), ING Groep (ING) and Heineken N.V. (HEIA on the Amsterdam exchange).

Plus, the Netherlands stock market has been hot. The iShares MSCI Netherlands Index Fund (EWN) is up by almost 27% this year.

I’ve lost count of how many of these boots-on-the-ground research trips I’ve made over the years. But I do it because every one of them — yes, EVERY single trip — has helped me find a new investment home run. And I expect this one to be no different.

So, I hope you’ll consider giving my Disruptors & Dominators newsletter a no-risk try. I think you’ll be very pleased with the results.

Best wishes,

Tony Sagami