“They made their money despite the government. They should be rewarded for creating so much value with the federal bureaucracy all over them like a cheap suit.”

His eyes fluttered with involuntary uncertainty as he spoke. If he played poker, I wanted in on the game.

“Sheeple” he’d called people like me who disagreed with him. I recalled a South African proverb: Tshwene ha e ipone lekopo. A baboon laughs at another baboon’s face … which, of course, is identical to his own.

We were discussing the stratospheric incomes of top executives at U.S. corporations. My interlocutor felt they earned every penny, and would earn even more were it not for the thieves in Washington, D.C. They were the Masters of the Universe.

“What if I told you that what they’re doing was illegal until 1982?” I replied.

That gave him pause.

I seized it. “And it’s cost the U.S. economy over $7 trillion over the last 15 years,” I replied. “$7 trillion that could have been invested in capital and jobs … and would have been, a generation ago.”

I had his attention now.

Profits Without Prosperity

Some months ago, an unknown author managed to get her debut novella onto the New York Times best-seller list. The problem was that nobody had heard of her book, or had seen it in stores.

She’d been buying all the copies herself to game the system. Once her book was in the Top 10, she schemed people would start buying it just because of its rank.

That’s essentially the same strategy on which U.S. corporate executives spent that $7 trillion.

Starting in the early 1990s, hundreds of publicly traded U.S. corporations have used cash reserves and borrowed funds to purchase their own stock. This does two things:

1. The large stock repurchases increase the demand for the shares, and thus their price.

2. By reducing the number of outstanding shares, stock repurchases artificially increase earnings per share, making them more valuable in the stock market … at least temporarily.

Yes, Blame the Bureaucrats

My conversation partner had an almost religious faith that government bureaucrats always intervene to hurt productive capitalists. He blamed it on jealousy.

It’s true that government typically constrains business — for example, by imposing rules against pollution or deceptive advertising, or antitrust actions.

But occasionally the tables are turned … when the wolves are running the henhouse.

Such was the case in 1982, when Securities and Exchange Commission (SEC) Chairman John Shad, a former Wall Street CEO, redefined unlawful “stock manipulation” to exclude stock buybacks.

Before then, it had been illegal for a company to buy its own stock.

Shad’s action set the stage, but it was President Bill Clinton’s $1 million cap on tax-deductible CEO pay that raised the curtain on Wall Street’s stock buyback performance.

Perverse Incentives

Faced with limits on the tax-deductibility of CEO salaries, corporate boards decided to reduce direct remuneration in favor of stock options.

That opened Pandora’s Box.

With their earnings now driven mainly by share prices, top executives had an incentive to inflate those prices by any means necessary.

Before the SEC rule change and the Clinton tax bill, corporations would use excess cash or borrowings to invest in research and development, productive plants and equipment, raising worker pay (and thereby consumer demand), shoring up shaky pension fund reserves, or increasing dividends to shareholders.

That led to a more gradual but sustainable increase in share prices. Companies became more valuable because they were … albeit in economic, not just financial, terms.

The rule changes created a massive conflict of interest between top U.S. corporate executives and their own companies.

By buying back company shares to boost their prices, and thus their own compensation, executives effectively extracted capital from their corporations instead of using it for investment and growth.

$7 trillion shifted from the real economy into the unproductive world of financial speculation.

CEOs: Vampires of the U.S. Economy

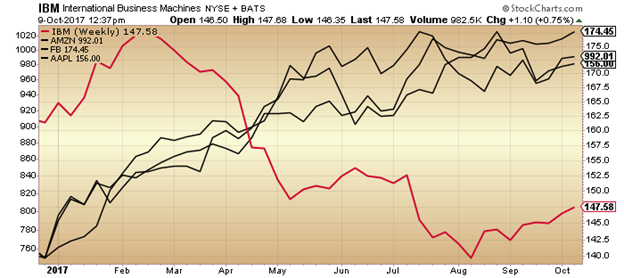

A new study from INSEAD (the European Institute of Business Administration) shows that since 2005, IBM has spent $125 billion on stock buybacks. Simultaneously, it invested only $69.9 billion in research and development — its supposed core business — and laid off large numbers of workers.

Here is IBM’s share price (red) vs. Amazon, Apple and Facebook this year:

The same study found that 64 U.S. companies — including dying retailers J.C. Penney and Macy’s — spent more on stock buybacks over the last decade than their businesses are currently worth in market value.

Winners and Losers

The CEOs and other executives of U.S. corporations get to keep the money they make when they exercise their stock options, even if their companies die.

If you’re an investor in firms like IBM, General Electric, J.C. Penney or Macy’s, however, you lose.

After all, government isn’t the only thing that can destroy value. Private enterprise can do that perfectly well too.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

{ 9 comments }

Stock buy backs also lead to long term destruction of corporations in other ways. By paying inflated prices for stock in a buy back it damages the balance sheets of the corporations most especially if they take on more debt to accomplish the share buy backs. Similarly even if they use existing cash on their balance sheets it also produces a hole in balance sheets, perhaps not as big as using leverage for the buy back. For it is high levels of debt by governments, corporations and individuals which is a looming threat to the entire financial system.

Important disclosure. Thank you, Mr. Bauman. Greed and manipulation have no natural bounds it would seem, only bounds imposed from the outside. Greed and manipulation are just two means by which to weaken the nation, the economy, our moral standing and our credibility as a nation and society. These CEOs you have referred to are predominantly interested in their own personal gain, not the vibrancy of the companies they lead or the long-term benefit to the stockholders they represent; short-term selfish vs. long-term universal. This same “social illness” is what pervades much of what has become associated with the conservative “Republican” political agenda and championed by the current president in his zeal to gut environmental efforts to curb global warming, to preserve open space, to cut pollution, to protect the common man and woman from the ravages of the 1%. The supreme irony is that through his ignorance and others who share his views he is actually weakening our country and economy. For example, the pathetically small number of coal jobs he was championing saving compared to the tens or even hundreds of thousands of jobs being and that can be created in the new alternative energy sector which he wants to remove incentives from. The man and his supporters are simply ignorant and prefer to stay that way. They choose to ignore and not learn the facts. Our nation, far from being great again, is headed very much in the wrong direction under him.

Interesting article. Share buybacks, while fine if the company has the organic cash flow to support it, are generally destructive. They have enriched executives and past shareholders at the expense of workers and future shareholders. Generally, they benefit present and past incumbents at the expense of the future, because they siphon off resources that could have gone to hiring and capital improvement.

Some corrections and clarifications. Share buybacks were not completely forbidden before 1982, but they were rare. Buybacks were allowed in 1982 because stocks were grossly *under*valued at the end of the Great Inflation (generational low in valuations). Buybacks were thought to be a legitimate way to boost depressed share prices. Things remained that way until the late 1990s.

In the meantime, a new trend had started of compensating executives with stock. Once shares entered grossly *over*valued territory in the late 90s, mid-2000s, and in the last five years, the bonanza of executives selling their overvalued shares back to their company treasuries was opened up. Add corporate debt issuance, and you have a toxic equity-for-debt swap on a giant scale.

Share price manipulation indeed. Since 2009, the only net sources of US equity purchases have been share buybacks and foreign money flooding in. And now we arrive at the ultimate cause, which does involve bad government policies, the world over: massive monetary stimulus that makes corporate borrowing artificially cheap and financial speculation more attractive than capital investment and hiring.

Good article Ted.

Thank you,

Someone please get this to President Trump and the US Senate ASAP before they screw up our taxes again.

Sounds to me like a perfect description of the money manipulation techniques described by Robert Prechter in a fifth wave. I enjoyed the article and learned some history too.

Dow

Sad everything becomes a political cause, the way I recall it we had both parties “leading”. Congress and the Presidency while these thefts have been going on. Ultimately the directors and stockholders allow the rape of these corporations. Executive compensation plans are submitted to shareholders, you can vote NO and send the self serving executives packing. Many large corps are burdened with poor management and multiple levels of useless puppets, You can change mgmt or change the stocks you own,

I have always been suspicious of stock buybacks. Company insiders can often buy stock, or even receive it as a bonus, then promote a buyback which often boosts the stock price to their benefit. What’s more, buybacks are usually financed, in part or wholly, with debt, which worsens the financial position of the company. If I have a stock, and a buyback is announced, I start looking for an opportune time to sell.

Ironically when queried by Bloomberg CEOs of major companies stated they would use the windfall produced by the newest round of tax cuts to increase dividends and buy back their stock. There was little mention of investing in productive assets. The markets are euphoric. This seems like the passengers on the Titanic cheering the iceberg.