|

Stocks will keep zooming higher and higher.

I’ve been making this prediction for a long time. And, so far, I’ve been right all along — despite what you hear from the naysayers in the popular press.

What’s more, I going to continue to stand on my soap box and shout the same forecast for anyone who’s interested in making money in the current environment.

I don’t have a crystal ball. I don’t have a Ouija board. And, I can’t channel the late Jeane Dixon, psychic to the stars and the National Enquirer.

But I can track what I call my “magic metric” – the yield on the 10-year U.S. Treasury bond.

And, right now, I see the yield firmly entrenched in the “sweet spot.” So, expect stocks to continue to zoom higher – especially the select group of high-quality growth opportunities in the Safe Money Portfolio.

And stocks can maintain their lofty levels as long as the world’s major central bankers — Janet Yellen in the U.S., Mario Draghi in the European Union and Haruhiko Kuroda, in Japan – can keep their magical money machines humming.

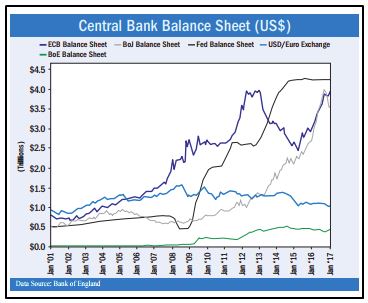

Here’s a chart that shows just how extensively the world’s central banks have expanded their balance sheet since 2009.

This explains why the Dow just broke through the 24,000 level and why it’s headed higher for now.

Here’s what you need to know about this unstoppable wave of liquidity swirling around the globe – especially what it means for your nest egg.

To get started, you need to understand how the modern banking system works.

It’s based on a concept called “fractional reserve banking,” which explains how banks can create money out of thin air.

Sound complicated? Well, it is. Fortunately, bond-king Bill Gross has come up with a simple story to explain it. The story, which appeared in his recent market letter, gives people a better sense of how the system works.

So here goes …

Pretend for a minute that there is only one dollar in all of the U.S. That it’s yours. And you have it on deposit with the Bank of USA — the only bank in the country.

Obviously, the Bank of USA owes you your dollar back any time you want to withdraw it. But the bank assumes that you probably won’t need your dollar back for a while. So they lend it to Joe, who wants to start a pizza store.

Joe borrows your dollar from the bank and pays for flour, pepperoni and a pizza oven from Sally’s Pizza Supply. Sally then takes the dollar and deposits it into her checking account at the Bank of USA — the same bank you use.

It works like magic. Your one-and-only dollar has now turned into two!

|

Where are the markets headed? Have you ever wondered what the pure, unbiased, DATA is showing? I know I’m constantly thinking about that, and it’s why I get so much use out of the Weiss Ratings website. My colleagues over there have a completely independent, unbiased, and proven analytical model that covers more than 14,000+ stocks, ETFs, and mutual funds trading in the U.S. or Canada. Best of all, they publish a free daily email newsletter that tells investors what they’re data is showing about trends in all of those investments. You can sign up to receive that critical intelligence here. |

You have a bank account with one buck in it, and Sally has a checking account with one buck in her account, too.

Both you and Sally have confidence that the dollar is yours. However, there’s actually only one dollar in the Bank of USA’s vault.

From an accountant’s perspective, the Bank of USA has now doubled its assets and liabilities. Its assets are the one dollar in its vault and the loan to Joe. Its liabilities are the dollar it owes to you — as the original depositor — and the dollar it owes to Sally.

At the Bank of USA, the cycle goes on and on. It continues lending and relending the single solitary dollar. And like a magician with a wand and a black hat, the fractional reserve banking system pulls five or six rabbits out of its hat.

|

|

| You can profit from the shell game that’s being played by Fed Chair Janet Yellen. |

But remember, there is still one — and only one — dollar bill in circulation. But our fractional reserve banking system has turned it into five or six dollars of credit and engineered a capitalistic miracle of growth and job creation.

It’s amazing!

That’s because all the depositors — like you and Sally — believe they can go down to their local branch of the Bank of USA and demand the single solitary dollar back that’s sitting in the bank’s vault. After all, it’s their dollar.

Well … not really.

It all works perfectly until there are too many pizza stores, competition slashes revenues for many of them, and they can’t pay the interest on their loans.

Everyone wants the single solitary dollar at the Bank of USA at exactly the same time. Everyone thinks it belongs to them and only them. Yikes!

This is what happened during the subprime crisis. And it’s what caused the venerable House of Lehman — which was the world’s fourth-largest investment bank at the time — to collapse in 2008.

You see, Ms. Yellen, Mr. Draghi and Mr. Kuroda were around for the Great Recession of 2009 that came about as the result of the subprime-lending blowup.

And they vowed to never let it happen again. At least, not on their watch!

That’s why they’ll continue to crank more and more money into the system as the global economy continues to stumble along.

And that’s why this stock market is good-until-canceled!

And better yet, by watching my magic metric – the yield on the 10-year U.S. Treasury – you’ll get the signal when it’s time to start closing out your “risk on” stock positions.

Until then, buy GROWTH, just as I am doing in the Safe Money Portfolio.

Best wishes,

Bill Hall

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

{ 11 comments }

The problem with this system is that it pushes all the wealth up to the top 1/2 percent of the population and results in social unrest which is now demonstrated in America’s political system. It crucifies the working classes who do not want to take on risk when they know that they will be stuck holding the bag when the market crasher “again”.

Please explain the magic yield of the 10 yr US Treasury, the sweet spot and how we determine when it indicates BEHR market time. Thanks

Hi Bill

Do you think the Energing Markets will go up as well the Dow is doing??

Thank you

Please send me a list of stocks I should purchase. Thanks.

With inflation booming, what would happen if you put your dollar into gold, and let the banks print all the money they need to loan out. Thanks,

Travis

At what yield on the US Treasury should we become concerned?

So you’re saying the entire World’s economy is based on the game of musical chairs and we should all play the game with the expectation that we will have access to a chair when the music stops. Taking into consideration of multiple warnings about the debt monster we should perhaps think of the current economic expansion as a drunken orgy in a fireworks factory with one small door at the far end of the room while everybody is smoking cigarettes and flipping the butts toward the open boxes of firecrackers.

Thought the FED had turned to tightening. A reversal of policy & perhaps your theory?

Regarding 10 year treasury bond: what levels of broken resistance % up or down worries you?

Thanks.

Very good article. But when this ends and it will, what do you suggest doing?

Excellent as always. Wish you added a little more info on your 10 year treasury tease.