| MARKET ROUNDUP | |

| Dow | +92.02 to 17,068.26 |

| S&P 500 | +10.82 to 1,985.44 |

| Nasdaq | +28.191 to 4,485.925 |

| 10-YR Yield | +0.012 to 2.639 |

| Gold | -10.00 to 1,320.90 |

| Crude Oil | -0.51 to 103.97 |

Mike Larson, Money and Markets columnist and editor of the Safe Money Report, is out today. Mark Najarian, the managing editor of Money and Markets, is filling in …

We survived the first half! And without much of the doom and gloom that many throughout the world had predicted. In fact, the Dow has broken 17,000, and today’s surprisingly solid jobs numbers (details below) have excited nearly everyone and indicate a recovering employment picture.

Now, as we start to open the books for the second half of the year, it’s a perfect time to take stock (literally) of the successes and failures so far and exchange ideas on where stock market gains could be made in the second half.

One segment that has caught the eye of the Money and Markets research team is that of stocks priced under $10. With values and listed prices of some favorite stocks so high at this time, for many investors, buying substantial multiples of shares in any one company, such as Amazon.com ($335), or Google Inc. ($581) or Apple, even after its 7-for-1 split bringing the price down below $100, can be difficult.

But that problem can be overcome through lower-priced shares. After all, it’s easier to buy a thousand shares of a $6 stock than of a $60 stock. Many shares are priced low for a reason — because they’re just not that good. But many are there solely because of a larger number of outstanding shares, or because they’ve been unfairly beaten up after some one-time event or rumor. So we decided to talk to the Top Stocks Under $10 portfolio team for potential hotspots in the segment.

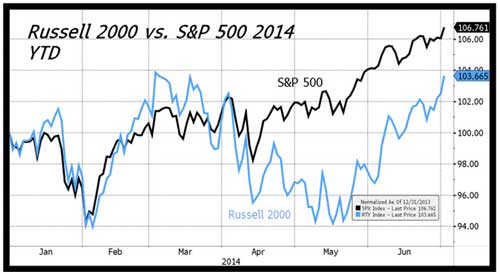

They point to the Russell 2000 small-cap index as one indication of the sector. Although not all low-priced stocks are necessarily small-cap names, the index pitted against the S&P 500 does show that it has lagged the overall rally in the first half.

Source: Bloomberg:

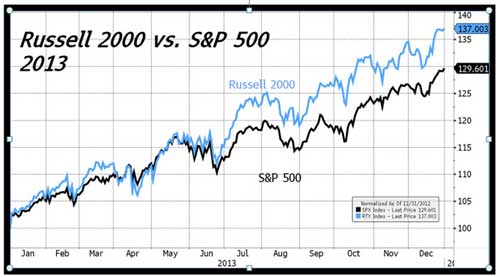

But don’t forget — 2013 started the same way for small caps, and it wasn’t until the second half that jittery investors went all in, allowing the segment to outperform the S&P 500, which was picking up steam itself and ended with an exceptional year as well.

Source: Bloomberg:

There’s no assurance that we’ll see the big gains we saw last year in the second half, but barring exogenous events like war or other uncertainties, there’s no reason that markets can’t continue the rally on the back of better employment, confidence and PMI numbers.

And a lot of money is still sitting on the sidelines, and there’s a lot earning low yields in fixed-income markets — money that’s ripe to be poured into equities.

Sorting that all out is the trick, and the Top Stocks Under $10 portfolio team closely tracks these and has shown that strong gains were possible in the first half.

| “There’s a lot of money on the sidelines and a lot earning low yields in fixed-income markets — money that’s ripe to be poured into equities.” |

In fact, many of the names in its portfolio are no longer actually under $10, having risen above that barrier since acquisition. One recent addition to the portfolio has rallied over 12 percent since the team bought it six trading days ago. Two airlines, a bank and an industrial company also have risen out of the sub-$10 universe since being added to the portfolio.

The team said it took large profits on some of its airline holdings on geopolitical risk in Iraq but sees more low-priced portfolio stocks going above $10 based on industry-specific and macroeconomic drivers.

What’s the strategy?

The team looks at a company’s business model and management, as well as any upcoming company or industry catalysts and valuation. In addition, the team often seeks out companies that are on the verge of innovation — like Peregrine Pharmaceuticals (PPHM), which has a drug in Phase 3 trials for the cure of non-small cell lung cancer. They took profits on this play since and continue to look for stocks that are making new roads. Or like Female Health Co. (FHCO),which has an innovative, unique product that’s protected by patents across the world and is the only family planning and disease prevention product that’s approved by both the FDA and the World Health Organization.

The team also utilizes the Weiss Ratings model to help determine the financial health of any particular stock.

With economic data looking better and global growth back in the picture — China’s ‘recent PMI print was comfortably above 50 — sub-$10 and small cap stocks may lead in the second half of 2014 as they did last year.

The sectors the team especially likes are energy, technology and financials, and said it will be seeking out companies in them to add to the portfolio as the second half progresses.

What is your experience with low-priced stocks? Have you made big profits? Some low-priced stocks can continue to fall and become real busts. Have you been hit by one of these? We’d love hear your comments — click here to add in your views.

| OTHER DEVELOPMENTS OF THE DAY |

Happy Third of July! Economists and Wall Street are focused this week on employment. And today’s numbers were surprisingly solid, showing that total nonfarm employment increased to 288,000 in June and that the unemployment rate declined to 6.1 percent from 6.3 percent.

A Bloomberg poll of economists had forecast a June rise of 215,000, just below the 217,000 figure in May. The unemployment rate was expected to remain unchanged at 6.3%.

The Bureau of Labor Statistics said today that “job gains were widespread, led by employment growth in professional and business services, retail trade, food services and drinking places, and health care.”

Today’s report comes a day after the ADP Employer Services data showed the economy created 281,000 jobs last month. That blew away the average economist forecast of 205,000. It blew away the 179,000 increase in May. And it was the strongest number seen in any month since November 2012.

“After Wednesday’s solid ADP number, we were quietly optimistic that today might be the big one. It was,” said Marcus Bullus, trading director of MB Capital. “The markets will go into the long weekend on a buzz, while strong upward revisions in April and May will add to the feel-good factor.”

Added Bill Kemp, head of dealing at the forex specialists FEXCO: “Not since the start of 2000 has the US enjoyed such a run of job creation — and the miserable GDP performance of the start of the year is fast becoming a distant memory.”

Looking overseas: As expected, the European Central Bank held steady on interest rates today, a month after it went to the unprecedented step of initiating a negative 0.1 percent interest rate on deposits that banks park at the central bank.

Holiday pain at the pump: The Automobile Association of America reports that gas prices are at a six-year-high for the Fourth of July holiday, with the national average price for regular unleaded gasoline at $3.67 a gallon Thursday. That was down a penny from a week ago but 19 cents more than a year ago. Fourth of July gas prices have not been this high since surpassing $4 a gallon in 2008, the AAA notes.

Don’t forget, you can let us know what you think by putting your comments here.

Best wishes for a safe, relaxing and fun Fourth of July,

Mark Najarian

P.S. Want to learn more about the Top Stocks Under $10 portfolio? Click here.

Mike Larson’s afternoon Money and Markets commentary will resume on Monday. To learn more about Mike’s services, click here.

{ 22 comments }

Remember that over 500,000 full time jobs were lost and 750,000 part time jobs were hired in this report-so don’t get carried away with this increase-teen unemployment was 21% last month-Bill

William spot on. The jobs numbers were not that good at all. I would also add that the labor participation rate dropped to 35 year lows and the wages were basically flat. In my opinion the market went up not because the jobs numbers were good but to the contrary and that the FED would have to keep interest rates low. The jobs numbers headline is simply more western media propaganda that would make the old Soviet Pravda news agency blush.

Well written and informative. Apple split was 7for1 however, not 6for1.

You’re right about the split. Thanks for pointing it out. We’ll fix it.

ah yes, the illusive “money on the sidelines”. I think it’s different this time. It has not been 20 years since naive middle-income people were fleeced of their savings and their retirement funds. It was just five years ago that a huge number of Americans lost their homes, their jobs and their nest eggs. If Goldman is waiting for the sheep to buy at the top and take overpriced stocks off their hands, they are waiting for Godot. The “sheep” have been using what was left of their retirement funds to eat and pay rent. I have heard that story a hundred times in recent years. Whatever wall street bought, they are stuck with it.

I am very new to investing into the stock market with limited money to invest. I have focused on penny stocks hoping to catch a rising star. Unfortunately I’ve lost more than half of my initial investment but it seems useless to buy 20 shares of stock that doesn’t appear to be ready to bust out for large gains. I’m old and foolish. Just trying to hit upon a particular stock that will help provide a little extra security for my family once I’ve departed.

give more stock picks

Do you really think we can have an economic recovery without more inflation when energy prices remain at current levels?

Also relative to your add on listening to Ron Paul and Charles Goyette, who would want to listen to Ron Paul after his statement on Chris Kyle that “he who lives by the sword dies by the sword.”

288,000 new jobs…great! How many were full time, career type jobs, and how many were part time jobs? Also, how many people dropped out of the labor force to drive the unemployment rate to 6.1%???

“What is your experience with low-priced stocks?”

Unfortunately, Mine has been bad. Wrong stocks, Probably.

One I bought 3000 shares of. Later they did a reverse split and later, another one.

I ended up with 30 shares and then sold at a loss to write it off on taxes.

Never bought any more low priced stocks.

They can be good but mine haven’t worked.

Don

Some construction jobs building more bridges and roads to nowhere. This artificial prosperity will be paid for by tax payers.

What kind off Obamanomic statistics is Bill Kemp analyzing? Full-time jobs actually fell 523,000 from May to June. Many months in 2004-2006 had employment increases exceeding 300,000–as much as 380,000 and they were mostly full-time jobs.

Of the 10 best stocks that you gave out free early this year, after my investigation, i bought shares of PDLI. Cost of 8.67. It seems to go up 4 of the 5 trading days. Now at about 9.80. Some of the stocks were not available on my brokerage site. I have not tracked the other stocks . Oh yeah, PDLI pays a healthy 6% divy!!!

How can any knowledgeable person believe any jobs/unemployment numbers out of this administration much less base investment strategy on these numbers?

The party’s goin great! Everybody’s getting drunk on all the financial stimulus…it’s wonderful! Nevermind the fight that’s sure to break out later…the real fireworks haven’t even started yet…and if we don’t get locked up, who’ll be sober enough to drive us home?? We don’t even want to think about the awful hangover in the morning…. There’s alot of similarities between our 4th of July celebrations and the current economic situation, huh?

The party’s goin great! Everybody’s getting drunk on all the financial stimulus…it’s wonderful! Nevermind the fight that’s sure to break out later…the real fireworks haven’t even started yet…and if we don’t get locked up, who’ll be sober enough to drive us home?? We don’t even want to think about the awful hangover in the morning…. There are alot of similarities between our 4th of July celebrations and the current economic situation, huh?

Stocks under or close to $10 are considered fair game by many traders. Penny and sub penny stocks are hard to work as it is easy for a so called major holder to “dump” leaving you high and dry in a short time. The common denometer Is %. Expensive or cheap if a stock goes up 5 % you made the same $ on the same dollar investment. Problem with dealing penny stocks are that you can not track them as well and you incur higher brokerage charges. Try BCLI for an inexpesive

And VLP for a mainline.

Everyone Has the Right to be Offended–Except Americans

Posted on July 4, 2014

2

by Al Benson Jr.

As we celebrate what we refer to as “Independence Day†now we begin to ascertain that the one “freedom†we really have is the “right†to support the Marxist Regime in power and we have the “right†to treat all of its socialist minions as upcoming powers-that-be, in other words, little socialist “gods.†Other rights, though talked about, have pretty much disappeared. Most folks don’t grasp this yet, probably won’t grasp it in my lifetime, and by the time they do they will be on their way to their local FEMA re-education facility, wondering why someone didn’t tell them about all this.

A perfect example of this is the “newspeak†that is foisted upon us by what passes for the “news†media and by the people in Washington, whose agenda is to change the way us and our kids think.

We are, from henceforth, not to speak in terms of any sort that might “offend†some minority group. The minority groups can insult and slander white, Christian Americans and that is permitted, even encouraged by our ruling elite and no one says anything. But let some traditional American say something that is perceived offensive to any minority group, particularly one on the Left, and the “news†media and their political bosses go into high gear with rigorous denunciations.

Looking at this horrendous situation with all these Latin American kids on our Southern border, we find that our ever-compassionate “news†media can’t even bear to label them anymore as illegal aliens. No, that might offend them. So we now refer to them as “undocumented workers.†Maybe we should start referring to other criminals the same way. We could start by rebaptizing bank robbers as “wealth redistribution engineers†and rapists as “contributors to the gene pool.†Although I must admit the term “wealth redistribution engineers†fits our politicians even better than it does the bank robbers. But, then, that’s the way it is when you vote Marxists into office.

In regard to these illegal aliens being detained on our borders–and at the risk of offending them–they are illegals and that’s the way it is in the real world, I have often wondered just where all these thousands of kids came from, most with no parents. We are told the majority of them don’t come from Mexico, but from Guatemala, El Salvador, and countries south of Mexico. How did these thousands of 8-15 year olds all get here with no adult help. I can’t believe that Mexico, from what I’ve seen of it, is safe enough for this Kiddie Crusade to just walk across it.

But apparently the Regime in power wants them all here and not deported back to where they came from and besides, they prevent the system in the Southwest from working with any kind of efficiency, which is part of the Marxist agenda–shut down effective government by flooding it with a situation it is not equipped to handle.

And there are other reasons the Washington Marxists want them here–they want the votes in the future. Writer Diana West has stated that: “There is one thing we can predict about the tens of thousands of ‘minor aliens’ crashing our Southern border. If permitted to stay in this country and gain citizenship, at least 8 in 10 of them will grow up to be Big Government Democrats. They will likely believe that the U S government isn’t big enough, and doesn’t offer enough tax-payer-funded services.†She quoted a 2011 Pew Research survey for this information. She said “Pew’s question zeroed in on Hispanic attitudes toward government: whether government should be bigger or smaller, with more services or fewer services. There was no mistaking the Hispanic preference. ‘Hispanics’ Pew wrote, ‘are more likely than the general public to say they would rather have a bigger government providing more services rather than a smaller government with fewer services.†According to the Pew Survey, 75% of Hispanics take this position, compared to 19% who favor smaller government.

If all these people get to stay, they will forever change the culture of this country–and that seems to be the name of the game. Their political attitudes, no doubt birthed in the socialist countries they come from, will ensure that socialists in government, as long as they promise more and more goodies, will get to stay there.

So folks, enjoy Independence Day while you can, even though it is now, thanks to the Washington Marxists, nearly meaningless, because thirty years down the road it may be abolished as a national holiday and you will find yourselves required to celebrate Cincy de Mayo instead. Of course, if such happens, maybe they will still let you shoot your fireworks off–and fot lots of folks, that’s all that’s important.

I’m puzzled by all the cheer leading about a not so hot jobs report. Full time jobs DECREASED over 500,000 and part time jobs INCREASED over 700,000. That’s a big time problem. There were also the usual “assumptions” ,whatever that means, totaling 121,000 without which construction and manufacturing turned in a dismal performance. When are we going to start looking past the government smokescreen and analyze the numbers? How coincidental that this “glowing” report should come out in the same week that Obama was given the ignominious distinction of worst president since WWII ( if not ever). I guess we should all just drink the Kool Aide and be happy because, justified or not, that’s what all too many of us like best. Next up will be a phony GDP report because everyone knows there’s nothing better for GDP growth than part time employment. James M. Franco

William and James are both spot on in their comments. Obama has made America the absolute definition of FUBAR! He and his minions have done this in less than six years. He has done exactly what he said he was going to do, “fundamentally transform America.”

Anyone that ever votes for another Dem is completely insane!

The depression grows stronger around here.

People who could not make it on 40 hour week pay checks are now not making it on 28 and less hour checks. Taking away one full time job and replacing it with two part time ones is Not more jobs

Concerning the jobs numbers….Of all those alleged jobs…how many were part-time and how many were full time? Seems like we are lacking in professional full time jobs. Service jobs are plentiful but they can’t help grow our country all by themselves.

I think our govt wants more folks working part time so they become more reliant on the govt…which in turn gets the present govt leaders more votes in future elections. What a stategy.

Full time workers aren’t so reliant on the govt.