|

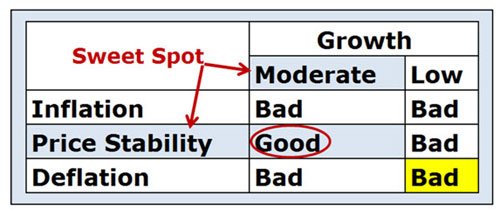

In recent Money and Markets columns, I have been saying that we are in the sweet spot for U.S. stocks and investors should consider pursuing a “risk on regardless” strategy in their portfolios.

Indeed, U.S. stocks, as measured by the S&P 500, gained 32 percent in 2013 and are up about 4 percent so far this year, propped up mainly because of the Federal Reserve’s and European Central Bank’s easy-money policies. In fact, the S&P 500 hit a record high this past Friday.

And for further evidence of speculative financial market activity, look at the chart below that shows that stock market indices in certain emerging markets are again peaking, specifically the so-called Fragile Five: Brazil, South Africa, Indonesia, India and Turkey.

Remember that it was just a few months ago that the Fragile Five were rumored to be the pin that would ultimately burst the stock market’s bubble. But with Fed Chair Janet Yellen and her counterpart at the ECB, Mario Draghi, both singing the same song — about a continued focus on promoting global growth — Wall Street quickly put its Fragile Five concerns in the rear view mirror.

And that’s what has been causing the recent rise in stock markets around the world.

It’s because investors trust that the central banks will prevent stocks from falling since that’s what has happened over the past five years. Thus, it’s become a commonly accepted belief that the central banks will support stocks no matter what the circumstances.

Collective belief can create its own reality, meaning that investors believe that stocks will go up so they do indeed go up, which becomes a self-fulfilling prophecy causing stock prices to rise.

That’s why the Fed and the ECB easy-money polices have really been just a confidence game. They are not based on any financial principle other than to make investors uncomfortable storing cash in Treasury bills, CDs and money-market accounts. In fact, the central bankers’ experimental policies — such as QE — have no theoretically valid or empirically supported transmission mechanism to the real economy at all.

But there is no denying that the impact of QE on investors has been quite real, even if it will ultimately be futile and destructive.

And recently I am beginning to see evidence that QE is a concept that is mostly played out.

In last week’s Money and Markets column, I said for stocks to go higher and a global economy plagued by excessive debt to make real advances, the world needs economic growth. That’s because growth is the magic elixir that cures all economic ills and propels financial markets higher.

Unfortunately, growth continues to be hard to find. As evidence, take a look at Wal-Mart Stores’ (WMT), Macy’s and Target’s disappointing recent earnings announcements. These retail giants are a barometer for the U.S. economy as a whole. Their entire organizations are focused on nothing but selling goods and services to the consumer, and they are all struggling.

From where I sit, it appears as if we are at an economic crossroads. The world and the global stock markets need growth to get going again. I am concerned that without growth we’ll fall out of the economic sweet spot for investors and into a deflationary environment with low growth that will be bad for stocks as shown in the chart below.

That’s why my view has changed from “risk on regardless” to “it’s not a time to be filling up your boots with risk.”

The next couple of weeks are going to be interesting. Stay tuned!

Best wishes,

Bill Hall

P.S. Click here to discover the four surprising secrets the world’s wealthiest families use to grow richer … And USE them to grow your wealth in record time!

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.