|

Tech shares inched higher last week, recovering some of the losses suffered in the first four months of this year.

Sessions on Tuesday and Wednesday were perfectly emblematic of the chop we have witnessed for five months, as buyers and sellers kept pawing at each other — trapped between technical support and resistance zones. The upper limit for the S&P 500 has been the 1,900 level, while the benchmark index’s 50-day moving average has provided robust support since mid-April.

Until bulls or bears take a chance on romance and go in for the kill, you can expect more sideways action. Personally, I think this thing is going to bust out on the upside, as bears have blown every opportunity to show they are boss. But timing is a question mark.

|

| Until bulls or bears take a chance on romance and go in for the kill, you can expect more sideways action. |

Something keeps holding back buyers’ enthusiasm, with a midweek downer on retail sales being a prime example. Eventually bears will run out of excuses and markets can return to their normally scheduled programming, which is to rise in value while making everyone sure it won’t last. The past five years have amounted to the most unappreciated, disliked and disrespected bull cycle in the past five decades, so why should this year be any different.

One stock that looks ready to rock and roll is Priceline.com (PCLN). As you can see in the chart below, it has started to stir from its serious downtrend and looks as if it is finally ready to get off the runway and into the air again.

Summer travel season is upon us. PCLN is not an “emerging” tech stock as it has been around for almost 15 years. So it’s probably time to buy your ticket on this surprisingly inexpensive company, if you haven’t already. I will tell you much more about it in my column next week.

As I mentioned, negative influences early last week were led by a round of surprisingly weak earnings reports by U.S. retailers, a breakdown in the yen carry trade, hawkish comments from New York Federal Reserve chief William Dudley, and more hawkish remarks from Philadelphia Fed President Charles Plosser, who said the U.S. central bank could raise rates sooner than the consensus now expects.

For good measure, the Russians fired off a nuclear missile test; Libya, Ukraine, Thailand and the South China Sea bubbled up with geopolitical risk; and from epidemiologists came word that the MERS virus has been transmitted to the United States.

But don’t get overly worried, not yet, at least. Keep an eye on the Nasdaq, which tends to be the market leader. It is not exactly at DEFCON 1. It has weakened to be sure, but not in a super-alarming way. That could come, but it’s not here yet. What we have had so far in mid-May is more of a buyer’s strike than a panic attack.

Most of this is due to exasperation with AT&T (T) management and its quixotic $67 billion buyout offer for DirecTVÂ (DTV), which simply does not seem all that well thought out. You know when you send your spouse to the store for eggs and they come home with chocolate cake? Yeah, like that.

The deal seems to be from another age, as if no one has told T management that television is going to be delivered by Internet in coming years, as both terrestrial broadcast and satellite broadcasting fade into irrelevance.

* * *

To cheer you up, and provide a side of the story that has not been well-explained by the pessimistic mainstream financial media, here is some good news on the economic front, from the highly regarded independent analysts at the boutique New York research firm Cornerstone Macro:

— “Based on the Fed’s weekly H.8 report, bank loans have increased at a 10 percent annual rate over the past 3 months, led by small-bank loans. Small-bank loans have grown at a 13 percent annual rate, while large-bank loans have increased at just a 5 percent pace. The acceleration in overall bank loans has been led by commercial and industrial loans (19 percent), followed by consumer loans (7 percent) and real estate loans (4 percent).

— “We believe the strength in U.S. bank loan growth increases the odds continued Fed tapering will not be a headwind on U.S. growth. QE was necessary to help the U.S. recovery as long as credit growth was declining/restrained. That phase of the business cycle is over, thank goodness, suggesting QE can end with the economy continuing to move ahead.

— “Based on the New York Fed’s Household Debt Report, consumer debt in 1Q increased at a $632 billion annual rate, its third quarterly increase in a row. The increase reflects a $445b increase in mortgage debt, a $102b increase in student-loan debt, and an $81b increase in auto debt. Credit card debt remained sluggish. In an unprecedented fashion, consumer debt declined $1.5 trillion over 3 years (2009-mid-2013), which was a very significant deflationary force. Over that same time period, the Fed’s balance sheet rose $1.3 trillion, buffering the economy from that deleveraging. Now that consumer debt is increasing, the economy is on more solid footing, suggesting that continued Fed tapering is appropriate. In addition, as outlined above, the increase in bank lending is another major support for growth.”

And now, here are ten signs that the U.S. economy is reaccelerating, directly excerpted from Cornerstone:

a) Retail sales were sluggish in April, but because of positive momentum from 1Q, even if real retail sales are flat in May/June, after a sluggish April, they will increase in 2Q at a 4.6 percent q/q annual rate.

b) NFIB’s small business optimism index rose almost 2 points in April to the highest since 2007.

c) Unemployment claims, 13-week average, declined to another new low of just 322k, the lowest since November of 2007.

d) A composite of the Phil Fed and Empire manufacturing indexes suggests the national manufacturing PMI will rise to 55.5 percent in May. If it remains at that level in June, it will average 55.3 percent for 2Q, versus 52.7 percent for 1Q.

e) The Phil Fed’s capex outlook index, 3-month average, rose to a 20 year high in May. There’s a 68 percent correlation between this index and the capex component of GDP.

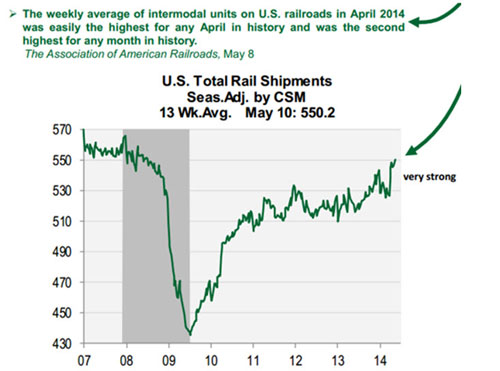

f) Weekly rail shipments are on track to increase at a 14.4 percent q/q annual rate here in 2Q, versus 3.6 percent q/q a.r. in 1Q.

g)Â Bank loans through early May have increased at a 10 percent annual rate over the past 13 weeks, the fastest in 6 years.

h) Rasmussen’s daily survey of consumer confidence, 7-day average, increased to 104.9 through Sunday, versus its 1Q average of 101.5.

i) BAA corporate bond spreads are a very low 220bp, versus their 1Q average of 235bp.

j) U.S. housing starts bounced in April to 1.07 million, up 16 percent from their 1Q average.

So as you can see, under the surface, there are plenty of positive currents. They just are not all lining up at the same time yet. But ultimately they will, providing a solid underpinning for tech investors.

Best wishes,

Jon

P.S. Be sure to watch your inbox after the market closes today for Mike Larson’s afternoon edition with updates on stocks, interest rates, the Fed, and much more.

{ 1 comment }

Awesome blog article.Really thank you! Will read on…