|

Bears have launched breathtaking strikes against technology stocks in the past month and a half, but their attack has not been random. They have mostly undercut tech companies whose shares are trading far above their intrinsic value, while mostly leaving alone companies whose shares are more fairly valued.

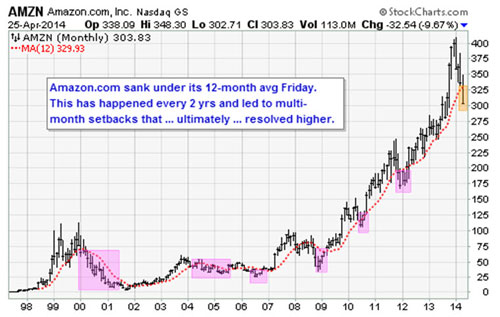

An example of the former was the -10 percent assault on Amazon.com (AMZN) a week ago Friday, after it reported earnings that were a bit shy of expectations and announced more heavy spending in distribution centers and other big capital expenses in coming quarters.

While the cash-burning investments in its business caught all the attention, what was lost in the hubbub was that Amazon.com is a really, really expensive stock. I mean, it is not just a little bit expensive. It is expensive on an epic scale. Momentum and optimism pushed the shares to $400 at the start of this year, while the model that I employ puts the intrinsic value closer to $75.

|

| You have to admire executives with guts and persistent vision. |

This means if sentiment worsens, the shares could fall another 75 percent from the current level just to get to par. And then after that, more often than not, sentiment overshoots and puts the value well under intrinsic value.

The case of Amazon.com is really quite fascinating. Despite attempts to generate excitement with fanciful ideas like drone- and truck-based shipping services, a price increase for its Prime free-shipping option, and a steady stream of 3D smartphone rumors, the company could not stave off selling by investors dismayed by something much more real: A steady erosion of profit margins.

So is Amazon.com bound to be eaten by piranhas and never heard from again? To the dismay of bears, probably not.

You see, it’s easy for everyone to tut-tut about Amazon.com’s high value and smack their hands against their heads when exclaiming that their spending is out of control. But the reality is that Amazon.com is simply doing what it has always done: Use its tremendous cash flow and sterling credit line to fuel its ambitions to grow at a time when its competitors are shyer.

Short-term investors hate this idea. But this is the strategy that has built Amazon.com into a juggernaut and has served long-term investors very well. It’s like a family who constantly maxes out its credit cards to add onto, and upgrade, their house. Critics call it foolish. But then one day they look up and the family has built a thriving resort hotel with thousands of guests generating billions in income, and wonder how that happened.

My favorite rumor for Amazon.com, by the way, was the least likely but the most potentially exciting: Some baseball people were speculating that the Seattle-based company might be preparing for a bid to buy the local Major League Baseball franchise, the woeful Mariners. This is an outstanding idea for both parties: MLB teams have made great investments in recent decades for companies savvy about building cable or entertainment empires, and the perennially underperforming Mariners could greatly benefit from being owned by a company famed for discovering and successfully applying statistical advantages.

The bottom line is that Amazon is just being Amazon. You don’t have to support it, or invest in it, but as an investor interested in the progress of business you have to admire executives’ guts and the persistence of their vision.

Back on planet Earth, the web-based music service Pandora (P) dropped a whopping 16.6 percent late last week on weaker-than-expected forward guidance. Other one-time momentum names under pressure included Twitter (TWTR), down another 7.2 percent, and Linkedin (LNKD), down 7.8 percent.

I think both TWTR and LNKD have bright futures, but they’re obviously overpriced at current levels. We are really lucky at this point to be able to stand back and wait for these shares to settle out and find buyers at lower levels. Once they flat-line and start to edge higher at levels closer to their intrinsic value, we’ll know it’s the right time to start our own positions. That might not be a very popular idea then, but from a contrarian point of view you want to buy the shares when sentiment has turned from “gotta have it!” to “don’t even think about it!”

[Editor’s note: Would you like to find the tech stocks with the power to multiply your money up to ten times over? Click here to download Jon’s proprietary report: New Technology Superstars for 2014.]

On the whole, does it seem like tech stocks are being too harshly punished lately? Well, they are. Bespoke Investment Group analysts last week observed that the average tech stock that beat earnings estimates has gained only 0.04 percent on its report date while the average tech that missed estimates has crashed 7.1 percent!

That’s an astonishing differential, especially considering that many techs have already fallen 15 percent to 20 percent heading into their reports, making many investors (including myself) figure that a disappointment has already been discounted. And then they’re being further slaughtered.

It all seems more than a little extreme, and I would not be surprised if we look back a year from now to see that long-term buying opportunities are being created right around the current quotes, give or take 5 percent to 10 percent.

Best wishes,

Jon

|

EDITOR’S PICKS

Five+ Years of Fed Futility Laid Bare for All to See! by Mike Larson So the great monetary oracles at the Federal Reserve have concluded their latest conclave. Here is what we learned: The Fed announced it will lop yet another $10 billion off its quantitative easing (QE) program. That’s the fourth consecutive move in a row for the Fed, and it leaves QE at a pace of $45 billion. The New Mantra: Value with Reasonable Growth by Jon Markman You know how much focus investors put on the concept of growth, right? It’s like a mantra, a lodestar, the one shining piece of information that is supposed to be prized above all else. War Cycles — the Effect on Your Portfolio by Larry Edelson The war cycles I’ve been telling you about simply must be taken seriously. But they must also be understood in the right context. That context is the following: Not since the mid and late 1800s have so many different war cycles converged together at the same time. |

THIS WEEK’S TOP STORIES

Deflation was the last war; NOW a more dangerous enemy lurks by Mike Burnick According to the Federal Reserve’s own statistics, total U.S. bank credit growth is accelerating at a rapid clip this year, as shown in the chart below, expanding by $250 billion since December 2013. Commercial and industrial loans are growing at an annual rate of 23 percent year to date. Despite Bank of America Blunder, Financials Look Good! by Don Lucek On Monday, Bank of America (BAC — Rated A) retracted its share repurchase plan and dividend increase. The reason: Accounting errors in some structured notes in its Merrill Lynch (acquired 2009) subsidiary. And the financial media was ablaze! “Echo Bust” Strikes Key Sector — What It Means for You by Mike Larson The “Echo Bust” is here! That’s the unmistakable conclusion you have to draw from the latest reports on the housing market. So what is it? And what are the consequences for you? |