|

My mother took education very seriously.

On the first day of first grade, my mother, Hiroko, marched me to school and told the teacher to seat me in the front row by her desk. And there I sat until junior high.

Oh, I hated sitting in the front row. But it paid off because I got straight As (as did my brother and sister). And I consider myself pretty successful today.

Successful enough that I almost fall out of my chair when my CPA tells me how much income tax I owe. I have my fingers crossed that Donald Trump will push through tax reform that lowers the tax bill for job creators, like me.

Tax relief or not, one of the things I’ve learned as a numbers nerd is to pay close attention to the taxes that publicly traded companies report.

Corporations can play lots of financial games with profit numbers thanks to liberal pro forma accounting rules, which are nothing more than a license to manipulate earnings into looking better than they really are.

However, corporations are just as loathe to pay taxes as I am, so I believe the profits that a company reports to the IRS paint a much more accurate picture of its financial health.

You’ll have to dig a little bit to find the tax information. You can find it either in the statement of cash flows or buried in the footnotes of financial statements.

According to a survey by the American Institute of Certified Public Accountants, roughly half of the S&P 500 companies report income taxes paid at the bottom of the statement of cash flows, while the other half bury income taxes in the notes to financial statements.

Why is this important? If a company tells Wall Street that it made $900 million of profits but tells the IRS it only made $300 million of profits, you could be looking at a financial accident waiting to happen.

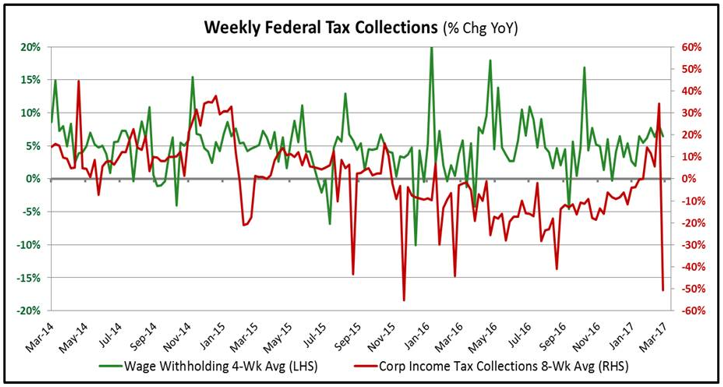

Speaking of accidents waiting to happen, the latest numbers from the Treasury Department really caught my attention. But not in a good way.

According to the Treasury Department, the federal government collected $87,355,000,000 in corporate income taxes, excise taxes, and custom duties in the first five months of fiscal year 2017 (October 1, 2016 through the end of February).

During the same time last year, FY16, the government collected $89,884,230,000, so we’re looking at a decline of approximately $2,529,230,000 and resulted in a $348,984,000,000 deficit in the first five months of this fiscal year.

On the personal income tax side, not much has changed. The government collected $611,318,000,000 in individual income tax revenues through the first five months of fiscal 2017

As the above chart shows, we’re talking about a huge drop in corporate tax collections, not the type of news you’d expect to hear during periods of strong economic growth.

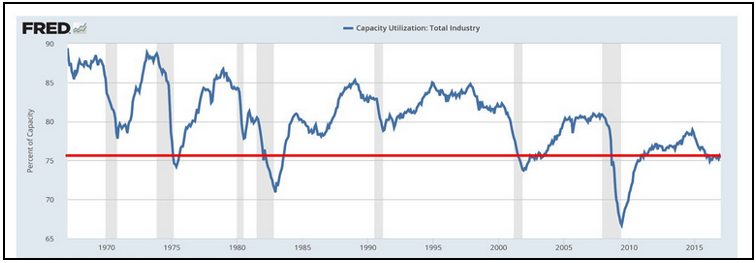

In fact, that type of drop suggests that a serious economic downturn is around the corner, which is why capacity-utilization at American factories is at a modern, non-recessionary low.

We won’t have to wait long to find out if those falling tax payments are a canary in the economic-growth coal mine.

We’ll get the Q4 GDP numbers on Thursday, March 30, and the consensus Wall Street estimate is for a 2% growth rate.

The American economy has been growing at a snail’s pace for the last two-plus years, and I’m having a hard time finding reasons to stay bullish.

Taking out a little portfolio insurance is easy and cheap these days thanks to inverse ETFs, such as:

- Short Dow 30 ETF (DOG)

- Short S&P 500 ETF (SH)

- Short QQQ ETF (PSQ)

- Short Russell 2000 ETF (RWM)

Each one of the above ETFs is designed to move in the inverse direction of the index that it attempts to track. For example, if the S&P 500 drops by 10%, the Short S&P 500 ETF (SH) is designed to increase by 10%.

|

|

| At 17, Eagle Scout Tony Sagami poses with his proud mother, Hiroko, who taught him the value of a good education. |

For the bolder, there are “leveraged” inverse ETFs that will give you two- or even three-times an index’s move. UltraPro QQQ ETF (TQQQ) is designed to deliver 300% of the inverse direction of the Nasdaq index.

If the Nasdaq drops 10%, this ETF should rise by 30%!

Of course, the opposite is also true, so the losses can really pile up if the market moves against you.

Remember, this Chicken Little talk doesn’t mean you should rush out and sell all your stocks tomorrow morning.

But as the cratering tax payments show, you need a strategy in place to protect your portfolio when times turn tough.

What’s yours?

Best wishes,

Tony Sagami

{ 7 comments }

Corps are paying the lowest share of overall tax revenue in decades. Between offshoring profits and expensing stock options they pay next to nothing despite whining about how the rates are too high. For many corps the non cash writeoffs are obscene.

Say Hello to $3 Trillion in Forgotten Debt

https://www.bloomberg.com/gadfly/articles/2017-03-20/say-hello-to-3-trillion-in-forgotten-debt?

I’m not doing well, but I’ve usually followed your predictions more than other stuff,because even since 2012 you seemed to be more accurate than others, but at the moment my speculative financial resources are down to about a £1000, so I can no longer afford to make many errors of judgement and I don’t fully understand ‘options’ – stuck, unless I can find a sure fire winner!

Kenneth.

That never occurred to me, and I have never seen an analysis from that point. Thank You. Dave

Interesting. A number of well respected financial firms have stated that inverse ETF’s are very risky and strongly recommend staying away from them. Who to believe?

I don’t know how the accounting works, but I would expect optimistic corporations to be in a growth/reinvestment mode which would lower their taxes. Could hiring and re-investment for an expected bright future explain the reduced tax revenues and reduced profits?

Sure corporations in America exist as a result of the blood and sacrifices of our men and woman in uniform. Yet, corporations are permitted to hide billions of dollars in corporate profits in overseas banks thereby avoiding paying their more than far share of taxes. This includes Buffett who also hides his billions over seas, while veterans receive substandard health care and rehabilitation support. How long will America put up with 5% of the population amassing 90% of the wealth of America through stock market manipulation? The Democrats’ loss is an omen that the deplorables are beginning to understand the deck is stacked against the working middle class in favor of multi-nationals. Unfortunately if these funds are repatriated, corporations will only by back more outstanding stock which will continue to enrich the 5%.