The stock market was quiet from mid-July through the end of August. Perhaps too quiet. In fact, the S&P 500 went 43 trading days without moving more than 1% in either direction.

Market Roundup

But that trading-range serenity was broken with a vengeance last week as the S&P 500 plunged 2.5% on Friday, rebounded 1.5% Monday, and plunged another 1.5% Tuesday.

So the past eight weeks or so were the calm before the stock market storm … welcome to September!

As I pointed out last week (See, Why this “Distrusted” Bull Market May be Due for a Pause), September has historically been the cruelest month for stock investors. Plus, there are several indicators flashing red right now that tell me to proceed with caution.

Market valuations are stretched: The S&P 500 Index is trading at more than 20-times trailing 12-month earnings.

That’s well above the long-term average of about 16 times.

Stock market breadth goes from bad to worse: Less than 30% of S&P 500 stocks are trading above their 50-day price moving average right now, meaning 70% are trending down.

Such a rapid deterioration in market internals is a red flag.

In spite of the recent selloff, investors are still too complacent. The VIX, for instance, is nowhere near oversold levels, indicating rampant fear and a possible bottom.

But there are other risk factors that warrant a cautious outlook on stocks near term. Here’s a big one on my radar …

Wall Street just loves to engineer investment fads and take them to unsustainable extremes.

| “Wall Street loves to engineer investment fads and take them to unsustainable extremes.” |

Portfolio “insurance” in the 1980s … dot-com stocks in the ’90s … and subprime mortgages before the 2008 crisis … are just a few of the fads that ended badly.

Well, the latest fad on Wall Street is something called “risk parity funds” and it’s destined to end badly too.

A risk parity fund is a type of hedge fund that takes highly leveraged bets by going long stocks and U.S. Treasuries at the same time … on super-margin.

In theory, an investor is hedged because oftentimes stock and bond prices move in opposite directions … when stocks slump, bonds rally and vice versa, so you’re hedged.

That’s nice in theory, but the reality is stocks and bonds don’t always move in opposite ways!

These funds have $400 billion in assets, but they routinely leverage anywhere from two- to three-times that amount … for a total investment of over $1 trillion today … and it’s a ticking time bomb.

Why? Because stocks and bonds are moving in the SAME direction recently. In fact, last Friday’s big selloff in stocks was preceded by a bigger selloff in Treasuries on Thursday.

In June, the correlation between stocks and bonds was negative 66% – moving in opposite directions – but today, the correlation has swung to a positive 27%. In other words, moving in lockstep.

So risk parity funds are losing money on both sides of their leveraged long stock-and-bond portfolios at the same time.

Analysts estimate these funds face up to $40 billion in forced selling as a result. That’s more selling pressure than the Brexit debacle, when stocks swooned over 6% in just over two weeks!

So if markets remain vulnerable on the downside, the question is: How low can stocks go?

When markets suffer a mild pullback, they typically give back, or retrace, anywhere from 25%-50% of the previous advance.

A deeper correction can retrace between one-third and two-thirds of the previous rally. The S&P 500 Index chart below highlights these key levels.

Measured from the June 27 post-Brexit low, the S&P is within a stone’s throw of a 25% retracement at the 2,105 level.

Next stop on the downside is near 2,050, in the vicinity of the S&P’s 200-day moving average. This would amount to roughly a one-third retracement of the June-August rally.

It wouldn’t be surprising to witness at least a short-term bounce higher for stocks somewhere in this range between 2,105 and 2,050.

It will be critically important to monitor the magnitude and quality of that bounce.

I’ll be looking for an increase in negative sentiment, a contrary bullish signal that investors are nervous and perhaps throwing in the towel.

Another key signal to watch on any rally attempt is market breadth: Are more stocks advancing on increased volume than are declining in heavy trading?

Finally, a deeper 50% retracement of the rally would bring the S&P 500 all the way back down to the post-Brexit low near 1,990. A correction of that magnitude would be troubling, since it would basically negate all the upside progress made since June, including the recent S&P 500 breakout to new highs.

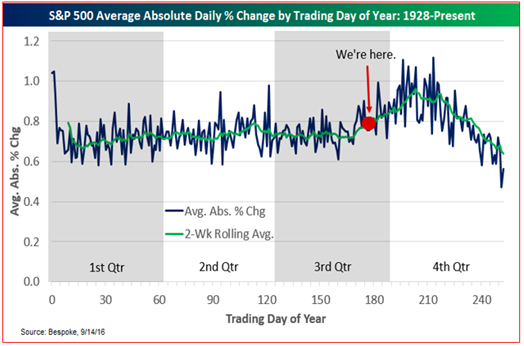

Bottom line: Not only is September the worst month of the year for stock returns, but the entire period from now up until Election Day is the most volatile time of year (see chart below).

Caution is the watchword. So be sure your seat belts are securely fastened and expect more volatility ahead for stocks, bonds and other markets!

|

![]() Dutch trick or treat: In a desperate reach for extra yield, a Dutch-based pension fund, one of the largest in Europe, could be on the hook for big losses on a $9.5 billion bet on European corporate loans. What’s the upside? If the loans don’t go bad, the upside for the pension fund is only “double-digit returns” according to Bloomberg.

Dutch trick or treat: In a desperate reach for extra yield, a Dutch-based pension fund, one of the largest in Europe, could be on the hook for big losses on a $9.5 billion bet on European corporate loans. What’s the upside? If the loans don’t go bad, the upside for the pension fund is only “double-digit returns” according to Bloomberg.

![]() Political Paralysis: Americans are well aware that our political system is broken, but they can’t put their finger on why it’s broken, let alone what to do about it. That’s the conclusion of a recent study from Harvard Business School, according to Bloomberg. The report goes on to cite American politics as the “single biggest barrier to competitiveness…” and goes on to say the U.S. has entered “an era of political paralysis.” The good news: November elections are just around the corner.

Political Paralysis: Americans are well aware that our political system is broken, but they can’t put their finger on why it’s broken, let alone what to do about it. That’s the conclusion of a recent study from Harvard Business School, according to Bloomberg. The report goes on to cite American politics as the “single biggest barrier to competitiveness…” and goes on to say the U.S. has entered “an era of political paralysis.” The good news: November elections are just around the corner.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 21 comments }

I get the feeling that you also read the “Street Freak” newsletter by Jared Dilian.

What’s coming will stagger…bewilder you…

and the total finantial collapse is only the beginning…

PLT

It’s quite easy to get WASHINGTON fixed. For too many years senators and congress people have bowed to and have been paid egregious sums by lobbyists- mostly special interest. With mostly millionaires running the two houses they have become out of touch with average Americans. Take away lobbyists and put term limits on senators/congress people. Also how can so called leaders continue to tax and spend when we are 20 Trillion in debt? A flat consumption tax for all would level the field.

Is it time now to buy Silver Wheaton stock ?

Not just yet Stan. Its getting very close to silver and gold buying time.Keep your eyes and ears perked up and you will hear the roar coming. Also listen to the crash of our dollar.

I feel like for at least a year we have been in “Road Runner” territory, over the edge of the cliff but refusing to accept it. Pundits keep talking growth, but a lot people are still underwater on mortgages, the millennials are trapped with college tuition loans, The rate of live births is dropping and the “baby boomers” are starting to cash out and have quit buying anything as they already have too much “stuff”.

The newsletter talks about the S&P retrenching to 2,000, perhaps 1,500 is more like it, and soon. But if Mr. T (Putin’s buddy) becomes President then it will likely be much worse.

I hope I’m completely wrong and we are on the verge of a golden age, so I’ crossing my fingers but getting out of the market for now.

Cyd,

don’t let those liberals in government trick you. Listen…..Listen to Trump, he will make America a great Nation again. Hillary is a liberal just like those other clowns in Government. If you vote for her we are headed for deep trouble. VOTE TRUMP for the sake of our nation.Listen to Trump and his family, they truly want only the best for all Americans.

Are we seeing any great infusion of money from Europe? I would think most of Europe’s wealthy people understand the trouble they are in if they leave their money in Europe.

Putting relative intellect over emotion, the Demo’s are for BIG government/bureaucracy at it’s most diminishing (fundamentally not producing any societally advancing benefits) and ,the GOP tends toward more “free-market” (equals more jobs no matter the slicing it) and is profoundly more productivity/benefit oriented. Bottom line: Give me a job producer that PRODUCES beneficial aspects to THE-BENEFIT-OF-MANKIND. Goodbye Hillary, you’re a taker, not a producer; never has-been, never will be!

This Horseman produces winners!!!

And yet governments around the world, including ours, while mouthing great concern, proceed along their incompetent and petulant ways. They assume the role of Canute and think commanding an economy is all it takes to get results. In the meantime the sheep continue to listen and go along with the program because they have not the faintest idea what is taking place. PLT is half right. The social collapse will be even worse.

I agree the end is near and it will be really bad; however, a rho=p= 0.27 is hardly lockstep. Lockstep is a p= 1.00, by definition.

Look out for the black swan whatever it may be . We are living in interesting times , let’s hope it does not get too interesting

Pierre

THE BANKS ???? (Derivatives to the moon )

Auto Subprime ????

College debt ??????

S&P avg earnings down 5 Quarters in a row ???

End of debt driven stock Buy Backs ????

Government debts to the moon ????

Lower Baltic dry index ?????

Lower railroad index ?????

Yeah these things bewilder me so I guess what these things could lead to would too !!!!

Well it looks like the algorithm boys are still front running the market. Yesterday the bad news bears were out and the market still shoots up 200 points amazing.

I am very fearful of the market collapse and have gone 87% cash and why not 100% cash because I am holding a loser. I hope the new President will some how fix our economy by paying of the national debt. Shutdown useless program and quit giving welfare to able body Americans. Time to tighten belt and pull America out of a impending disaster.

The only way to recover is to “Kill all the lawyers.!” –Shakespeare. As long as lawyers comprise Congress, there is no hope for intelligent solutions. What the f%:k does a lawyer know about markets…or anything but lying for a living and lining their own pockets. Get some mathematicians, physicists in charge of proposing solutions. Naturally inclined to solving problems objectively, scientists are NOT influenced by lobbyists because doing so would produce biased results. Mathematicians and physicists do not care for biased results because they are trained to employ rigorous methods to find solutions. Let me ask this: what is the general consensus of lawyers? And these are the people we trust for solutions??

I read an interesting article a few days back that stated the federal reserve was created by the British eleit in order to exstort and on going war that these aristocrats have had since the revolutionary war if I find it amongst the many publishing’s I keep and read I will Send it

The Stock Market will be safe until after the election and interest rates will not be raised also until after the election ……….and you can take that to the bank!

Te sky will not fall before the election!

I really know nothing about stocks, I inherited them from family. I have one that went from $21.00 to 42.30 not sure if and when to sell to make a profit as I can use some extra cas. I have 1400 shares

Take your profit & sell