|

There is a crisis brewing at our borders. But if you think this is a story about immigration, or President Trump’s wall, it’s not. The crisis is in trade. And if you think that’s not going to affect you, think again.

The crisis is so bad, America’s Retail Industry Leaders Association says we are facing “economic catastrophe.”

What is this crisis? It’s NAFTA, the North American Free Trade Agreement. It is unraveling like a ball of yarn. The future of the trade agreement is in doubt. It’s being renegotiated right now. And it’s not looking good.

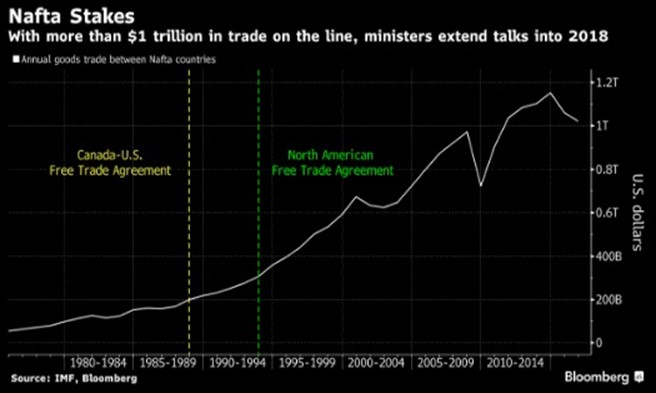

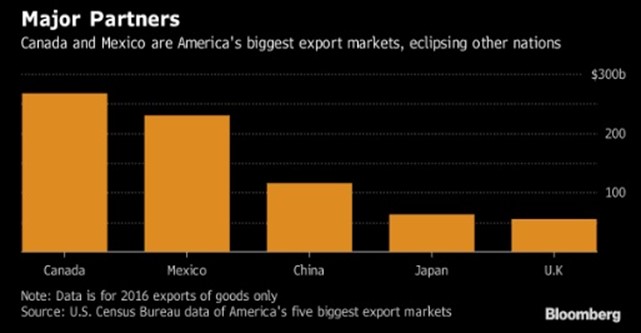

I’ll show you why in two charts.

First, cross-border trade with Canada has soared since NAFTA started in 1994.

Second, it’s not just Canada. Though along with Mexico, Canada is one of the top destinations for U.S. exports.

Raising trade barriers is a two-sided sword. Yes, domestic manufacturers can produce more. But it potentially raises the costs for everything from lumber to car parts to just about everything else that can be manufactured and put on a truck.

And guess who pays those higher costs? Consumers. Me. And You.

President Trump has called NAFTA “the worst trade deal ever made” and repeatedly threatened to withdraw the U.S. from the agreement.

And President Trump isn’t the only one. Leo Gerard, president of the United Steelworkers union, says NAFTA was sold to the American public with “a bag full of lies.”

So, it’s being renegotiated. It’s going so well, they’ve pushed the negotiations off into 2018.

Psst! That means it’s not going well at all! In fact, Canadian Foreign Minister Chrystia Freeland accusing the United States of bringing a “winner-take-all mindset” to negotiations.

But we don’t even have to wait for next year for the fallout. The U.S. slapped tariffs totaling 31.7% on Canadian lumber. Boeing is pushing steep tariffs on Canadian jet maker Bombardier through Congress.

So, what happens if there is no NAFTA?

If it falls apart, trade among Mexico, Canada and the United States then comes under World Trade Organization rules. That means modest average tariff rates and an established but clunky process for resolving disputes.

The good news is the tariff rates would be relatively low. The bad news is the tariffs would be higher on U.S. exports than on U.S. imports.

Meanwhile, Canada and Mexico have a sneak-around. They could export goods through free-trade agreements they recently forged with Europe. Those agreements levy tariffs at zero.

Still, Mexico would likely suffer worse than we do. So, if the real goal in Washington is to make Mexico suffer, they have that option.

But we won’t be unscathed, either. U.S. exports to Mexico would go from a tariff of zero to 7.1%. And U.S. goods going into Canada could face an average tariff of 4.2%. Many trade experts say that would hurt U.S. exporters of everything from corn to auto parts.

Auto parts are made on both sides of the border. Let me give you a real-life example: Depending on what you buy, the cost you pay for a car could go up by hundreds of dollars … maybe more than a thousand dollars per car.

NAFTA is a tangled mess. There aren’t any easy answers. But if you enjoy the low prices that come with free trade, you probably won’t like what’s being brewed up in Washington.

All the best,

Sean Brodrick

{ 13 comments }

Since America began allowing free exploitation of our markets 20 years ago, the United States has accrued more than $12 Trillion in trade deficits. That means we have shipped $12 Trillion of our wealth to countries who sell us far more than they buy from us. On an annualized basis, that represents the loss of more than 23 million American jobs. The lost tax revenue from those jobs has caused us to borrow $20 Trillion to support our own unemployed people. This clandestine economic war has led to a declning ability to protect and sustain ourselves. The only solution is TRADE BALANCE legislation. If you sell us a billion dollars of your stuff, you have to buy a billion dollars of our stuff. It’s the only way.

what a tangled mess!! there’s an an advantage and disadvantage on both sides. and it seems like we’re tied with the wotld economy. i hope that these politicians have a not only educated economist but soneone who’s a real business person to advice the pros and cons of nafta.

One thousand dollars increase in a price of a 45,000 dollar car is not a deal breaker.

Rolling back some of the EPA’s idiotic regulations would help in shrinking this difference.

Our strength is going to come from what has always been – high quality of

“Made in America” products. I am optimistic about the overall results.

I guess you didn’t buy American made cars in the Seventies. Low quality.

Hi Sean,

My name is Cem and I import natural stone (travertine) from Turkey. I believe we pay around 4% for the customs.

I didn’t see any figures for imports from Mexico in your article although you mentioned a 7.1% for the exports to Mexico

Sean,

There is no free trade anywhere any more. Free trade takes one sentence containing the essence “we will not charge or pay tariffs with those whom we trade with”. Trade agreements running longer than a phone book are about legislating winners and losers, with most citizens being the losers no matter which side of the border they live on. Modern states and corporations love and pay for monopolies and complex “trade agreements ” provide the political cover for their true actions.

CAR BUYING BOOM YEARS ENDING

American voters are clueless nitwits. They can not for the life of them connect these dots, as its “too complicated”. Right now, there is an oversupply of passenger cars on most dealer lots and cash incentives must be offered to turn the sale and reduce expensive inventory. Car purchases have been climbing for seven years in the U.S., fueled by easy credit and low interest rates. The growth in the sale of new autos is over for this part of the cycle. However, as rates slowly increase it may be difficult to buy the next replacement, as prices will go up for those who buy on time.

Trade and countries have a chance once again to do what’s in the best interest of the nations and the whole, that’s the three, the USA, Mexico and Canada. What’s best for us our on this continent.

It’s time we go back to made in America. There are many reasons to employment of Americans to higher quality, regulated, no cheating products. It’s almost impossible to shop and find made in America products. I’m old enough to know what I’m saying, growing up after WW11. My father invented and manufactured the first rotary power mowers. Cessna and Boeing were in the area also. I’ve seen it working and employing well.

I live in Canada. I always buy a Ford truck for several reasons. However, the price of that truck over the last several years has gone up more than $10,000.00. To get leather in that truck, an upgrade to leather will cost $8000.00 more for the Lariat version. But I can pay just $1,500.00 to have leather installed by the dealer. When I trade that truck in, it usually is sent to the US because of the dollar exchange rate. Our dollar is low which is good for our exports but terrible for travel in the USA or to buy their products, on top of this is our HST tax of 13%.Correcting the currency rates would go a long way.

I am tired of hearing how the most powerful country in the world is being taken advantage of by others. Canada with 10% of the population of the USA is our best customer and we are treating them like a bully. When Canada joined NAFTA they lost jobs as well. NAFTA in Canada was not popular since wages in Canada tend to be higher than the US or Mexico making it tougher to compete.Boeing used our current political climate to try to destroy a competitor (Bombardier) because the Canadian manufacturer developed a superb aircraft.Canada buys a lot of US made Boeing aircraft…we want to have our cake and eat it too.

Sometimes I can’t get over the brilliance of breaking a trade alliance with Canada. Let’s see, the trade in goods between the two countries is for all intents and purposes a saw off. Look it up, its in the public record. Meanwhile, the imbalances with Germany, China, and numerous Asian countries is through the roof. The strategy: Kill Canada. Fortunately for Canada escaping from a trade pact with a country that stiffs it’s friends is probably the best thing that ever happened. Now we can go and find some new friends who know what fairness and reason is all about. And oh yes, about the pipe dream that the U.S. can finally start making (and growing) everything it needs. Just how many pineapples do you grow? Willing to do without them? You’ll have to give up a lot more than pineapples after you have severed all all your trade relationships. Do I expect anyone down there to care? Judging by the loose grip on reality of your current president, I doubt it. Reminds one of the old saying: A man who does not know his friends has no friends.

Yep, and China is more than willing to step in any where they can. Two cheers for the liar in chief, who made America hate again.