|

It’s a recession when your neighbor loses his job, but it’s a depression when you lose yours!

Layoffs aren’t funny by any means. But they are an important leading economic indicator that can help investors make money. Lots of money.

That’s why I pay close attention to the monthly layoff announcement from outplacement firm Challenger, Gray & Christmas.

According to the report, American companies announced 51,700 layoffs in May, which was much higher than the 38,200 Wall Street was expecting.

Moreover, it was a whopping 41% increase from the 36,600 layoffs in April and 71% higher than May 2016. And that tells me that our economy may be slowing faster than most of the so-called experts think.

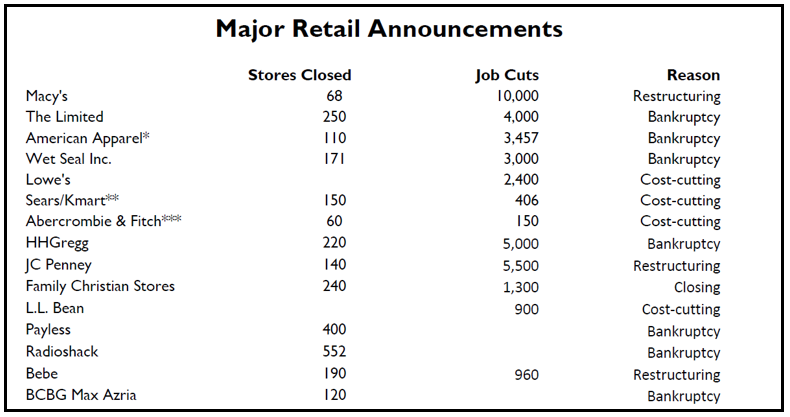

The bulk of the job cuts came from the retail industry. In fact, retailers have laid off 55,910 employees so far this year. Ouch!

That sounds awful on the surface. But what is really happening is that the retailing landscape is changing due to the growth of e-commerce and online shopping.

In short, the brick-and-mortar retailers are getting their lunch eaten by e-retailers like Amazon (whose stock hit $1,000 a share last week).

That’s why, despite the job layoffs, retail sales at U.S. stores increased by 0.4% in April (most recent). In addition, consumer confidence numbers from the University of Michigan rose to 97.7 in May; the strongest reading since January, when sentiment reached a 13-year high.

That’s all fine and good, but here’s what matters…

|

|

| Even big sales can’t bring in enough customers to keep retailers from shutting stores and cutting jobs. |

If you act ahead of those monthly layoff reports, you can make a bundle. How? By investing in the one sector that is highly correlated and super-sensitive to layoff announcements: Retail!

There is a retail-focused ETF, the Direxion Daily Retail Bull 3X Shares ETF, symbol RETL, that can help you profit from the changing retail landscape and the once-a-month jobs report from Challenger, Gray, and Christmas.

Check out these numbers …

The April 2017 and May 2017 numbers from Challenger were released on April 6 and May 4, respectively, and you could have made a bundle by buying RETL the day before and selling just one week later.

|

April 5 $28.46 |

May 3 $33.00 |

That’s right; You could have made 7.3% in one week and 10.7% in another week by investing ahead of the monthly jobs report!

But wait; the numbers get even bigger if you had instead bought call options on the SPDR S&P Retail ETF (XRT).

Call options on the SPDR S&P Retail ETF could have netted you from 136% up to 1,210% during April and May, 2017. Those are not typos: 136% and 1,210%!

Remember, Challenger releases its report every month like clockwork, so all you have to do is mark your calendar for the next jobs report and act accordingly. It is that simple.

There is one big caveat, though. The only time this calendar system works is when there is a clear, established trend in the jobs numbers. That is why I’ve developed a “trend persistency” ranking system that tells me when to jump on board and when to stand on the sidelines.

The older I get, the less I like looking at calendars, but when it comes to investing, the calendar can be a very profitable friend.

Best wishes,

Tony Sagami

Â