|

Not losing money is sometimes just as important as making money. And with the bond bubble bursting, I’m thankful that I’ve helped you with the former.

Since late 2012 I’ve recommended getting out of bonds of all types: Treasuries, munis, emerging markets, junk and longer-term corporates.

I said all of them were swept up in a bubble that’s even bigger than the housing and dot-com bubbles that preceded it. I even recommended a specialized ETF in my Safe Money Report that would rise in value as bond prices fell.

|

| 2013 has been an absolute bloodbath for bonds, with the average long-term government bond fund losing more than 11%. |

Sure enough, 2013 has been an absolute bloodbath for bonds. Take the Barclays U.S. Aggregate Index – a common benchmark for bond performance. If it finishes the year roughly where it is now, it’ll notch its worst annual loss in 14 years.

The average long-term government bond fund has lost more than 11%, according to Morningstar. Meanwhile, categories like emerging market bonds and high-yield munis have lost 7% and almost 6%, respectively.

Amazingly, these losses come despite the fact that the Federal Reserve has officially changed nothing with its interest rate or QE policies. Many pundits said those policies would cushion investors from bond losses, though I suggested that was folly. I trust you got out well ahead of the crowd as a result because that crowd is now yanking their money from bonds at a record pace.

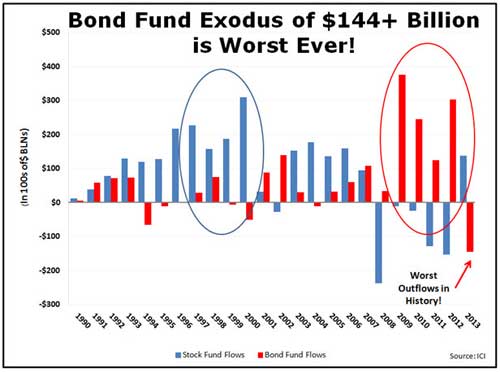

Just look at this chart:

You can see that after pouring more than a trillion dollars into bond funds during the bond bubble, they’ve withdrawn more than $144 billion out of those funds over the past few months. That puts 2013 on track to be the worst year ever for bond fund outflows.

So what happens next? Well, one of the biggest issues for bonds as we head into 2014 is going to be the economic outlook. My sense is that things look better in many parts of the economy (particularly sectors I’ve identified as being wrapped up in their own, private bull markets like aerospace and domestic energy) even as rate-sensitive sectors like housing are likely to cool.

If I’m right, and the data continues to confirm that the crisis era for the economy is behind us for now, then I can’t stress enough how vulnerable bonds still are. The Fed will be forced to taper QE sooner than expected, and raise short-term rates sooner than expected. That would help make 2014 yet another ugly year for bond investors.

I’ll have much more for you on that front once everyone digests their turkey and trading volume returns to the markets.

For now, I recommend you continue to mitigate your fixed-income risk by avoiding longer-maturity, higher-duration bond funds or individual bonds. Also, I recommend you swap out of rate-sensitive equities or ETFs – like the iShares U.S. Home Construction ETF (ITB) – and in to sectors with little or no rate sensitivity, such as those I’ve highlighted previously.

Until next time,

Mike

{ 1 comment }

My bond bubble didn't burst. I'm holding bonds from the last 5 years that are still doing fine. What bonds are you holding? Detroit munis? Even those are coming back, particularly the insured ones or the Water and Sewage ones. What bonds are you talking about that burst??