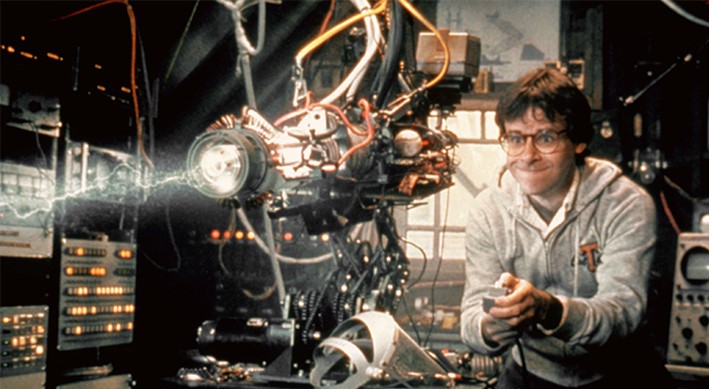

Inventor Wayne Szalinski (Rick Moranis) debuted his electromagnetic shrink machine in the 1989 Disney film “Honey, I Shrunk the Kids.”

Due to a mishap, his contraption shrinks his two kids and his neighbor’s two kids to a quarter-inch tall.

Once Szalinski realizes the miniature kids are fighting for their lives in his own backyard, he utters:

“I’ll tell you at their size, that backyard is like 10 miles. Giant blades of grass, huge insects; it’s a jungle out there!”

In the investment jungle, a similar shrinkage has occurred in the number of U.S. stocks. However, it’s been more of a gradual contraction in this case …

Total Listed Domestic Companies

Source: World Bank

Source: World Bank

In 1983, there were 12,075 U.S. public companies.

In 1996, there were 8,090 U.S. public companies.

In 2007, there were 5,109 U.S. public companies.

Last year, there were 4,331 U.S. public companies.

In the last two decades, we’ve lost almost 3,800 companies. (Nearly 50%!)

For example, take the Wilshire 5000 Total Market Index. It’s the oldest measure of the entire U.S. stock market. The index contained 5,000 stocks at its creation in 1974. It grew to a high count of 7,562 constituents in 1998. Today, it has fewer than 3,600 names.

With no mad scientist and shrink-ray gun to blame, what’s the cause?

The root cause is twofold. But, the real answers lie below the surface…

-

Fewer new listings. A lot of companies that would normally go public … are not going public. According to FactSet, the number of IPOs in 2016 hit its lowest annual count (106 IPOs) since 2009 (64 IPOs).

Companies are staying private because it’s more efficient. As private companies, they don’t have to deal with rising costs associated with being a public company. While larger, established companies can deal with regulatory burdens (e.g., armies of lawyers and accountants), it’s easier and more cost-effective for smaller companies to just stay private.

The growth of private equity businesses helped, too. Larger pools of institutional money have been flowing to the private equity and venture capital space for years. The attraction is the potential for higher returns and added diversification.

-

More delistings. Public companies are even calling it quits and going private. (Think Dell Computer, H.J. Heinz and PetSmart.) In many cases, activist investors are leading the charge.

Failures and bankruptcies. Some companies just can’t make it as public companies and they go out of business. Two big bear markets (2000 dot-com crash and 2008 financial crisis) have led to public stock disappearance.

M&A activity has contributed as well. While deal activity has its ebbs and flows, total U.S. deal activity hasn’t dipped below $700 billion in any of the last 10 calendar years. With a low cost of capital, plenty of cash on corporate balance sheets and a low-growth environment, it’s hard to believe M&A activity will dry up anytime soon.

While there have been advantages and disadvantages for companies along the way, the shrinking stock market has rewarded investors.

Of course, central banks have contributed. With low rates and a lack of decent alternatives, investors have been forced into riskier assets — aka, the stock market.

And those investors — and their increasing investment dollars — have been buying from a smaller pool of publicly traded stocks. It’s simple supply and demand.

In other words …Â more money is chasing fewer names.

The U.S. stock market was worth $27.4 trillion as of Dec. 31, 2016. That’s up more than $10 trillion from 2010. And since 1996, the Wilshire 5000 Total Market Index is up 400% (including a couple bear markets).

This trend isn’t set to reverse either …

Global consulting firm McKinsey projects 75% of S&P 500 companies will disappear over the next decade.

There are two simple ways to play the continuation of this trend …

-

Stay in the stock market. If the number of U.S. stocks continues to shrink, that could help support higher stock prices.

-

Dip your toe into private equity. About 5% of companies in the U.S. are public. The other 95% are private.

In the past, directly investing in private equity was off-limits for 98% of America. But, recent SEC approvals now make direct access available for everyone. For instance, equity crowdfunding platforms Indiegogo and SeedInvest allow “non-accredited” investors the opportunity to invest in startups and small businesses with as little as $100 and $500, respectively.

You can also use traditional routes for indirect access. But, big management and performance fees typically apply. For example, there are publicly traded private equity firms, such as Apollo Global Management LLC (APO), Blackstone Group L.P. (BX), KKR & Co. L.P. (KKR) and The Carlyle Group L.P. (CG). And ETFs like PowerShares Global Listed Private Equity Portfolio (PSP) and ProShares Global Listed Private Equity (PEX).

Ultimately, the yet-to-be-made sequel “Honey, I Shrunk the Stock Market” could continue to be a good thing for investors in U.S. public and private companies.

Best,

Grant Wasylik

{ 6 comments }

I was unaware of the shrinking stock market. This is really critical new information.

Thanks

Don Morgan

Morgan Consulting Inc.

Powerful people and organizations have managed to protect themselves at the public’s expense – e.g. massive deficit spending on desired “business sectors” like defense, SS, and medical subsidies; and bank bailouts via massive money printing.

All that money “borrowed from the future” is going into the hands of the powerful, who have used it to buy everything – real estate, natural resources, and companies (and to paper over their mistakes). That has pushed the overall prices up – that’s why the stock market is going up. Not increased productivity, but the result of the powerful seeking to put their freshly-printed money to work.

Normally, the rich get richer and the poor get poorer. But the (relatively) poor have found a way around it – put their savings into EVERYTHING. Index funds. How can the rich and powerful manipulate the market to shake the poor out – the poor are invested in the entire economy!

Well, inflating everything and getting a bigger share works (i.e. inflate the poor by 2%; inflate the rich 100%). The neat trick has been to hide the discrepancy; manage inflation in the short term so the game isn’t revealed. But when the on-paper money in the stock market is significantly withdrawn, when the Baby Boomers retire and start asking for their profits, inflation will have to jump up. The Boomers don’t really have all that money; their share of the pie has shrunk due to money printing.

This article enlightened me on another trick the powerful can use – develop an off-the-books economy, one that is private and separate from the public economy (e.g. stock market). When the private economy is secure enough, the stock market can be allowed to crash quickly – or consistently shrink over time (which is much preferred, as it results in fewer mob actions).

The shrinking value of the stock market (and other public investments) will finally reveal the true worth of regular-folks’ retirement savings, and show the damage caused by all the money printing and deficit spending. Basically, due to all the printed money the value of the market MUST shrink (or costs inflate, same thing). But how to do that while protecting the powerful?

Finally, the market can be manipulated to selectively take from the (relatively) poor, while the powerful remain safe in their private economy. That’s another tool in the toolbox for the rich and powerful – one I hadn’t considered before.

Thanks for the heads-up!

STICK TO THE BASICS & CONSIDER FORTUNE EPHEMERAL

I’m not at all sure you can neatly predict such outcomes. Many extravagantly wealthy investors seemed bulletproof in the late 1920’s. Many of them with 15-Room Mansions and 15-Person Household Staff) lost all their paper wealth in the 1929-1932 Bear Market Crash ( Depression). So, whether it happens in only a few short years or starts today and drags-on for five years makes little difference in the end.

Those who were overly dependent upon their financial assets and investments, including real estate ( not immune), will be hurt along with the middle classes. Few if any investors will be able to escape without any losses the next time around, as it will be global in its scope. The Central Bankers around the world are responsible for that. So, the more you are worth, the more you will be hurt if you did not keep your lifestyle in check as your paper wealth increased in the past 20 years. Certainly, any leverage or (margin) debt will be a contributing factor, as it was in 1929. History repeats

I would like to know what the change has been in the worldwide basket of public companies? Back in the 80’s we hardly talked about overseas stock markets, including emerging markets.

The number of companies in 1983 appears to be an anomaly. 1982 and 1984 are more in line with a normal trend. What was it during the Reagan years that caused so many more companies? What was it in 1996 that caused the decline a decline in the number of companies? How significant was the dot-com bust in the drop in the early years of this century? There is a saying that those who do not review history are doomed to repeat it.

Enjoy what you are doing!! More or fewer companies, our money will soon be worth next to nothing.Remember the man who filled his silos so he could eat, drink, and be merry. Little did he know he wouldn*t make it to the next day.Happy camping!!!!