|

You know how much focus investors put on the concept of growth, right? It’s like a mantra, a lodestar, the one shining piece of information that is supposed to be prized above all else.

Yet in years like this one, it seems as if that model has been completely turned upside down. This has been a year when growth has seemingly been shunned, as if it were a false god.

Now new research by analysts at boutique New York research firm Cornerstone Macro suggests that the latter view might be more accurate than most investors realize. Particularly in an environment when the economy is improving.

In a research paper published this week, CM analysts note that the recent choppiness in growth stocks has been worrisome for many investors who see it as a sign of impending broad-market weakness. The analysts disagree and in fact see the rotation toward value and away from growth as an indication of brighter days ahead.

|

| This year, the growth mantra has been shunned, as if it were a false god. |

Regardless of the market’s current style bias, however, the analysts argue that looking to growth as a primary factor can be dangerous in any environment. In fact they go so far as to state that trusting in growth as a paramount factor in stock selection is a fallacy, and then provide a better way to outperform.

A key finding: Even if investors had perfect insight and bought the stocks that will have the highest growth rates in the year ahead, those stocks would only outperform the benchmark 56 percent of the time — i.e. not much better than a coin flip.

In fact, some of the high-growth screens CM tested actually subtracted value. Parsing stocks into quintiles according to their estimated growth rates over the next 12 months yields a monotonic performance pattern — but in exactly the opposite direction of what one would expect: The higher the estimated growth rate, the worse the stock performance. Similar patterns emerge for sales growth and long-term growth.

CM analysts cite three examples in which screening for growth alone does not work:

- The expectations bar is often set so high by investors that even incredible growth is a disappointment.

- Growing sales does not equate to profitability, and growing earnings does not equate to better stock performance.

- A 100 percent increase in earnings per share from 1 cent to 2 cents should not be ranked equal to a 100 percent increase from $1 billion to $2 billion.

In an effort to incorporate valuation into the use of growth as a screening factor, many investors combine it with a price/earnings multiple in the famed PEG ratio (PE/Growth). Yet again this doesn’t work. While P/E is an effective factor alone, regression analysis shows that it explains only 30 percent of the PEG ratio. The vast majority of the PEG ratio is still unreliable, according to the CM analysis. In other words, the PEG ratio amounts to 70 percent of a bad factor and 30 percent of a good one.

The better way to think about growth is by including it as a separate, secondary factor — and not blend away its use. In other words, the best approach is to start with stocks that represent a good value, and then secondarily look for ones that have good growth prospects.

The bottom line is that the most attractively valued stocks within the growth universe outperform both high-growth names and value alone — and by a big margin.

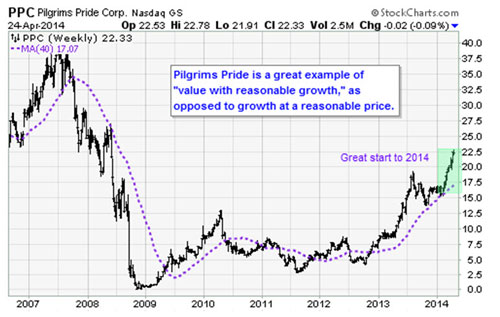

A good example of a successful stock that is cheap first and a grower second is chicken processor Pilgrim’s Pride (PPC). Its trailing 12-month price/earnings multiple is 10.5, and its price/sales multiple is 0.7. These are solid value credentials. The stock’s intrinsic value, according to the Parallax Financial pricing model that I employ, is close to $30 — about $8 higher than the current quote.

Quarterly revenue growth for PPC is 6.5 percent, but its smoothed year/year earnings growth is over 25 percent. Normally you would call this “growth at a reasonable price,” or GARP, but the better way to say it is that Pilgrim’s Pride represents “value with reasonable growth.” VRG does not make for as good an acronym as GARP, but will probably make you more money as an investor.

In the technology space, some top VRG stocks are Micron (MU), Apple (AAPL), Corning (GLW), Hewlett Packard (HPQ), IBM (IBM) and Cirrus Logic (CRUS).

Best wishes,

Jon

P.S. For more on how you can spot the hottest tech stocks of the 21st Century, don’t miss my latest report — New Tech Superstars for 2014. Claim your FREE copy by clicking here now.