|

Stocks last month posted the worst performance since May 2012.

The benchmark S&P 500 Index fell 3 percent on concern about an end to the Federal Reserve’s four-year stimulus program and possible U.S. military intervention in Syria. But just a few weeks ago, the index had rallied an impressive 21.5 percent for the year. So will this decline continue or will a stronger economy propel stocks through the rest of 2013?

Investors will be closely watching key economic indicators and the Fed’s policy meeting, all coming up in the next two weeks, for the answer. Federal Reserve policy makers meet Sept. 17-18, during which time Chairman Ben Bernanke may say he plans to “taper,” in his words, the central bank’s $85-billion-a-month quantitative-easing program.

The Fed is on record saying QE is dependent on an improving economy; specifically, the unemployment rate and inflation. That’s why the talking heads on CNBC will be working overtime parsing every snippet of data this week, including: Manufacturing, construction and service-sector reports, and especially August employment numbers set for release Friday.

|

| Investors shouldn’t read too much into how the Fed may interpret this week’s economic data. |

As the days go by, expect volatility to remain elevated. The Chicago Board Options Exchange Volatility Index (VIX) surged 22 percent last week to the highest level in two months. As the Fed meeting dates approach, the talking heads will try to handicap Bernanke’s next move, but I would caution investors not to read too much into the economic data itself.

The truth is there isn’t a strong relationship, or correlation, between any particular economic report (good or bad) and the near-term performance of the stock market.

For instance, there were several positive surprises last week, including housing-price gains, better-than-expected consumer confidence and a sharp upward revision to second-quarter gross domestic product.

Still, on the day of the consumer confidence report, the S&P 500 dropped 1.7 percent on its way to a weekly loss.

In fact, there is a small inverse correlation — minus 0.21 — between GDP growth and equity-market returns over the next year. Stocks can, and often do, struggle when the economic data look rosy, and the reverse is also true, with stocks often posting their best returns when economic data look dismal. Just think back to 2008 and 2009.

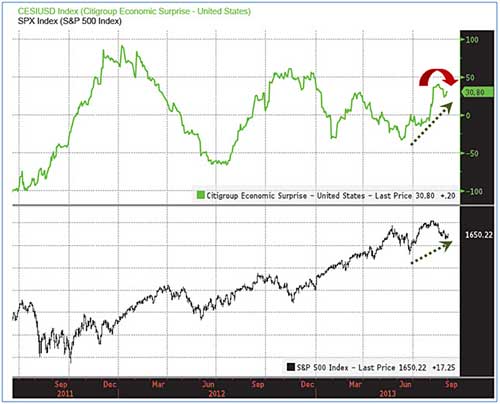

An indicator with a positive correlation with stocks is the rate-of-change in the data, as measured by the Citigroup Economic Surprise Index (above).

When most economic reports are better than expected, the index rises, and stocks tend to follow. After bottoming in June, the Citigroup Economic Surprise Index has been climbing, and the S&P 500 has followed — until recently.

You can see in the graph that the August pullback in the S&P 500 corresponds with a dip in the surprise index, which means that negative economic data surprises have been increasing lately.

This brings us back full circle to the question: Where are stocks headed next? After slipping 3 percent last month, is it a good buying opportunity for stocks, or is this the beginning of a steeper decline?

The S&P 500 Index finds itself in similar circumstances to the correction in June, with the index now down 4.5 percent from its August high four weeks ago. In June, the index fell 3.7 percent in four weeks but was only two weeks away from bottoming after a peak-to-trough drop of about 7 percent. From the low point on June 24, stocks turned on a dime and rallied 8.7 percent to new highs.

As of last Friday’s close, 56 percent of New York Stock Exchange stocks were trading above their 200-day moving average of prices, which means almost half have already broken below this key technical level and are in downtrends. This measure of market breadth shows just how much damage has been done, but it also means stocks are fast approaching oversold levels (a reading below 50 percent).

With this in mind, I’m not surprised stocks bounced Tuesday and yesterday. But don’t let your guard down, because September is historically the worst month of the year for stock-market returns.

Like Federal Reserve policy makers, keep an eye on economic reports. More negative than positive surprises in the weeks ahead could mean tough sledding for the stock market. Ironically, weaker economic data could also persuade the Fed to be less aggressive in its plans to taper QE.

Investors are already discounting the downshift in the Fed’s bond buying. Should the Fed blink and taper less than expected, it could provide a positive catalyst for stocks. And make sure to check Money and Markets’ Facebook page for a small post from me on when we might get another bounce in stocks.

Good investing,

Mike Burnick

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.