|

The first quarter concluded on Monday with stocks (as measured by the S&P 500) registering a 1.8 percent gain for the first three months of the year. The modest rise so far this year is right in line with my forecast, as the Federal Reserve has created a state of affairs which is just what the market needs to maintain its lofty level.

In fact, I expect U.S. stocks to move even higher in the coming weeks because of one very important number that the Fed is crafting most of its current policies around. Read on and I’ll reveal what that one number is.

Recall that it’s the Fed’s easy money policies that are the key to maintaining current market conditions, because without the central bank’s continued intervention, the current status quo, where savers are unfairly punished while speculators are rewarded, would almost certainly fail. That’s also why it’s imperative for investors to keep a watchful eye on the Fed, so you can keep your portfolio out of harm’s way should the Fed’s policies change.

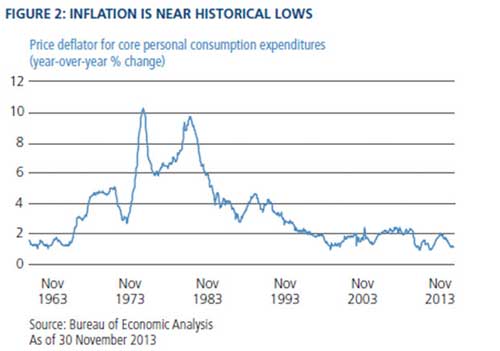

Since the onset of the financial crisis, the Federal Reserve has repeatedly maintained the stance that it will keep interest rates low until unemployment falls to around 6.5 percent and inflation — as measured by PCE, or Personal Consumption Expenditures — starts to track around the 2 percent level. Now that the unemployment rate is coming within the desired range, Fed officials are beginning to focus more on inflation than on unemployment. That makes PCE the one number that every informed investor should be tracking.

How do we know that PCE is the number the Fed is using to measure inflation?

|

| At her first press conference as head of the Fed, Janet Yellen told investors what number to watch. |

Because they told us.

A careful review of the central bank’s meeting minutes show “a willingness to keep rates low as long as inflation (as measured by PCE, or Personal Consumption Expenditures) remains below its 2 percent target.”

What’s more, Janet Yellen, in her first press conference since assuming the position of head of the Federal Reserve, said the following a couple of weeks ago:

“Inflation has remained low as the economy has picked up strength, with both the headline and core personal consumption expenditures, or PCE, price indexes rising only about 1 percent last year, well below the FOMC’s 2 percent objective for inflation over the longer run.”

This means PCE is now the single most important number to consider for stock investors. That’s because as long as inflation remains low, the Fed is going to extend its experimental easy money policies.

What’s the PCE level now? On Friday, the Fed announced that current PCE core inflation stands at only 1.1 percent, which is well below the 2 percent target. Indeed, as the chart below shows, inflation is near its lowest level since record-keeping began in 1960, which is why Yellen’s Fed can be patient in reducing its highly accommodative stance on monetary policy.

What all of this means is that we are likely to remain in the sweet spot for stock investors of tepid economic growth and low inflation that I described in a recent Money and Markets column.

As I’ve previously pointed out, this period of stable economic disequilibrium can’t and won’t go on forever. But with this past Friday’s announcement of PCE core inflation coming in at such a low level, there’s little pressure for the Fed to raise rates. In the short run, that’s a really good sign for stock investors.

Best wishes,

Bill

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.

Bill Hall is the editor of the Safe Money Report. He is a Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP). Besides his editorial duties with Weiss Research, Bill is the managing director of Plimsoll Mark Capital, a firm that provides financial, tax and investment advice to wealthy families all over the world.