|

If you missed our marathon Q&A session this Wednesday, that’s kind of unfortunate in a way. That’s because, as I explain today, a portion of the profits we talked about are already being made … just in the last couple of days. The good thing is you can still view the entire video recording. Just click here and watch it now while the information is still “hot off the press.”

One of the big drivers of these here-and-now profit opportunities is solar power. Which is growing faster than any other energy source.

But here’s a question for you: How are we going to store all that solar power? The answer to that question contains a treasure trove of profit potential.

And I’ll prove it to you in three charts.

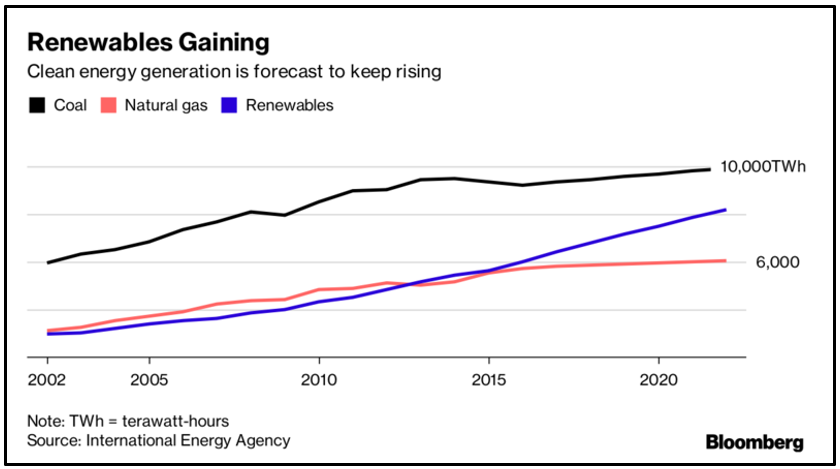

Based on estimates in the chart below, clean-energy sources — which include a major solar component — will soon produce way more energy than natural gas while threatening to beat out coal as well.

But, here’s the real scoop: The International Energy Agency says that not only did 2016 see solar grow faster than any other source of fuel for the first time. But solar tech is expected to dominate in the years ahead.

That’s nice when the sun shines. But there is that thing called “Darkness.” How in the world are we going to store all that energy?

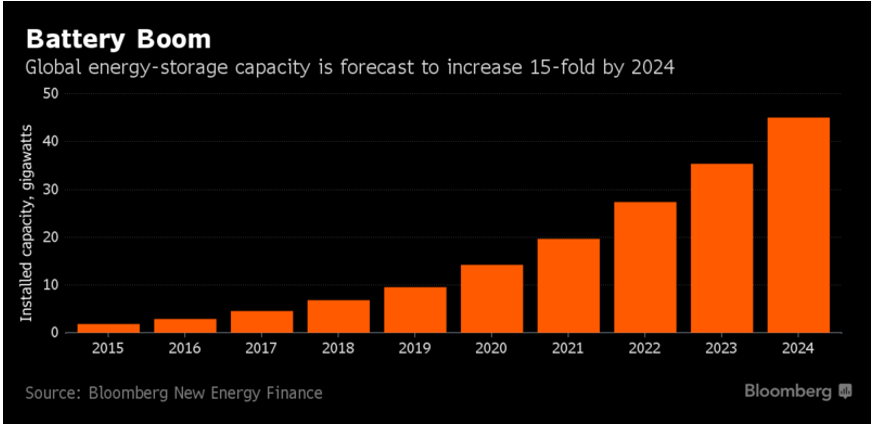

The answer is batteries. In fact, global energy-storage in batteries is projected to increase 15-fold by 2024, as this chart from Bloomberg shows …

Only about 800 megawatts of storage is installed in the U.S., says a Bloomberg report. That’s about the size of a single natural gas-fired power plant.

The growth potential in this industry is huge! HUGE!

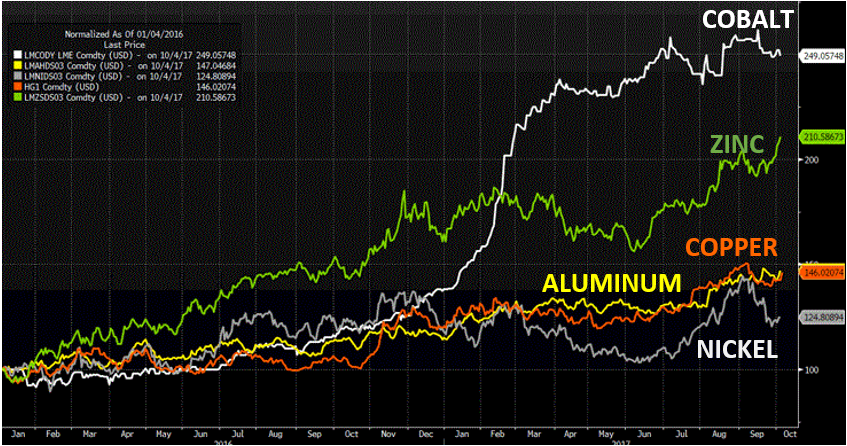

And what do you build those batteries out of? As it turns out, the same stuff you use to build electric-vehicle (EV) batteries. Cobalt, lithium, nickel, copper and more. And guess what’s happening to those metals …

If you read my columns, you know I showed you a similar chart on Sept. 20 of global metals and materials. Since then, cobalt has stayed sky-high. Meanwhile, zinc has hit its high for the year, copper is up 8% and aluminum is up 4%.

The only one that is down is nickel. It’s easing off two-year highs as Indonesia clears out an export backlog. But ask yourself: How long will that last?

If that first chart of solar-power production is a clue … if that second chart on the growth of battery storage is an indication … not long.

Lithium is traded on private markets and doesn’t chart. But Benchmark Minerals says that lithium prices rose in September on tight supply, particularly in Asia. And prices are likely to go higher still.

I’m bullish on cobalt and lithium. They’re both big winners for my Supercycle Investor subscribers. And I just turned bullish on copper. I recommended two picks to my subscribers earlier this week. BEFORE copper blasted off.

You can do it, too. Just watch the megatrends in electric vehicles and battery storage. And how those megatrends are feeding supercycles in all sorts of energy metals.

Here’s a fun fact for you: There’s no copper in a lithium battery. But electric vehicles use three times the amount of copper as a regular car. And transmitting the kind of voltage we’re talking about with these huge energy storage batteries requires copper, too. Is copper an energy metal? Heck, yeah!

You can play the rally in copper itself, through the iPath Bloomberg Copper Subindex Total Return ETN (NYSE: JJC). But the real profit potential, the real treasure trove, is in miners leveraged to the metal. That’s where I’m steering my subscribers. That’s the road to riches.

All the best,

Sean Brodrick

P.S. And in this free report, I name even more investments you can ride to some pretty amazing profits. One even posted gains of up to 2,150% in 40 days!

{ 2 comments }

I am a full-fledged (signed for 5-year offer) member of your investment group which promised to name specific stpcks to invest in, how much to pay and alerts on when to sell. So far you have expounded on previous fabulous returns but no suggestions of stock picks.You like cobalt, lithium. copper and solar, but we have not been guided to specific stocks. I would like STOCK SYMBOLS to identify the stocks to invest in and a recommendation of approximate price to pay. Isn’t that what you promised in your proposals? I’m ready! Thanks!

Certainly promising !