|

Before you make any new investment, you should always ask a lot of probing, doubting-Thomas questions. And that’s exactly what I’ve done in recent days with tech stock guru Jon Markman.

If you want to hear his answers, check out our recent podcasts Or, if you’d prefer to read the transcripts (edited for clarity), see below.

Most important, if you want to make money from all this — and you don’t have your head-of-the-line pass for his gala event this coming Tuesday — click here.

Podcast #1:

Why Should I Believe You, Jon Markman?

Martin Weiss: Welcome to the first in a series of six podcasts with my special guest, Money and Markets technology specialist, Jon Markman.

As you know, I’m a perennial skeptic. I’m always very conscious of the downside. So my role is to be your advocate; to ask the probing questions you’ve been asking, to hold Jon’s feet to the fire to get reliable, well thought-out answers.

Welcome, Jon! My first question is the most obvious one. Why Jon Markman?

|

Jon Markman: I was a reporter and editor at the Los Angeles Times for about a dozen years.

My dad died in 1994, and I had to take over his portfolio. And I really didn’t know that much about stocks other than the fact that they helped make him a relatively wealthy individual. So I started to study them with a lot of interest, and then it became an obsession. Pretty soon I asked the business section to let me write a column about strategies. I’ve been effectively writing that same column for the last 20 years.

I was on a staff that won Pulitzer Prizes for spot-news reporting in 1992 and 1994. Those events really train you to be an investor because you have to be able to work quickly on your feet and work well with other people.

I won the Sigma Delta Chi best in Journalism award for the work I did in helping people understand how to invest in a post-9/11 environment.

I also won a Gerald Loeb award in 2007 for a series of columns about the S&P 500. The Gerald Loeb award is essentially the Pulitzer for business since there’s no business award in the Pulitzer. So when you’ve won a Loeb award it means you’ve attained the highest honor you can get as a business reporter.

Martin: Congratulations, Jon! After the L.A. Times, where did you go?

|

Jon: Around 1997 the Internet was just breaking onto the scene. Microsoft called me out of the blue and asked me to come start the revolution up there in the Internet and help them launch MSN Money. I was Managing Editor for the next six years.

Martin: Why do you think they called you?

Jon: They had a consultant look at all the journalists working on business news around the country and they thought my focus on strategies and the writing I had done about technology would be a good fit for them.

Martin: How did that go?

Jon: I was an outsider as a journalist and came into the belly of the beast of a software company. It really helped me understand how software companies work from the inside. I learned how software is created, how it works, how program managers, testers and developers all work together to create the kind of products you see. I helped create many features and products that people continue to use today.

Martin: For example?

Jon: After the great Tech Wreck, people had become disenchanted with tech writers and I thought Microsoft could use its engineering expertise to develop the first stock rating system. So I wrote a white paper and created the first stock rating system since Value Line. We launched that stock rating system called Stock Scouter in 2001 and it’s been operating continuously on the website ever since. Beating the market by an average of 5-to-1 in the process.

Martin: Sounds like our Weiss Stock Ratings. Very similar track records.

Jon: Once Stock Scouter got going, an organization that helped me develop it asked me to help create a hedge fund based on the ratings. I did that. I left Microsoft in 2002 and started a hedge fund. I worked for that organization for about the next three years before going off and starting on my own.

Martin: So you still use the same system or have you refined it further?

Jon: You don’t want to change it too much because the results you have in the beginning — if you have a robust system — should persist for a long time. Although there have been slight tweaks, I have been using that same methodology ever since.

Martin: Your focus is technology stocks. Can you tell us a little more about that?

Jon: I’ve discovered that the sweet spot for buying tech stocks is about three months to a year after the IPO. After that period of time you can tell if the management team can be successful at running a publicly owned company. These companies are still fairly unknown and yet they have a long growth path ahead of them.

Martin: Can you give us some examples of some tech stocks you’ve been recommending recently?

Jon: Sure. There is a company called Splunk. It became public in 2012. There was quite a bit of fanfare around it. It became public at $50 if you bought the first day of the IPO. This was the first time people had heard of the term “Big Data.” Big data helps companies organize and analyze. The stock went up to around $60, came back to $50, went back to $60 again. I recommended people buy it at $50 and it’s almost tripled since then.

Investing is all about the future and the future is inherently unknown. But by applying some time-honored principles, I really think people can make more money in young growth stocks than they realize. At the end of the day it’s all about buying low and selling high. My experience as a journalist, a strategist and a trader helps me understand and communicate the difference between them.

Martin: Now, let me address our listeners for a moment: Over the past several weeks — both in emails and on the Money and Markets blog — you have asked Jon to name some of his best picks.

Jon has agreed and he has selected the day for making that announcement: Tuesday, April 8.

He will come to our headquarters here in Florida, where we will hold a special video conference in our studios. He will give us a play-by-play scenario of the most powerful, most sustainable technological megatrends in the world today. He will name the leading companies in each of those fields. And then he will announce some of his picks.

This is all going to happen at 2:00 PM Eastern Time, April 8. Registration is now open. Jon, thank you again for joining us today.

Editor’s note: To attend, you will need a head-of-the-line pass, available only until this coming Monday.

Podcast #2:

Why Tech Stocks?

Martin: Ready for the next question from our skeptics? It’s simple: Why tech stocks? Why not focus on some other sector instead?

Jon: I love the fact that you even had to ask. Fifteen years ago, no one would have had to ask. It was just assumed that those were going to be the superstars. Once they crashed in 2001-2002, people felt as if they had been cheated by a group of stocks that they loved. They vowed “never again!” But now, you come along and say “why tech stocks?” and you are coming from a point of disbelief. That’s fantastic because it’s this gulf between disbelief, some belief and great belief that we can make money.

When people are skeptical about stocks, they aren’t bidding up their prices. That’s really the case now. Even though we are in the middle of a bull market that started in 2009, a lot of tech stocks have done well but not as well as they could.

You’ve really seen that in the valuation system in the top tech stocks. Look at Apple, trading at 10 times earnings. In a fully valued market, Apple would be going for 20 times earnings. If people were really super excited about stocks, Apple would be trading at 50 or 100 times earnings.

Martin: Can we look at the recent performance and explain why it’s happening?

Jon: In 2013, the average tech stock outperformed the S&P 500 by 50%.

Martin: Why?

Jon: Because they’re growing much faster than the average stock in the S&P 500.

Martin: What about this year?

|

Jon: Tech stocks are beating the S&P by about 6 to 1 right now. By the way, the stocks I recommend are beating the S&P by a lot more than that.

Martin: What is it about tech that makes it interesting?

Jon: Technology is responsible for some of the most important megatrends occurring today. For example, the explosion of mobile communication via wireless technology has connected the 7 billion people on the planet that may have not ever connected otherwise.

Technology that was for the elite five years ago can be used by children today. And massive new business models are being built around just this one trend of connecting people through small handheld devices. It’s hard to understand because it’s happening so quickly. But it’s a massive change in the way people are interacting with each other. There are lots of great ways to take advantage of that through tech stocks.

Same for healthcare. Drug companies today can solve problems like AIDS and hepatitis. We all know people who died of AIDS in the 1990s and early 2000s and you rarely hear about people dying of AIDS today because of the tremendous therapies that biotech companies have developed. If you can invest in these kinds of companies, if you understand what they are doing, you can be very successful.

I think that technology is great because it’s misunderstood. Therefore it’s the greatest gulf between what people think now and what they think in the future. The reason we get doubles and triples and ten-baggers in this space is because there is an information disequilibrium. It’s my job to help you understand the difference between what you think is happening now, what’s really happening and what’s likely to happen in the future.

Martin: You mentioned earlier some picks that you made that have done better than tech stocks as a whole. Can you tell us some more about that?

Jon: There’s a business learning and talent management platform. I discovered that company very soon after its IPO. It was not very well understood after its IPO and the stock went down afterwards. I recommended that my readers go out and buy it in mid-2012. It’s up about 180% since.

Another one I like provides inexpensive photography on the internet for businesses and individuals. It’s risen 200% since I recommended it.

Martin: What percentage of your recommendations have been losers?

Jon: About 7%.

Martin: 93% winners.

Jon: Yep!

Martin: Jon, over the past several weeks — both in emails and on the Money and Markets blog — you’ve gotten a lot of probing questions, doubting questions, and we’re going to address each one of them in this series. But you have also gotten a very positive question, perhaps the most frequent of all. And that’s simply this: What tech stocks do I buy now?

Jon: Well, as I told you Martin, for that I think we need to meet in person. So the best time for me to do that would be on April 8. That’s when I’ll be on the east coast, I’ll be on a trip to New York and then on to Florida and I can meet you in your studios.

I’m going to give you a play by play scenario of the most powerful, most sustainable trends in the world today. And I am going to name the leading companies in each of those fields and I’ll announce my picks.

Podcast #3:

Is This Just Another Tech Bubble?

Martin: In this podcast, let’s address another tough question we got from one of our readers: “Is this a tech boom? Or is this a tech bubble?”

Jon: Oh, it’s absolutely a boom. It’s not a bubble, not even in the slightest. But I like bubbles. I think they’re great for making money. Bubbles are all about people getting excited and investing in companies that have a great promise, and we saw that in the 1990s.

|

| Bubbles are about investors getting excited, and are great for making money. |

You know, the 1990s have been trashed in the public memory for the crash that came later, but there were a lot of companies that were funded by the public that have gone on to do extremely well. I’m talking about companies like Amazon and Yahoo and Priceline.com. These were all companies that survived, and why did they survive? Because they had great business models, they knew how to provide value for customers and therefore they provided a lot of value to shareholders as well.

Martin: You predicted the tech wreck, didn’t you?

Jon: Well, yes! First of all it’s important to realize that I got people involved in tech stocks from a very early point in that process. You know, Qualcomm was a value company for a long time throughout the 1990s. It wasn’t until Nokia affirmed its patent and agreed to license it that Qualcomm went up 1,000 percent in 1999 alone.

When a stock goes up 100 percent, that’s one thing; 300 percent, 500 percent — ok, I can understand that. But when it goes up 1,000 percent and it absolutely goes vertical, then you know you have a problem. And that’s what I was reacting to. Not some garden variety over-valuation, but valuations that were absolutely insane. When stocks go vertical, it’s because people just can’t stand not being in them. This kind of emotion just takes valuation from high to ridiculous. And one of the statements I used to make back then — and I’ll probably make in another couple of years again — is that parabolic advances always lead to parabolic declines. If you can remember that — and really understand it — you can make and save a lot of money.

Martin: Right now are valuations high? Are they ridiculous?

Jon: In a lot of cases, they’re relatively low. There are some that are high but you know high valuation is the market’s way of saying, “we like you.” If you want to be a growth investor you’re going to have to accept some high valuation. But the companies that you’re investing in should have the kind of growth characteristics that will fulfill those expectations, and that’s where I come in.

By the end of the 1990s, the market had been in a bull cycle since 1982. It had basically been going up for 18 years. So that was really the end of a very long process in which people became accustomed to the environment of the economy being successful and stocks being at the vanguard of that.

But today, people are still wondering: “Hey, is the economy about to crash?” “Is unemployment ever going to get better?” “Are the Russians going to take over Eastern Europe?” “Is the China economy going to crash?”

When people really start to focus on the upside of technology stocks, they won’t be asking those questions. They’re just going to be saying, “What should I be buying right now?” They’ll go right to their machines and buy them.

So we are in nothing like the kind of ebullient atmosphere we’ve seen in the past. And by the way, I’ve heard the history of the financial markets in the 1860s and the 1890s as well as the 1990s. I’m very aware of what booms look like and what bubbles look like. And they look the same in the 1990s as they did in the 1890s.

It’s always about the public becoming way too excited, way too enamored, over-emotional with unreasonable expectations. We do not see that today.

Martin: Well thank you, Jon. I can see why our readers are getting so excited about our April video summit. It’s so they can be on hand to get your top tech picks.

That’s going to be 2 p.m. Eastern Time on Tuesday, April 8. Jon’s going to give us a play-by-play scenario for the powerful megatrends transforming the world as we speak. He’s going to name some of the best picks and he’s going to open enrollment for his new trading service, “New Technology Superstars.” Registration for the April 8 event is now open.

Podcast #4:

How Can Anyone Pick the RIGHT Tech Stocks?

Martin: Jon, welcome back for the next question, the next challenge from our audience of skeptics. Here it is: “How can anyone truly pick the right tech stocks?”

Jon: Obviously the right tech stocks are the ones that are going to go up the most. We’ve seen a lot of great stocks go up in the past and we can profile them — to understand what those great picks look like very early in the process. I’ve done that for many years. And so I have a formula that I use. It’s not perfect, no formula is, but it helps me get a lot closer than I would otherwise. Some of those traits are:

You want to buy stocks relatively AFTER their IPO — not on their IPO.

You want companies that have very large markets and have few competitors.

You want companies that have rich patent portfolios because it prevents competitors from edging in on them once they see they have a good thing going.

You want companies that have products or services that are easy to explain to fund managers who are often tech-challenged themselves.

Martin: I thought they’re supposed to know this stuff.

|

Jon: They are, but everyone needs to understand your story, and I really look at a company’s marketing to see how well they explain themselves. That’s really important.

It’s very common for very successful tech stocks to be in niches that are not very well understood or known at the time but will become much better known later.

As an example, in the 1990s not very many people knew about wireless communications. So if I told you about a young semi-conductor company called Qualcomm you’d be like, “What’s wireless communications, I don’t get it.”

I’d explain to you what a cell phone is and I’d say someday people might have two or three of them, even children might have them. And Qualcomm owns the most important technology behind them and it’s all patent protected. You might go, “uh-huh, uh-huh, uh-huh.” But you still might not get it.

Martin: My eyes would roll and I’d blank out.

Jon: Exactly. That’s an example of a niche that was not well-known then but is extremely well known now. I’m trying to find those niches that are not well-known now but will become much better known in the future. You want to find companies that make products better, cheaper, or faster than their competitors, and have a unique, disruptive, technology with a proven business model.

Martin: Disruptive meaning they’re going to upset the whole industry and turn it upside down.

Jon: Exactly! In the same way, for instance, that Amazon.com has done with retailing.

Martin: Right, well this is very informative, Jon but there is a lot more to come. We have two more podcasts to go, each with an even more challenging question. And then at 2 p.m. Eastern Time next Tuesday, April 8, you and I will meet here in Florida for a special video summit at our studios.

Now, in an earlier podcast you outlined what your agenda is, so I’ll just reiterate it here if you don’t mind: You’re going to open enrollment to your new service, “New Tech Superstars.” You’re going to reveal the major mega trends that you think are going to drive the greatest profits in the tech sector in the months and years ahead.

Jon: Correct.

Martin: And then, you’re going to name some of the stocks that you believe could match or even exceed the doubles and triples you’ve seen in your recommended stocks.

Jon: Yep, that’s the plan.

Martin: Registration for next Tuesday’s event is now open. This is Martin Weiss with Jon Markman. We’ll see you soon.

Podcast #5:

Where’s The Post-IPO Sweet Spot in Tech Stocks?

Martin: Hello again and welcome to the fifth session of this rapid-fire series on technology stock investing with one of Silicon Valley’s greatest insiders, Mr. Jon Markman!

In case you haven’t seen Jon’s bio, he is an award-winning financial journalist, co-founder of MSN Money, best-selling author a book that predicted the Tech Wreck, former hedge fund manager and for many years, a tech stock picker with a batting average of 930 out of 1000.

Here’s the next question Jon. You’re talking about the sweet spot, and this sweet spot is ..

Jon: Three to 18 months after an IPO.

Martin: Help me here. How do you pick the spot in that 15-month period?

Jon: Well that’s sort of the secret sauce which I share with subscribers. Typically you’re looking for a company that’s gone public — it’s probably 50% to 100% over its offering price. So if it’s offered say, to insiders at 20, maybe it goes public and its first trade is 40. We’re looking for that excitement to die down.

A good example was Splunk, which is a leader in the space called Big Data. It went public with a lot of hullaballoo in 2012 at 15 and its first trade was at 40.

I told my readers: “This is a great company, we’re starting a big new category that people are going to get excited about.” But I told them to wait for it to come down a bit. We were able to buy Splunk near the bottom of the trading range, at about 35 and we’ve held it ever since.

Martin: So are you saying that, in this 15-month time zone, the stock establishes a sort of sideways trading range?

Jon: Sure, the stock might be sold to institutions at 15. The first trade might be at 40 and then the people who, let’s say, bought at 40 might wait for it to go up to 45. But it doesn’t. Let’s say it goes down to 38 or 37 and they get frustrated so they start selling. And it’ll go down to some level at which institutional and professionals realize, this is where the fundamental value is.

In the case of Splunk, it was right around 35. So they come in and buy at 35. The stock holds there for a while and moves back up. It usually goes back up to the initial prices, let’s say 40, and it will stay there for a little while. Then people who bought it at 35 will sell it, and it’ll come back down to 35, and it’ll do that a couple of times.

Another place to buy IPOs is after they break out of those ranges. So if it travels between 35 and 40 for a while and then, one day it breaks up to 42, very often that’s a fantastic place to buy. Although it looks like you’re buying at a new high — and you very often are — that is a point where these IPOs really begin to take off.

Martin: Well that gives us a pretty clear vision of the timing. You have a trading range — you can buy it at the bottom of the trading range, or you can buy it as it’s breaking out above the trading range.

Jon: I would also mention one other scenario, if you don’t mind.

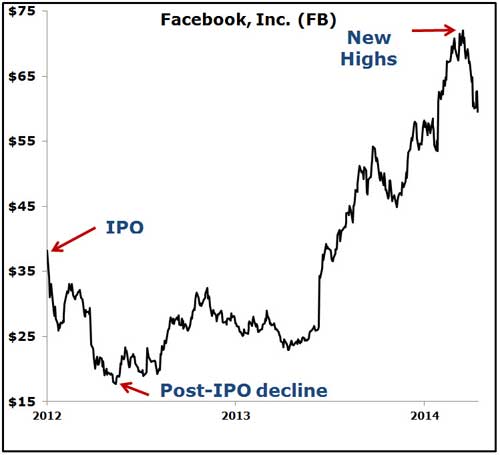

When Facebook went public, everybody knew that it had come public at a completely ridiculous valuation — a valuation where investors really could not make money.

It reminded me a lot of Amazon.com. It was brought public at a really, really high valuation. And ultimately, it fell by half from its initial IPO price.

I thought that could happen again with Facebook and I told my readers. We were able to buy Facebook at half off, and once it moved back up to its IPO price, it was already a double. As it broke out of that initial range, it doubled again from there.

Podcast #6:

Tech Stocks: Why Now?

Martin: Martin Weiss here, welcoming you to the last of our series with tech stock maven Jon Markman — until our big gala event with Jon, this coming Tuesday, April 8. Editor’s note: If you want to attend, you’ll need a head-of-the-line pass. Go here to get yours. (Passes not available after Monday.)

Ok, Jon, here’s our last question of the series: Why now? I mean, tech stocks have already had a major run-up, as you yourself have illustrated. Why should an investor who’s been sitting on the sidelines jump in now?

Jon: More money is wasted by people sitting on the sidelines than people would actually lose if they invested in stocks that didn’t work out as well as they should have. There’s no better time than the present. You can wait, but stocks are not going to wait for you.

Tech is all about the future, and we’re hurdling toward the future at an incredible rate. Anybody who has kids realizes that. And if you’re older or middle age, if you’re set in your ways, you need to learn some new tricks. You need to get your head up out of the Intels and Microsofts that you remember from the past and learn about the new highly-profitable companies of the present. These companies are taking advantage of megatrends that started a short while ago and are gathering steam now.

Martin: This is key. You’re talking about a megatrend that started very recently. How long into the future can you expect that to continue? Let’s take, for example, the shift into mobile devices.

Jon: For a long time, smart phones were largely for business people. It was only very recently that companies like Apple and Google began to produce these devices at low enough prices that the average person can buy them. And so this trend towards mobile communication is just gathering steam now. You’re going to see it really explode in the future.

Think about 7 billion people on the planet — most of them not having access to landlines. Now, suddenly we’re in the process of connecting them all through wireless communications — through satellites or other methodologies.

You just don’t know what’s going to happen once you’re able to get all of those people moving in the same direction, communicating with each other, sharing ideas. You may find that the next great tech superstar is someone who’s born in Ghana or in the desert of Mali. You just don’t know. I want to get people involved in the companies that are taking advantage of those trends.

Martin: Over the past several weeks, both in emails and on the Money and Markets blog, many of our readers have begged you to name some of your favorite technology stocks to buy now. So can you tell our listeners, when and how you’re going to do that?

Jon: Sure. I’m going to make that announcement on April 8.

I’m going to lay out my scenario for the most powerful tech mega trends of our time.

I’m going to name some picks to go with each of those trends.

And then to wrap up, I’m going to open enrollment to my new trading service, New Tech Superstars.

Martin: We look forward to seeing you there.

|

EDITOR’S PICKS

Urgent question: Which is safer? Bonds or stocks? by Mike Larson You know what bothers me more than anything? That too many investors are just sitting there hiding in their Bond Bunkers. Paralyzed by the fear created by two sharp market collapses, and two economic recessions, they’re investing heavily in bonds. by Bill Hall The first quarter concluded on Monday with stocks (as measured by the S&P 500) registering a 1.8 percent gain for the first three months of the year. The modest rise so far this year is right in line with my forecast, as the Federal Reserve has created a state of affairs which is just what the market needs to maintain its lofty level. Energy, Financials, Tech: What’s next? by Don Lucek Now, our Weiss Ratings are telling us that it’s also time to expand your horizons to other areas that have been performing well recently — energy (up 0.78 percent year-to-date), financials (up 2.6 percent) and technology (up 2.2 percent) and even materials (up 2.8 percent). |

THIS WEEK’S TOP STORIES

What is THE fastest growing industry? by Charles Goyette The answer: Technology! It is one of the last remaining outposts of the free economy. That is why tech megatrends continue to be a powerful and dynamic source of wonders that bless our lives with innovation and convenience. The first-quarter winners are … TECHNOLOGY IPOs from 2012 and 2013! by Mike Burnick The S&P 500 Index is up just 1.2 percent after the first three months of 2014, with plenty of volatility along the way. Dig a bit deeper, however, and you can separate the winners from the losers. by Douglas Davenport If the past is any indication, we’re in for a good month in the stock market. That’s because over the last 50 years, April has been by far the strongest month of the year for the Dow. Over the past 20 and 50 years, the Dow has averaged a gain of more than 2 percent in April, beating every other month of the year. |