It has certainly been a roller coaster ride full of unexpected twists and turns, but the Dow Jones Industrial Average is on track for a decent gain this year, up 6.6% year-to-date.

Market Roundup

Barring any September swoon or October pre-election day panic, stocks have a good shot at being up double digits in 2016.

Of course investing is a relative game, and your own performance could be much better or worse than the Dow Jones depending on your personal stock and sector preferences.

This is precisely why I put a lot of time and effort into analyzing the relative performance of asset classes and sectors against the benchmark.

That’s the best way I know of to determine which markets are leading, which are lagging, and where the best buying opportunities can be found.

With that in mind, let’s take a closer look at some sectors that have been leading the stock market’s charge higher recently …

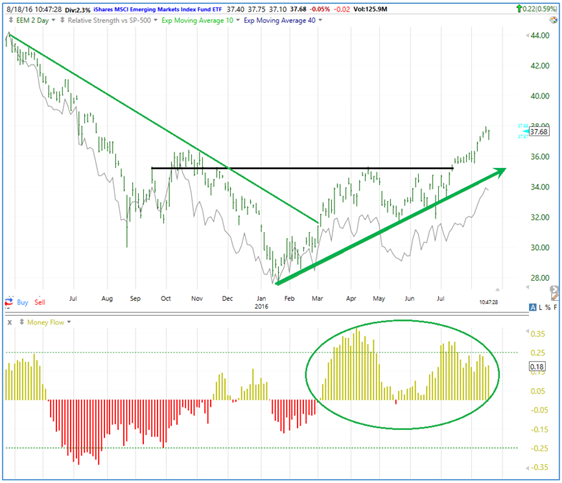

First, it’s worth noting that after a very long nap, Emerging Markets are outperforming the Dow and S&P 500 again.

As you can see in the graph above, the iShares MSCI Emerging Market ETF (EEM) recently broke out to a new high. And EEM has been outperforming the S&P 500 Index since the January low (middle panel, grey line).

Plus, money flows turned positive for emerging markets again in March (bottom panel) as investors consistently move into EEM, after 18 months of consistent outflows, a bullish sign.

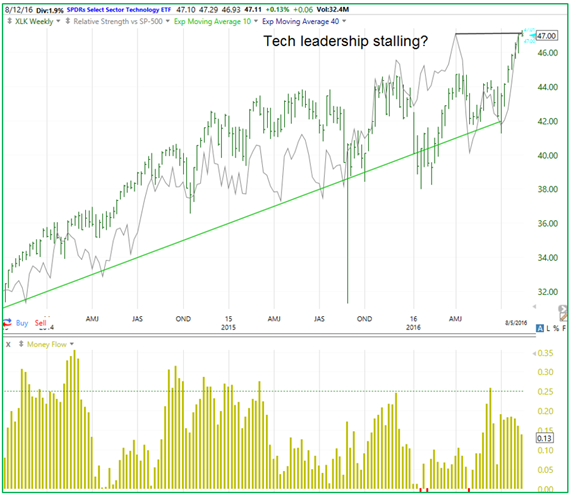

Next, let’s look at a leading domestic sector: Technology.

Technology stocks have been consistently leading the stock market higher for several years now. You can see in the chart of the SPDR Technology Sector ETF (XLK) below how the grey relative strength line vs. the S&P has been steadily moving up and to the right since mid-2013.

But since April, tech stocks have stalled on a relative basis. Even though XLK broke out to new highs in July, the grey relative strength line (tech compared to S&P) has yet to do so.

This could be just a temporary pause, or a sign of a more fundamental shift in market leadership away from Tech, so stay tuned.

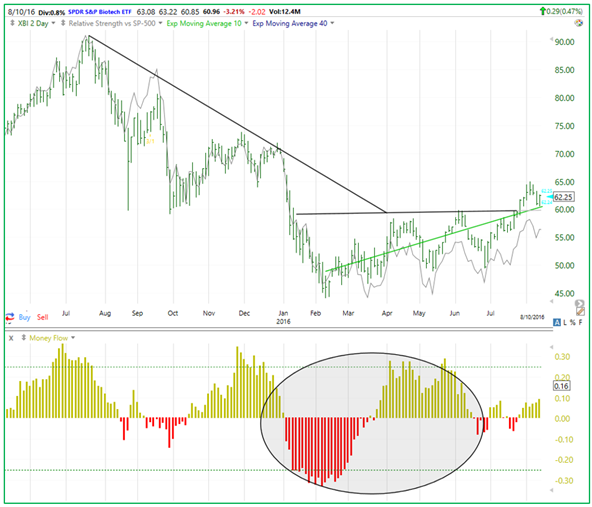

Finally, the Biotech sector was a stellar performer in 2014 and early last year. However, Biotech stumbled badly since mid-2015, falling more than 50%, mostly due to fears over price controls heading into this year’s election.

But now it looks like Biotech has turned bullish again on a relative strength basis.

Notice in the chart of the SPDR S&P Biotech ETF (XBI) above how the sector just broke out to new highs in price, and is now outperforming the S&P 500 Index at the same time.

This could be just the start of a bullish change in trend for beaten-down Biotech stocks!

Bottom line: Don’t get too wrapped up in the absolute performance of sectors and individual stocks you own. It pays to take a closer look at the relative performance compared to a key benchmark like the S&P or Dow to see at a glance if the sector or stock is leading or lagging the market.

So how about it; are you keeping up with the Dow Joneses so far this year? Which sectors have been your best performers in 2016? Let me know your picks and pans by joining the conversation below.

Good investing,

Mike Burnick

|

![]() Because Hillary Clinton and Donald Trump are adaptive political animals, the only major difference between the presidential candidates has boiled down to taxes, according to an analysis reported by the Associated Press.

Because Hillary Clinton and Donald Trump are adaptive political animals, the only major difference between the presidential candidates has boiled down to taxes, according to an analysis reported by the Associated Press.

Republican Trump and Democrat Clinton have shifted their stances closer together on major issues like trade agreements and infrastructure spending. But the rich will face either a big tax hike by Hillary or a big tax cut by Donald, says the Tax Policy Center. With just their income tax proposals, Trump would boost the after-tax income of the wealthiest 1 percent by a little over 5 percent, says the non-partisan Tax Policy Center. Meanwhile Hillary’s plan would reduce the 1-percenters after-tax income by about 5 percent. Ironically, neither Clinton nor Trump, says the report, would have much of an effect on the taxes of the middle class or the upper-middle class.

![]() Most American retailers have been slashing budgets and cutting employees in the face of sluggish sales. But Wal-Mart has done just the opposite – and it’s working. The super-seller reported a 1.6% sales increase for the past quarter, which marks gains for eight consecutive quarters.

Most American retailers have been slashing budgets and cutting employees in the face of sluggish sales. But Wal-Mart has done just the opposite – and it’s working. The super-seller reported a 1.6% sales increase for the past quarter, which marks gains for eight consecutive quarters.

Beating out Target and Macy’s, Wal-Mart has shelled out billions to increase employee wages, to make its stores more efficient and customer friendly and to boost its e-commerce profile. Based on this success, the company boosted its predicted annual profit per share from $4.00-$4.15 to $4.15-$4.35.

![]() People are buying less chocolate in these health-conscious times. So Nestle is banking on a strategy to encourage candy lovers to pay more for their cocoa fix. The company, which makes KitKat, Crunch and Butterfingers, plans to sell high-end chocolate products, featuring less sugar, organic ingredients and exotic flavors.

People are buying less chocolate in these health-conscious times. So Nestle is banking on a strategy to encourage candy lovers to pay more for their cocoa fix. The company, which makes KitKat, Crunch and Butterfingers, plans to sell high-end chocolate products, featuring less sugar, organic ingredients and exotic flavors.

The Money and Markets Team

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 7 comments }

A major reason that Walmart is knocking out Target & Macy’s is a silent national boycott. Due to their liberal bathroom policies and the CC issue, both are being avoided by the average person.

I have cut up all Macy’s & Target CC’s.

I will never shop in any of their stores until they reverse their unnatural policies. Mainstream America is rejecting this moral insanity. Both stores are within a mile of my house. I drive 4 miles to Walmart.

“… the only major difference between the presidential candidates has boiled down to taxes …”

Trump has promised to regulate and limit legal immigration, and build a wall to end illegal immigration. Hillary has promised to give amnesty to all illegal invaders, and to import as many more as possible, legal or illegal.

Trump is anti-abortion. Hillary is strongly pro-abortion.

Trump does not want to declare war. Hillary has threatened war with Russia and Syria.

If you can’t see differences between the candidates, you have your eyes, ears and nose tightly shut.

Yeah Mike I guess you assume the Fed is on hold … forever? It’s a dangerous path you’re leading your readers on.

Right now, I’m looking at the engine that actually drives stock price movements, and things are looking like the gas tank is almost empty. Time to fill up again – as in a correction is desperately needed. For several years now, we’ve had a stock market decline from summer to fall. Then there was that nasty thing in 2009. That was followed by a reprieve of that phenomenon for a couple of years, but we’re back at it with regularity. Get ready for a buying opportunity in the October/November timeframe. It’ll be interesting to see what happens after that: if we’re off to new highs or if things sputter out.

I started saving and investing in my early forties. Good thing ,since the corporation my husband worked for went bankrupt and the life insurance promised was cancelled. That was a $160,000 hit to my future if he died before me. I have never tried to beat the market; just tried to make steady reasonable returns. Only had small amounts to invest or save, like grocery money, birthday money, etc. Saved in CDs, invested in Bonds and some small amounts in Stock mutual funds with low fees. Saved in a deferred fixed annuity. Went thru the Stock market meltdown of 2000 and 2008 with minor losses. Dollar cost averaged. Twenty five years later, I have a six figure amount saved/invested. Also, we’ve lived within our means, saved for the things we wanted – basically the conservative old fashioned way of doing things. Paid the charge bill off each month.

Never had a huge income. It can be done.

Looking at the stock indexes above all the stock markets are buying into the cheap money low interest gravy train continuing. The fundamentals in their home countries must be in great shape or are they just latching on to all the Fed speak BS

This analysis is superb. Thumbs up for it!!!